A Bet on the Future(s): Evaluating FTX and the $FTT Token

$GCR is a Tokenized Community of Researchers and Investors in the crypto space. Join our community today to get access to all the best investments ideas and deal flow, workshops and direct access to founders and key players in the space.

You will need 100 $GCR tokens to join the Discord community. You can purchase the token on Uniswap here and join the gated Discord group here.

Summary

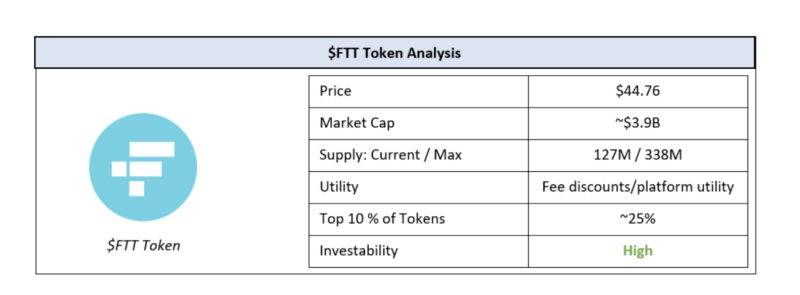

- FTX, marketed as being “by traders for traders”, has quickly become one of the top futures and derivatives exchanges in the crypto market

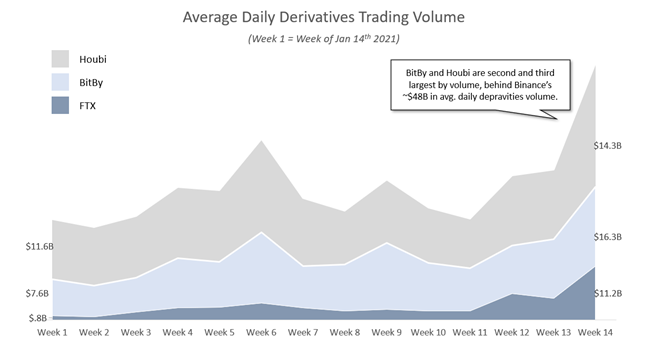

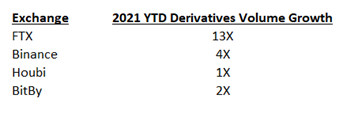

- Due to its wide product breadth and strong exchange liquidity it has also become a top choice for institutions (average daily derivatives trading volume grew ~13X in the past four months alone)

- FTX’s $FTT token is a utility token that gives traders discounts on the FTX platform, among other platform benefits

- FTX rewards $FTT holders by using a portion of the proceeds from platform fees to buy and burn $FTT tokens weekly on the open market , much like an equity buyback

- Using the H-model (a dividend discount model for high growth companies), our conservative estimate of the intrinsic value of the $FTT token is ~$76 (i.e. ~2X current trading price)

The complete model can be found here: https://bit.ly/3sPxX7O

Overview

As the cryptocurrency market booms, the demand for derivatives has increased meaningfully. Institutional and retail traders alike have been looking for the most convenient and secure way to take leveraged bets against the prices of various crypto assets. In 2019, former Jane Street trader and crypto quant trader, Sam Bankman-Fried was looking for a futures exchange that was institution-grade in terms of liquidity, product breadth, and service. Finding none, he created FTX, a product that is now branded as being “by traders for traders.” FTX is quickly becoming the platform of choice for most traders because it product breadth and exchange liquidity, courtesy of Bankman-Fried’s quant fund Alameda Research.

Like other centralized exchanges (e.g. Binance), FTX has created its own utility token $FTT. The token allows holders various perks across the platform and rewards holders through buy-back-burns using a percentage of the profit generated by the platform. In this piece we evaluate how the platform stacks up against the competition and estimate the $FTT token’s intrinsic value based on the buy-back-burn program.

How does FTX Work

FTX’s products can be divided into four key segments: 1) fixed-term and perpetual futures, 2) leveraged tokens, 3) volatility products, 4) OTC platform. Let’s dig into these:

- Fixed-term and Perpetual Futures

FTX’s primary product is fixed-term and perpetual futures. Traders can make bets on the price movement of major cryptocurrencies over a fixed time horizon, or roll the contract over indefinitely through FTX’s perpetual futures, using 3X to 100X leverage. FTX’s primary innovation with this product is its three-step liquidation solution, which adjusts the collateral at various price levels to avoid large one-time clawbacks. Some of the assets that traders can bet on or against are BTC, ETH, LTC, EOS, XRP, ADA, LINK etc.

