A Moment in (Proof of) History: Evaluating Solana

$GCR is a Tokenized Community of Researchers and Investors in the crypto space. Join our community today to get access to all the best investments ideas and deal flow, workshops and direct access to founders and key players in the space.

You will need 100 $GCR tokens to join the Discord community. You can purchase the token on Uniswap here and join the gated Discord group here.

Summary

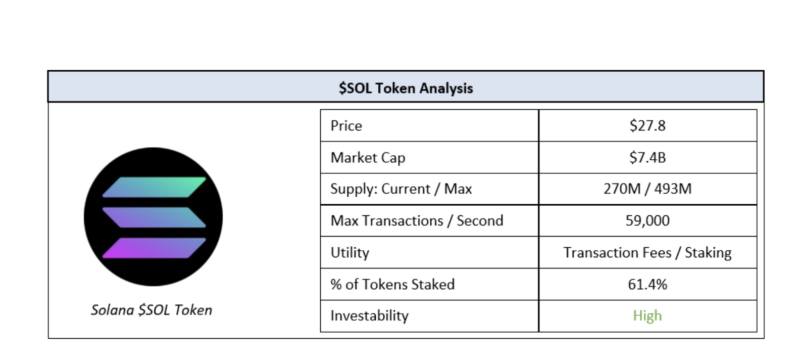

Solana is a robust Proof of Stake smart contract network that can handle 3,500X the volume of Ethereum 1.0, without meaningfully compromising on security or decentralization. Within the network, the primary use cases for the $SOL token are staking and paying transaction fees.

Solana currently leads a number of competitors in terms of network participation (transactions per day and applications built on the network). With higher levels of activity on the network, it stands to reason that demand for the $SOL token will also continue to increase. With >60% of tokens in supply currently staked on the network, large volumes of supply are unlikely to flood the market in the near future. The combination of these factors means that the future price of the $SOL token will likely continue to trend upwards in the mid to long run.

Overview

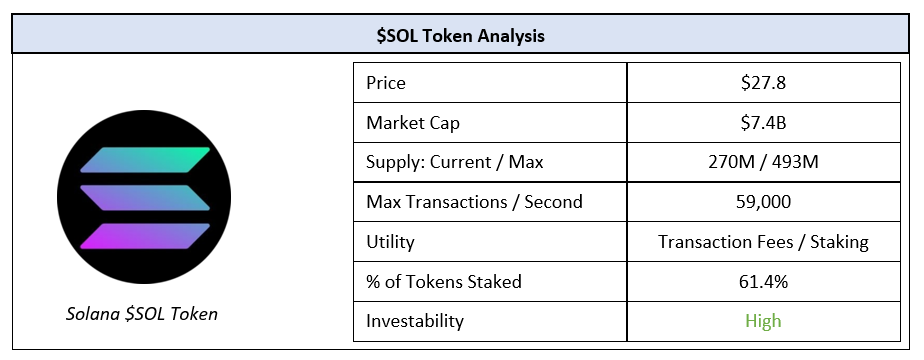

Solana is a Layer 1 proof-of-stake smart contract blockchain similar to Ethereum, Polkadot, Cardano, EOS and Cosmos. The largest challenge facing the smart contract space over the past few years has been the scalability problem i.e. finding the best way to allow more transactions per second without sacrificing decentralization and security.

Ethereum is trying to solve this through sharding, Polkadot through parachains — Solana has developed what they call Proof of History (PoH). PoH allows transactions on a developing blockchain to be time stamped so that consensus can be reached faster without compromising security.

How Solana Works

Unlike other smart contract platforms, Solana does not require validator nodes to have a minimum number of tokens to participate. This means that anyone who owns $SOL tokens can stake their tokens and become a validator node. In practice, however, most stakers delegate their rights to larger validator nodes.

Every 4 blocks (or 1.6 seconds) a “leader” is selected in a pseudorandom fashion, amongst these validators. The leader can add transactions to the blocks during this time and these blocks are then verified by other validators on the network. Validators who act in bad faith will have part or all of their tokens slashed, while those who act appropriately get rewarded with additional $SOL tokens.

The combination of the leader system and the timestamps from PoH optimize for security, decentralization and scalability (by reducing time per transaction). This has yielded favorable results compared to other Layer 1 smart contract protocols. In particular, max transactions per second can go up to 30X the nearest competitor and ~3,500X Ethereum 1.0. This allows transaction fees to be extremely low (~0.0005% that of Ethereum).

