Index Cooperative — Community Owned Asset Manager

Public awareness and adoption of blockchain technology and the crypto industry are on the rise. DeFi or decentralized finance has contributed to the growth and launch of several sophisticated open-financial systems and tools that don’t rely on banks and other legacy systems.

The potential of this space is corroborated by the successful launch of new products/protocols on a daily basis. Moreover, in recent times, investors have turned to passive income generation techniques in order to extract value from their digital assets and DeFi has several favorable propositions in its kitty.

The application of traditional financial analysis to the crypto world is being explored on a large scale. DeFi has opened the doors wide open for retail investors offering a boatload of opportunities to earn passive income. Several DeFi platforms have emerged in the recent past that enable investors to earn high APYs with just a click of a button. However, trading or investing in crypto as exciting as it sounds is also extremely daunting for the novice. Moreover, the plethora of opportunities available today for the generation of passive wealth requires in-depth knowledge of the product and the ability to make split-second decisions. Thus, even though the opportunities exist actually profiting from them requires time and effort.

So How Does One Jump Onboard And Commence Their Crypto Investment Journey?

To answer the above let me remind you in the traditional world of finance, the smartest investment move for investors who’re about to start their investment journey is to opt for index funds. Index products belong to a mature category of products, and have been in play for over 5 decades.”In the traditional financial world, ETFs and index products are the most widely traded instruments, and companies such as BlackRock ($7.4T AUM) & Vanguard ($6.2T AUM) are the largest asset managers in the world with trillions of assets under management.”

Index funds have made their way into the ever-growing and rapidly emerging DeFi space. But before we dive deep into crypto Index Funds let’s take a look at ETFs and index products in the traditional financial sector.

Pitched as low-risk and inexpensive Index Funds are the ultimate example of passive investing, offering investors relatively stable and long-term returns. But what are index funds? To understand index funds let’s understand what an index is-

An index is a tool used to track an asset or group of assets’ performance. The measurement is taken to replicate the actions of a specific segment of the market.

To put it simply index funds provide a straightforward way to gain exposure to an entire sector by investing in a single asset. The peg to its constituents makes the portfolio mix of these funds not only simpler to understand but more predictable as well. Furthermore, these funds usually have a low expense ratio when compared to funds that require active management and this can be attributed to their passive management.

Thus, the broad diversification, low costs, and attractive returns associated with Index Funds make them the perfect passive investment strategy.

A quick recap of Index Funds

- They incur low expenses as they’re not actively managed

- They’re designed to replicate the performance of a designated index and aren’t aimed at outperforming the market.

- They help investors manage as well as balance the risk in their portfolios.

What Is Important To Note Is That:

Index funds do not guarantee massive gains or the best returns. Then why should one opt for them? Firstly, they overcome human bias, and secondly, and more importantly, they instantly diversify your portfolio and minimize the risk involved. Thus, an Index Fund created by a portfolio manager/methodologist with in-depth knowledge of the underlying products provides investors the opportunity to earn a better return given the level of risk. To put it simply, while investors may not be able to earn massive returns they’re definitely protected from huge losses.

Index funds have made their way into the emerging world of cryptocurrencies and decentralized finance (DeFi) wherein they’re not only efficient but affordable and permissionless. Moreover, investors don’t need to acquaint themselves with the economics or performance of various tokens or understand the intricacies of different protocols in order to invest.

Similar to the Traditional Financial world where investors can purchase ETFs and Index Products, investors in DeFi can head to Index Coop to buy these products. Currently, there are very few organizations working in the cryptocurrency index fund space with Index Coop being the leader.

As previously mentioned, crypto index funds are similar in concept to traditional index funds with the exception of being entirely blockchain-based. As a result, these funds are not controlled or managed by a centralized asset manager instead there is open-source software and a decentralized governance system or DAO like Index Coop for making the decisions.

Index Coop

The Index Coop is a community-led decentralized autonomous organization (DAO) focused on enabling the creation and adoption of on-chain crypto index products for both retail investors, institutions, and investment professionals.

Together we launch, grow, and maintain the most trustworthy crypto indices on the market.

