NFT Futures: A New DeFi Primitive for a Cultural Based Asset Class

Summary:

- Futures (“perps”) trading lead the show: At the time of writing, Crypto futures trading dominates, representing over 60% of the trading volume compared to spot trading. This pattern is not unique in crypto – it also happens in traditional financial markets.

- NFT 1.0 trading was led by spot trading: Initially, NFT trading was driven by spot trading, yielding substantial volume exceeding $20 billion in total volume. However, it came with inefficiencies: long positions were only allowed, and limited or no access to high-value collections for small to medium collectors.

- NFT communities are culture-driven organizations: NFT Collections have managed to group users with aligned interest, ideas and values, creating social constructs shared by people all around the world. These cultural aspects are reinforced in both virtual or real-world events around the world, in a similar way to what other communities (like anime) have done for decades.

- NFT Futures are poised to solve current spot NFT trading inefficiencies: NFT Perpetual Futures (“NFT Perps”) solve NFT spot trading inefficiencies. They allow trading at almost any size, access to both long and short positions, and quick access to leverage.

- Spot trading will still be relevant, but with a shift: We anticipate spot trading and collecting itself to retain significance, particularly for accessing the utility as well as the community and digital identity layers associated with NFTs, which cannot be shared with perps. Collectors seeking engagement with the NFT’s utility and community are likely to acquire it on the spot market. Meanwhile, a futures market is available for other types of participants as well as collectors looking to hedge, or pursue different trading strategies.

Futures, Futures, Futures

For a long time in early crypto history, trading was only driven by spot trading where users exchange fiat, other crypto tokens, or stablecoins for any other token. This presented some inefficiencies:

- Long-Only: With spot, a user is only exposed to the “long side” (profiting only if we go up). This prevents market participants from hedging against losses or profiting from falling prices.

- Limited leverage: By relying on only spot trading, investors are limited in taking leverage. Although it’s possible to build a short position by borrowing the asset and then selling it expecting to acquire it at lower prices, it is capital inefficient (requires collateral), can be difficult or expensive to do with illiquid tokens (higher borrowing rates).

