USDT: 25%-60% of ImToken Network Traffic in 2019; Ranking 2nd in DEXes

This is a contributing article from June Liu, ImToken.

Join the Global Coin Research Network now and contribute your thoughts on Asia!

Written as of April 15, 2020

Recently, the global capital market has shifted from the haze in late March, and has driven the digital asset market to pick up. In addition to mainstream currencies such as BTC and ETH, stablecoins have also become the focus of attention within and outside the industry.

Blockchain data analysis agency Flipside Crypto recently released an activity map of the three major stable currencies in Q1 2020.

The green line in the figure shows USDT transactions, the blue line USDC transactions, and the yellow line DAI. Each node is an Ethereum address, and the closer the nodes are the more frequent transactions between each other. In this activity map, USDT is concentrated in the centralized exchanges in Asia, while DAI is concentrated in the field of DeFi. However, from the perspective of trade volumes and other industry data, we find that USDT is even eager to expand decentralized exchanges and even DeFi.

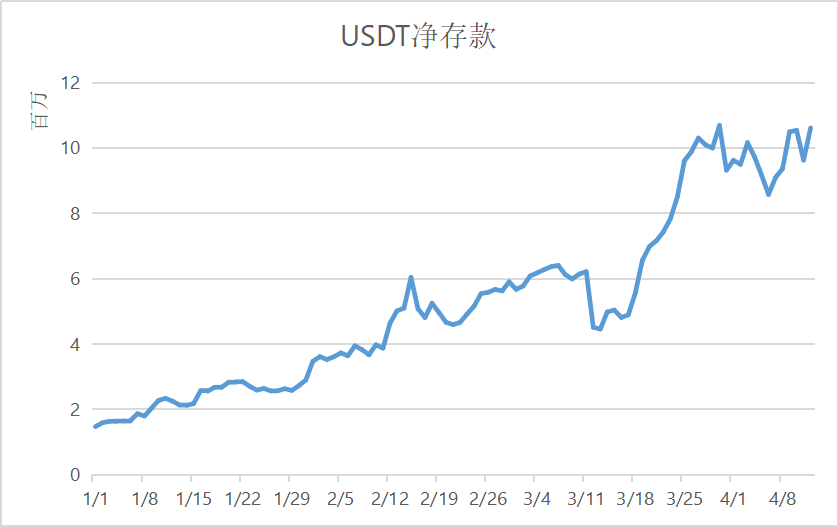

USDT has always been controversial because of its opaque issuance mechanism, but because it is the earliest stablecoin, it ranks first in terms of circulation and acceptance, especially in Asia. According to Whale Alert data, Tether USDT has conducted 17 additional issuances totaling $1.984 billion since March, and its total market value is second only to BTC, ETH, and XRP. From this perspective, the massive issuance of USDT means huge demand in the market.

USDT continues to maintain high demand in the market

According to the data tracked by the decentralized wallet imToken, the average transfer number of stablecoins in imToken accounts for one-third of the total transfers, and the highest share in the last 30 days has reached 39.54%.

Among them, the total value of USDT transfers in the past 30 days reached 1.865 billion US dollars, and the maximum transfer amount in a single day was 114 million US dollars. In 2019, the number of USDT transfers in imToken accounted for an average of 25% of the entire network, and the highest reached 60% of the entire network. How come? Users who are based in Asia account for 80% of imToken’s current installed devices of more than 10 million. This shows that Asian users have a higher acceptance of USDT.

Where does the stable high demand for USDT come from?

Both the proportion and amount of transfers reflect that USDT is the stable asset with the largest market share and trading volume in Asia. The reason for this high demand is mainly due to its ability to meet “high circulation” and “stable risk avoidance.

USDT occupies more than 80% of the market share of the stable currency, becoming the main, liquid channel for the circulation of legal currency and digital assets. market volatility is relatively high, USDT, which can quickly circulate and is relatively stable, naturally becomes the user’s first choice as a safe haven. As can be seen from the imToken data, not only did the USDT transaction volume explode during the market fluctuations of mid March, but in daily transactions, USDT has also maintained a stable and high demand.

USDT’s expansion to the DEX ecosystem

Although USDT liquidity offers an absolute advantage in centralized exchanges (CEX), its influence is slowly penetrating into decentralized exchanges (DEX) and even DeFi.

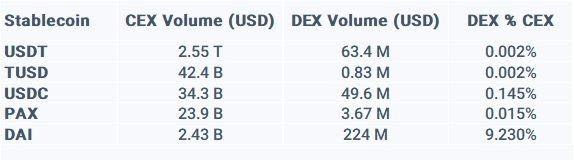

According to data from Etherscan, USDT’s trading volume in DEXs ranks second after DAI at a scale of $63 million. But what is interesting is that most of its transactions are concentrated in two DEX Tokenlon and Kyber Network, which operate mainly out of Asia. There, the transaction volume of USDT in Tokenlon accounted for more than 90%.

In decentralized lending, one of the keys to growth of the Lendf.Me lending market by dForce is the access to USDT. Relying on the high liquidity and usage of USDT, it has quickly penetrated into the lending market. Yang Mindao, founder of “Lendf.Me”, said that the total market deposit of USDT in Lendf.Me has exceeded 10 million USD. A large amount of ERC20 USDT is deposited in ETH wallets such as imToken. For users seeking passive income, DeFi lending markets have become a very good application scenario, and the natural flow of USDT has begun to enter. This is why DeFi applications such as Aave, iearn, curve, and DDEX are gradually supporting USDT.

So far, the major stable coins each occupy a niche of the crypto market. But with the continuous innovation of DeFi products and the continued high demand for USDT from Asian users, USDT has opened the way to expansion. With DeFi projects expanding their product palettes, it is possible that the expansion of USDT will become more obvious.