Index Coop, a decentralized autonomous organization (DAO) came into existence to create and maintain crypto-native structured products built on DeFi asset management primitives. Index Coop is governed and maintained by INDEX token holders. Designed to facilitate voting and community ownership, $INDEX apart from being Coop’s governance token is an ERC-20 token on the Ethereum blockchain that was launched in October 2020. Moreover, community members and methodologists are rewarded for their contribution with $INDEX.

Index Token

$INDEX is the governance token of Index Coop. It grants holders the access to vote on Coop’s various proposals, future products, and strategic direction as well as on all of the projects it invests in. $INDEX should be viewed as a ‘proof-of-work’ token as it is distributed to those who contribute to the progress of Index Coop.

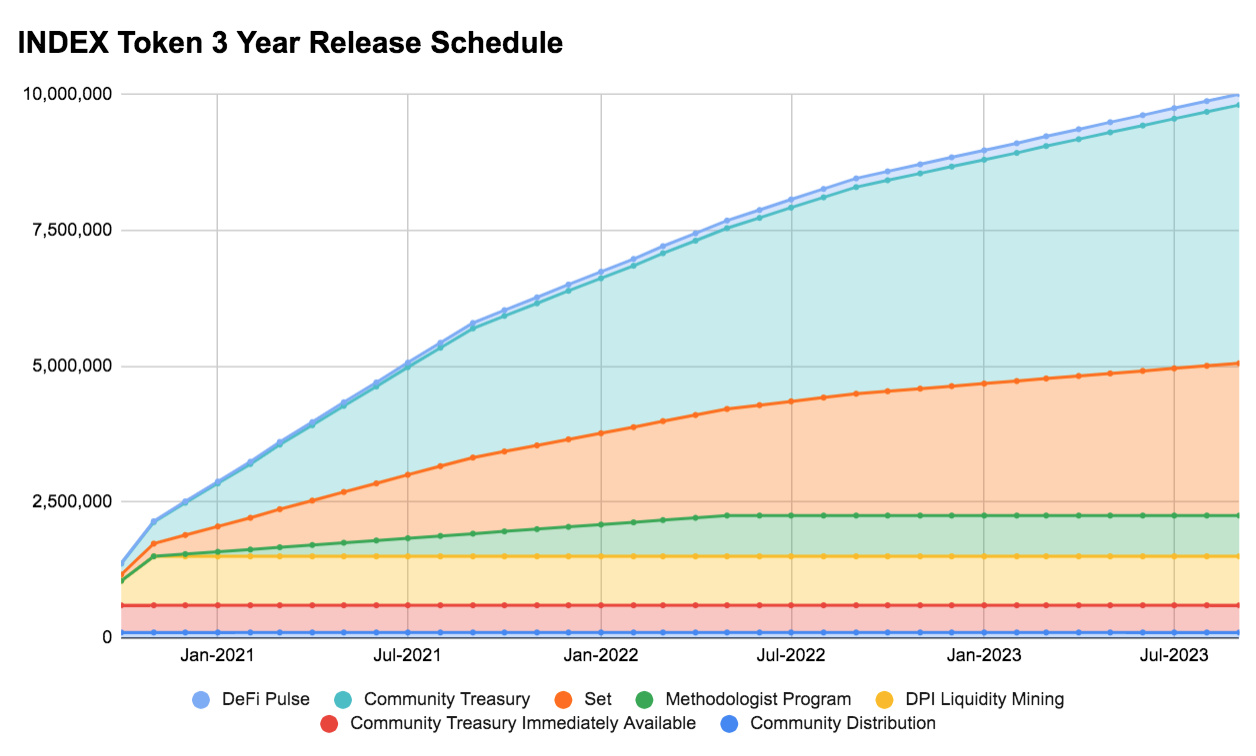

There is a max supply of 10 million Index tokens which will be distributed as follows.

In case you’re interested in acquiring these tokens, you can do so through the following means

- DEX?—?You can purchase $INDEX on a decentralized exchange (DEX)

- Liquidity Mining Programs?—?You can participate in liquidity minings programs to obtain $INDEX

- Index Coop?—?Contribution to the DAO is rewarded with $INDEX.

