Understanding the L2 Race

A follow-on about the multi-chain future

Understanding the L2 Race: By Kerman Kohli, Founder @arcxmoney

Join the Global Coin Research Network now and contribute your thoughts!

If you’d like to learn about crypto, join our Discord channel and be kept up to date with the latest investment research, breaking news and content, Crypto community happenings around the world!

After posting last week’s article, I started getting a lot of messages and questions about the layer 2 landscape and why I’m not as optimistic despite some amazing progress being made all across the ecosystem. Rather than leaving it for another day, I thought this would be the perfect follow-up article to last week’s article: https://defiweekly.substack.com/p/the-multi-chain-universe-is-here

The Flavours of “L2”

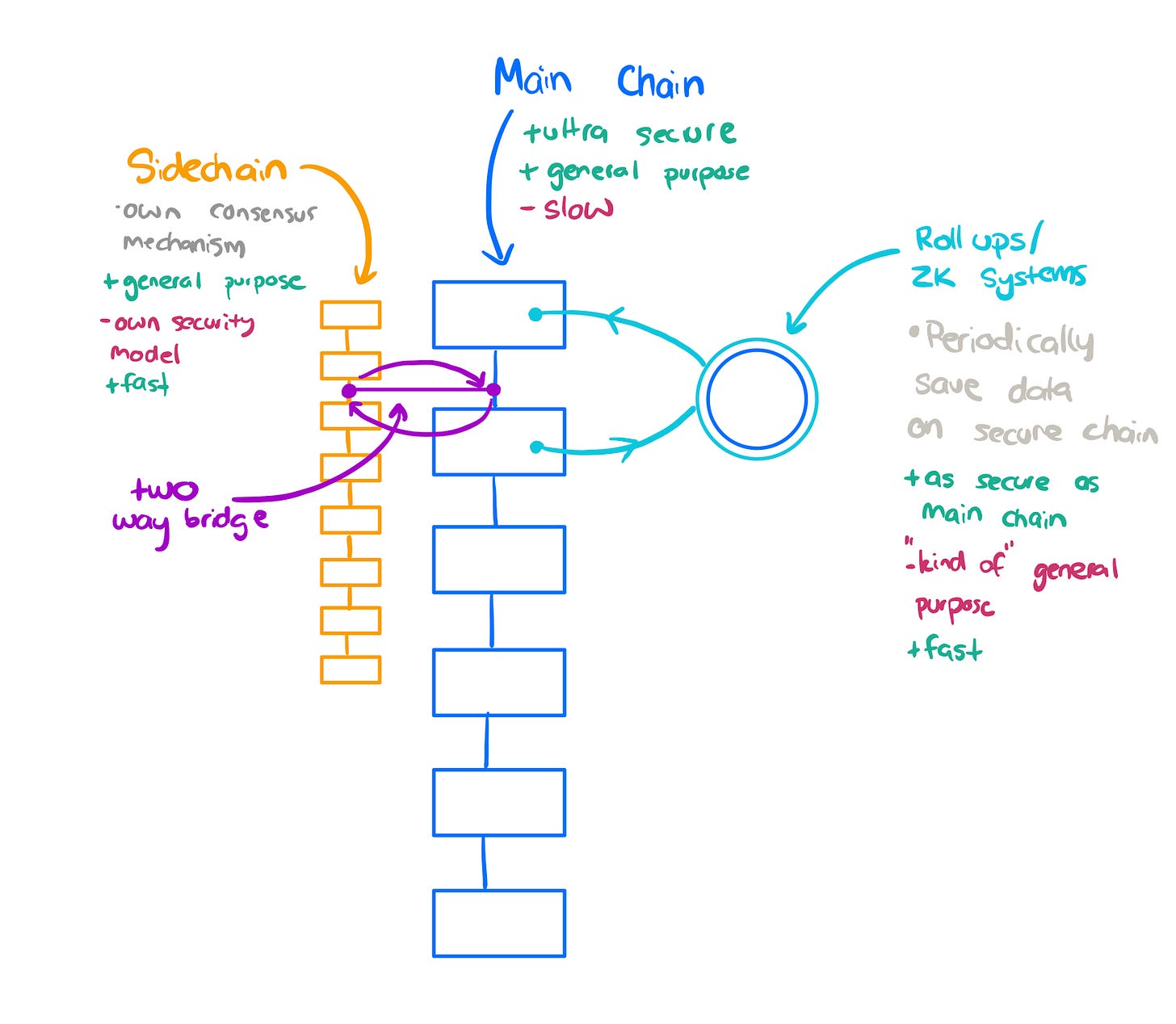

Before we get into the various teams, where they’re at and what they’re doing I thought I’d list what I include in my definition of L2 but also explaining what they mean. Here’s a cool picture to show the entire landscape as well:

