The Potential and Opportunities of Application-specific Chains on Cosmos

The world of public blockchains is ever-growing. While inflows of users and liquidity bring usage activity and transaction volumes, block space becomes increasingly scarce and valuable. This makes the narrative of a super blockchain network for application-specific chains appealing.

Blockchains such as Ethereum are increasingly transforming themselves into settlement layers, allowing most of the economic activities to happen on various Layer 2 or Layer 3 chains building on it. A similar trend is also taking place in Cosmos, where Cosmos Hub is trying to become the security layer for the application-specific chains or appchains in the ecosystem.

This article will look at this inevitable modular future for public blockchains, explore why the Cosmos ecosystem might be a potential winner, and introduce promising application-specific chains on Cosmos that are worthy of attention.

Cosmos: A Potential Winner of An Emerging Trend

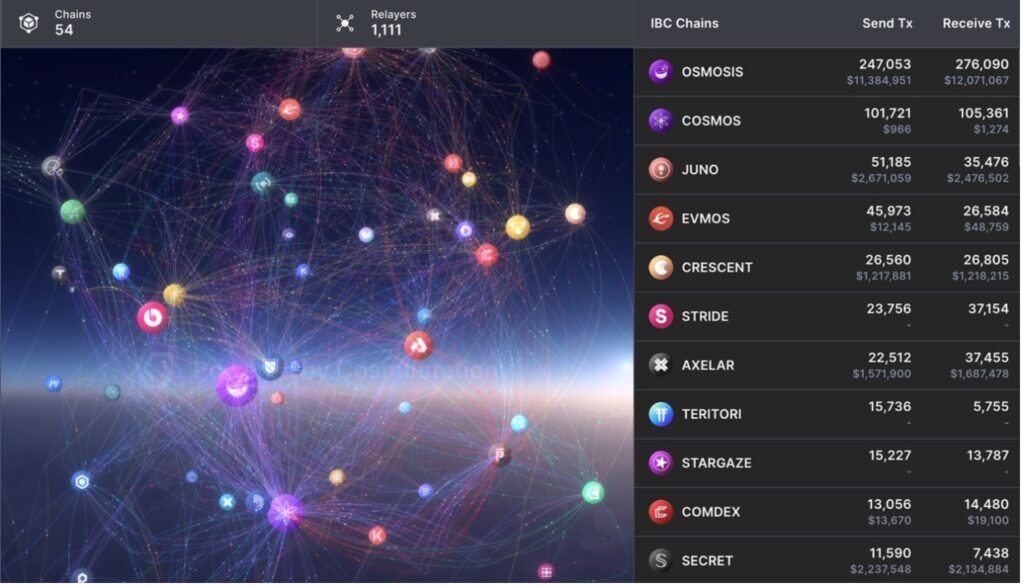

As public chains develop, they have formed large ecosystems. The major ones among them include Ethereum and its various Layer2s and sidechains, Cosmos and its appchains, Avalanche and its subnets, and Polkadot and its parachains. There are many blockchains existing in each of such ecosystems. For instance, there are over 50 appchains in the Cosmos ecosystem. All these chains are connected to each other through the Inter Blockchain Communication or IBC protocol, forming an extensive network.

It seems to be a natural evolution of the broader multi-chain ecosystem that each blockchain dedicates its block space to a specific application while relying on the infrastructure provided by a blockchain network. This trend brings new opportunities for all public chains in the ecosystem.

Cosmos might stand to benefit hugely from this trend. Firstly, with the IBC protocol, Cosmos has the infrastructure ready to expand its ecosystem horizontally to new chains and applications. Developers can easily build new appchains that are interoperable, and this will, in turn, drive the growth of the ecosystem. Secondly, with the connectivity offered by the IBC protocol and asset issuing chains such as that for USDC, the Cosmos ecosystem has the potential to attract large fund inflows. Lastly, as other ecosystems continue to be plagued by loopholes in their bridges, Cosmos has a bigger chance to grow its market share.

Source: mintscan

Analogous to how people are prone to inhabit crossroads of major trade routes in history, we believe similar opportunities will emerge for Cosmos’ appchains. By building connection points between major ecosystems with appchains, Cosmos will be able to form important hubs that users flock to. And this will give rise to a whole range of new projects too, such as products for stablecoin swapping, arbitrage, and capturing MEV or DeFi protocols aggregating yields on two or more ecosystems.

