Is Crypto Winter Coming?

The total cryptocurrency market cap plunged by 25% to $2.3 trillion from its peak at the time of writing (Dec 16, 2021). Is crypto winter coming? No one knows. I believe an approximately 70% correction is unlikely at this point. Crypto winter may not be as brutal as it used to be. Here are some reasons why I think this cycle is fundamentally different from predecessors:

A) Institutional money inflow;

B) ETH`s decoupling from BTC;

C) Emerging multichain ecosystem;

D) Stablecoin growth;

E) Inclusive crypto regulations in developed market

A) Institutional Money Inflow

In the past cycle, institutional money inflow to the cryptocurrency space and market cap was negligible. However, we now have legendary investors Paul Tudor Jones (@ptj_official ), Ray Dalio (@RayDalio), Cathie Wood (@CathieDWood), etc., and forward-thinking corporations like MicroStrategy (@Microstrategy, and Twitter (@Twitter@blocks,) making substantial cryptocurrency investments, as well as being vocal about their involvement, bringing numerous high-profile endorsements to the space.

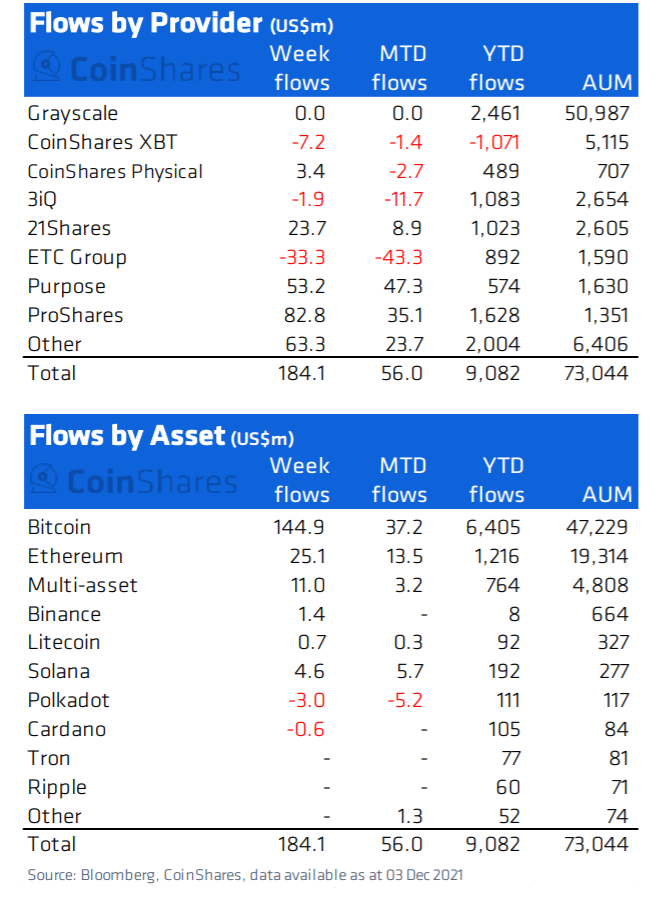

Let` look at numbers. On the fund flow side, total crypto fund AUM reached USD 73b as of the 1st week of Dec 21 (>10x y/Let’s look at the numbers. On the fund flow side, total cryptocurrency fund assets under management (AUM) reached $73 billion as of the first week of December 2021 (approximately 10x year over year, according to Coinshares and they’re featuring various institutional-grade investment products to attract institutional money (even a cryptocurrency underlying ETF!).

Of note, institutional money inflow has been largely limited to BTC and ETH at present. For instance, BTC and ETH products represent 65% and 26% of total cryptocurrency fund AUM, respectively. It seems that altcoins are still an experimental bet for most institutions.

On the infrastructure side, crypto-related startups raised a record-high amount of $6.6 billion (28% quarter over quarter, 563% year over year) in 3Q21. Institutions are actively exploring the cryptocurrency field and investing in promising crypto infrastructure (e.g., exchange, custody, tech provider, etc.). This is unstoppable.