- Leveraged Tokens

Leveraged tokens are ERC-20 tokens that represent bets on or against certain assets. Through leveraged tokens, the collateral balance is auto-balanced and there is no concept of a margin call, making trade management easier for traders.

- Volatility Products

FTX’s MOVE contract allows traders to get exposure to the volatility in the price of assets such as BTC, rather than the price itself.

- OTC Platform

Finally, the OTC platform is embedded with Bankman-Fried’s Alameda research and allows traders to gain access to up to 25 cryptocurrencies 24/7.

In exchange for providing these services, FTX charges patrons a range of relatively small fees against their transactions. These fees are structured as follows:

- In spot and futures markets, the maker fee is 2bps and the taker fee is 7bps; this fee reduces to a low of 0bps and 4bps for makers and takers respectively, as the traders 30-day volume increases

- Leveraged tokens have a creation / redemption fee of 10bps and a daily management fee of 3bps

- Taking leverage of 50X or 100X could increase these fees by 2bps and 3bps respectively

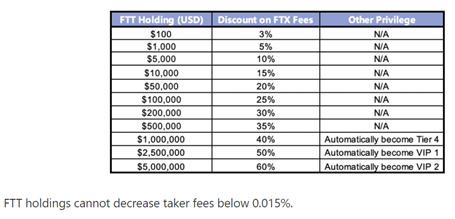

Within the FTX platform, $FTT token-holders get a range of discounts against these fees and are rewarded by a buy-back-burn, using a portion of the total fees collected by the platform. Token holders can also participate in the platform’s governance to some extent.

$FTT Token Perks

- All $FTT holders get fee discounts on spot and futures trades as follows

- In addition to that, holders who choose to stake their $FTT are also eligible for the following perks

- Increased referral rebates

- Maker fee over-rides and rebates

- Bonus votes

- Increased air drop rewards

- Waived blockchain fees (when interacting with leveraged ERC-20 tokens)

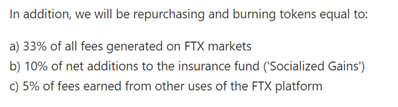

Buy-back Burns

- In addition to these platform rewards, FTX uses a portion of the fees, in the following proportions to buy back $FTT tokens on the open market and burn them. This decreases the supply of $FTT on the open market and offers upward pressure on price movement.

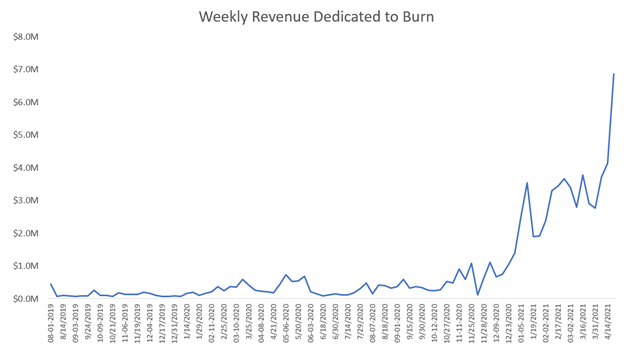

- Tokens are bought and burned on a weekly basis. ~11M tokens have already been burned, with ~$78M committed to this program thus far.

Evaluating the FTX Platform and $FTT Token

FTX has garnered a reputation of having the widest breadth of products and the strongest liquidity profile. Given the institutional backing it has from Alameda, FTX has also become a provider of choice for financial institutions taking leveraged bets on crypto. Eventually, however, the $FTT token is eventually only valuable if this reputation translates to strong platform utilization.

In this regard, FTX has been taking the fight to the established players, going from processing ~10% of average daily derivatives volume vs. the closest established competitor at the start of 2021 to ~78% as of this writing. FTX is now quickly approaching 3rd position in derivative volume processed, behind BitBy, Houbi and Binance, who currently processes ~$48B in daily derivatives volume.