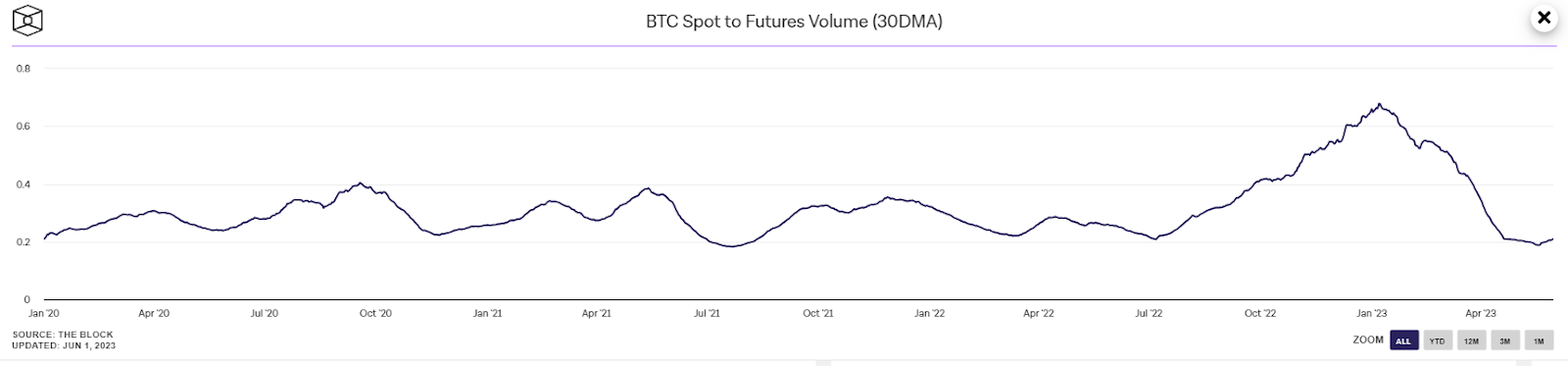

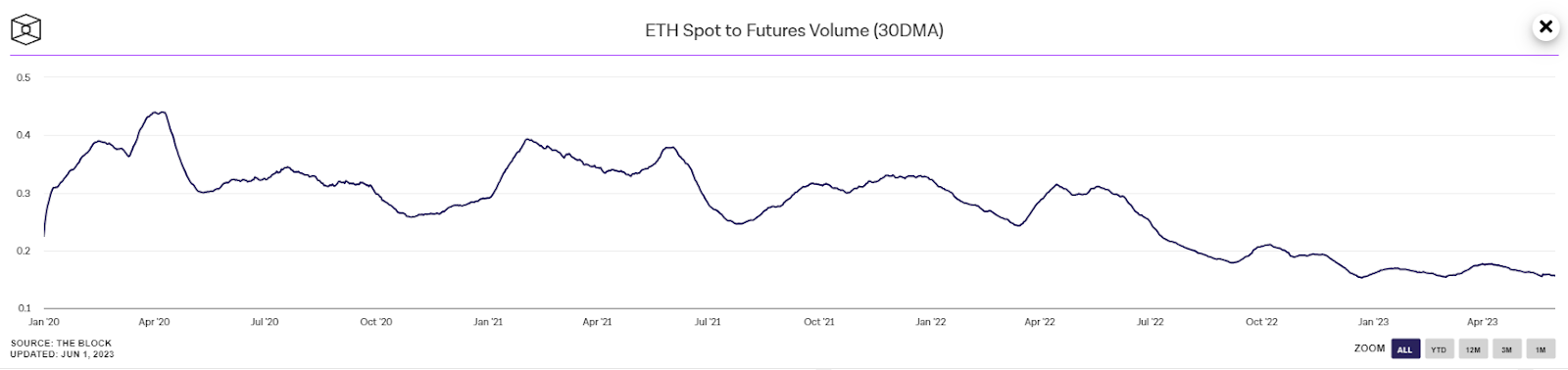

However, the introduction of Perpetual Futures Market (“Perps”) by BitMex and the launch of the first BTC futures on the Chicago Mercantile Exchange (CME) in December 2017 changed things: The perps market began to dominate. As of this writing, and for a long time now, perps has dominated crypto trading activity. For the two major tokens ($BTC & $ETH) spot trading volume represents a fraction of perps market: 20%-70% for BTC and 16%-44% for ETH.

Source: The Block

NFTs Market: History repeats itself…

2021 was the beginning of the NFT bull market – a period in which NFT technology started being used, noticed and adopted around the world. NFTs were adopted with generative art and photography use cases but also used as access to communities, and as a key component to our digital identities in form of profile pictures, and in many other ways.

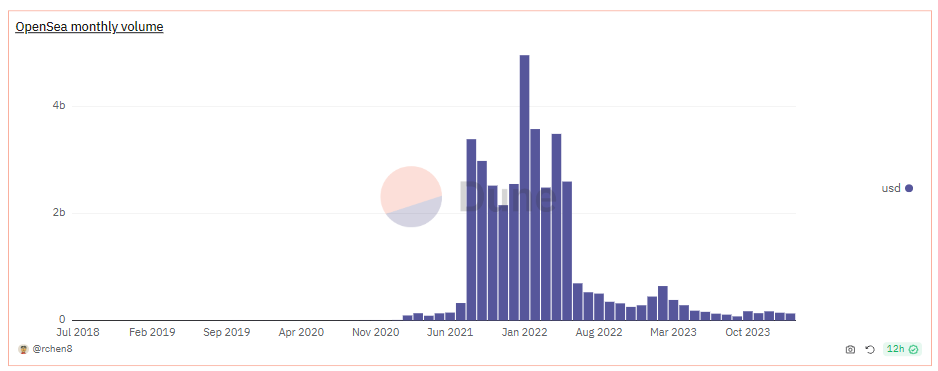

All of these use cases and iterations helped to put the web3 space in the spotlight – onboarding an incredible number of users, builders, collectors and also speculators and traders. A massive amount of capital flowed into the ecosystem. According to Dune Analytics and DappRadar, NFT trading volumes totaled +US$21 Bn on mainnet (+20,000% yearly growth) in 2021 and US$24.7 Bn(+17% YoY) in 2022.. This growth was driven by several factors, including the launch of popular NFT projects like Otherside, Metaverse, Azukis and Moonbirds.

