NEO Global Capital’s All-Weather Investment Strategy for Crypto

Can’t travel to Asia anymore due to Covid-19? Can’t have that meeting that you wanted anymore?

As our team receives ongoing questions and pings from our western readers on the things happening in Asia, we are re-surfacing some of the in-depth coverage interviews and write-ups of notable themes, organizations and figures in Asia that continue to be relevant in the cryptocurrency circle. We hope that once travel opens up again, you’ll be more prepared than ever to pursue and learn about the happenings in Asia.

This post was originally written in June 19, 2019.

Neo Global Capital, an Asia-based fund that initially started out as one of the investment funds funded by NEO, has announced that it will be raising a second fund of about $50mn dollars.

Here are some highlights from partner Tony Gu on the fund’s strategy. This post was originally in Chinese and posted in Wechat, we have taken some relevant parts and translated it here ->

According to the team, NGC’s first fund, NGC Ventures Fund I, was established in November 2017 with offices in Singapore, Shanghai and the United States. NGC returned 7-8x the fund, which Tony highlights is rare as one of the largest funds in Asia that managed hundreds of millions of dollars.

Tony comments that tn the past 10 years, there have been very few industries such as cryptocurrency that has caught such wide global attention.

Before diving into more detail, Tony highlighted a few points:

1) In this fast-changing market, investment income is mainly from the ? of the market, not the ? of an institution, so grasping the macrostructure of the market is more important than investing in several leading projects.

2) The cyclical nature of the cryptocurrency market is not fundamentally different from the traditional capital market, except that the coordinates and direction needs to be adjusted.

3) The cryptocurrency market also reflects the characteristics of stocks/bonds/commodities in the traditional capital market.

4) The investment management and allocation framework for cryptocurrency assets should not deviate from that of traditional asset management/asset allocation, and should be integrated and enhanced the performance of the overall portfolio.

5) Lack of fundamentals also implies that the framework in which we approach the industry is unstable. The analytical framework can shift significantly at any given time. Past successes are often the basis for future failures.

As seen by these aforementioned points, mastering the macroeconomics and cyclical phases of industries are very important, especially for the cryptocurrency industry that lacks fundamentals.

The traditional financial industry has many mature analytical frameworks to analyze the industry cycle. The familiar ones include the Kitchin Cycle (short cycle), the Juglar cycle (medium cycle), and the Kondratieff Wave cycle (long cycle). The purpose of macro analysis is to judge the current state of the market after superimposing the short /medium / long cycles, and to predict the subsequent development. These short /medium / long cycles are essentially derived from real-life economic activities such as commercial inventories, fixed asset investments, real estate investments, interest rate changes, and so on. Obviously, these economic activities do not exist in the cryptocurrency industry, so if the cryptocurrency industry has periodicity, then this cycle should be relatively simple (relative to the multiple cycles of the real economy) and be more practical of framework to guides investments.

So is there a cycle within the cryptocurrency industry? Let’s first look at what the nature of the cycle is. The essence of the cycle is the inevitable result of internal conflicts caused by various factors within the economic system, such as capital markets, production factors, and the speed of development of human resources. A representative analytical framework is the “investment cycle” proposed by Merrill Lynch in 2004. It uses two main drivers of the modern economic system- monetary policy (interest rate and inflation) and economic development (GDP growth) to analyze complex financial markets. And as a result, obtain more accurate conclusions through 30 years of US economic data backtesting.

We believe that there are similar drivers in the cryptocurrency industry, namely, the amount of market capital (representing market sentiment, similar to inflation) and technological advancement (representing industry development, similar to industry output and GDP growth). These two dimensions are driven by different groups, and the logic and speed of development are different, so that the superimposing exercise produces a similar cycle effect. Taken together, we believe that Merrill’s investment cycle framework may be suitable for analyzing the cryptocurrency industry. Therefore, let’s take a closer look at the theory of Merrill’s investment cycle.

As shown in the figure above, the investment cycle theory divides the economy into four stages: recovery, overheating, stagflation and recession. One would obtains optimal investment returns by investing in relevant asset allocations at different stages. Merrill Lynch used the US capital markets data from the 70s to 2004 for more than 30 years of backtesting and found some patterns.