To put this in context, FTT has had the strongest growth in average daily derivative volume of the top four players by volume, including Binance.

Finally, $FTT appears to be seeing organic demand, with the top 10 wallets accounting for ~25% of total circulating supply. This is typically a good proxy for demand; low concentration in top wallets means that there is enough demand for the circulating supply to be distributed.

What is interesting about the $FTT token is that holders are not rewarded by direct dividends. Instead, FTX uses a portion of fees generated to buy back tokens on the open market and burn them. The idea is that this will reduce the circulating supply and push the price of existing tokens up. Since 2019, FTX has completed a token burn every week, dedicating up to ~$6.9M per week to burn up to ~200k tokens per week.

Given the regularity of these buy-back-burns, the revenue dedicated towards them can be used as a proxy for dividends. This allows us to use a dividend discount model to estimate the intrinsic value of the $FTT token, assuming that the tokens burned, and tokens vested into the circulating supply over time roughly offset one another.

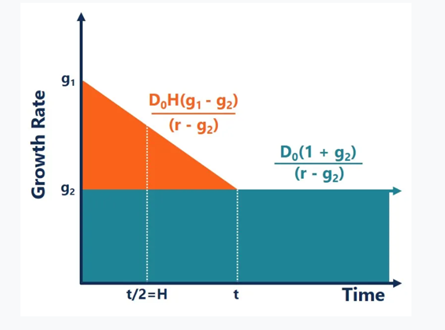

As with any high-growth dividend-issuing enterprise, the most prudent version of the dividend discount model to estimate intrinsic value is the H-model. The concept behind the H-model is simply: it assumes that the high-growth, dividend-issuing enterprise will eventually settle on a modest YoY growth rate, as with most enterprises in the long-run. However, in the short-run, it will continue to display high growth in dividends issued, the rate of which will decline linearly over time until it settles on the long-run growth rate. The concept looks something like this, where D0 is the dividend issued in the most recent period, g1 is the short-run growth rate, g2 is the long-run growth rate, r is the risk-free rate, and t is the duration of time over which g1 converges to g2.

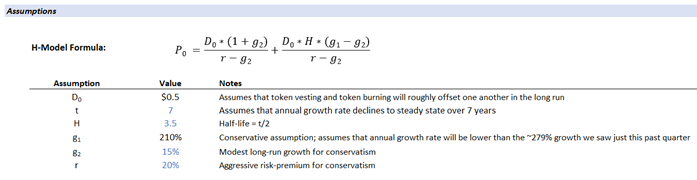

The following were our assumptions:

Based on these assumptions, we estimate the intrinsic value of the $FTT token to be ~$76 per token (2X current trading price).

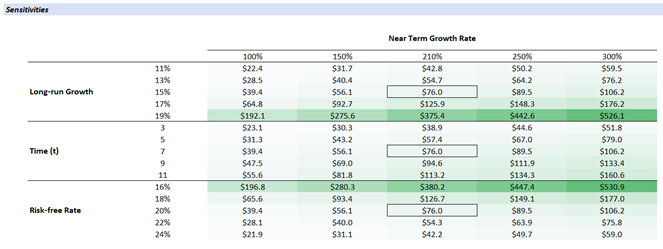

It is important to remember that the H-model is proxy for intrinsic value, and that changes in the underlying assumptions can result in a range of values. Given that we have been extremely conservative with our assumptions, we believe that there is significantly more upside potential than downside potential, based on the following sensitivity analysis. FTX is currently not regulated in the US and cannot be used there; if / when it becomes more accessible to the US market, we would expect growth to increase proportionally.

The complete model can be found here: https://bit.ly/3sPxX7O

Conclusion

FTX has developed a robust business model around a platform that is starting to see near-parabolic growth in utilization. In addition to this, its $FTT token has a range of valuable use cases, which has generated meaningful demand as evidenced by distribution of tokens in circulation. FTX has also consistently used a meaningful share of fees generated to buy back and burn $FTT token, and reward existing $FTT token holders. Finally, our dividend discount model indicated that, with extremely conservative assumptions, the intrinsic value of the $FTT token is ~$76 (~2X current trading value). Based on all of these factors, we believe that the $FTT token is one of the strongest tokens associated with a centralized exchange, and has a lot of upside for growth.