Japan Crypto Snapshot — Japan’s Crypto Market Sees New Heights

This is a contributing article written by Yuya Hasegawa, a Market Analyst at bitbank, inc..

Join the Global Coin Research Network now and contribute your thoughts on Asia!

This article is based on official information of Cryptocurrency Monthly Trade Data published by JVCEA (Japan Virtual and Crypto assets Exchange Association), which is a Self-Regulatory Organization named by Financial Services Agency in Japan. Formerly known as the Japan Virtual Currencies Exchange Association, the organization has revised its name to its current one due to changes in Japan’s regulatory rules.

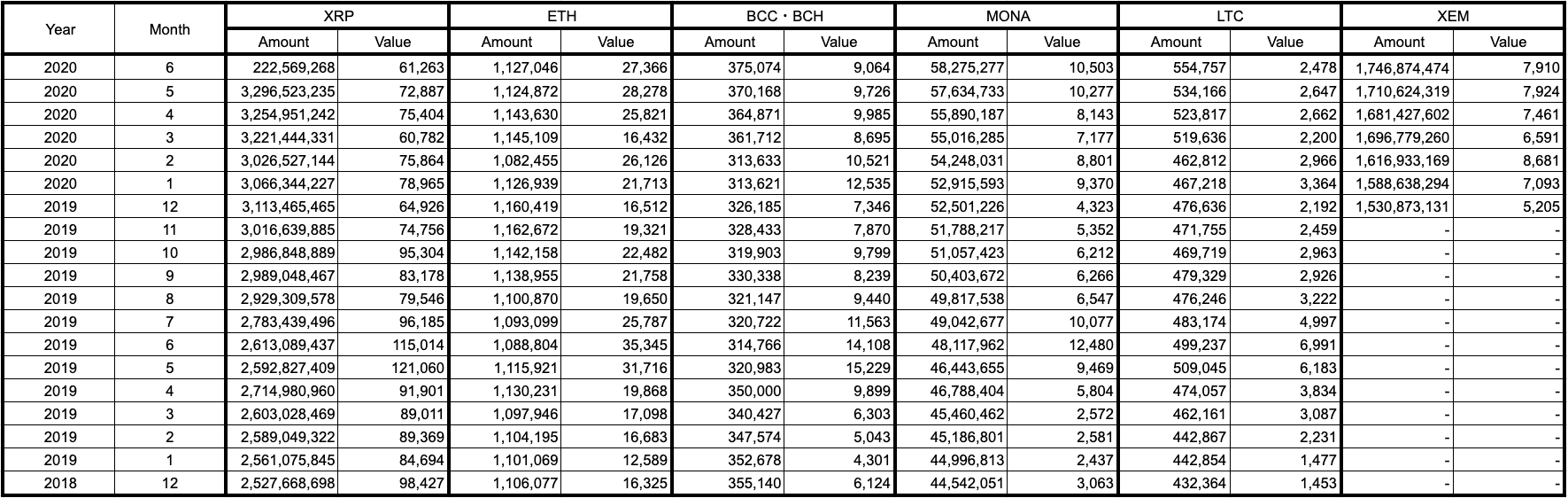

*Value = 1 million JPY

Source: Japan Virtual and Crypto assets Exchange Association

*Value = 1 million JPY

Source: Japan Virtual and Crypto assets Exchange Association

*Value = 1 million JPY

Source: Japan Virtual and Crypto assets Exchange Association

*Value = 1 million JPY

Source: Japan Virtual and Crypto assets Exchange Association

Quick Take

- Bitcoin Halving Raked in 134k Active Accounts for the Spot and Margin Combined.

- The number of active accounts exceeds pre-COVID-19 levels.

- Bitcoin’s halving likely had attracted more newcomers.

- With the demand for hedging on the rise, Bitcoin’s monthly traded value climbs to its ATH, 91.04%.

Japan’s crypto market seems to have completely sprung back from the damage caused by the COVID-19, at least in terms of the number of active accounts. The market took a hit from the COVID-19 as the number of active accounts for spot and margin trading decreased in March and April respectively, which, for the spot market, was the first time since the JVCEA statistics, and for the margin trading, was the largest loss since February 2019. However, back in May, the spot market saw the biggest increase with 55k more active accounts, and margin trading added 79k more active users from April, both exceeding well above their respective pre-COVID-19 levels (Fig. 1).

Source: Japan Virtual and Crypto assets Exchange Association

These record-breaking numbers are most likely due to bitcoin’s halving, which took place on May 12th. Although BTC failed to breach the $10k psychological resistance during May, a lot of Japanese investors seem to have bet on a positive halving effect. In fact, BTC’s monthly traded value in May accounted for 91.04% of the total value traded in Japan (Fig.2. Excluding smaller market cap coins).

This suggests, yet again, that most of newcomers to Japan’s crypto market are likely to be only interested in bitcoin, which is not that surprising as, after all, bitcoin is THE cryptocurrency, and has been acting as a digital gold and a hedge against dollar’s depreciation since the Corona Shock (Fig. 3: Particularly during May, BTC’s correlation with Gold and inverse correlation with the Dollar Index were strong).

*Excluding other smaller market cap coins

Source: Japan Virtual and Crypto assets Exchange Association

Source: Tradingview

In retrospect, BTC’s very slow and steady price depreciation and record-low volatility in the following months are actually quite understandable. As the market was obviously pricing in the halving, the event itself signaled the end of a buying round and the beginning of a round of profit-taking. However, for bitcoin, halving is a cyclical event that has, in the past two times, marked the beginning of long-term rallies — hence, the price did not cash after halving — but also, since the event was relatively well priced in, the market needed a strong event or just had to wait until selling pressure to wear off to start a new buying spree.

Notes

On Table .1 and Table .2

“Trade Value ‘’ includes a numerical value by trade agencies to the other cryptocurrency exchanges. “Amount” and “Value” of open interest of margin trade don’t include a numerical value by trade agencies to the other cryptocurrency exchanges. “Base Accounts” includes the accounts for the purpose of agency trade to the other cryptocurrency exchanges. “Total Accounts” includes the series of accounts for the purpose of compatible use of spot trade and margin trade. “Active Accounts” means the accounts by which users trade at least once in each month, or by which there remain some amount of cryptocurrencies or JPY. “Trade Value ‘’ and ”Open Interest of Margin Trade ‘’ were aggregated apart from one member company of JVCEA. Lastly, “Trade value” is a numerical value calculated from the first day to the last day of each month. “Users’ Holding Amount”, “Open Interest of Margin Trade”, and “Users’ Crypto Accounts” are as of the last day of each month.

On Table .3

This table is a series of data of users’ monthly BTC holding of each month. “Spot” is the amount of BTC deposited by users and its evaluated value. “Open Interest of Margin Trade ‘’ is the amount of open interest held by users and its evaluated value. This table excludes the result of trade agency to the other cryptocurrency exchanges. Each numerical datum is as of the last day of each month. ”Open Interest of Margin Trade ‘’ was aggregated apart from one member company of JVCEA.

On Table .4

“Value” of each cryptocurrency is the aggregation of the valuations reported by each JVCEA member company. Each JVCEA member company calculates the valuation on the deposited amount by users multiplied by each companies’ final valuation rate. This table is based on the types of cryptocurrencies, which three or more JVCEA member companies list. The types of cryptocurrencies will be reviewed once a year. This table excludes the result of trade agency to the other cryptocurrency exchanges. Each numerical datum is as of the last day of each month.