For more information, click here.

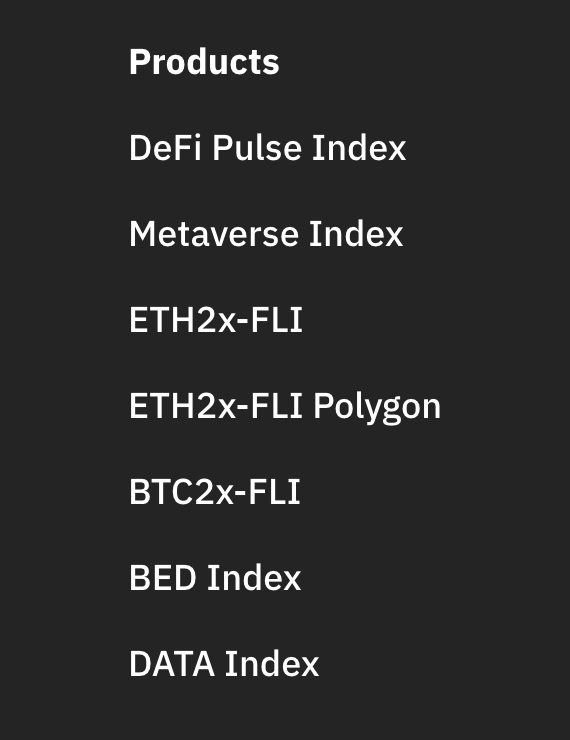

Index Coop Product List

Following is the list of products available on Index Coop. I am going to cover each product briefly.

DeFi Pulse Index (DPI)

$DPI is a result of a partnership between two leading crypto teams TokenSet and DeFi Pulse. This digital asset is designed to track DeFi token performance. $DPI an ERC-20 token as a capitalization-weighted index contains popular Ethereum-based DeFi tokens. It provides investors with the ability to gain broad exposure to Etherem DeFi in a single token.

Metaverse Index (MVI)

MVI is Coop’s first Index Product to be launched without an external partner as the methodologist. It is composed of tokens from VR, AR, music, NFT, and entertainment as it is designed to capture the trend of entertainment, sports, and business shifting to a virtual environment.

Flexible Leverage Indices (FLI)

Built on Set Protocol, FLI is Coop’s second collaboration with DeFi Pulse. The Flexible Leverage Indices are built to minimize the risks and costs associated with managing and maintaining collateralized debt. In the words of Index Coop itself,

Leverage is one of the killer use-cases for DeFi. However, legacy DeFi leverage workflows are not for the faint of heart. Users have to monitor health ratios, watch out for liquidation risk, and avoid penalties.

The Flexible Leverage Index was created to address those risks and to make the use of leverage safer and easier to maintain.

The FLI uses a novel strategy built on Set Protocol and Compound that abstracts collateralized debt management into a simple index?—?constructed as an ERC-20 token.

- ETH 2x Flexible Leverage Index- Ethereum Flexible Leverage Index

- ETH 2x Flexible Leverage Index (Polygon)-The Polygon-native version of the Ethereum Flexible Leverage Index

- BTC 2x Flexible Leverage Index- Bitcoin Flexible Leverage Index

Note- ETH2x-FLI is the original ETH2x product on Ethereum main net, while ETH2x-FLI-P is a distinct, Polygon-native product.