ICS as the Security Cornerstone

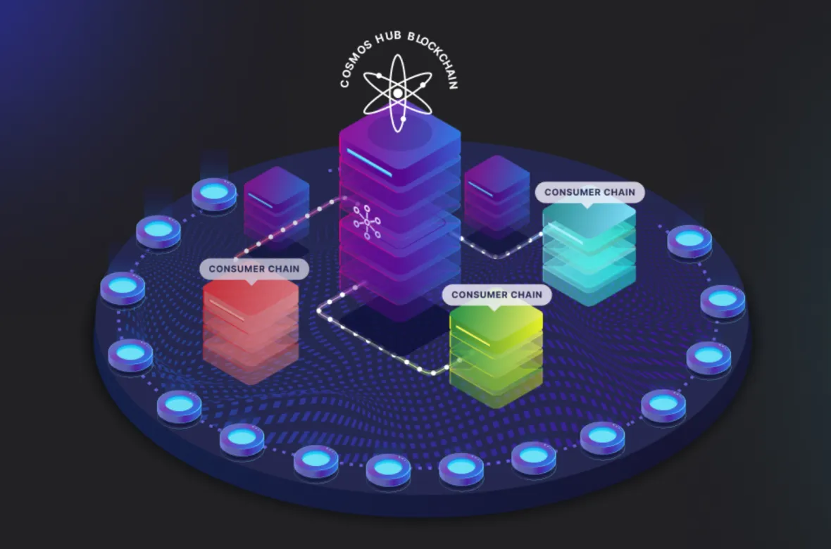

Replicated Security, originally named Interchain Security (ICS) is a long-anticipated new feature of the Cosmos Hub. It is a family of ‘shared security’ protocols that allow the Cosmos Hub validator set to be used to secure and produce blocks for the appchains. This allows appchains to inherit the robust security of the Cosmos Hub.

ICS brings forth a sustainable economic model that brings closer the relationships between the Cosmos Hub and the appchains. Together they will form an ATOM Economic Zone. Specifically, “consumer chains” of Replicated Security will reward the Cosmos Hub with a proportion of their transaction fees or tokens for the provision of security. The rewards will go to ATOM validators and delegators, increasing their income. And these new consumer chains will receive more attention and support from ATOM validators and delegators.

Source: Informal Systems

ICS marks a giant leap for Cosmos. It significantly lowers the barriers to securing new chains, saving consumer chains the trouble of running arduous tests. It also creates a new source of income for the Cosmos Hub, which can be used to further develop the ecosystem.

Thanks to ICS, the appchains on Cosmos will have advantages over those in other ecosystems for the following reasons:

1. New chains will be easier to launch.

2. Appchains will not need to assemble their own validator sets or lease validators on other chains, which reduces the risks and security costs associated with launching new chains.

3. ICS will improve interoperability. It could be used to frictionlessly transfer assets, synchronize events, or call smart contacts between different appchains. By joining ICS, the appchains can communicate and cooperate with others in new ways while maintaining sovereignty in aspects such as consensus mechanisms and programming languages. Thus, they can focus more on their key functions and meanwhile benefit from the services provided by other appchain peers.

4. ICS will bring new economic opportunities to the appchains by means of transaction fees, MEV capturing, block space auctions and revenue splits, etc.

The Attraction of Cosmos’ Appchains

Appchains are an important component of the Cosmos ecosystem. While general-purpose blockchains allow dApps to be launched without permission, appchains decide which applications they’ll run via social coordination. Also, they will need to use IBC for cross-chain communication.

It’s a worthwhile trade-off. By giving up the agility of working with general-purpose blockchains, developers enjoy maximum sovereignty with appchains. Plus, as appchains are customized to operate a single application, they offer a better user experience for their dApps. Appchains also make sense as they enable dApps to better capture the value they make. Comparably, on general-purpose blockchains, revenues often leak to gas tokens of the underlying blockchain; and it’s difficult for even some of the most popular dApps to capture most of the value they create.

In the sector of hybrid public blockchains which combine the functions of general-purpose and application-specific chains, Cosmos is one of the few that has the infrastructure to enable quick and convenient launch of new chains. This means the ecosystem is faced with great opportunities.

It has even attracted some other Layer1 (“L1”) blockchains. Picasso Network, the L1 network on Kusama developed by Composable Finance, is one of them. It aims to provide cross-chain infrastructure for the DeFi sector through its cross-chain virtual machine (XCVM). Picasso exists as the first parachain in the Polkadot ecosystem to be able to connect to Cosmos chains via IBC. It will become a bridge between the two ecosystems.

