iBuffer Finance: Interesting, With Options Trading Gaining Traction

Analysis Overview

It’s the nature of asset markets that funds flow from one asset class to another. Within an asset class, funds from one segment to the other. The same trend holds true for the world of cryptocurrencies.

In the initial phase of the bull-run, it’s the large market capitalization coins/tokens that make the big move. With time, altcoins enter into a rally mode.

As an example, meme coins dominated the headlines in 2021 along with themes like gaming and metaverse.

One segment that’s likely to make it big in 2022 and beyond is options trading in the world of cryptocurrencies.

In 2021, the trading volume in Bitcoin and Ethereum options was $387 billion. On a year-on-year basis, options trading volume surged by 443%. The chart below gives the volume of Bitcoin options on a monthly basis.

Goldman Sachs also opines that the crypto options market will be the next big step for institutional adoption. If this view holds true and the options market continues to develop, there is likely to be some good investment opportunities in the options segment.

This thesis will discuss iBuffer Finance (IBFR), which looks like an interesting micro-cap project in the options segment.

An Overview On iBuffer Finance

As an overview, iBuffer is a gamified options trading platform. The platform currently allows investors to buy and sell multiple assets directly against the liquidity pool.

What sets iBuffer apart is the projects focus on several segments. Currently, investors can trade options or involve in prediction gaming in the following segments.

- Equities

- Cryptocurrencies

- Gold and Silver

Some of the stocks supported for options trading and prediction gaming in the equities segment includes Apple, Tesla and Amazon, among others.

In cryptocurrencies, iBuffer supports assets that include (but not limited to), Bitcoin, Ethereum, Dogecoin, Matic and Binance.

iBuffer is a Binance Smart Chain project, but the project has plans to go cross-chain. As a matter of fact, the project is already live on Avalanche with few other chains likely to come online soon.

iBuffer Prediction Gaming Platform

The prediction gaming platform of iBuffer looks interesting with investors allowed to bet on a particular asset going up or down.

The image below gives the simple predictions interface.

Investors can choose the maturity date for the prediction gaming and the amount of bet. The pay-out calculator will provide the profit and loss scenarios. The prediction gaming on an asset can be closed anytime before maturity. The interface is simplified and gives investors an option to benefit from extreme bullish or bearish market sentiments.

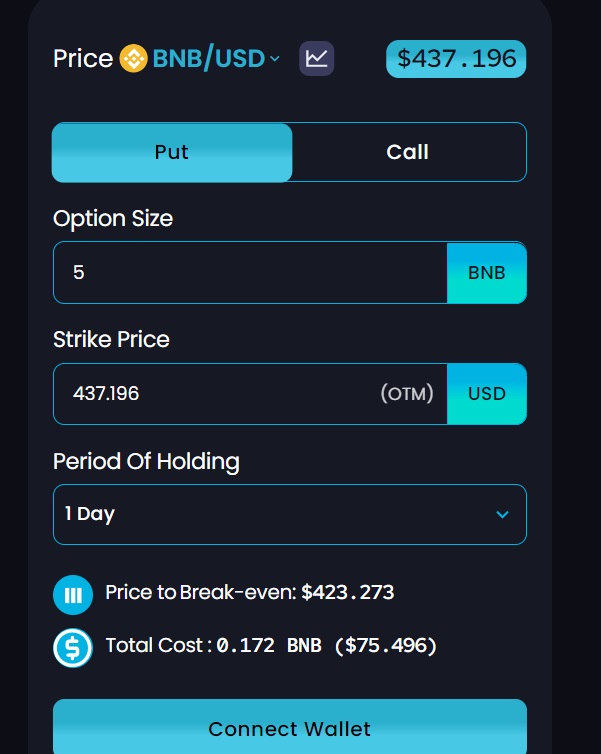

Buying Options

Besides the prediction gaming, iBuffer also has a platform for buying put and call options. The options on iBuffer are American style options. It can therefore be exercised at anytime before maturity.

There are several benefits of options trading for investors.

As an example, an investor who has significant long positions in Binance Coin (BNB) can buy a put option for BNB. Similarly, if there is a big short position, call option can be bought. This will help in hedging the portfolio risk.

The image below gives the options trading platform where users can input the options size, strike price and period of holding. The profit calculator is available for estimates.

Revenue Sharing

For holders of IBFR tokens, there are options for staking and revenue sharing.

In revenue sharing, the current APR is around 9.5%. Token holders are rewarded with 50% of the platform revenue in the form of BNB coin. With $0.8 million in total value locked, a significant percent of circulating tokens is locked for revenue sharing.

It’s worth noting that as the number of options traded on the platform increases, it’s likely that APR will improve. For Avalanche, revenue sharing pay-outs will be in AVAX.

Concluding Views

In the coming months, iBuffer prediction gaming and options trading will be available on multiple chains. Insurance is also likely to be launched where investors can buy insurance on BNB holdings to protect from price volatility.

IBFR has a total supply of 100 million tokens. However, currently around 12 million tokens are in circulation. At a market price of 17 cents, the project trades at a market capitalization of less than $2 million.

The segment is interesting and iBuffer Finance project looks promising.

-

I think the future of trading in crypto will be option trading, promising project