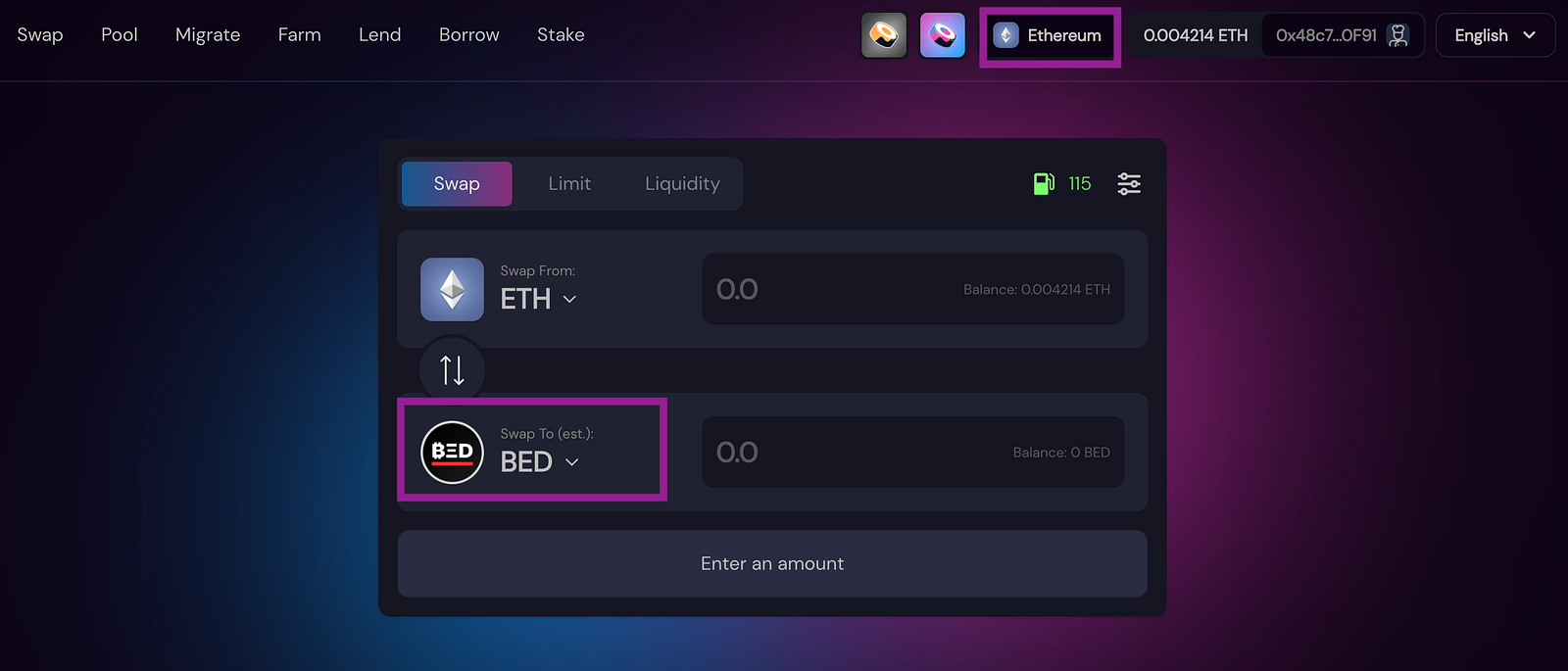

Bankless BED Index (BED)

A collaboration between Bankless and Index Coop resulted in the creation of BED on Set Protocol infrastructure. Investing in BED provides users with the ability to gain passive exposure to assets that allow for independent banking.

BED stands for Bitcoin, Ethereum, and DeFi. These are considered the essential components of the open finance or bankless revolution. It is based on the thesis that each of these holdings captures the upside of three investment crypto themes, in equal weight:

- Bitcoin?—?the “digital gold” or store of value

- Ethereum?—?programmable money

- DeFi?—?decentralized finance

Data Economy Index (DATA)

The Data Economy refers to an ecosystem comprising of data-based products and services. Created by Thomas Hepner and Kiba Gateaux, The Data Economy Index ($DATA) gives investors passive exposure to some of the most significant innovators in the data economy. The index includes Filecoin(renFIL), the Graph(GRT), Basic Attention Token(BAT), livepeer(LPT), OCEAN, Numeraire(NMR) and Chainlink(LINK) and is data-centric and chain agnostic.

How to Buy Index Coop Products?