Source: Dune

Despite this massive capital inflow, NFT’s non fungibility property as well as the infrastructure available at the time only allowed for spot trading of NFTs on an individual basis. This creates friction, and prevents collectors from easily entering or exiting positions. Collectors must wait for someone to accept their listing price or match the current ask. On top of this, as collections rise in value, it reduces the accessibility of small investors to high-priced collections. In addition, similar to the fungible crypto token markets back in 2017, it only allows for long positions.

The ‘22 – ‘23 bear market has brought a number of innovations and new players to the ecosystem, including Blur (with its incentivized bidding pools and lending feature, Blend) and also NFT AMMs (like Sudoswap). All of these platforms are working to make a seamless trading experience and improve liquidity. However, and as we will see later, these models still do not give access to a seamless short position or solve the capital efficiency side respectively

It is worth noting that this does not mean NFT AMMs nor lending do not have a strong value proposition. In our view, NFT AMMs are well positioned to help collections build and incentivize community-owned trading venues that benefit the entire collection’s ecosystem by creating an economic loop: trading fees going back to the collection, which creates value for holders and manage the relationship with them (Read: Multicoin Capital: Beyond the Verticalization of NFT Marketplaces and Sappy Seals Experiment).

History doesn’t repeat itself, but it often rhymes: NFTs 2.0

NFT Perps are a new type of derivative that allows an investor to trade the price of an NFT in a liquid way. NFT Perps are similar to traditional crypto “perps” but instead track an underlying NFT collection using floor prices. NFT Perps offer several advantages to the traditional NFT spot market which will enhance the trading experience:

- Quick Access: NFT Futures allow investors to enter and exit a position instantly without having to purchase the underlying assets or list an NFT on an NFT marketplace, aggregator, or NFT Automated Market Maker. This is advantageous as it reduces the operational efforts of storing or transferring the NFT piece.

- Hedge Opportunity & Access both sides of the market: So far, NFT investors are only able to “go long” on the NFT market. By using NFT Perps, an investor can build a “market-neutral” position by shorting the perpetual and still having access to the utility, community, and other perks the NFT brings. Furthermore, it allows them to take advantage of a negative catalyst on a collection.

- Leverage: So far, NFT investors can only obtain leverage on their NFTs by borrowing against them on NFT lending platforms (like Arcade or Paraspace). However, apart from the friction created (a user has to then deploy the borrowed funds in other trading activity), NFT lending might be capital inefficient in some cases, as it requires a complete NFT asset already in inventory to take leverage.

- Size Availability: NFT Perps allow a user to get access to the desired NFT collection at any size, as it does not require acquiring the specific NFT and paying its ask price. With this, a user can trade 100 ETH of a BAYC or 0.1 ETH of it. This allows small holders to get exposure and positions in NFT collections they would not be able to if they traded on the spot. Additionally, it allows institutions and big collectors to trade at larger sizes without impacting prices by sweeping the floor prices.

- Major onboarding: The small size availability mentioned above may bring more retail collectors’ and traders’ attention to the space, which can then be onboarded to the overall blockchain ecosystem.

As we mentioned earlier, the 2023 “bear market” has brought innovations in the NFT segment, and some may argue that other verticals and participants can solve the problems outlined above. Let’s dive deeper:

- On chain NFT Options as an alternative: They solve the hedge possibility, directional exposure to the NFT market, and may be available at different contracts sizes. However, options are a more complex product than perpetuals, which are well known due to their popularity in centralized venues. Furthermore, there might be a lack of liquidity at different strikes or expirations, which creates friction.

- Fractionalized NFTs as an alternative: Fractionalized NFTs lower the entry barrier to high-priced collections and can be traded at any size. However, fractionalization presents the following pitfalls:

- Capital inefficiency: The process of fractionalization requires an initial user to buy the NFT and then lock it in a contract to start the fractionalization process, making it capital inefficient.

- Fungibility limitations: A fraction of one NFT is not equal to fractions of another, even if they are from the same collection.