Avalanche’s subnet Landslide is another example. By availing the IBC protocol and other technologies, Landslide aims to allow Cosmos dApps to be ported to the Avalanche ecosystem and reduce the finality time of transactions on Tendermint using Avalanche consensus. It combines the high throughput of the Avalanche consensus with the power of Rust-based virtual machines, enabling better interoperability between the two ecosystems.

Sei Network also realized this trend. They are building Nitro, the first Solana VM chain on Cosmos. Nitro lets developers deploy existing Solana smart contracts with no changes, while users can seamlessly access these apps with Solana wallets. It serves as the gateway between the Solana and Cosmos ecosystems, helping bridge capital, talent, and innovation. Not only can it scale the Solana ecosystem to reach more users and developers, but it can also increase the diversity and overall competitiveness of the Cosmos ecosystem. It offers a new idea of cross-chain cooperation and interoperability.

Promising Appchains on Cosmos

Cosmos has become a byword for application-specific chains. It represents the most production-ready toolkit to permissionless build new chains. In the long term, as related technologies continue to develop, we believe appchains will be used more and more widely as rollups or rollapps.

Here, we introduce some existing and upcoming appchains on Cosmos to give a general picture of this growing segment.

Neutron: PoS-based Appchain for Smart Contracts

Neutron is a permissionless smart contract platform secured by the Cosmos Hub. Smart-contract applications using CosmWasm can be deployed on Neutron without being whitelisted via a governance vote.

It serves as an incubation center for innovative dApps joining the ATOM Economic Zone. Availing CosmWasm-based smart contracts, Interchain Accounts (ICA), Interchain Queries, and their combination, a lot of innovative and experimental products are being developed here, for instance, interchain DEXes.

Lido will be among the earliest to deploy an app on Neutron for offering ATOM liquid staking services.

Osmosis: Cosmos’ Liquidity Backbone

Osmosis is one of the most active chains in the Cosmos ecosystem and it also has the deepest liquidity among IBC-enabled chains with a monthly trading volume of over $1 billion.

Osmosis’ major innovation is Superfluid Staking, a module that enables the underlying OSMO tokens in liquidity pools to be simultaneously LPed and staked to secure the security of Osmosis. Its latest Fluorine upgrade comes with new features such as stable swap AMMs, IBC rate limits, and multi-hop swap fee reduction. Particularly, IBC rate limits will limit the number of a specific type of asset that can be moved off from (or on to) Osmosis within a defined time window. It’s a protective feature added in response to the many exploits occurring on cross-chain messaging protocols and bridges.

There are even more exciting features due to being launched in 2023, including concentrated liquidity, threshold decryption to reduce MEV, internalizing benign MEV via Skip Protocol, the launch of Mars Protocol to bring lending and borrowing function to Osmosis, interfluid staking, mesh security, etc.

The growth of Osmosis thus far has been mainly driven by its high token inflation. But with these upcoming features and integrations providing more opportunities, Osmosis has the potential to become the liquidity backbone in the whole IBC-powered ecosystem and realize more robust growth in the future.

Sei: A True Hybrid Layer1

Sei is another promising blockchain built on the Cosmos SDK. It aims to operate as a Layer1 that offers developers a higher degree of flexibility and freedom, allowing anyone to build their own blockchain and various applications with interoperability and language compatibility, especially DeFi applications such as those based on equity or assets. With its technical features, it offers high performance and low transaction fees while maintaining security and scalability.

Most importantly, it will launch two highly optimized rollup solutions: Nitro and Paddle. Nitro is a Solana Virtual Machine rollup while Paddle is a Move Virtual Machine rollup. It’s worth noting that the Move VM is an emerging type of smart contract platform that has been adopted by the likes of Sui and Aptos and is being considered one of the fastest and most secure virtual machines available, and Paddle will be the first rollup using a Move VM.

Adopting optimized rollup solutions will highly improve the performance and security of a blockchain and, as a result, increase the attraction of its ecosystem. As a hybrid layer1 purpose-built for DeFi applications, Sei is poised to have bright prospects.

dYdX: A DEX-focused Appchain

DYdX will deploy its own blockchain on Cosmos and it will happen at the same time as the launch of Cosmos Hub’s consumer chain Noble, which will act as the issuance chain for USDC on Cosmos. At that time, dYdX will become Noble’s biggest customer. And this will significantly boost the circulation of native USDC across the Interchain, filling in a long-time missing piece of Cosmos and the IBC protocol.

It will also create a virtuous circle where the growth of dYdX will propel the growth of native USDC, the growth of native USDC will help increase economic activity around the Cosmos Hub, the growth of the Cosmos Hub, as the provider of ICS, will boost the adoption of consumer chains and native USDC will facilitate the launch of consumer chains. And the virtuous circle will go on as more and more appchains join.

