Ethereum’s EIP 1559 – Overview through its Pros & Cons

Before we talk about EIP1559, let’s take a brief look at one of the biggest issues plaguing Ethereum – it’s fee market.

Current issues with Ethereum’s fee market

Transactions on Ethereum are processed auction-style where highest bidders are considered first for inclusion in a block, and each block only has limited space available. During times of high activity (eg. DeFi summer 2020, market dumps), gas prices have spiked to over 1000 – 2000 gwei and even . At these gas prices, even a simple swap on Uniswap could cost anywhere between $150 – $400 while other more complex operations can cost double or more of that.

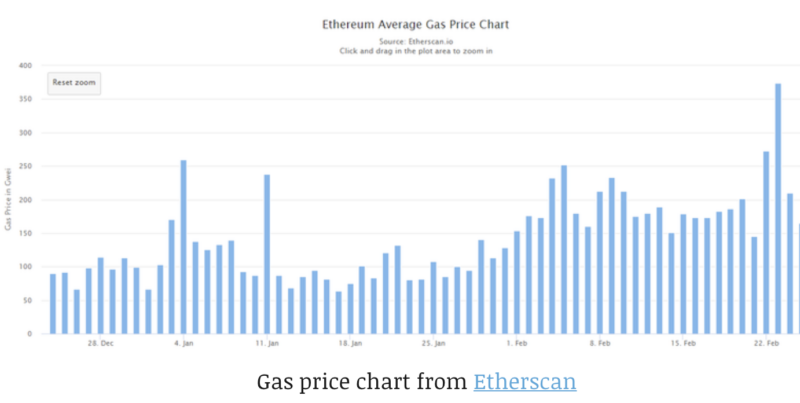

Throughout 2021, Ethereum’s gas prices have been rising steadily and averages around 150+ gwei in recent weeks, driven by a surge in contract interactions on the Ethereum network.

Gas price chart from Etherscan

Gas price chart from Etherscan

Under these conditions, unaware users are likely stuck waiting until they speed their transactions up with a higher fee to have their transaction picked up. Waiting for the gas prices to retuirn to lower levels could take hours, days, or even months.

An auction style fee market also leaves Ethereum vulnerable to exploits through bidding up of the fee market (eg. malicious miners publishing empty blocks to create artificial demand).

Compounding on the issue would be the fact that each wallet (eg. Metamask) has its own method of estimating the market rate for block inclusion, leading to everyone bidding on top of one another, eventually leading to overpaying of gas fees.

One of the Ethereum Improvement Proposals (EIP), EIP1559 proposed in 2019 is now the focus for much of the Ethereum community as attempts are made to remove this bottleneck.

In today’s article, we’ll be taking a quick run through EIP1559 and the pros/cons that come along with it.

1. Introduction of BASEFEE, which is the portion of transaction fee that gets burned.

BASEFEE is intended as the “Market rate” for transaction inclusion. In each transaction, users can add tips on top of BASEFEE to incentivize miners to pick up their transaction first.

? Pros:

- A more consistent UX for users. As the “market rate” becomes known, application developers can now estimate gas prices for transactions more accurately and help users avoid overpaying.

- Removes fee manipulation vectors – eg. ones where malicious miners fill up blocks with empty transactions to inflate market prices (

BASEFEEgets burned). (detailed study) - Reduced inflation on ETH – In addition to paying less fees, ETH holders will also benefit directly from reduced inflation as some fees paid in ETH gets burned.

? Cons:

- ~20 – 35% of miner’s income will be directly impacted as

BASEFEEgets burned. Note that miners still earn fromtips&block_rewards. @hasufl and @gakonst published a very well done study earlier that estimates the impacts of EIP1559 on miner revenue (source).

? Debatable:

- Reduced inflation may not necessarily be good. At the time of writing, each Ethereum block (Etherscan) has a reward of approximately 3.5 ETH/block, where 2 ETH comes in the form of

block_rewardsand 1.5 ETH as fees paid. If some ETH gets burned asBASEFEE, assuming demand stays the same, simple supply/demand states that the price of ETH will increase.

However, it is worth thinking if this may ultimately lead to even more expensive transactions if ETH prices are higher than what they are now

2. Variable block size

Idea is to relax the constraint where each block must be 12.5M gas in size, and instead allow it to float between 0 – 25M gas in size while targeting an average of 12.5M gas in size. Blocks shrink/expand according to network demand which is then used to adjust BASEFEE.

? Pros:

- Reduced network congestion. Since block size can increase in response to demand (only up to a certain limit though).

- Potentially lower fees. As each block can now fit more transactions, transaction prices may fall to a lower and more reasonable level.

? Cons:

- Further straining the Ethereum infrastructure – with block sizes up to 25M gas (2x current maximum), node operators will have to scale/prepare their infrastructure accordingly to handle it.

That said, it is worth noting infrastructure wise state growth (speed which Ethereum state grows) is usually the main cost concern and EIP1559 likely does not affect that as it targets to maintain an average of 12.5M gas per block (current max). - Possibly ending up the same as before. While

BASEFEEcan be burnt, at times of high usage, people may simply resort to outbidding each other.

? Debatable:

- Block variance introduced by EIP1559 may be nothing to worry about. See arguments on Vitalik’s article.

Current status (Feb 2021)

A large proportion of the ETH community appears to support EIP1559 while the majority of miners are against it. @harithk17 from @etherscan also shared an insightful dashboard that helps give an idea on the hash rates supporting or opposing EIP1559.

Closing thoughts

As a hobbyist Ethereum miner as well as a user myself, I personally think that the implementation of EIP1559 is worth a shot – Ethereum at its current state prices out many users and developers.

The biggest benefit that EIP1559 will bring about will be a potentially lower fee market & better user experience, both of which benefit users and developers who are around to spend. In the longer run, it would benefit miners as on-chain activity remains high and their revenue stabilizes rather than spike up/down during peak times.

One universal risk will be deployment risks – from the process of updating the entire Ethereum blockchain down to dapp updates.

However, these risks could be well worth taking on to ensure continuous and sustainable economic activity of the Ethereum ecosystem that is the decentralized financial system for us all.

Updates

Special thanks to @hasufl for sharing a few pointers and perspectives. I have since amended some points in this article to better reflect certain points of consideration post-discussion.

This article was originally posted on CoinGecko Buzz.

References

- EIP1559 Proposal – https://github.com/ethereum/EIPs/blob/master/EIPS/eip-1559.md

- An extensive economic analysis, with suggestions on other variants of EIP1559 – http://timroughgarden.org/papers/eip1559.pdf

- More on EIP 1559 – https://medium.com/@TrustlessState/eip-1559-the-final-puzzle-piece-to-ethereums-monetary-policy-58802ab28a27

- EIP 1559 Community Sentiment – https://twitter.com/trent_vanepps/status/1364690167840337921

- Flash Boys 2.0: Frontrunning, Transaction Reordering, and Consensus Instability in Decentralized Exchanges – https://twitter.com/phildaian/status/1116155236433956865

- Miner revenue change with EIP1559 – https://insights.deribit.com/market-research/establishing-bounds-for-miner-revenue-in-eip-1559/

- Vitalik’s views on why EIP1559’s block variance change isn’t an issue – https://notes.ethereum.org/@vbuterin/eip_1559_spikes