To put it simply, a rational investor should allocate more money into stocks during the economic recovery period, invest in commodities during the overheating period, hold cash during the stagflation period, and hold bonds during the recession. Also shown in the above diagram is that according to the normal economic operation logic, the cyclical rotation should be carried out clockwise, so it can be used to predict the market and guide investment behavior.

Such investment cycle is also easier to understand by the average investor, because the investment logic it draws is often consistent with the average person’s understanding of the economy. For example, when the economy is in a positive state (at the upper section of the diagram), investments should be placed in more stock-type growth assets. When inflation falls (on the left side of the four quadrants), the cost of capital is reduced and more financial assets (stocks and bonds) should be held. When inflation rises (on the right side of the four quadrants), commodity prices become more reactive and rise quicker than financial assets.

However, such a logically fluent and widely accepted theory does not produce good results in practicality. In the wealth management industry, investment cycles are more likely to be judged as an analytical framework and cycle position, and cannot directly guide investment behavior. This is mainly due to several reasons:

1) Central bank intervention

The cycle going from economic growth to a recession reflects natural de-leveraging. In the process, retired capacity gets eliminated. Although this is a good thing for long-term economic development, it will inevitably lead to economic depression, asset price decline, and unemployment among workers in the short term. In order to avoid such painful scenarios pain, central banks tend to make countercyclical adjustments. In other words, while it should be a cycle that runs clockwise, it may turn counterclockwise for a while, and then return to run clockwise.

This causes the predictability of the cycle to deteriorate. The forecast of the cycle then becomes a prediction of central bank policy. The famous investment fund Bridgewater is a leader in this research (their most famous product is the all-weather fund), they are even the economic advisors to many governments, by predicting (or even influencing) central bank’s policies to obtain excess returns. This is something that no ordinary investor or fund can do.

2. Global economic integration and transmission effects

Since the investment cycle framework was introduced in 2004 , global economic integration has developed rapidly. The economic relationship between countries has become closer and more likely to affect each other. If each country has an investment cycle, in the process of global economic integration, each country’s cycle is affected by another national cycle.

One example is the US financial crisis during 2007. When the US quickly entered a recession due to the crisis, China’s economy was expanding at a high speed and it was launching a 4 trillion economic stimulus plan. China’s stimulus plan has effectively boosted global economic development and directly drove the rapid recovery of the US economy and even prosperity. These conditions were impossible in the United States before 2004, and is another reason pointing to the impractical theory of theis investment cycles framework.

3) Technological progress

In addition to global economic integration, another major change is the advancement of technology, especially the Internet, smartphones and cloud computing. Technology has changed the way GDP grows. With technology, today’s companies can achieve higher output values ??with fewer people and lower costs. This is a good thing for companies that have access to technology, but for the entire society, this means fewer employment opportunities and larger structural problems such as increased gap between the rich and the poor. In order to solve these problems, the government often has to adopt adjustment measures. This has two consequences. First, the growth of technology companies exceeds the confines of the cycle, and the theory of using said cycle may miss such breakout companies, resulting in lower investment returns. Second, the government’s adjustment approach is often macro drivers, subsequently introducing changes to the entire economic cycle.

4) Market game

As mentioned earlier, the investment cycle theory is widely accepted. This also leads to the homogenization of the global investor’s asset allocation when the characteristics of certain periods are very clear, leading to rapid rise/fall of asset prices and the rapid disappearance of investment opportunities. In other words, as financial markets become more effective, it is more difficult to obtain excess returns through the same strategy.

The points mentioned above are the limitations of investment cycle theory in the traditional financial world. So are these restrictions in the cryptocurrency industry?

The characteristics of the cryptocurrency industry

The crypocurrency industry is really interesting. First, the vast majority of cryptocurrencies are not real currencies, they have multiple financial and commodity attributes. Secondly, most cryptocurrencies do not use special encryption technology, are still based on the traditional PKI system, and are not fundamentally different from the SSL that everyone uses every day. Finally, most cryptocurrencies are not decentralized. Although they use decentralized blockchain technology, many cryptocurrency projects operate more centrally than traditional companies.