Meanwhile, @nayibbukele escalated BTC to national agenda beyond corporation level. He relentlessly deployed capital to buy the dip although its amount is relatively smaller to other bitcoin billionaires (@saylor) This limits downside of BTC. Meanwhile, El Salvador president Nayib Bukele (@nayibbukele) escalated BTC to a national agenda, well beyond the corporate level. He relentlessly deployed more capital to buy the dip, although the amount he purchased for his country is relatively small if compared to other bitcoin billionaires (such as Michael Saylor (@saylor)). Such large corporate and national purchases (intended to be held in reserves for a very long time) actually limits the downside potential and volatility of future BTC dips, helping to create and ensure a new and higher “price floor” for BTC.

B) ETH`s Decoupling With BTC

As shown below, ETH has outperformed BTC in recent quarters due mainly to DeFi, the explosion of NFTs, Layer 2 protocols, and high expectations for Ethereum 2.0. Although there are many alternative Layer 1 products in the market, Ethereuem’s dominant position in the smart contract platform is still unchallenged.

Of note, ETH/BTC ratio is now >0.08, the highest figure in three years, and an “ETH flipping BTC scenario” is widely accepted among #web3 folks. I think it could be possible “temporarily.” However, in the long term, I think BTC will likely maintain the #1 cryptocurrency spot (I will address this in more detail later on).

I think the investment theses on BTC and ETH are completely different. While BTC is sound money to hedge money manipulation risk by central banks, ETH is more akin to a disruptive blockchain technology bet. However, ETH price has been historically correlated with BTC.

Recent decoupling with BTC’s price implies that the Ethereum network is more mature than ever. It is obvious that almost all “builders” have been involved in the Ethereum network, and various metrics show the usefulness of Ethereum network. (e.g., DeFi TVL, NFT market activity, DAO treasury, etc.).

C) Emerging Multichain Ecosystem

I addressed this topic previously, with a thread of tweets beginning:

Please read this if you`re interested. https://twitter.com/BTCThinker88/status/1459029304419840003

D) Stablecoin Growth

Total stablecoin market cap has grown to greater than $155 billion (>7x year over year). Tether FUD is no longer valid now that they have reached settlement. Since stablecoins are mainly used to buy other cryptocurrencies and for yield farming, the recent all-time highs for the stablecoin market cap implies that the market is fueling more buying power.

Despite there`s uncertainty on stablecoin regulation, I believe US will not kill stablecoin (US politicians and regulators starteDespite there being current uncertainty regarding stablecoin regulation, I believe that the U.S. will not kill stablecoins (U.S. politicians and regulators have recently started to understand USD-pegged stablecoin growth is actually good for the worldwide supremacy of the dollar) and decentralized stablecoins will play their roles.

E) Inclusive Crypto Regulations In Developed Market

China banned crypto mining and exchanges. They`re rather building their own Digital Currency Electronic Payment (DCEP) system, using permissioned blockchain. On the other hand, U.S. and other developed markets have accepted – or in some cases embraced – cryptocurrency based on permissionless blockchain.

Intranet versus internet, what`s your bet? If you don’t get it, study the history of the internet’s evolution. Cryptocurrency (“not blockchain”) is the native value system of the internet, and it has great potential to empower the people. Open finance will give financial freedom to the people.

Risk

My biggest concern is crypto is cMy biggest concern is what could happen if cryptocurrency is coupled with equities. Potential macro headwinds (e.g. tapering, Omicron, elevated tension between U.S. and China, etc.) may hit equities and the cryptocurrency market significantly.

Conclusion

Manage your portfolio and risks. Have some cash in your pocket to acquire more blue-chip crypto at a cheap price. HODL wins no matter what the market situation is.

+Please follow me if you enjoyed reading this post. https://twitter.com/BTCThinker88