Trade on dYdX with 10% Off Trading Fees- Perpetuals, Margin and Spot

Dear GCR readers and friends, as we mentioned last week, BTC-USDC is now live on dYdX!

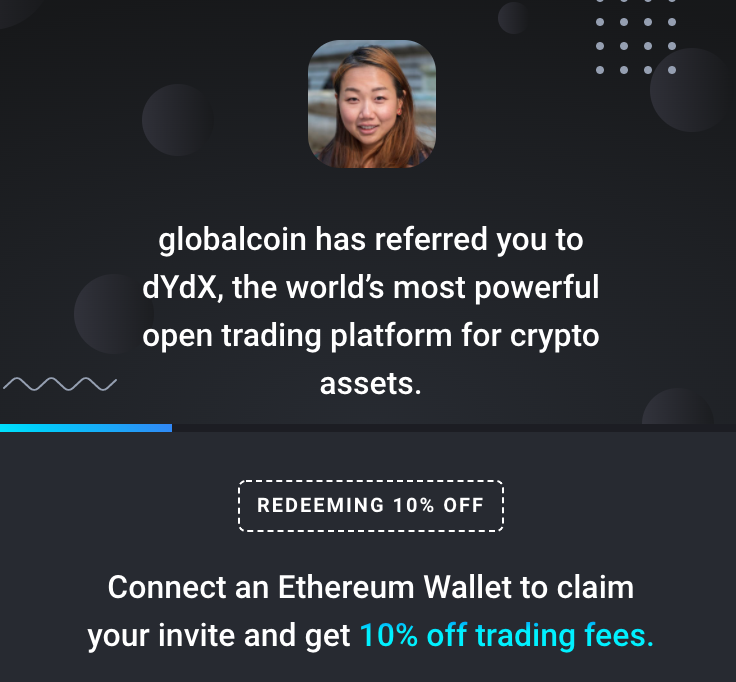

Global Coin Research is teaming up with the dYdX team to offer our readers a 10% discount off of ALL trading fees on the launch of their new Bitcoin Perpetual Market, with up to 10x leverage.

And this discount applies to BOTH EXISTING and NEW CUSTOMERS. All you have to do is use our exclusive referral link: https://trade.dydx.exchange/r/globalcoin

Get An Immediate Discount on dYdX for Perpetuals, Margin and Spot Trading

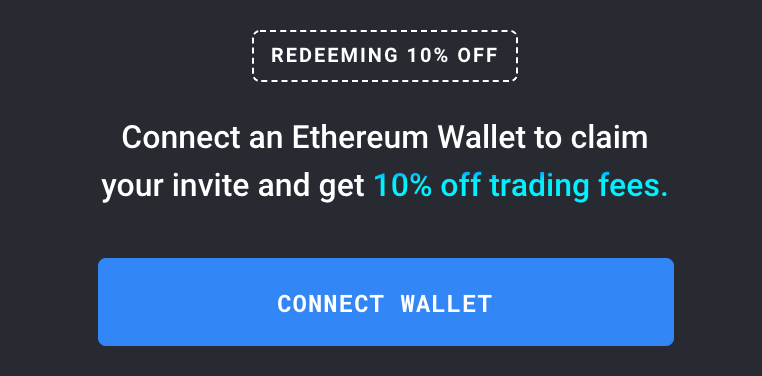

When you first click through our referral link, you’ll see a 10% discount offer.

NOTE: Global Coin Research may receive commission if you make a purchase through one of the links above. Thanks for your support!

Why Are You Partnering with dYdX?

Here’s a little bit more info about why we are partnering with the team:

- From our perspective, dYdX is the best place to get liquid trading exposure on BTC while retaining custody of funds

- There is already over 500K USDC on the order books at a 1 USDC spread, with less than 100 users on the platform. See the latest spreads and liquidity numbers all the way down.

- dYdX provides the only BTC Perpetual with fully transparent and verifiable liquidation mechanisms

- Given recent market volatility, traders are increasingly expressing concerns around opacity and lack of transparency of existing perpetuals such as BitMEX. If there was ever a product that made sense to be built with transparency in mind, it is dYdX.

- It’s THE Simplest way to trade the volatility of BTC

- Get linear exposure to the BTC/USD futures curve without having to simultaneously worry about the value of collateral (as with inverse perpetuals margined in BTC, ETH etc).

- Most secure derivatives platform on DeFi

- dYdX’s infrastructure with the highest industry standards. The smart contracts have also been audited by OpenZeppelin — a leading security audit firm. No critical or high severity issues were found.

Latest Spreads and Liquidity Stats

According to the CEO Antonio Juliano, here are last week’s 24 hour spreads on the platform:

BTC-USDC perpetual: 1 USDC / 0.01%

ETH-DAI: 0.04 DAI / 0.02%

ETH-USDC: 0.33 USDC / 0.17%

DAI-USDC: 0.0007 USDC / 0.07%

Additional datapoints:

- ETH-DAI has a spread of 0.02% with almost 500k DAI liquidity within a 1% price spread

- ETH-USDC has a spread of 0.17%, and has over 800k liquidity within 1% (including a casual 3,000 ETH buy order close to mid-market)

- DAI-USDC has a spread of 0.07% and over 700k liquidity within 1%

Indeed, dYdX still has a bit to go before it gets to centralized exchange levels of liquidity, but it’s not that far off Coinbase has a spread of 0.005% and ~$1.16M within 1% on ETH-USD.

Join US NOW on dYdX and take advantage of the 10% discount! trade.dydx.exchange/r/globalcoin