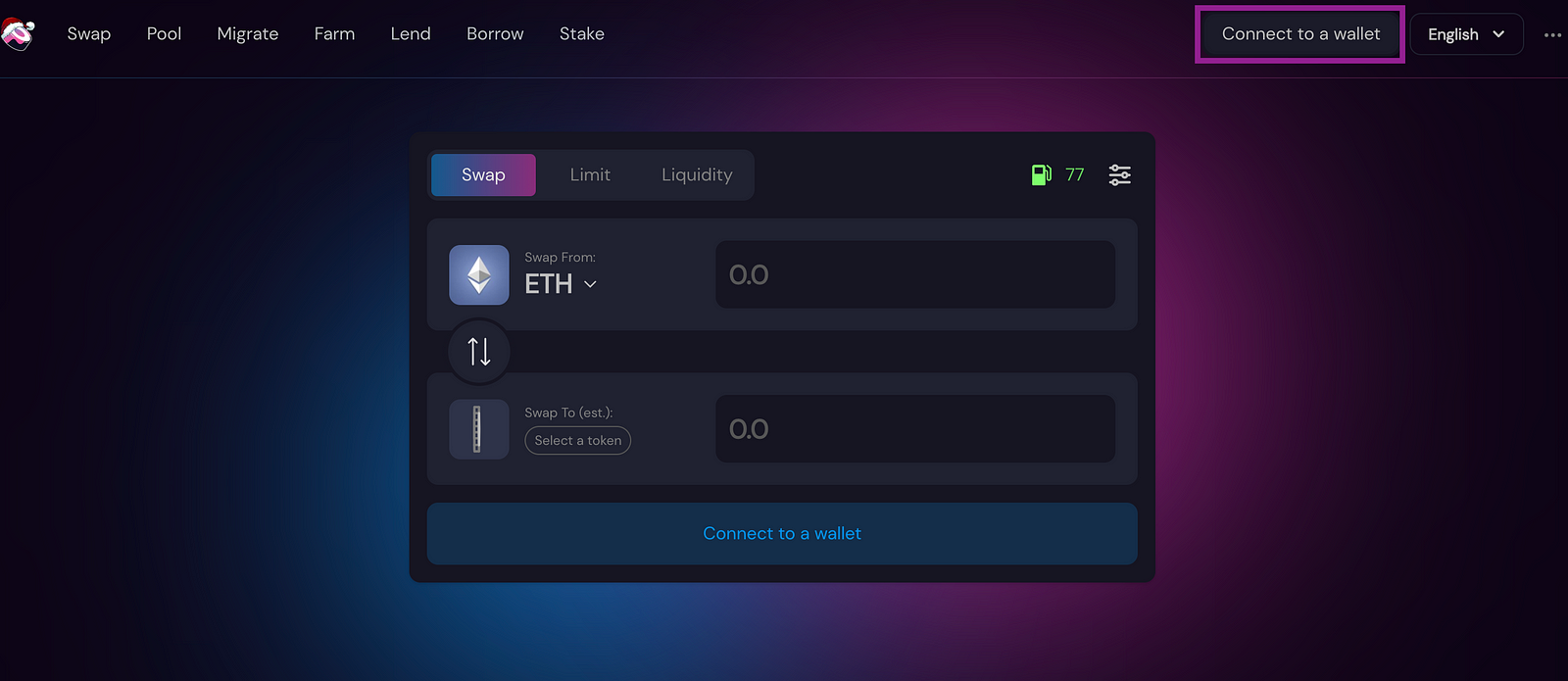

To get started, Let’s assume you have a Web 3.0 wallet like Metamask. This tutorial will focus on buying Index Coop Products from Decentralized exchanges directly. There are many DEXes like Uniswap, Sushiswap, Loopring, Matcha that can be used. For the sake of this tutorial, let’s go ahead with Sushi.

All these products can be availed from the Index Coop App and are offered by Uniswap and Sushiswap on Ethereum Mainnet. Users have the option to use Polygon or Ethereum for DPI, MVI & DATA. BED is only available on Ethereum Mainnet.

