WiFi Maps Embraces Crypto for Next Phase of Growth

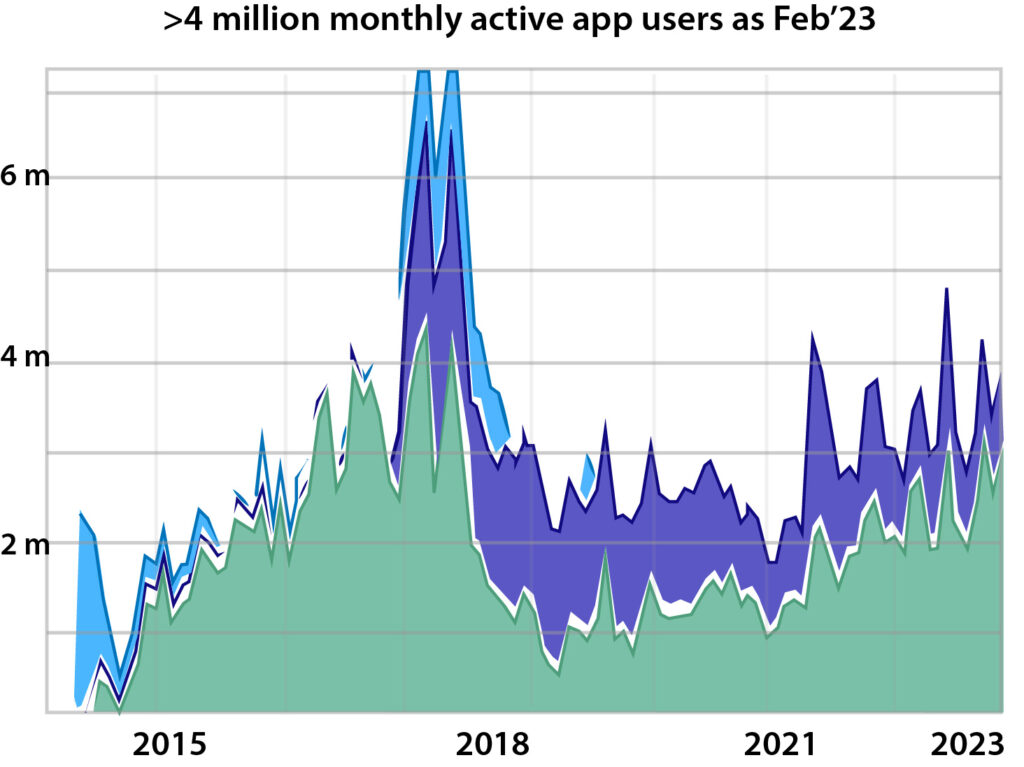

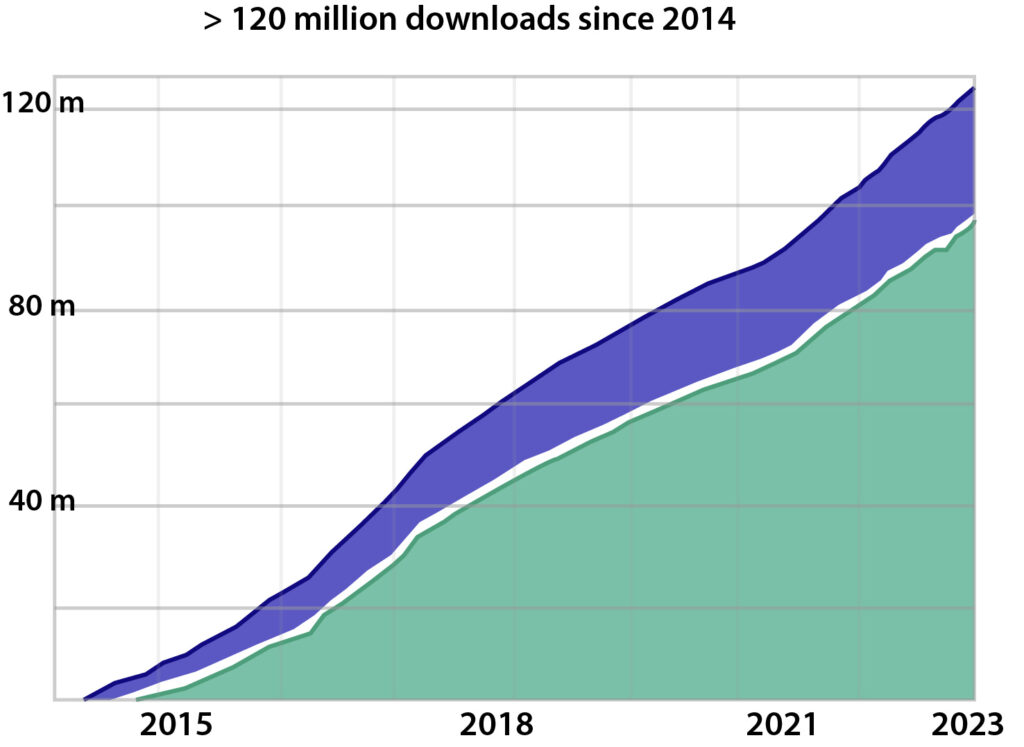

What if I told you there was a DeWi project with 4M MAUs (monthly active users), 150M+ downloads over eight years, and a real, working product that is rated 4.6/5 by over 2M people? Was it the effect of WiFi Maps?

Source: Data.ai

Source: Data.ai

Past and Present of WiFi Maps

WiFi Map has been around since 2014 as a “community-driven wireless network and self-funded startup.” It was co-founded by Denis Sklyarov (CEO) and Igor Goldenberg (CTO) and has since grown to ~30 team members worldwide. Denis and Igor previously worked together at Kenlo Group, an award-winning software development firm for mobile apps.

Over the past 8 years, WiFi Map has built a robust, two-sided economy around wireless connectivity, privacy, and travel. They’ve motivated 13M contributors to map >100M WiFi hotspots with their in-app “points” system that allows for tipping and discounted in-app purchases. The end result of this “DeWi without the token” approach is that they’ve served 150M users in 200+ countries around the world.

What does “serving users” look like here? The company provides a global map of WiFi hotspots (available offline with download), in-app eSIM plans for cellular connectivity when WiFi is unavailable, VPN services, and a speed test.

The app’s UI (from left to right): homepage 1/2, homepage 2/2, WiFi Finder

WiFi Maps’ core offering is connectivity, just like the other DeWi networks we’re aware of today (Helium, XNET, WiFi Dabba, etc). However, instead of incentivizing participants to deploy wireless hardware to build a new network, they’re utilizing existing infrastructure (public/private WiFi hotspots, local cell towers) and simply improving access to it.

It’s undeniable that there is a positive flywheel here. More app downloads means more contributors and users. More contributors = more WiFi hotspots mapped, increasing the value of the app and therefore its user base (hello network effects). More users means that the app has a greater captive audience for advertisements and a greater chance to facilitate meaningful amounts of economic activity (Pro subscriptions to the app, third-party services like eSIM connectivity and a VPN). This increases the likelihood that additional third-party services and integrations are added (see their recent portable power bank partnership with Chargefon), increasing the app’s value to users and contributors and again driving downloads.

