GCR Market and Investment Trends Review – Q2 2023

Highlights

GCR is a research and investment community. As a collective, we source investments, conduct research and diligence, and make investments together.

This piece lays out some highlights from the past quarter:

- The GCR Community saw over 59 investment opportunities in Q2, of which ~80% came directly from community members and contributors.

- The only top category we invested in was Infrastructure.

- During Q2 2023, GCR invested in a total of 1 deal.

- GCR Core Team presents Q2 macro review and shares our outlook for Q3 2023.

Making Progress Towards Community-Driven Investing

Q2 2023 Summary Stats

The GCR Community continues to make significant strides, demonstrating unwavering discipline in curating top-notch deal flow and forging partnerships with high-conviction companies.

- During Q2 2023, the community assessed over 59 deals, a number akin to Q1 2023. Notably, approximately 80% of these opportunities were directly contributed by community members and contributors. This figure contrasts with the 150+ investment opportunities observed in Q2 2022, where 55% were community-sourced.

- Despite the subdued investment appetite in both the crypto and traditional asset classes, GCR proactively sourced and thoroughly reviewed more deals this quarter than in both Q4 2022 and Q1 2023.

- When categorizing the opportunities explored by the community, Infrastructure remained the most prevalent at approximately 40%, followed by DeFi and CeFi at 27%, and Gaming and Social at around 17% each.

- Furthermore, the community solely focused on investments in the Infrastructure category during this quarter, in contrast to the diversified approach seen in Q2 of the previous year, where investments spanned various segments, notably Consumer and Crypto Services.

- In alignment with the prevailing market sentiment and the discerning approach of the GCR Community, GCR executed only 1 deal in Q2 2023, a notable difference from the 16 deals invested in Q2 2022.

Every quarter, we proudly share our progress to showcase the capabilities of GCR’s community-led investment platform. The GCR Community continues to grow stronger as members educate each other about their specific areas of expertise. If you would like to learn more about how you can be involved with the GCR Community, join our Discord.

Venture Investing Continues in Hibernation

Compared to last year’s Q2 2022, this year witnessed considerably less subdued market activities. Q2 2022 was an interesting time for the crypto industry, marked by the far-reaching consequences of the Terra ecosystem implosion. Despite these challenges, we remain optimistic about both GCR’s prospects and the future of crypto space.

Similar to Q1 2023, Q2 was a relatively muted period for the Web3 space. Economic pressures and hawkish policies continue to exert their influence, while the United States Securities and Exchange Commission (SEC) has recently taken stringent actions against several U.S. crypto firms, which has had a dampening effect on institutional investment appetite.

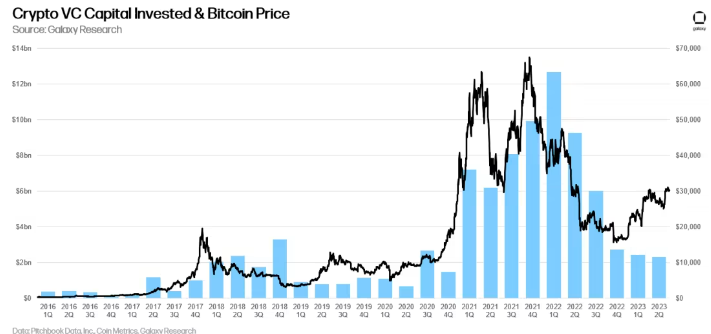

According to Galaxy Digital’s research, the number of deals increased slightly in Q2; however, the total capital invested by venture capitalists into crypto and blockchain startups continued to decline quarter over quarter, stabilizing at around $2 billion dollars. This stands in stark contrast to the industry’s peak of $12.14 billion in the first quarter of 2022. Notable raises during Q2 2023 include LayerZero’s $120 million Series B round and Worldcoin’s $115 million Series C round.

Source: Galaxy Research

Other sources also reported a consistent drop in early-stage valuations. Specifically, valuations in the industry plummeted by a significant 50% from the first half of 2022 to the second half of 2022. Subsequently, crypto startup valuations experienced an additional 15% drop, reaching a total decline of almost 70% year over year by the first half of 2023. This trend is evident in smaller ticket sizes, which have decreased from an average of ~$14.8 million to ~$10 million in the past quarter.

Across the pond in Europe, one of the main topics in the crypto market is the increasing adoption of cryptocurrencies by businesses and governments. With the European MiCA (Markets in Crypto Assets Regulation), national regulations like Crypto Custody and the concept of the digital Euro as a CBDC, confidence arises in the rather conservative European Union. Over the course of the last year, investment in European Crypto projects has increased significantly.

