Yield-Farming Is The Future Growth Engine of Every Company in The World

If you as an investor want to understand how to create massive Alpha from yield-farming tokens…

You must understand the coming era of the Yield Engine Revolution:

The era of software development when yield-farming platforms become critical growth technology to over 80% of business and organizational treasuries on Earth.

Treasuries matter.

Organizations of all sizes have a fiduciary responsibility to grow value for their shareholders, stakeholders, employees, operational management, and clients. Treasuries optimize liquidity and lower the cost of capital, increasing the return on equity and drive shareholder value. Treasuries allow companies to run smoothly.

We all watched in awe in August of 2020 when Michal Saylor of MicroStrategy made the decision to purchase 21,000 bitcoin ($250 MM) as an offensive treasury strategy. Rather than lose capital efficiency, or the company’s ability to grow profitably, to the ravages of inflation, Saylor understood that to preserve and expand the value of his company’s $75 million in earned income, he needed a profound investment strategy for the MicroStrategy Treasury.

MicroStrategy wasn’t alone. Twitter, Square, Tesla, Coinbase, and others joined in publicly popularizing Bitcoin as a treasury reserve asset on a national scale.

Treasury investment strategies are nothing new.

Companies typically turn to professional hedge funds to fulfill their fiduciary responsibilities to employee pensions, benefits packages, long-term expenses, and cash accounts.

Universities and major public and private foundations deploy a portion of their treasuries to endowments that allow them to program for scholarships, research activities, and faculty and staff positions.

Typically, these treasuries invest in other paper assets like stocks, bonds, unit-investment trusts, and real assets like Real-Estate. University endowments will even purchase real businesses and include them on their balance sheets as portfolio companies.

But 2020 was the obvious moment where Bitcoin made the list of treasury reserve assets for the first time in a public way.

A quiet Revolution had begun.

And Bitcoin was only the beginning.

That’s because Decentralized Finance (Defi) allows for companies and organizational treasuries to do more than store value in an effective way thru Bitcoin (which, by the way, is already a big deal). Defi allows for treasuries to get more from their cash reserves, to enhance capital efficiency, capital productivity, and hire more employees without increasing top-line revenue.

In so doing, Defi allows companies to grow from the inside out, ultimately accruing more value to shareholders, stake holders, and operations (which eventually increases top-line revenue anyway). Defi allows organizations to grow with a new type of digital, financial technology never before known to human civilization: Yield-Farming.

In this post, I’ll show how the next evolution of yield-farming is creating a new, revolutionary growth engine for traditional organizations… and how a new financial era called the Yield Engine Revolution builds MASSIVE value for yield-farming platform investors.

Yield Farming as The New Engine of Business Finance: Pie DAO Sets The Example

It wasn’t until I saw this chart from Pie DAO, a decentralized crypto-index fund manager, that I began to understand how yield-farming is more than just about individual gains in your or my portfolios.

Check this out:

Pie DAO is my example because it holds at its core a yield-farming treasury strategy that is a model for all businesses moving forward. The strategy is simple:

- First, the committee votes to take money from the Pie DAO treasury and deploy it in external Liquidity Pools on yield-farming platforms like Uniswap, and Balancer.

- Then, the yield from this farming goes to three places: 1. 25% goes to growing the treasury even more. 2. 15% goes to operations and developers. 3. 60% goes to token holders (shareholders) who decide how to make improvements to the protocol.

- The success of the yield-farming strategies initiated by Pie DAO helps pay Pie DAO developers to create more and better products for users.

- Finally, Pie DAO’s product sales generate fees and revenues that go into enhancing the treasury even more. And the pattern repeats in an ever-expanding cycle of growth for Pie DAO.

Pie DAO is not the only DAO that can do this. Many protocols can achieve growth through the same system.

But the real power comes when traditional businesses, universities, charities, churches, and organizations begin to deploy this core yield strategy as a growth engine for themselves.

The amount of liquidity and need for yield-farming protocols becomes obvious when one thinks about the $3.82 Trillion dollars sitting in Corporate Treasury cash accounts from 2020-2021 in the U.S. alone.