Evaluating the $SOL Token

The primary use case of the $SOL token is to pay transaction fees — this is eventually what will generate demand. Therefore the number of applications on the network and the demand for those applications will generate demand for the $SOL token. We can see how a similar sequence of events has played out with Ethereum’s ETH token during the recent NFT rush, as customers have flocked to platforms such as OpenSea where the only means of payment is ETH.

By understanding the projects being built on Solana as well as the movement and momentum of daily transactions on the platform, we can evaluate the strength of the network and determine whether there may be meaningful demand for the $SOL token in the future. Similarly, by understanding the number of tokens staked versus other Layer 1 smart contract platforms, we can estimate the level of tradeable supply we might expect.

Transaction Volume Comparison

Transaction volume is an indicator of the strength of the network. While the value of transactions may vary, a high volume of transactions indicates high participation in the network, which means that more consumers would want to hold the $SOL token to transact. In this regard, Solana blows the competition out of the water.

At the moment, a large portion of Solana’s transactions are voting related micro-transactions. However, applications such as Solana-native DEX, Serum, and other use cases continue to pick up steam.

It is important to keep in mind that Solana’s fee per transaction is meaningfully lower than other networks, however this is offset by significantly higher volumes, which continue to increase over time. As this volume continues to grow, more people will want to hold the $SOL token in order to transact on the network.

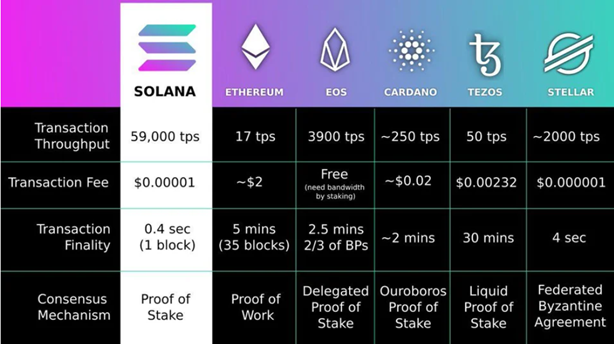

Number of projects over time

The number of projects on Solana’s network is also increasing. We measure this by the number of projects committed to Solana on GitHub. The more applications being built on Solana, the more transactions there will be. A high and increasing number of commits is an indication that there will be more demand for the $SOL token in the future.

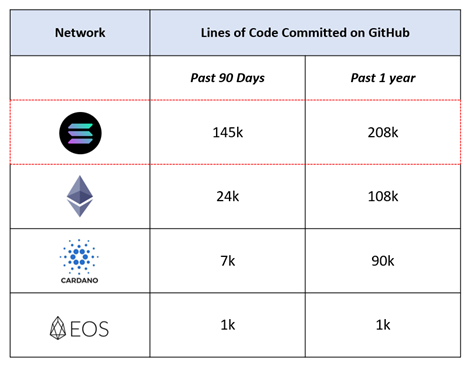

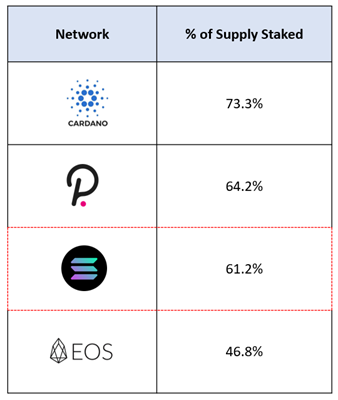

% of Tokens Staked

Finally, % of tokens staked is a good indicator of locked supply. This provides certain assurances when it comes to the organic supply that we might find in the market. The higher the % of tokens staked, the lower we can expect the natural supply to be and the greater our confidence in an asset like $SOL as an investment vehicle.

Overall, Solana has a meaningful number of tokens staked vs. competitors. With these figures we can be relatively certain that large amounts of supply will not be flooding the market anytime soon.

Conclusion

Overall, Solana has built a network that can handle meaningfully more transactions per second than any L1 smart contract blockchain without compromising significantly on security and decentralization.

While Solana has not achieved mainstream adoption yet, as more developers begin building on Solana, we can expect demand for the $SOL token to continue to increase. Coupled with the fact that >60% of $SOL tokens are currently staked and are unlikely to flood the market with supply (ceteris paribus), we can expect the price of the $SOL token to continue to increase in the mid to long run.