What’s an NFT?

This article was first published on IOSG medium on March 17th.

Anyone and everyone plugged into the tech industry has heard about NFTs in the last 2 months or so. They’ve seen Beeple, Mark Cuban, Chamath and other KOLs mention their investments in NFTs or using the technology. NFT is also heavily linked to the creator’s economy. Beeple sold his “Everydays 5000” for $69.3M via Christie’s Auction on 11th March 2021.

What does NFT mean? What are some of its applications? These are some of the questions that this article will attempt to answer.

What does a non-fungible token mean?

Technical: Non-fungible tokens that follow Ethereum’s ERC 721 token standard which makes each NFT unique with no interchangeable property.

Non Technical:

Alice and Bob can exchange $1 notes with one another with 0 consequences and are fungible. Fiat currencies are designed to be fungible. In the barter system, exchanging 1 potato for another is fungible.

Alice and Bob exchange da Vinci’s Mona Lisa for Monet’s Water Lily. This is not interchangeable nor is it a 0 consequence exchange even if both art pieces were priced the same. This represents non-fungibility?—?they are valued the same in terms of USD but they both have unique properties that cannot be replicated and are unique to the piece.

Sports analogy: Ronaldo makes 3 goals in a 3–2 match. The last goal is the high value goal since it’s the “winning goal” and that is the unique property assigned to it. It cannot be exchanged in value with his 1st or 2nd goal.

How does NFT work?

NFTs are tokenized representations of a non-fungible underlying asset. The asset can be virtually anything?—?art, music, video, an in-game asset, first edition of a book, etc.

The way we categorize them at IOSG are as following:

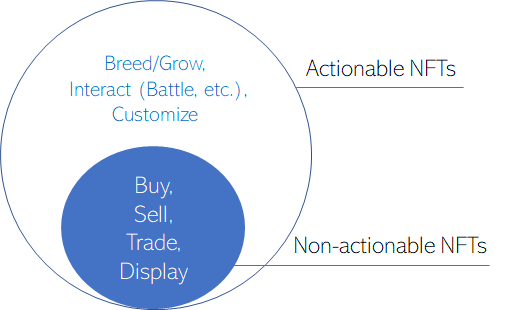

- Non-actionable

- Actionable

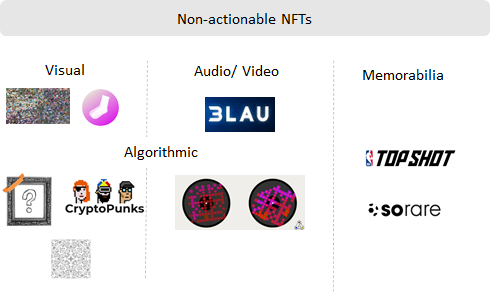

Non-actionable NFTs are items that have a store of value and the user generally cannot interact with them except by displaying them in virtual galleries or trade them.

These are typically NFTs that hold digital art, music, videos and or other forms of content or memorabilia.

Algorithmic content is created by a collection of artists. They are provided with a template of attributes: eyes, background, face, etc. These multiple features are then fed into a random number generator which churns out several different NFTs with hybrid features from various artists. The features have varying scarcity levels that define the uniqueness and hence the value of the NFT piece.

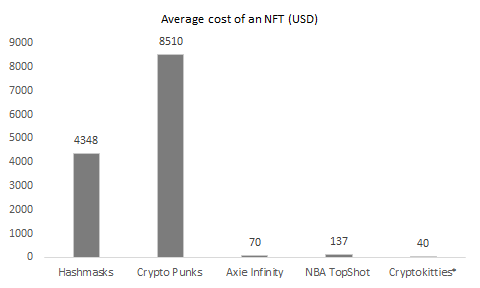

Some great examples of algorithmically scarce collectibles are Hashmasks (~16.3k) , CryptoPunks (10k) and AutoGlyphs (512). The average price of these collectibles sky rocket due to the associated scarcity and randomness of distribution (refer to fig 1.0)

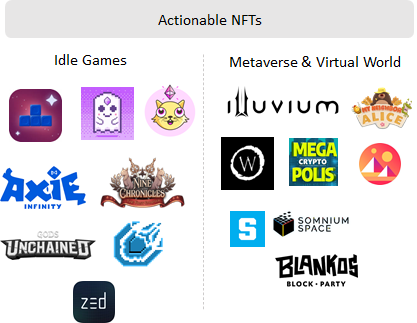

Actionable NFTs are items that have a gamified or interactive component to them. Crypto Kitties, Axies, Illuvials etc are examples of actionable NFT assets. These assets are also tradeable.

Most actionable NFTs are game-based and offer interactions like “breed” or “grow”. The NFTs are usually in-game assets and gamers typically will buy, grow and then sell these assets. They usually have higher rates of engagement and users typically see a higher attachment level to these NFTs.