The cryptocurrency is a typical “a man with many faces”. Everyone tries to apply the existing knowledge that they have to approach this space. And the multi-faceted nature of cryptocurrencies also makes everyone think they understand some parts of it.

We believe that cryptocurrency is an evolving system and has a complex multi-layered existence. Its complexity does not come from blockchain technology (blockchain technology, or DLT, is not a particularly complex technology system). Its complexity lies in the new decentralized trust system based on blockchain technology and the new ecosystem and business models on top of this system. It can be said however complex human society is, cryptocurrency will be just as so. And so in summary, cryptocurrencies should be analyzed through a number of attributes.

1) Technical attributes

Cryptocurrency is a combination of several technologies, including blockchain (or distributed ledger) technology and cryptography. Advances in technology will promote the widespread use of cryptocurrencies. The industry’s more popular blockchain technologies, including Layer0/1/2 layering, sharding, sidechaining and cross-chaining, are all committed to building a faster and more usable infrastructure.

Cryptographic techniques include zero-knowledge proof, multi-party encryption computing, homomorphic encryption computing, and TEE, etc., which are dedicated to building better privacy, including mechanisms and data sharing mechanisms. As these underlying technologies become more and more mature, commercial applications will continue to increase. The application scenarios of cryptocurrencies will increase, which will push the industry forward. In this sense, the advancement of technology and the breadth of acceptance are fundamental to the cryptocurrency industry.

2) Business attributes

Compared to traditional business systems ( in where business behavior and distribution of interests are fragmented), cryptocurrencies place more emphasis on community governance and incentives ( in where business behavior and benefit distribution are tied together). One would try to influence business decisions by changing relations of production.

Taking Bitcoin as an example, Nakamoto has ingeniously designed the mining to turn the miner into a guardian and promoter of the Bitcoin system and eventually become a beneficiary. Through this self-reinforcing process, Bitcoin has become a widely accepted value transfer intermediary worldwide, and thus has the commercial attributes of cross-border payments. But then soon after this property became weaker, and was replaced by financial attributes. At present, the development of this industry is still at early stages, and we have not seen too many successful cases. Business attributes are fundamental to cryptocurrencies.

3) Financial attributes

At present, financial attributes are the most important attribute of cryptocurrency . Depending on the design of the interest mechanism of the cryptocurrency, it can have both the attributes of a commodity (such as the right to use a certain service and computing power), the attributes of equity (such as repurchase and dividends), the attributes of a bond (such as the staking mechanism), and the attributes of the currency (such as various stablecoins).

The intangible nature of cryptocurrencies creates two consequences. First, the existing financial regulatory systems in various countries cannot effectively regulate cryptocurrencies, which leads to a vacuum of supervision. Second, a variety of financial attributes in the eyes of investors mean greater imagination and trading strategies. The liquidity generated by trading volumes strengthens cryptocurrency financial attributes.

A global financial system that lacks regulation and has strong liquidity is the best portrayal of the current cryptocurrency industry. At present, Bitcoin transactions account for more than 50% of the market and have an absolute advantage. How bitcoin prices fare can be almost interpreted as the “emotional index” of the entire industry.

4) Political attributes

A growing global financial system will inevitably have political attributes. In the context of the current global countries’ monetary policy, the decentralization of cryptocurrency (here mainly referred to as bitcoin) has become a good hedging tool and even potentially strategic.

At the same time, the mass distribution of stablecoins also mean there will be increasing influence from the traditional financial system. This means that the cryptocurrency industry is becoming more closely related to the political and economic realities of the real world (previously not). Political factors (such as regulations/trade disputes/foreign exchange controls) will increasingly affect the development of the industry. Political attributes are important macro factors that affect cryptocurrencies.

After a systematic analysis of the various attributes of cryptocurrency, we re-visit the various limitations of Merrill’s investment cycle, and whether it still exists in the cryptocurrency industry.

As can be seen from the above comparison, the investment cycle theory is potentially more suitable for the cryptocurrency industry than the traditional financial industry. However, the technological advancement factor may cause the cycle to fail. For example, technological advances can potentially lead to “paradigm shifts” in the industry, and the leading and representative projects there should be identified. By choosing the best investment team and fund, investors can always get excess returns, which is the same as the traditional financial industry.