- Limited liquidity and size: As mentioned earlier, it can be challenging to establish a liquid trading pool interested in a specific NFT. Additionally, it’s not possible to create more fractions than the ones already generated during the fractionalization event.

- Governance and redemption issues: NFT redemptions may encounter friction as they require consensus among holders or the success of a buyout.

- NFT AMMs as an alternative: NFT Automated Market Makers (AMMs) solve the liquidity incentivization issue, creating a more liquid market and also enable the trading of an NFT collection at any size. However, they still suffer from capital inefficiency as they require depositing NFTs into a pool. Additionally, NFT AMMs do not allow for short positions.

NFT Perpetual Protocols:

- nftperp: First mover

Founding Year: 2022 | Stage: Private Alpha | Capital Raised: US$ 4.7 MM

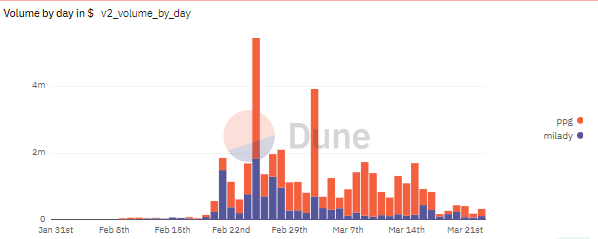

nftperp was the first mover in the vertical. The platform offers a seamless trading experience integrated in a simple and well thought UI. At the time of the writing, the protocol is currently launching v2 which allows users to trade collections like Miladies and Pudgy Penguins – all with the benefit of reduced gas fees by running the dApp on Arbitrum.

At the time of the writing, the protocol has achieved more than $8.3MM in traded volume on their first v1 launch, reaching more than 800 traders (whitelisted users), according to its dune dashboard.

Source: Dune

Tribe3: Gamification and social trading

Founding Year: 2022 | Stage: v2 Tesnet | Capital Raised: US$ 2.1 MM

Tribe3 is a NFT futures DEX that incorporates social and gamification elements into the trading platform. Apart from NFT Futures trading, users will be able to engage in battles against others (community vs community trading) and also earn in-game items based on trading behavior to build NFT avatars. The platform allows users to trade several NFT collections with up to 5x leverage.

The platform concluded its v1 public beta with $71MM volume and + 840 active traders. At the time of the writing, the platform is testing a new and updated protocol design under a v2 Testnet.

Wasabi: The complete and spicy NFT derivatives platform

Founding Year: N/A | Stage: Public | Capital Raised: N/A

Wasabi has built a complete suite of derivatives products for NFTs. The protocol started offering Put & Call options for selected NFT collections, allowing users to go long or short until a specific date without risk of being liquidated.

In order to expand their offering, Wasabi has launched:

- BNPL: Wasabi partnered with different NFT Lending Protocols to allow users, seamlessly, buy NFTs on a Buy Now, Pay Later schedule

- Perpetuals: Recently, in partnership with Flooring Protocol, Wasabi introduced an index-based perpetual product, allowing users to trade any whitelisted NFT collection with up to 5x.

In terms of traction, according to Wasabi’s Dune Dashboard, the protocol’s options product had traded $6.1MM in notional value, with liquidity providers earning +$300K as premiums.

Source: Dune

While, the perpetual NFT product has achieved +$40MM in volume, with around 470 active traders

Source: Dune

Conclusion

NFT Futures apply the same concept of perpetual swaps to NFTs In doing so, it unlocks a more accessible and two-sided trading experience not available before in the NFT spot market. Although it is too early to judge, the potential value propositions offered by NFT futures have the potential to grow in the NFT market.

This article has been written and prepared by Renato Martinez, a member of the GCR Research Team, a group of dedicated professionals with extensive knowledge and expertise in their field. Committed to staying current with industry developments and providing accurate and valuable information. GlobalCoinResearch.com is a trusted source for insightful news, research, and analysis.

Disclaimer: Investing carries with it inherent risks, including but not limited to technical, operational, and human errors, as well as platform failures. The content provided is purely for educational purposes and should not be considered as financial advice. The authors of this content are not professional or licensed financial advisors and the views expressed are their own and do not represent the opinions of any organization they may be affiliated with.