So you want to mint your own NFT?

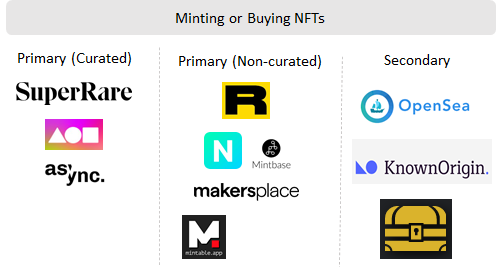

As an artist, you can mint your own NFTs via multiple platforms. Some of these are curated platforms with dedicated teams who manage the artists who can list their art and have a dedicated curation team. The curation team is responsible for conducting due diligence on the artist and takes on the burden of work in ensuring that buyers and collectors purchase works of reliable artists that are most likely to appreciate in value in the long term.

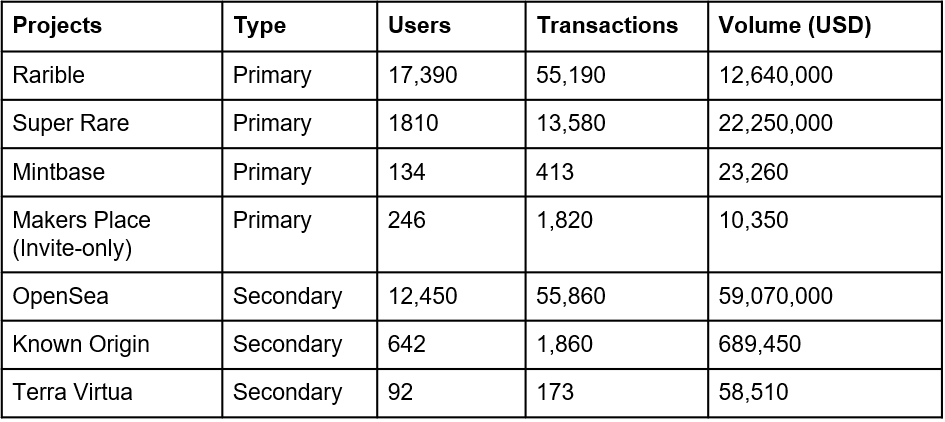

Other platforms like Rarible and Mintbase allow anyone to mint their own NFT. Currently high gas fees associated with minting NFTs is one of the biggest bottlenecks for artists who want to mint and sell low-value NFT pieces.

If you’re a new buyer, OpenSea is the market leader in all secondary sales of NFTs.

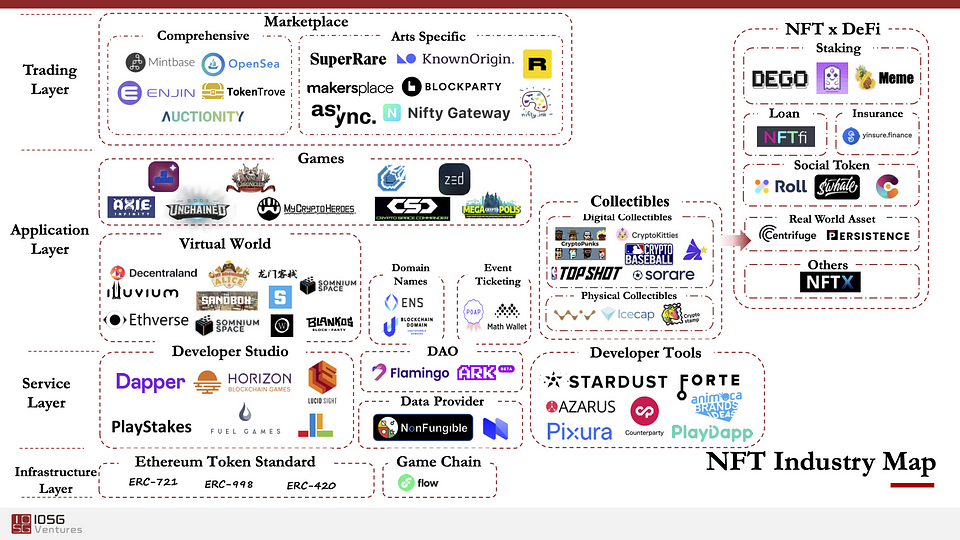

NFTs have gained traction in multi-folds over the last few months and NFT projects are on the rise. The last few months have seen new NFT marketplaces, NFT collectible projects and NFT-based games crop up.

Whilst NFTs have been fun additions to the crypto hype Hall of Fame (ICOs and DeFi Summer), they have been a major catalyst and contributor towards crypto gaining popularity and mainstream adoption. NFTs however would be a short term hype (exception of some of the collectibles listed in this article) and while crypto & NFT will continue to exist, their form and functions will see multiple iterations before seeing a sustainable adoption.