Compared to StarkEX and other rollup networks, Cosmos is more decentralized in terms of node operators. This makes Cosmos a better choice for DEXs like dYdX as they often have high requirements for node downtime. For them, node downtime will mean safety risks and low user retention.

Better composability and developer friendliness might also be the reasons that dYdX chose Cosmos over other choices. dYdX can explore many possibilities of composability with other appchains on Cosmos and take advantage of the Cosmos SDK, the most mature developer tool kit for building blockchains available. By contract, StarkEx adopts a different programming language Cairo, which might mean additional time and efforts for developers to learn and adapt to.

Injective: A Decentralized Derivatives Protocol

Injective aims to create a global trading market for derivatives that anyone can trade on freely. The protocol is built to be fully trustless, guaranteeing the security and fairness of transactions. Different from dYdX which is an appchain purely focused on derivatives trading, the Injective chain, like that of Sei, can also provide infrastructure for other applications such as perpetual futures, options, and stablecoins.

Duality: A Hybrid between AMMs and CLOBs

The core function of Duality is to create AMM pools that allow swaps at a constant price. This is different from typical concentrated AMMs which determine price ranges through price scaling. Duality allows liquidity to be placed at specific prices, resembling limit orders on a CLOB. Any curve can be built on the Duality pool, and traders can access the liquidity shared among all pools using market or limit orders. Like its main competitor Osmosis, Duality aims to internalize arbitrage profits from MEV and redistribute them to LPs.

Stride: Appchain for Liquid Staking

Stride is a standalone blockchain built using the Cosmos SDK and it has announced the plan to join ICS as a consumer chain to obtain the security and economic alignment provided by the Cosmos Hub. When we think of a liquid staking token, it’s imperative that the security of the underlying asset is not jeopardized by a chain with a low-market cap token and less-tested validator set securing it. Stride has issued the liquid staking tokens stATOM, stOSMO, and stSTARS, all of which have incentivized pools on Osmosis. Stride’s major competitors will include Lido and Quicksilver, another local liquid staking provider on Cosmos.

Polymer: A Modular IBC Protocol based on ZK Technology

Polymer will be the first zk-IBC appchain in the Cosmos ecosystem. It allows different blockchain protocols to communicate with each other without trusting third parties. With the added features of privacy preservation and security provided by ZK technology, Polymer has great prospects in the field of interchain asset transfer.

FairBlock: A Solution to Bad MEV

FairBlock is building a solution to combat bad MEV by using distributed Identity Based Encryption (IBE). And it will be a consumer chain secured by the Cosmos Hub.

Conclusion

The current hybrid public blockchain sector is fragmented with many projects trying to build their own interoperability solutions. The lack of a unified protocol like what TCP/IP means for the Internet is creating a bottleneck for the sector. However, there have been signs of increased adoption of Cosmos where outside Layer1s are gathering to Cosmos to make use of the IBC protocol to join the ecosystem.

Against this backdrop, the trend for public blockchains going hybrid with application-specific chains seems to be inevitable. These chains will integrate functions of various other chains and combine them into a more scalable and secure whole. In such hybrid public blockchains, Layer1 will serve as the settlement layer while Layer2s and Layer3s can carry specific applications. These hybrid public blockchains might break the bottleneck and address many problems the sector faces and they will be able to offer more flexible and efficient solutions for more diverse use cases too.

The development of any ecosystem is often reliant on the network effect. With each new blockchain joining the Cosmos ecosystem, the value of the network increases. And such an increase might be exponential. In summary, we believe the future will be modular and Cosmos, as a first mover in this field, has an exciting prospect of combining different technology stacks into their more robust versions.

About the Author:

Kyle Liu is the investment manager at Bing Ventures and a seasoned crypto analyst and writer. He provides insightful analysis and research on a wide range of topics including market trends, sector analysis and emerging projects. He is especially strong at providing forward-looking analysis on DeFi related topics.

This article was reviewed and lightly edited by the GCR Research Team, a group of dedicated professionals with extensive knowledge and expertise in their field. Committed to staying current with industry developments and providing accurate and valuable information, GlobalCoinResearch.com is a trusted source for insightful news, research, and analysis.

Disclaimer: Investing carries with it inherent risks, including but not limited to technical, operational and human errors, as well as platform failures. The content provided is purely for educational purposes and should not be considered as financial advice. The authors of this content are not professional or licensed financial advisors and the views expressed are their own and do not represent the opinions of any organization they may be affiliated with.