Cryptocurrency investment cycle and all-weather configuration strategy

Applying the investment cycle theory to the cryptocurrency industry requires some adjustments. Firstly, the inflation factor has to be replaced by an emotional factor. Cryptocurrency does not come from the central bank, it’s not issued. But when the investment sentiment is high, the capital inflow will have an inflation-like effect. Considering that bitcoin accounts for more than 50% of the market value, bitcoin prices can be used as an emotional indicator.

Second, GDP growth needs to be replaced by fundamental factors (including technological advancement and commercial applications), which represents the intrinsic development and organic growth of the industry. This can include multiple factors, such as number of P2P transfers or transaction, number of wallets, industry leader entry, etc., all of which need to be dynamically adjusted as the industry develops. After the replacement, the investment clock for the cryptocurrency version looks like this:

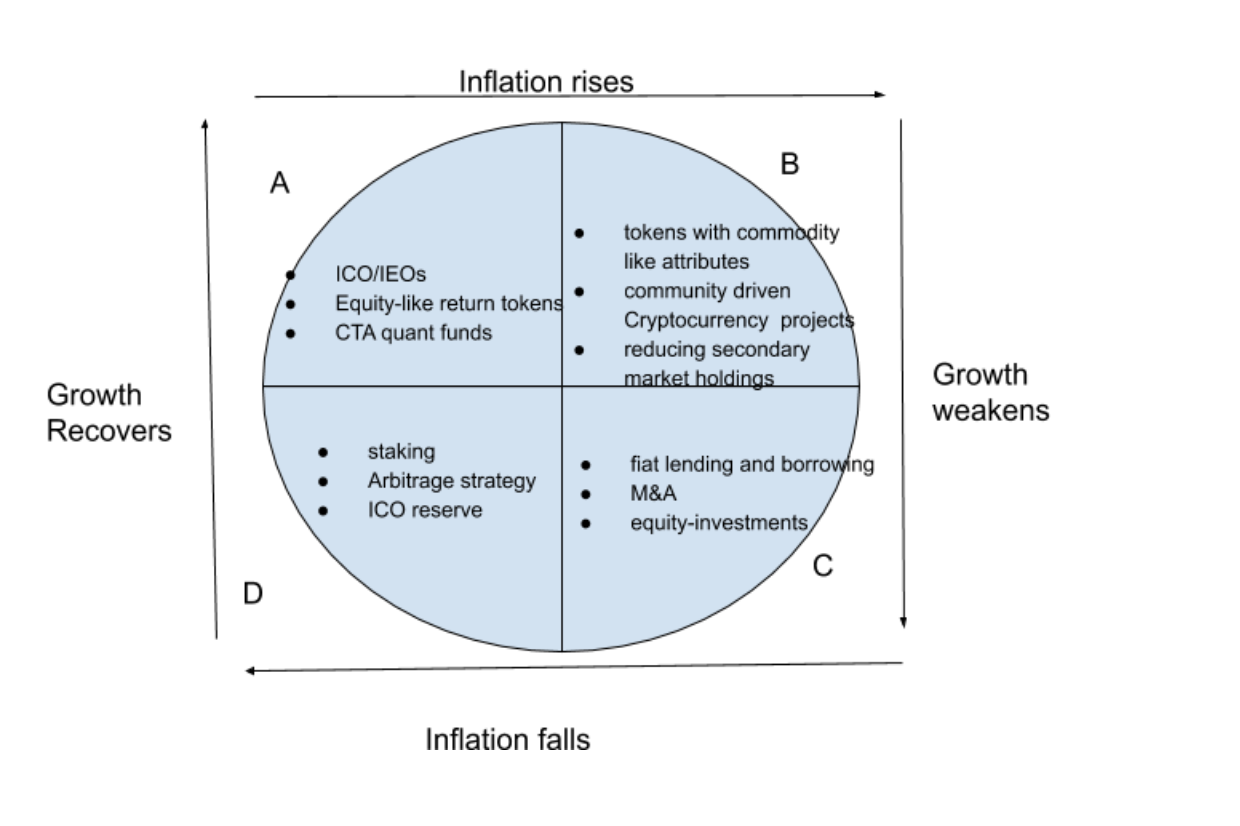

For ease of description, we refer to the four cycles corresponding to the cryptocurrency investment framework as A/B/C/D, which corresponds to the growth/overheat/stagflation/recession of the Merrill Lynch investment clock. So how should investors allocate assets for each cycle? Because of the lack of sufficient historical data, it is difficult for us to answer this question quantitatively like Merrill Lynch. Nevertheless, considering the logic of the two investment frameworks, we can analogize the conclusions of the Merrill Lynch investment cycle to identify similar cryptocurrency assets.

For example, in quadrant A (growth quadrant), Merrill Lynch Investment Cycle recommends the allocation of equity-type equity assets. So in the cryptocurrency market, we need to look for assets like equity. According to NGC’s experience, we have found three types of assets, namely ICO/IEO (similar to IPO, first- and second-tier market spread arbitrage), platform coins (such as BNB, with strong cash flow and repurchase ability) and CTA oriented quantitative funds (tracking cryptocurrencies with rising trends). In fact, NGC also operates like this. For example, the period from the end of 2017 to the beginning of 2018 was a typical growth cycle. NGC quickly invested into a large number of head ICO projects. Since March 2019, NGC has judged the return of the growth cycle. It has purchased platform coins such as BNB and participated in the IEO projects of most leading exchanges. At the same time, it began to deploy funds into quant funds with CTA strategy to seize the potential bull market.

For example, in quadrant C/D (stagflation to recession), Merrill Lynch’s Investment Framework recommends the allocation of cash or bonds (fixed investment products) to reduce equity investments. In the cryptocurrency industry, there is basically no fixed investment product, so what do we do? NGC determined that the market demand for fixed-income products will continue to rise, so they have done two things.

