What Does DAO 2.0 Tokenomics Look Like? (Part 2) – Introducing BUFF

With the incoming wave of new social DAOs, this series aims to create a tokenomics framework for DAO creators and builders, using the Global Coin Research (GCR) token as an example.

In Part 1, we highlighted why it’s crucial to 1) generate liquidity organically from the community, and 2) prioritize price stability from the get-go.

In Part 2, we discuss strategies and services to bootstrap liquidity for the DAO directly from the community and introduce a new concept called BUFF.

For Part 3, we discuss specific initiatives GCR exercises for its liquidity plan.

Background

GCR is a research and investment DAO in Web3. Anyone can join the DAO by holding enough GCR tokens.

Members of the DAO get direct access to investment opportunities and also share high-quality discussions and research around cryptocurrencies and Web3 projects.

One can check out GlobalCoinResearch.com for insights and research, while discussions and events are held in the GCR Discord.

Roles in the GCR Community

- Contributor: People who maintain the DAO’s operation and promote the DAO’s sustainable development. In this framework, contributors are an abstract primitive, including the team, the contributors, the media miners, and everyone that contributes to the DAO.

- Customer: In this model, the Customer is also an abstract primitive. All people who enjoy the DAO services are customers. For example, supporters, readers, and even some information seekers in our discord server.

- $GCR: GCR is the governance token in the GCR ecosystem. It ensures the autonomy and sustainability of the whole ecosystem. Its market cap also reveals, among other things, the value of this ecosystem.

- DAO Treasury: DAO Treasury is just like the Federal Reserve Board. It is an automatic relay station that controls the fund flow of this system.

- Supporters (and partners): Individuals who are long-term holders of the GCR token. A number of them recently participated in GCR’s treasury diversification efforts.

Long Term Sustainability for DAOs

How does a decentralized autonomous organization stay self-sustainable in the long run? How can we onboard new members when the treasury is dried up?

The more I think about this question, the more I think it is necessary to incentivize holders to provide liquidity.

Existing Members Provides Liquidity for New Members

The long-term success of any system depends on steady growth.

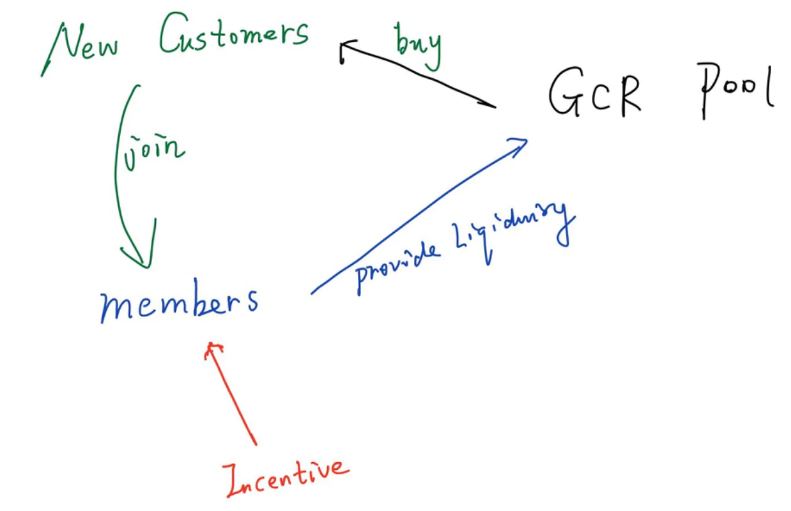

Right now, it is in the early stages for DAOs, and many of them lack the liquidity for steady price appreciation. A single purchase or sale of a DAO’s tokens can lead to dramatic volatility. It is our belief that a healthy incentive structure must be created to maintain liquidity and ensure steady growth. Specifically, by incentivizing existing members to provide liquidity for new members looking to join.

Here’s a positive feedback loop when the right incentives are in place:

- Existing members provide liquidity for new members to join

- New members find it easier to join; less price volatility

- GCR community grows, and the brand gets stronger

- GCR community sees better-quality deals

- Demand for GCR increases while members are incentivized to provide liquidity for the new buyers

- The DAO Treasury revenue increases

- More contributors, better DAO services

- New members continue joining

We can see from the above that a reasonable incentive is needed here, otherwise, the positive feedback loop will be terminated by step 4.

Without sufficient liquidity in the market, the token price will skyrocket too fast, exceeding a reasonable valuation range for the project, and potential members get priced out of the market. This negative cycle is detailed extensively in part 1.

What Levers, then, can the DAO Pull to Incentivize Existing Members to Provide Liquidity?

As a truly decentralized autonomous organization, these levers and rewards should directly come from the DAO Treasury, which may be composed of GCR tokens, revenue from services, and alternative assets.

Broadly speaking, there are two levers to incentivize existing members to provide liquidity:

- Reward them with GCR tokens or other forms that can be directly exchanged for cash flow

- Reward them with options (in a broad sense)

If we choose the first solution, we are no different from traditional DeFi projects. We will get mercenary LPs and unstable liquidity.

Thus, we choose the second one.

For example, current DeFi 2.0 protocols like Olympus DAO ($OHM) use a bond mechanism to exchange their future tokens for current protocol-owned liquidity.

There are similarities with option 2, in $OHM, however, all of the LP rewards are highly correlated with the native token, which means the liquidity providers (LP) share risks with the protocol.

DAO 2.0 Can Get More Creative

Unlike DeFi, a DAO ecosystem is far more flexible. DAOs can be more creative about how to incentivize liquidity.

Here I introduce the concept of BUFF, a new primitive in the DAO ecosystem.

Members with BUFF are incentivized to provide liquidity because, in return, they will have more rights and benefits in a DAO ecosystem.

And we can see this type of primitive in many existing centralized platforms. For example, Binance and FTX. Both of these platforms have a staking mechanism that works like this: the more you stake, the greater the discount you will receive from your transactions.

Think about coupons for shopping malls. It means you save more when you trade more, but you get nothing if you don’t trade. It’s like stakers’ benefit from exercising an option, and platforms benefit from their exercise.

On the surface, platforms lose some revenue while they offer discounts for stakers. But in fact, they earn more from this discount mechanism because they incentivize more trades and their platform tokens gain more demand.

The concept BUFF here is very similar to the aforementioned platforms.

And in a DAO system, one can offer more options to LPs, effectively a number of different BUFFs. LPs will benefit more with higher participation and further contributions.

We believe this kind of benefit will never belong to mercenary LPs, but to the real DAO participants. Will the DAO Treasury lose revenue from offering this kind of BUFF? Probably NOT, it’ll likely earn more.

What Does a Real DAO 2.0 BUFF Look Like?

In part 3, we will discuss specific initiatives GCR exercises for its liquidity plan and the BUFF strategies we plan to have in place.

Before you read more, come checkout the GCR community and get a feel for the DAO yourself!