In other words, yield-farming sits at the center of a perpetual growth strategy that can operationalize and expand trillions of dollars in cash accounts for companies everywhere in the world (everywhere its legal, anyway). Yield farming is the engine that can literally help companies earn on income so they can hire, create, and produce more and better products and services.

At the time of this writing, Pie DAO operationalizes liquidity through Balancer, Sushiswap, Uniswap, etc. directly.

That works for them.

But there is a learning curve on these platforms for the rest of the world.

What if there was a protocol or set of protocols that could help businesses easily plug into and begin realizing the benefits of yield farming?

Oh, wait.

Did AAVE just release AAVE arc, its institutional grade pool that allows organizations to deploy capital on AAVE?

Did Onomy Protocol really bring on institutional clients to its borrowing and lending services?

Did Compound bring yield farming to institutions with Compound Treasury?

Of course, they did.

But what do these moves mean?

They mean that institutions are coming to Defi, not just Bitcoin. And they are coming because they want the yield-growth engine blockchain can provide.

They also mean that protocols like AAVE, Compound, Yearn Finance and Convex Finance are not just tokens with a $10 billion dollar upside.

THEY. ARE. PLATFORM-TOKEN. PLAYS.

With $1 to $3 trillion dollars in upside potential.

What is the difference between a token and a Platform-token?

A token has limited uses like governance rights and gives access to one vector of value. i.e., as seen in Notional Finance’s NOTE token which at the time of this writing is only used for governance purposes (no additional way to accrue value to holders).

But…

A platform-token connects consumers and producers together to generate more value for all users, including token holders, across multiple vectors of value. i.e., seen in the power of Sandbox to enable metaverse digital real estate purchases that allow companies like Adidas to offer exclusive deals to platform users, which in turn, creates a secondary market for NFT resales between individual users. These SAND tokens can then be used to develop in-game applications that charge players fees to enjoy. Each action drives additional value to the platform’s SAND token.

How The Platform-Tokens of the Future Will Work

When Yearn (YFI) and Convex Finance (CVX) upgrade to institutional clients (and I believe they will in the future), they will be obvious platforms that people, companies, and organizations plug into to access the growth potential of yield farming Defi.

Institutions and organizations can simply plug into the YFI and CVX ecosystems and have their growth strategies automated for them. Hands-Free.

And when YFI and CVX create revenue-generating academies for companies to develop their own in-house professional teams to create proprietary strategies that are more closely tailored to their organization’s goals…you will see an explosion of value and usage to and from traditional organizations.

There has never been an in-house, decentralized hedge fund platform that puts hundreds of people to work on building profitable vault strategies that make you money…until now.

YFI and CVX are those decentralized hedge funds. But their highest potentials are as platforms.

Traditional hedge funds will be able to join YFI and CVX to create their own strategies, through an ever-expanding supply of tokenized assets including real, physical assets like Real Estate.

Imagine if Amazon was in the business of giving people “1-click” access to quality hedge fund yield strategies instead of e-commerce products, building massive revenues from transactions and farming fees.

That is what YFI and CVX can become.

And why would institutions opt to flock to a digital hedge fund platform like YFI?

Because it offers them access to digital asset revenue clearly impossible to get elsewhere.

And in an era of increasing tokenization, where art can be tokenized (see Beeple), where real estate can be tokenized and sold online, where vehicles and other real world items can be tokenized as NFTs and sold in metaverses, where digital land can be tokenized and rented out to advertisers… the yield opportunities are greater than in the physical world by a factor of 1000. There is no way a traditional hedge fund could even access many of these assets in the analog world, much less earn yield from them.

If you’re going to play, you go to play where you can get access to the most incentivized strategists and where you can train your team to develop strategies that serve the needs of your organization all on one digital platform.

That is the YFI and CVX hedge fund platforms of the future (Or their next generation iterations).

In other words, companies will be able to plug in, with a click of a button, to a financial ecosystem where they can get yield on a range of real world and digital assets that support the growth of their treasuries. They will be able to benefit both from producing these strategies and from using the strategies of others.