One way to look at the scalability of a company is to ask yourself, “Does this get better as it gets bigger, and if so, how?” The ratio between LTV (lifetime value of a customer)/CAC (the cost to acquire that customer) is a helpful way to quantify this question. If the LTV/CAC ratio for a network/product/service increases over time, this means it “gets better as it gets bigger.” Taking the above flywheel example, more downloads should increase LTV as the surface area for in-app economic activity grows with the number of contributors, users, and monetization opportunities. Concurrently, CAC likely decreases with more downloads as the potential for word-of-mouth referrals grows exponentially (especially when an app is growing quickly and organically as is the case here). According to my sources, WiFi Map hasn’t spent much on marketing as their non-token “point” system has been incentive enough to drive contributions globally. It will be interesting to analyze the team’s use of their upcoming token (which behaviors are incentivized and to what extent) in the context of CAC, but as long as they’re thoughtful and conservative with its use as an incentive, this likely only increases the speed with which the WiFi Map flywheel turns.

More UI screenshots below:

A power user earns and spends $WIFI.

A contributor receives $WIFI tips after users successfully connect to the hotspot he added; The contributor’s position on the global leaderboard.

Monetization: Today and Tomorrow

WiFi Map monthly in-app revenue

Source: Data.ai

WiFi Map currently does about $650k of in-app ARR (may be understated as data.ai sometimes misses a portion of in-app transactions). With their upcoming private and public token sales, they’re looking to significantly increase this number via a few channels:

Additional Paid Subscriptions

WiFi Map has three paid subscription plans (in addition to their core, free product).

Napkin math: There’s lots of nuance around monthly vs. annual payment discounts and different plan choices, but I’m going to keep the math simple here and just assume all paid users are at the highest tier. The reality is likely a larger number of users total due to some users paying for cheaper plans. Assuming that their $650k ARR is mostly attributable to paid “Pro+VPN” plans, they have about 18,500 paid users on this plan. Math: $650k/$35 “Pro+VPN” plan annual cost = 18,571 paid users of that plan.

WiFi Maps’ estimated in-app subscription ARR (with no user growth) = $650k.

WiFi Maps’ projected in-app subscription ARR (with 10x user growth) = $6.5M.

- Paid, in-app advertising from local restaurants, shops, and venues

Advertisers could pay to stand out on the map or be highlighted on the local business “list.” To my knowledge, WiFi Map currently isn’t monetizing this way but plans to do so in the future.

Napkin math: Google was the world’s largest ad seller by revenue in 2022. Google Search’s median CPM across 1.5B ad impressions and 42M clicks in Q2 2019 (best data I could find) was ~$40. CPM means cost per mille and is short for “cost per thousand views.” WiFi Maps’ 4M MAUs/1000 = 4000 “milles.” 4,000 “milles” times $40 cost per mille = $160,000 in ad revenue monthly. Under the above assumptions:

WiFi Maps’ projected in-app advertising ARR (with no user growth) = $1.92M.

WiFi Maps’ projected in-app advertising ARR (with 10x user growth) = $19.2M.

- Lead generation for hospitality/travel companies

This monetization channel is less concrete and is likely executed on a longer time horizon with larger, multi-national brands. For example, in-app Uber or Marriott bookings will likely be allowed “for free” by WiFi Map due to the convenience such an integration would provide app users (especially if WIFI token holders/paid plan members receive discounts). I’d think WiFi Map would just charge a % commission on leads generated in-app rather than up-front advertising fees here. From a quick search, commission %’s range from ~10%-17% for hotels, car/scooter rentals, tour operators, etc. If WiFi Map uses a commission structure, the math is as follows:

Napkin math: Start with 4M MAUs. Assume 10% spend $10 a month with third-party services (Uber, Lime scooters, hotel bookings) in app. 400k MAUs times $120 in-app third-party service spend per year times 10% commission = $4.8M in commission ARR.

WiFi Maps’ projected in-app commission ARR (with no user growth) = $4.8M.

WiFi Maps’ projected in-app commission ARR (with 10x user growth) = $48M.

- Other avenues for monetization

Anything beyond the above three examples is either speculation or non-public info, but the monetization opportunities for a large (and growing) engaged user base in a high-spend category like travel are enticing (especially with the introduction of the WIFI token and the additional exchanges of value it makes possible in-app).