- Mainchains. These are your L1s that you know and love/hate such as Etheruem, Polkadot, Solana, Near etc etc. Older ones such as Etheruem have reached a very healthy amount of decentralization and it’s basically a fact that you can’t “hack” these chains since the cost of doing so is worth far less than any attack you could launch. This is very important for things such as DeFi where tens of billions of dollars worth of value is secured. They’re great except for the fact that Ethereum, the OG is reaching capacity. What makes L1s great is that it’s a single playground where everyone can play together no qualms whatsoever.

- Sidechains (kind of L2). Think of them as “sister chains” where assets can move between each chain but the sidechain has its own technology as to how it achieves decentralisation. The argument here is that you can sacrifice some level of decentralisation for the higher throughput and users who want more security guarantees. Many of them still use checkpoints to borrow from the security of the main chain. I classify them as L2s for argument’s sake but they’re a hybrid of an L2/L1.

- Optimistic Roll ups & ZK Roll ups (actuals L2s). The main difference between system such as Optimism’s Rollup, Starkware’s ZK-STARKs, Matter Labs’ zkSync versus the rest of the market is that all of these aim to use the underlying security of the main-chain they’re hosted on. The best way to think of them are these isolated system where you can do a bunch of computation, save it on the main-chain and the isolated system is backed by math/game theory rather than PoS/PoA schemes as commonly seen with sidechains. These are meant to be as secure as the main chain, fast but their main issue (for now) is that general purpose is still hard to achieve. If you’re getting your pitchforks out with this statement, hold on – we’ve still got the rest of the article ahead of us.

Digging Deeper

So now that we’ve on the same page about all the trade-offs, the high level race going on in the industry is that people want a solution that is:

a) As secure as Ethereum

b) Fast and cheap to use

c) Interoperable/bridged with Etheruem

While this discussion is highly relevant to multi-chain, we’re going to put it aside for a second and keep our focus purely on Layer 2. I’m also going to put a disclaimer that I am not an expert on layer 2 scaling solutions and in the weeds of everything going on. My purpose for writing this article is to give an objective, high level view of what I see going on in the landscape of L2s and the reasoning around it. I’m super grateful for the teams that ship and are iterating tirelessly to deliver us this future. At a high level we have 3 main contenders at the moment in our race to fame:

- Optimism Labs. a16z led their recent $25m round. Current protocols they’ve signed up are: Uniswap, Maker, Synthetix, Chainlink, Rari Capital and probably a few more under stealth. This blog post by a16z is a pretty good write-up of what they’re doing and more background info: https://a16z.com/2021/02/24/investing-in-optimism/. The team that Optimism has rallied is pretty incredible if you dig deeper.

- Matter Labs (zkSync). Backed by USV, 1kx, Dragonfly and a few other global investors. They closed a recent ecosystem round with a bunch of top DeFi protocols that will most likely use them. This list includes: Curve, Aave, Balance, 1inch, Loopring and more. Matter has done an impressive job at getting a lot of ecosystem buy-in.

- StarkWare (StarkExchange). Backed by Paradigm, Sequoia, Naval and more, they’re another force to be taken seriously. The special thing about Starkware is that Eli Ben Sasson, their chief scientist, is arguably the most knowledgeable person in the world when it comes to zero knowledge proofs. I’ve had the privilege of getting some Zero Knowledge (ZK) math lessons from him myself! Anyways, they’ve secured dYdX, DiversiFi, Rari Capital and Immutable X and are live with half of the list already.

I’d love to give a shoutout to Polygon and Loopring here. I’ll write a piece about them in the future but for the scope of this article I’d like to keep it narrow and focused with close competitors.

Not only are each of these teams incredibly impressive with their talent + backers, they’re all going for the a similar market: the dominant, general purpose, layer 2 smart contract platform of choice. Before we get into the details of where they’re at, I want to take some time explaining the technical choices made by each of these teams.

At a high level, your mental model should be thinking about two distinct approaches to the underlying security. Optimism = Optimistic Rollups. Starkware & zkLabs = Zero Knowledge Rollups. Here is a tweet storm from Ali Atiia that outlines it perfectly:

So TLDR: Optimistic assumes that everything is okay unless said otherwise. Zero Knowledge Rollups don’t make any assumption and explicitly check that everything is okay via complex mathematics and cryptography.

Okay so where does this leave us? Here’s where it gets interesting.