The new crypto-related regulation has been implemented on a national level in various European countries and will be increasingly harmonized through MiCA. While most of the rules seem to be clear on the high level, a detailed roadmap and guidance are still in progress – for national and European regulation. This comes with uncertainty for projects and established market participants, where clarity will come eventually over the period of months. However, even though the regulation is on its way to providing some clarity, VC investing, in general, is not taking off in Europe, where the framework is not as favorable as in other economic areas. This is mostly affecting early-stage projects more than established ones.

GCR Portfolio Companies Continue to Ship

We have previously focused our quarterly reviews on highlighting our deal pipeline and funded investments, but GCR now has grown to nearly 70 portfolio companies that are relentlessly building. In these times when our conviction in Web3 is being tested, we want to take this opportunity to showcase what some of our awesome portfolio companies have been up to lately.

Manta Network

Manta Network is a ZK Layer-1 blockchain with the fastest prover speed and most decentralized trusted setup that brings programmable privacy to Web3.

- Manta Network introduced the Manta Pacific Testnet, offering a modular execution layer for EVM-native ZK applications.

Mysten Labs

Mysten Labs is a crypto and blockchain infrastructure technology company founded in September 2021 by 4 former Facebook engineers.

- Mysten Labs’s Sui’s Mainnet went live on May 3rd.

Sweatcoin

Sweatcoin is a new breed of step counter and activity tracker that converts your steps into a currency you can spend on gadgets, sports and fitness kits, and more.

- Sweatcoin announced the launch of Sweat Hero, an engaging game that encourages physical activity and rewards players for walking more. The project will also launch in the U.S. in September.

Topology

Topology is a project that aims to develop zkRollup-native infrastructure for a strongly decentralized metaverse.

- Topology has unveiled Shoshin, a Minimal Viable Reality with Asynchronous Onchain Strategies, in Paris on July 22nd.

zkLink

zkLink is a trustless chain-to-chain DEX based on Zero-Knowledge technology.

- zkLink has launched its Alpha Mainnet, operating in private mode with selected whitelist users.

LayerZero

LayerZero is a User Application (UA) configurable on-chain endpoint that runs an Ultra Light Node (ULN).

- LayerZero announces Series B raise of $120M at $3B valuation.

Morpho Labs

Morpho Labs is a completely new kind of DeFi protocol that improves the capital efficiency of protocols like AAVE or Compound whilst preserving the same liquidity and risk guarantees.

- Morpho’s Aave V3 Optimizer is a new and technically advanced matching engine with a data structure called logarithmic buckets.

Utopia Labs

Utopia Labs is an all-in-one platform to create, execute, and understand your Safe transactions.

- Utopia Labs recently started allowing businesses to send USDC to any U.S. bank account without going through centralized exchanges.

Lens Protocol

Lens Protocol is building a Web3 product aimed at creating a decentralized Social Networking ecosystem.

- Lens announced that they’ve raised $15M Seed. The GCR Team also shared our investment thesis on the GCR website.

Magic Eden

Magic Eden is one of the largest NFT marketplaces in the world.

- Magic Eden announced Ethereum and Bitcoin marketplaces and has become the largest Bitcoin ordinals marketplace in the space.

Macro Outlook

The cryptocurrency market experienced a turbulent and challenging Q2 2023, extending the downtrend that had begun in Q1 of the same year. Despite the bearish sentiment, no clear crypto-specific catalysts emerged in the near term. Digital asset traders focused on meme tokens, such as PEPE and BRC-20 Ordinal tokens, while AI and Infrastructure themes continued to influence the private crypto markets.

Macro Overall Hasn’t Improved

However, amidst rising interest rate expectations, the overall asset class showed slight weakness in May. Market expectations for higher and longer interest rates impacted the U.S. 2-year yield, causing the U.S. Treasury yield curve to eliminate rate cut expectations for the remainder of the year.

Mixed Market News

The crypto market remained range-bound throughout June, facing tests from significant announcements. Notably, the SEC announcements from Binance and Coinbase influenced market lows, while market highs were influenced by BlackRock’s and other large institutional player filings for a Bitcoin spot ETF. Bitcoin garnered increased attention during this period, particularly with BlackRock’s ETF application-generating discussions.

Still Trending: NFTs

Ordinal inscriptions, akin to Bitcoin NFTs, captured renewed interest in the crypto ecosystem. Along with meme tokens such as PEPE, the rising popularity of Bitcoin NFTs contributed to a more vibrant market environment and generated considerable discussions about the asset’s potential. However, the NFT space extended beyond Bitcoin, as evidenced by Nike’s .Swoosh introduction of the ‘Our Force 1’ NFT collection, which yielded impressive sales figures and mints.