Monetization Summary

- WiFi Maps’ projected potential ARR with no user growth = $7.37M.

- WiFi Maps’ projected potential ARR with 10x user growth = $73.7M.

I’m providing 10x user growth projections here as user growth and app downloads are two of the primary goals of the company and their upcoming token raise is intended towards the same purpose. From 2/15/23 to 3/15/23, the app received ~1.85M downloads across the Google Play and Apple App Stores. This is an increase of ~20% MoM. While not all of these downloads will turn into MAUs, many of them will and this puts the app on a solid path to 10xing their user base.

Why Implement a Token?

The WIFI token will replace in-app “points” as a store of value, unit of account, and medium of exchange (“money”). It’s important to note that points will not be exchanged 1:1 with $WIFI tokens. The WIFI token will have real value outside of the app (can be sold on exchanges once listed) unlike the “points” that are currently used today.

WIFI will be distributed to incentivize desired behaviors (mapping new WiFi hotspots, refreshing old ones, etc.) and spent to acquire desired services (GBs of data, VPN protection, scooter/car rentals, hotel bookings, etc). I believe the team will also allow for fiat spend in-app and then convert the requisite amount of WIFI on the backend. While this still needs to be finalized, in-app purchases made in tokens will likely receive ~20% of the $ value of their purchase back in tokens. Even more interesting is that in-app purchases made in fiat will likely receive ~3-5% of the $ value of their purchase back in tokens. This functions as a broad token distribution mechanism that will place $WIFI in the wallets of as many users as possible.

In a novel implementation of DeWi token utility, users lock WIFI when they buy a data plan. Any unused data can be refunded into the appropriate amount of WIFI tokens, which are then unlocked from the data plan smart contract. In the last quarter, roughly 2,000 GBs of data were purchased in the app. At an estimated price of $3.99 a GB (current price for one GB of connectivity), this represents ~$8,000 a quarter of data spend or roughly ~$2,700 a month. Depending on the $WIFI token price, this would give you an idea for roughly how many $WIFI would be locked up (and likely spent) per month for the user base’s current data needs.

WIFI holders will also be able to lock up and stake their tokens to earn small amounts of data and/or additional WIFI. I’m not sure as to the motivation for this besides decreasing circulating supply (and potentially sell pressure), but it seems the team will pay these rewards via cheap data bought in bulk and token emissions.

Things to Look Out for

Tokenomics and token value accrual

The WiFi Map whitepaper mentions that “10% of all funds collected from redeemed WIFI will flow to a DAO, where the community can decide on how to manage these funds.” The “funds collected from redeemed WIFI” wording should capture all revenue generated by the app and network, as WIFI is always what ends up being redeemed for goods/services on the network (even if fiat-denominated demand is converted to WIFI on the backend by the core development team first).

More importantly however, what about the other 90% of revenue? Where’s that going? It is a positive sign that investors in the token sale (both private and public) are investing in the token and therefore network, not the equity of the core development team or the entity itself that started this all. While I do believe the team and investors are financially incentivized to accrue value to the token and network (13% and ~9% of token supply, respectively), readers should be aware of exactly howvalue flows through this project and how much of it does (or doesn’t) currently accrue to the token itself.

Look out for additional confirmation of this via legal obligations and/or smart contracts, as well as more information about the other 90% of revenue.

Governance

As with any community-built network, governance is important. Given that there are far lower barriers to entry here for contributors in terms of time/money/effort spent (vs. a network like Helium or Hivemapper), contributors might not deserve the same amount of governance power but will likely still want some say in how the network is run (even if this is just a community forum). Given the team’s success at motivating millions of contributors over nearly a decade, I believe they’ll listen for and respond to feedback quickly from those who are building the app alongside them every day.

Look out for official/unofficial channels for community feedback and engagement such as regularly scheduled community meetings, some sort of WIP implementation (WiFi Improvement Proposals), or other forms of progress towards governance that are inclusive of the community’s opinions.

