NFT Investment Tip

Please note below content is from an NFT investor’s point of view (as opposed to that of a collector).

Having gone through the frenzy of ICOs a few years ago, DeFi yield farming and now NFTs, even relatively early entrants like myself are having a hard time catching up with rapid transitions within the crypto space.

Lately, I’ve spent quite some time on NFTs and wanted to share some thoughts on what could maximize probabilities for a profitable investment in this category.

In short, the below in my opinion is a shortcut for minimum failures.

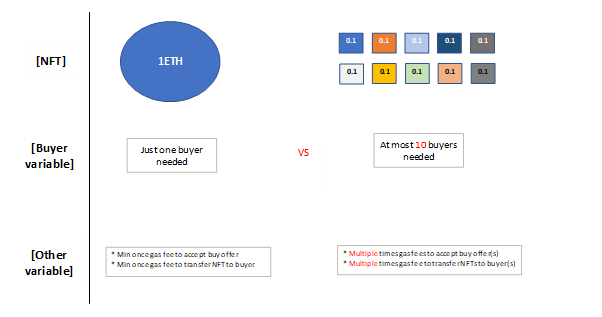

“Buy the higher price single NFT (vs multiple NFT pieces if both are under same budget)”.

For example, if an NFT you would like to buy is currently priced at 1ETH while there are also 10 other ones each priced at 0.1ETH, in most cases the likelihood of recouping your initial investment is higher with the former. Many will be tempted to go for the latter (0.1*10=1) especially if the project plans to implement or has announced potential upgrade features for the NFTs you hold. However, the latter is a simple bet (or prayer) for one of the cheap ones to at least deliver several multiplier gains. If the project reveals the probabilities of the cheaper ones turning into a so called “rare” one, you will be able to calculate and come up with a more rational decision. Nevertheless, this is rarely the case and the logic behind will more likely be skewed to increase probabilities of upgrade for the more expensive one to begin with.

Now let’s assume somehow the single piece NFT’s price and the sum of 10 other individual NFTs were identical (so you were indeed lucky with the bet or prayer). If not already lucky enough, you now have additional variables (or obstacles). phentermine online india https://jccdallas.org/ First is to find a buyer so you can reap the profit. With the single NFT, you only need to find one. With the others, you might have to find at most 10 different buyers to reap the profit. In addition, come the fees upon the sale of NFTs. Taking Opensea as an example, a single NFT sell will require gas fees to accept the buy offer and to transfer the NFT to the buyer. With multiple NFTs, these gas fee payouts will occur several times (unless it is sold to a single buyer in a bundle). Under this case, it is very likely the fees tied to the single NFT will be lower than that with multiple NFTs (unless gas fees were dramatically lower during the latter’s case).

We’ve often heard “don’t put your all your eggs in one basket”. Nevertheless, for NFTs of an identical project, the above may not be the best strategy.

Having said this, a “good” NFT project will always implement features to entice holders or potential holders in contemplating between the higher price single NFT vs latter (I have a few names in my mind but will refrain from mentioning it in this piece).

Thus far my opinion was based on an investment choice within one project. As for decision making amongst different ones, other factors such as total supply, mint price, difference between floor and ceiling price, holder distribution ratio and others.