First, NGC exclusively invested in Babel Finance in the mid-2018 to provide lending/liquidity to Bitcoin miners. For the next 10 months, Babel Finance’s business volume has grown nearly 20-fold and has become one of the world’s largest virtual currency lending providers. At the same time, NGC’s fiat funds have also obtained relatively stable income through lending. Second, NGC and Xorder, a company that uses big data and artificial intelligence for investment decisions, launched StakeX, becoming one of the first funds in the industry to do staking. Through Staking, NGC’s long-term projects such as Loom, TomoChain, Iris, Cosmos, etc., have achieved stable returns.

Similarly, in the other quadrants, one can rely on experience to find cryptocurrencies similar to commodities and bonds, and rotate through the selection depending on the cycle phase.

The picture below is a simple summary juxtaposed with the original framework. Considering the rapid development of the industry and the emergence of many new cryptocurrency assets, the content of each quadrant needs to be updated frequently. The figure below is only part of the strategy of NGC at a certain point in time. It does not fully represent the actual position and operation of NGC, nor does it constitute investment advice.

As mentioned earlier, cryptocurrency is a rapidly changing industry, and advances in technology can lead to disruptive, innovating opportunities. When this opportunity arises, it is necessary to break away from the cyclical allocation strategy and adopt a long-held strategy to fully see the growth through.

With the above framework, one would be able to establish an “all weather investment strategy fund”. However, because the cryptocurrency industry is in the early stage and there is information asymmetry, investors will have different judgments of the cycle. Therefore, the analytical capabilities of the investment team are crucial. In this respect, NGC has adopted the Big Data + AI + Artificial Analyst approach to gain its own competitive advantage by analyzing multi-source data in real time.

-

I recently secured a bitcoin portfolio with marketplus247 . com, at first I was unsure because of previous failed attempts with scam companies but this one is just right. I grew my portfolio in under 2 months and I’ve saved quite a lot from my investment. You should try it

-

While the blockchains themselves are secure, the applications running on the blockchain may not be. These applications interact with the blockchain through smart contracts, but just like any other software, bugs in the code can lead to security vulnerabilities. For this, we need to involve the auditors who conduct security audits on the smart contract. Smart Contract Audit Services helps you find hidden exploits and eventually reduce the risk and provide you an extra layer of security. Bug-free code is nice to have in other types of software, in blockchain applications, it is essential.