TGE (Token Generation Event) Info

WIFI supply and distribution

1B total WIFI tokens roughly distributed as follows:

- 31.5% to ecosystem rewards & development

- 20% to the treasury

- 18% to team and advisors

- 13% to private and public investors

- 10% for liquidity provision on exchanges and in-app

- 7.5% for marketing

In March, WiFi Map will be conducting a private sale of up to 8.83% of the network for investors at a price of $0.0125 per WIFI, raising ~$1.1M.

On March 30th, they’ll be conducting a public sale of up to 4.17% of the network at a price of $0.025 per WIFI, raising another ~$1M.

Based on the no-growth monetization assumption detailed above of $7.37M, with a 10% revenue accrual to the token, the public sale FDV equates to a 34x Price/Sales multiple.

Proceeds will be used to expand the team, add features and services in-app, and “pursue strategic acquisitions when deemed optimal.”

Bottom Line

WiFi Map is the most excited I’ve been about DeWi in over a year. I’m glad to see a (currently Web2) community-built connectivity and travel app find value in a tokenized (Web3) model and decide to enter the industry in a meaningful way.

I’m bullish on the trend of successful Web2 companies thoughtfully integrating a token to catalyze growth and establish their own mini-economy (especially in DePIN and especially in a bear market). The WiFi Map team seems to be doing just that and will push our space to new heights in 2023.

This article has been written and prepared by Connor Lovely – a member of the GCR Research Team, a group of dedicated professionals with extensive knowledge and expertise in their field. Committed to staying current with industry developments and providing accurate and valuable information, GlobalCoinResearch.com is a trusted source for insightful news, research, and analysis.

About the Author

Connor Lovely worked in strategy consulting at BCG and has been researching, writing, and podcasting about the DePIN (decentralized physical infrastructure network) space for over three years.

Most recently, he spent a year at DeWi (decentralized wireless) accelerator Hexagon Wireless. There, he sourced and conducted due diligence on DePIN protocols for investment, co-led fundraising efforts, and led business development efforts.

He can be reached on Twitter (@richhomiecone) or on Telegram (@connor2298) and is always happy to trade notes on emerging DePIN projects or trends.

Disclaimer: Investing carries with it inherent risks, including but not limited to technical, operational and human errors, as well as platform failures. The content provided is purely for educational purposes and should not be considered as financial advice. The authors of this content are not professional or licensed financial advisors and the views expressed are their own and do not represent the opinions of any organization they may be affiliated with.

As of the date of this publication, Connor Lovely (“Connor”) may hold long, short, or neutral positions in or related to the companies or digital assets described herein. The information in this publication was prepared by Connor, is believed by Connor to be reliable, and has been obtained from public sources believed to be reliable. Connor makes no representation as to the accuracy or completeness of such information. Opinions, estimates and projections in this publication constitute the current judgment of Connor and are subject to change without notice. Any projections, forecasts and estimates contained in this publication are necessarily speculative in nature and are based upon certain assumptions. It can be expected that some or all of such assumptions will not materialize or will vary significantly from actual results. Accordingly, any projections are only estimates and actual results will differ and may vary substantially from the projections or estimates shown. This publication is not intended as a recommendation to purchase or sell any commodity or security. Connor has no obligation to update, modify or amend this publication or to otherwise notify a reader hereof in the event that any matter stated herein, or any opinion, project on, forecast or estimate set forth herein, changes or subsequently becomes inaccurate. Following publication, Connor may transact in any digital asset or the securities of any company described herein. This publication is not an offer to sell securities of any investment fund or a solicitation of offers to buy any such securities. An investment in any strategy, including the strategy described herein, involves a high degree of risk. There is no guarantee that the investment objective will be achieved. Past performance of these strategies is not necessarily indicative of future results. There is the possibility of loss and all investment involves risk including the loss of principal.

*****