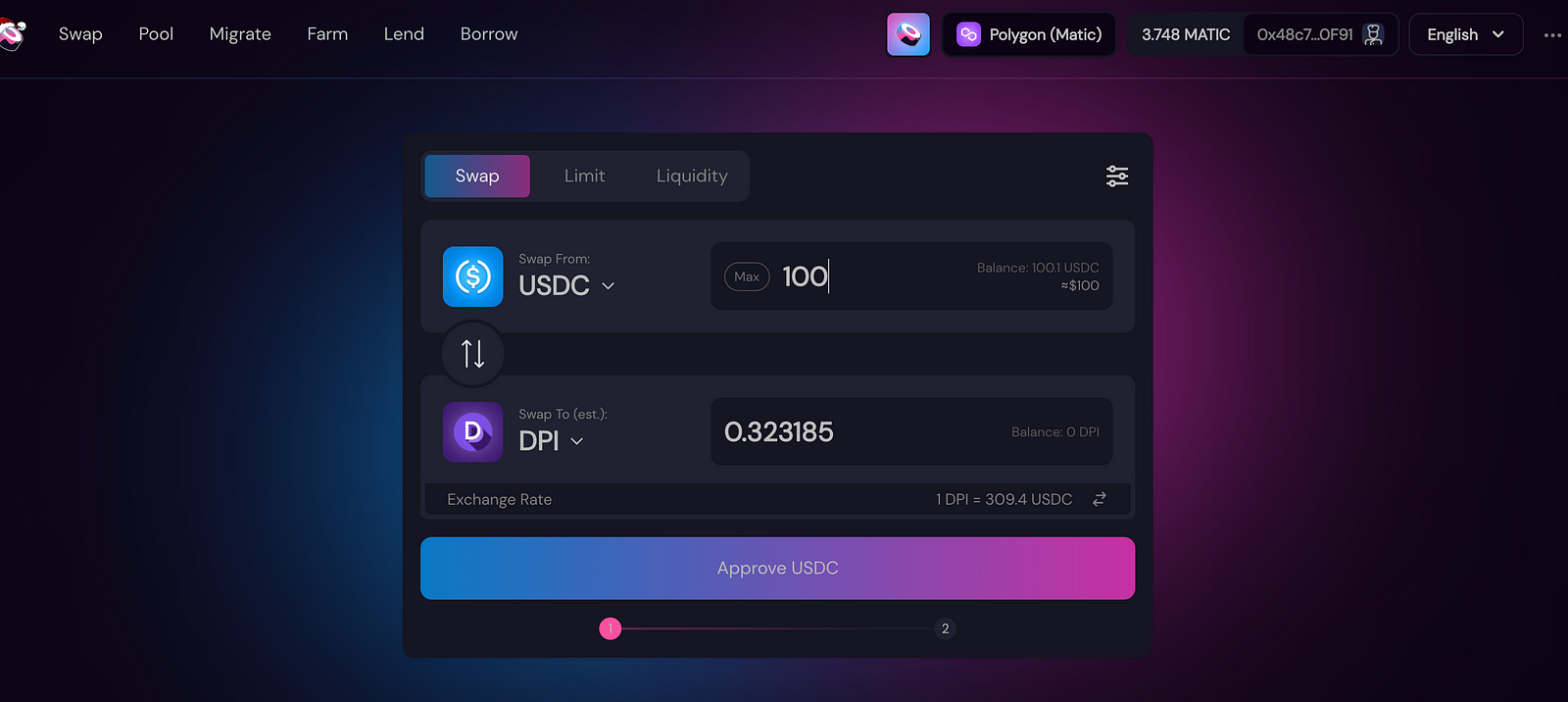

DPI, MVI, FLI & DATA on Sushiswap

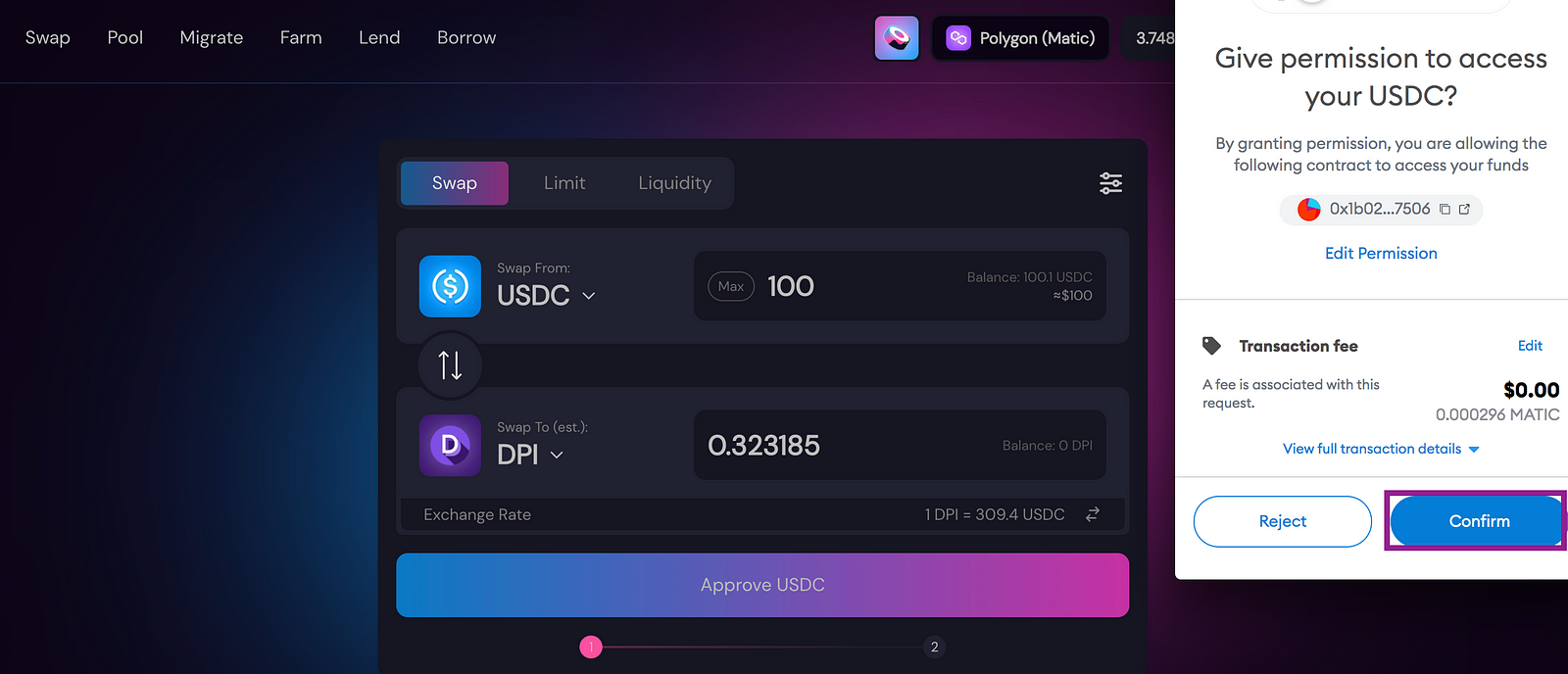

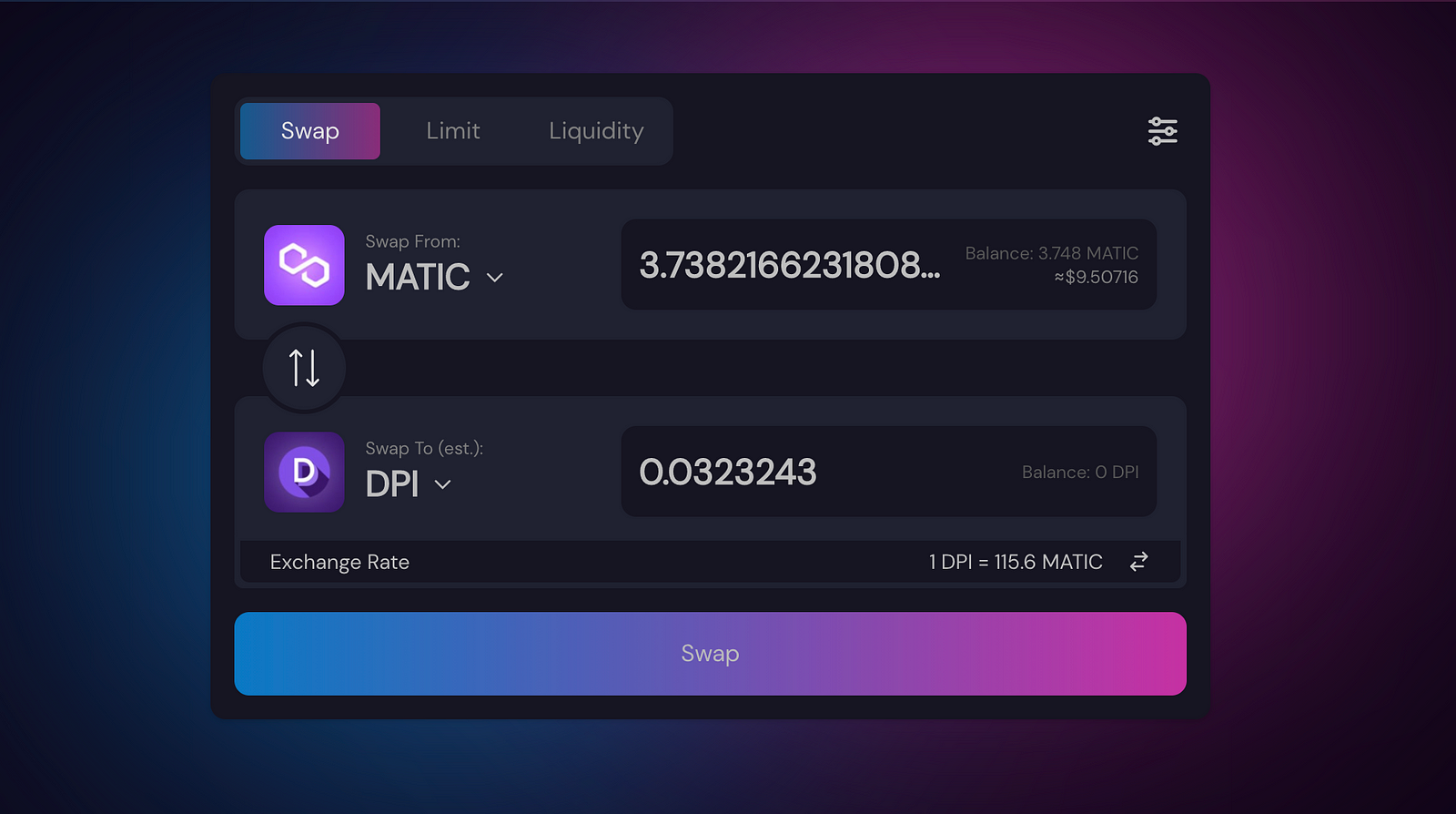

Head onto SushiSwap app.

1. Connect your wallet using Ethereum/Polygon Mainnet.

2. Search the product that you want?—?DPI, MVI, and DATA.

3. Select the token and enter the amount that you want to use. Click on Approve.

4. Confirm the transaction.

5. Click on Swap and confirm the transaction again.

For BED?—?Use Ethereum Mainnet.

Conclusion

With simplicity and efficiency being the strongest value proposition Index Funds are here to stay. The ability to create a diversified portfolio through investment in a single highly liquid asset makes them highly valued. Investing in only one asset enables DeFi users to save on significant gas fees associated with the purchase of multiple tokens while having access to a wide range of tokens. Users don’t have to worry about tracking individual tokens saving on valuable time and effort. Index Funds grant a more mainstream audience exposure to DeFi’s incredible offerings. It reduces the existing barriers of high volatility by diversification of investment.

I believe as the DeFi space evolves and grows so will the demand for these index products. The fact that there are only limited players that exist in this particular space, Index Coop with its broad list of products and strong partnerships is definitely emerging as a front runner. If this wasn’t enough, Index Coop works as a DAO with a strong community responsible for the key decisions propelling it in the right direction.

Socials

Substack, Loop, Torum, Odysee, Twitter, Youtube, Read.cash, Publish0x, Presearch, Medium, Noisecash

Crypto Taps Pipeflare, GlobalHive, GetZen for some free crypto

Exchange on SwapSpace

For price updates, check Coinmarketcap or download the app on Apple/ Google

Join CMC for Airdrops, Diamonds, Learn&Earn

On Telegram(G), Telegram(EN), Twitter, Reddit, Instagram, Facebook

Create your crypto Watchlist or track your Portfolio on Coinmarketcap