This means that every business, foundation, and university, large or small, can afford to benefit from their own, automated in-house endowment and expand growth for little upfront cost. By partnering with protocols like OPYN, yield farming platforms can literally connect users in “1-click” to perpetual swaps and options that help companies lock-in fixed costs thru derivatives. That is power. But it gets even better…

Enter Olympus DAO and Wonderland: More Than Hype APYs

I thought the 20,000% APY on Olympus DAO and the 84,843% APY on Wonderland was ridiculous when I first saw it, too.

But I must say:

There is so much that the thinking behind Olympus DAO and Wonderland can offer to the financial environment.

These projects are not just for fun and games but can become institutional grade opportunities for the next generation of yield-farming for organizations.

Here’s what I mean: Olympus DAO is producing a next-generation bond market for the world. Olympus Pro offers Bonds-As-A-Service to other protocols so that they can issue debt and raise capital for operations on their own platforms in a decentralized way.

Through bond sales, Olympus DAO offers Liquidity-As-A-Service to protocols in the crypto ecosystem.

The punchline?

Liquidity-As-A-Service can also be offered to companies, organizations, and yield farming aggregators, allowing traditional companies to raise capital more efficiently, then yield farm with productive debt to generate returns on raised capital.

Put another way, smart decentralized debt-financing deployed within a powerful yield farming engine can stabilize and enhance treasuries with no more effort than the click of a button.

For example, a bond issued at a 6% repayment fee can be offset by deploying a portion of the raised capital into a Fixed Yield-Farming Vault provided by a protocol like Notional Finance at 9.1%. That produces a 3.1% surplus of capital to enhance shareholder value.

Companies and organizations now have easy access to financial tools that allow them to take full fiduciary responsibility over their own growth potential by implementing a yield-farming engine.

In this world, strategies are everything.

Trust and access to the best fund managers are not.

But if you think that is all, let me show you one last technology in the coming Yield Engine Revolution…

DRIP NETWORK

By now, you might have heard of Drip Network.

At first, I thought it was a scam (no matter what… DYOR. This is not financial advice.)

I mean, how can any protocol guarantee 1% payouts every day for a year? Where does all this money come from?

But by digging deeper, another thought was revealed to me:

What if Drip Network is laying the groundwork for bringing income investment infrastructure to the decentralized Yield Engine Revolution?

Let me explain.

Right now, most crypto yield-farming is about, well, yield.

That is, the return on investment (ROI) measured out over a period of a year.

But robust investment strategies include more than the pursuit of annual percentage yield (APY) alone.

In traditional finance (TradFi), treasury strategies that rely on external hedge funds will create income from dividend-paying assets like stocks.

In crypto, the focus is on APY alone.

But what current protocols are missing is an effective income strategy for yield seekers.

Enter the Drip Network.

Drip Network is one of the first protocols to create a passive income strategy for investors. Because it offers income of 1% on initial investments every day, for up to 365% a year, I see it as worthy of inclusion in this conversation of yield growth as it, or a protocol like it, could become an essential Lego-like building block in the growth strategies of treasuries.

Drip Network was created by Forex Shark and is taking off with a powerful referral-based system.

Here’s how it works:

Drip network is a protocol that pays 1% on invested capital to stakers every day. Stakers can claim their 1% payout, or they can re-invest it to boost their rewards.

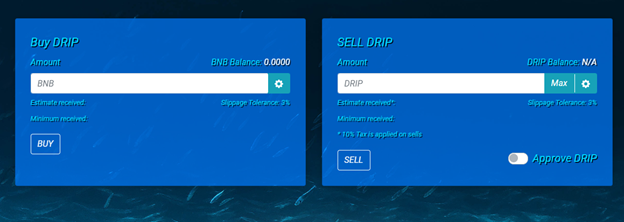

To join Drip network, you must first purchase the Drip token with BNB tokens on the Drip Network website.

Then you must stake your drip on the Drip network here.

Important: The moment you stake your drip tokens, they are burned forever!

And because there is only, and will only ever be 1 million drip tokens, burning token supply means price appreciation for every other token left in circulation.

The protocol can afford to pay users 1% a day because Drip burns every coin that gets staked, immediately raising the value of the remaining drip tokens that still exists. The appreciated value is what gets “dripped” to you daily in 1% interest increments.

