UMA KPI Options – Explained (Key Performance Indicators)

Following up on the last article about UMA Protocol, this one will explain KPI Options that can possibly contribute towards a more holistic growth for DAOs and other protocols.

Sounds interesting, Read on!

Built to promote a decentralized architecture that can grant Universal Market Access to DeFi markets, UMA provides an open-source infrastructure for priceless financial contracts on Ethereum (expanded on to Polygon). Essentially, UMA is powered by

- Priceless financial contract infrastructure– that enables the creation of synthetic tokens.

- The Optimistic Oracle– that focuses on the management and enforcement of contracts.

These together contribute to the creation of fast, efficient, and secure derivatives.

KPI Options

Pegged to community growth, KPI Options are an incentivization mechanism introduced by UMA. Designed to reward the community for helping grow the underlying fundamentals of the protocol, Key Performance Indicator (KPI) options are synthetic tokens that will pay out more rewards if a project’s KPI reaches predetermined targets before a given expiry date. Every KPI option holder has an incentive to improve that KPI because their option will be worth more. This is intended to align individual token holder interests with the collective interests of the protocol.

The Rationale Behind Its Creation

The existence and growth of DAOs (Decentralized Autonomous Organizations) serves as a definitive proof that the use of digital assets goes beyond speculative trading. Unlike traditional companies, DAOs are decentralized and their rules and governance for the most part are encoded in a blockchain.

Tokens form an essential part of DAOs and perform the following functions

- serve as a measure of an individual’s stake in the organization

- reward participation

- guarantee voting rights

- are tradeable, making them valuable

Even though the popularity of DAOs is on the rise, free riders and voter fatigue are major hindrances to their growth. Benefiting from the sustained efforts of committed community members, free riders make it difficult for DAOs to effectively work towards a common goal and create real value.

While standard airdrops serve as incentive mechanisms and accelerate network growth, their effectiveness is limited as one cannot disregard the associated risk of dumping. Most airdrop recipients tend to sell the tokens the moment they become tradeable causing their value to plummet. As such, it is difficult to predict the outcome of airdrops. Moreover, the aforementioned risk makes airdrops impractical for projects with tokens already in circulation.

The main problem is the absence of a mechanism that provides a direct correlation between the work performed for a DAO and the reward received.

UMA’s KPI Options

The explosive growth of DAOs owing to people experimenting with building companies on top of tokens and leveraging smart contracts has created a flourishing industry but one that lacks the required infrastructure and incentive mechanism to reach its full potential.

UMA allows anyone to create contracts and build financial products on-chain. This helps to create a future market for business metrics where the value is derived through Key Performance Indicators (KPIs). DAOs can use the KPIs to incentivize members to achieve pre-defined and explicit goals. These options are issued to the members that are redeemable if the underlying goals are met.

Examples of KPI Options

- Defi protocols can create TVL Options: In this, options will pay out more project tokens as TVL goes up thereby uniting option holders in growing protocol TVL.

- Exchange protocols can create Volume Options: In this, options will pay out more project tokens as trading volume increases thereby uniting option holders in growing volume metrics.

- dApp can create DAU Options: In this, options will pay out more rewards as DAU numbers go up thereby uniting option holders in growing dApp usage.

KPIs shall vary between DAOs, hence these are just examples of some KPI options that can be easily created on the UMA platform.

Interestingly, UMA was the first one to experiment with this mechanism. It did so by creating the first version of these tokens to incentivize growth in UMA’s TVL. In April uTVL tokens were airdropped and were exchangeable for UMA on 30th June at a rate determined by the total value locked in the protocol at that time.

Why UMA?

The answer to this lies in UMA’s architecture

- With its flexible contract template, UMA permits the launch of a vast assortment of expiring contracts with negligible development work.

- UMA’s unique oracle solution paves the way for a trustless, incorruptible, and economically incentivized solution. Moreover, UMA uses the priceless methodology for price identification thereby offering a large amount of flexibility.

How To Launch a KPI Options Contract On UMA?

UMA’s process to launch a KPI options contract is rather simple and requires no on-chain price feed or smart contract development. It only requires a long-short pair contract template and Optimistic Oracle.

Steps involved-

- Submission of two UMA Improvement Proposals (UMIPs). The first to add the governance token as a supported collateral type. The second is to define a methodology for how the UMA Optimistic Oracle should price the KPI options. An UMIP takes a minimum of 10 days from submission to on-chain implementation.

- Launch of the expiring KPI Options contract post-approval from UMA governance. The said procedure can be completed within a few minutes by following the LSP deployment tutorial.

- Commence minting of KPI tokens by locking collateral in the contract. Once minted, airdrop of KPI token in the desired manner to the desired list of addresses.

- Upon contract expiry, redemption of KPI Options for an amount determined by the KPI’s progress. Alternatively, in an attempt to compound KPI growth, the project could decide to “roll over” into new KPI options.

The uTVL campaign was successful in creating an incredibly tight-knit community working for UMA adoption. The community success prompted UMA to launch a new KPI Options program for Q3, 2021: the uDAO campaign with DAO integrations as the KPI.

Q3 2021 KPI Options campaign – uDAO

This was brought into effect on the 1st of July with its expiry on the 30th of September and payout based on the number of DAO integrations UMA achieves.

Integration would require the DAO to fund with tokens one of the following three products:

- KPI options

- Call/Put options

- Range bonds

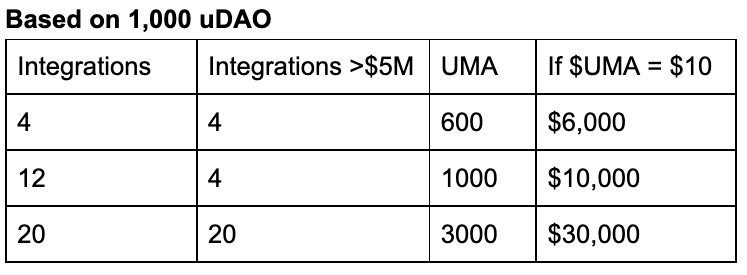

The aforementioned products being the strategic focus of the SuperUMAns for the quarter were selected. The tokens were set to pay out 50 $UMA tokens per integration, per 1000 uDAO. Any integration funded in excess of 5 million USD worth of tokens, uDAO was to pay out an additional 100 $UMA tokens.

Example (from UMA medium) –

The maximum value of each uDAO token would have been 3 $UMA in the event of 20 integrations worth more than $5M.

The uDAO campaign ended on Sept 30 with each uDAO worth 0.35 $UMA token.

Conclusion

KPI option is not just a synthetic token but a tool for DAOs and organizations to align their communities towards specific metrics where everyone is a stakeholder. It has the power to mobilize the community towards predefined goals and increase the chances of success of meeting those metrics. The ease and simplicity around these options should see more projects looking to implement KPI options in the future.

Socials

-

original and insightful descriptions to win 5X-10X more Coins!