Trading Numbers, Uniswap Maintains Dominance

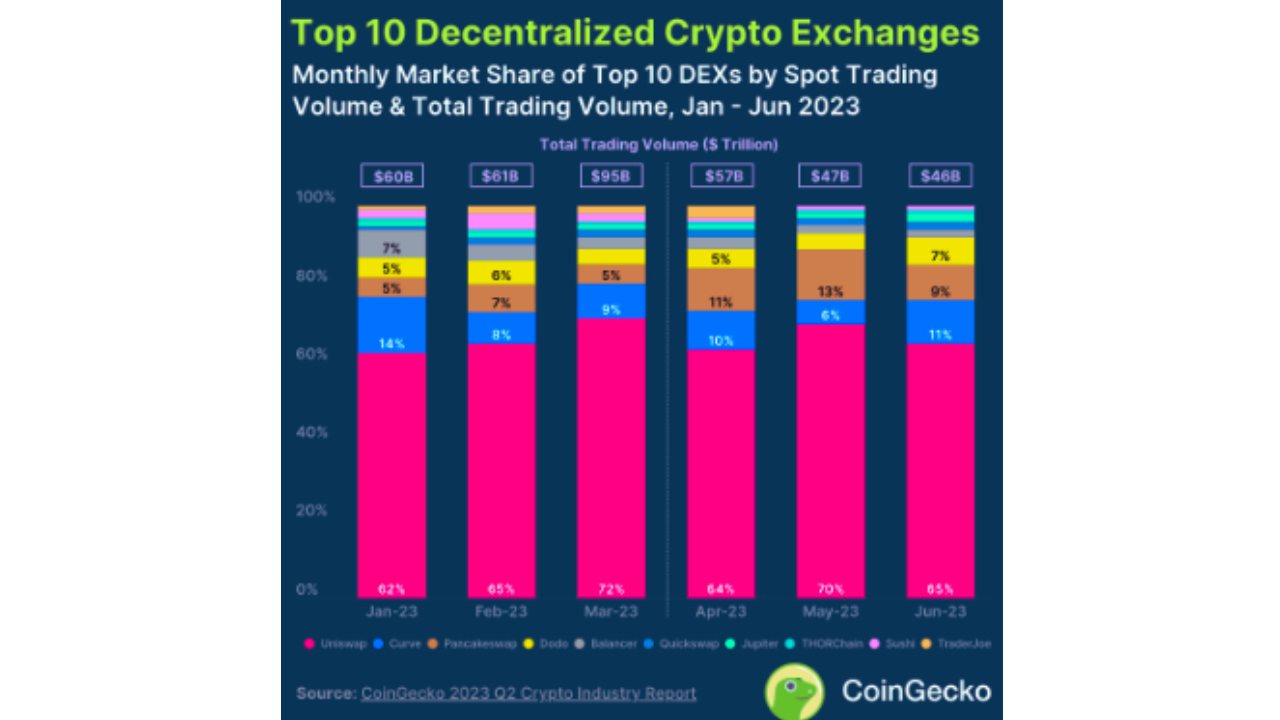

Some highlights from the CoinGecko’s 2023 Q2 Crypto Industry Report:

- BTC saw some volatility in 2023 Q2, ending the quarter with a 6.9% gain.

- Stablecoins shrank 3.5%, with USDC and BUSD the biggest losers again.

- ETH staking grew 30.3% in 2023 Q2, after withdrawals were enabled.

- NFT trading volume saw a 35.0% drop, despite the growing popularity of Bitcoin Ordinals.

- Spot trading volume on centralized exchanges fell by 43.2%, with Binance’s market share dropping to 52%.

- Spot trading volume on decentralized exchanges fell by 28.1% in 2023 Q2, as Uniswap maintained its dominance.

Source: CoinGecko

The diverse trends observed in Q2 2023 provided us generally with an increasingly more favorable outlook, and we continue to look for opportunities in the private markets with lower valuations.

Join Us

We continue to be excited about what lies ahead in 2023 for GCR and the rest of the crypto community.

If you are a startup raising capital and are interested in learning more about what it is like to have the support of a community with thousands of members, please reach out to one of our GCR Core Team Deal Leads!

If you are a Web3 enthusiast and are interested in learning about new crypto projects, investing alongside sophisticated members, and sharing investment opportunities, hop into our Discord and join the conversation.

As part of our effort to onboard the next one billion users to crypto, we are giving away complimentary 1-month Gold memberships to people who are aligned with GCR’s core values and are seriously interested in investing with us. If you are interested, please fill out this form here.

Please reach out if you have any questions, comments or feedback! We welcome the dialogue.

[This article has been written and prepared by the GCR Team, a group of dedicated professionals with extensive knowledge and expertise in their field. Committed to staying current with industry developments and providing accurate and valuable information, GlobalCoinResearch.com is a trusted source for insightful news, research and analysis.]

Disclaimer: Investing carries with it inherent risks, including but not limited to technical, operational and human errors, as well as platform failures. The content provided is purely for educational purposes and should not be considered as financial advice. The authors of this content are not professional or licensed financial advisors and the views expressed are their own and do not represent the opinions of any organization they may be affiliated with.