Drip can afford to keep this up because it charges 10% fees on all transactions. And 5% on all reinvestment decisions. The drip fees you pay go to two places: 1. Into the Drip Treasury vault for savings and 2. Back on the open market for other people to purchase.

Drip has a referral-based reward-system built directly into the protocol. That’s because Drip benefits from the network effects of having people use the protocol.

That’s why you can’t even join Drip Network unless you join a team using a free “Buddy” address like this one:

0xA481ab0029a5e569F2E2e2526233822c41739cF8

By joining a team, you get the ability to earn rewards from bringing on other users. This is a built-in mechanism to fuel network adoption.

Or you can simply earn your 1% per day and do nothing else like most people (that’s how I knew it wasn’t a pure pyramid scheme because it still pays you no matter what). The choice is yours.

Consider using the Buddy address above to join my team.

I’m airdropping 6% cash back rewards in BNB to anyone who joins my team with at least 5 to 12 Drip tokens. And 9% in Drip rewards to anyone who deposits between 13 and 30 drip to my team (for first time deposits only). Since you must join a free team anyway to use the protocol, you might as well get paid for it too.

Email shawnsmith.smith5@gmail.com with these 3 items to claim your cashback and rewards.

1. Drip Deposit screenshot on faucet page

2. “Get a Buddy” screenshot on faucet page

3. Your buddy code

(Click “Use my address” button in “Team Viewer” tab in faucet page and copy)

But the most power comes back to what Drip Network means for the future of yield-farming for company treasuries.

Imagine a yield farming strategy that generates income through the Drip Network. Here’s…

What an Income Generating Protocol Means for Yield-Farming in the Yield Engine Revolution

Putting everything that we’ve covered so far together… imagine you’re a small, distressed company that desperately needs to grow or face going under.

You know that you must focus on your company’s yield-farming growth engine to pull you out of your doldrums, keep your staff paid for the year, and continue to produce quality products.

Your treasury is rapidly running out of funds and will be lost in 18 months at your current rate, and you won’t be able to afford to roll out your new product next year.

You know you need at least an extra $1M in your treasury to stay alive and continue to grow for the next 5 years.

So you spring into action to expand your treasury and grow the company.

You decide to turn to the next-generation hedge fund platforms (like future-YFI or CVX in partnership with Olympus DAO) and you raise $1M in debt through a tokenized bond sale at 5%. You then take 50% of the total raised funds from the sale of the bonds ($500,000) and you deploy them in a fixed yield strategy at 11% with Notional Finance. This means you generate $55K in interest to pay down $50K in debt on an annual basis.

Next, you take $250,000K and deploy in Yearn vaults that generate an average of 27% per year or an extra $67,500 that goes directly to support year one advertising spend to drive annual revenue. The final $250,000 is dollar-cost-averaged into Drip in increments of 50K every quarter for a year.

You reinvest daily for the first quarter only. By the end of year, your total has grown to $1M. In total, you have created an extra $1,072,500.00 (before fees) and your debt payments are completely serviced for the year.

Congratulations, you’ve exceeded your 18-month goal in 12 months!

All from your phone.

This is the power of harnessing the Yield Engine Revolution for organizations.

What a world.

What we must Realize is…

It doesn’t matter if I’m right about organizations adopting yield-farming as a core treasury strategy this year or next.

The spirit of its possibility exists today.

And that makes all the difference.

Therefore…if you cannot cherish what these protocols are today, cherish the platforms they might become tomorrow.

The Yield farming growth engine is a strategy that can be made available to individuals and institutions alike. As regulations and safety procedures improve in crypto, traditional organizations will see they have an obvious choice when it comes to dictating their own financial destinies. And they will use it.

Investors who allocate accordingly and begin to look at popular yield-farming protocols as critical infrastructure for the Yield Engine Revolution will be the ones seated comfortably, belts securely fastened, by the time the crowd arrives and realizes there was even a vehicle in which to ride.

About the Author:

Dr. Shawn Smith runs a Venture Firm that specializes in Defi applications. Dr. Smith owns everything he says here and owns every token expressed in this writing except Compound, Sushi, Balancer, Sandbox and Convex.