The Solana Ecosystem

This piece was originally published on Decentralised.co. We at GCR will bring to you long forms from Decentralised twice every Month – every alternate Thursday! Decentralised.co is trusted by management at over 200 firms to stay updated on the trends, data and insights that matter. Sign up for their newsletter below—more on this collaboration for our most active members on Discord.

We started the year with a note on belonging. I felt inspired to write about this because of our work on two protocols, one of which today’s issue covers extensively. In mid-to-late 2022, Solana was the industry’s darling due to its figureheads. SBF’s overarching influence on its ecosystem could not be understated. But in the following months, as FTX collapsed, so did the Solana ecosystem.

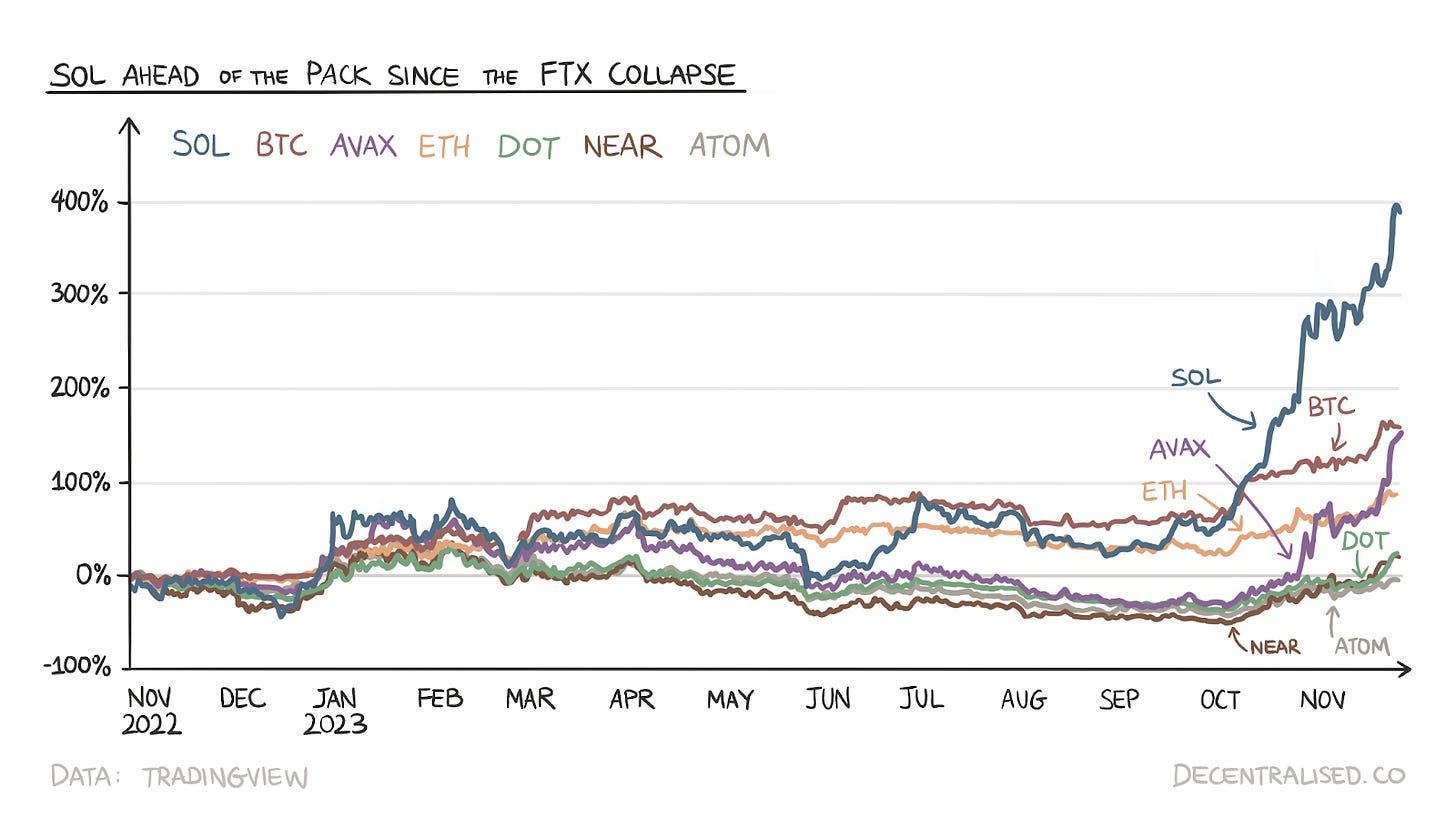

The token’s price tanked from $236 to $13 in a few weeks. VCs often advised start-ups to continue building on EVM chains instead of Solana because it was unlikely the ecosystem would flourish again. A few marquee projects moved from Solana to other chains. And yet, a year later, Solana has rallied considerably ahead of its peers, as the chart below shows. Everybody likes a good comeback story.

Today’s issue explores the choices that helped Solana recover from the depths of the bear market last year and the design differences that make it an interesting protocol to build upon.

You may wonder why we used a price chart here. We think the price (of an asset) carries much information. Even if you believe the efficient market hypothesis is a meme and not everything gets priced immediately, market participants’ opinions of events are baked into the price. When one asset significantly outperforms the rest, it warrants attention. This is especially true in an industry like crypto, where assets are highly correlated. An asset breaking that correlation and significantly outperforming similar assets is noteworthy.

Across podcasts and articles, Solana has consistent messaging – create fair markets at the core information level. This means creating better or more democratic access to prices and market information, which is gated or, in some respects, lagging today. When you see prices of assets on exchanges like NYSE or NSE using regular broking services, sophisticated participants see the info slightly before you.

When you route your buy/sell orders through your brokers, your execution is slightly worse off than those with access to better infrastructure or even proximity to the exchange servers. What happens when you distribute exchange servers across the world? Proximity advantage goes away. Solana aims to become the perfect state machine everyone can rely on to access correct information.

We will follow a bottom-up approach. That is, we start with the validator clients, understand the latent culture, build up to the application and observe the broad arc of what Solana could do. Where possible, we have linked sources to the data used.

Sidenote: Flash Boys by Michael Lewis is a good read to understand how frontrunning in traditional markets works.

Client Diversity

Anatoly and others at Solana have backgrounds in the mobile industry. Over a decade at Qualcomm, they had to write code that keeps up with continuously upgrading hardware. They’ve witnessed Moore’s law (hardware capacity doubles every two years) first-hand. Their approach to building Solana is similar. Unlike Bitcoin and Ethereum, Solana does not put a cap on hardware requirements for running nodes.

One of the goals of Ethereum and Bitcoin is for the maximum number of people to be able to verify transactions on their nodes. Solana, on the other hand, says it is okay to use higher-end hardware if the software justifies it. This means that a large number of people can often run ETH or BTC nodes. However, for Solana, you need specialised hardware which is often not as accessible.

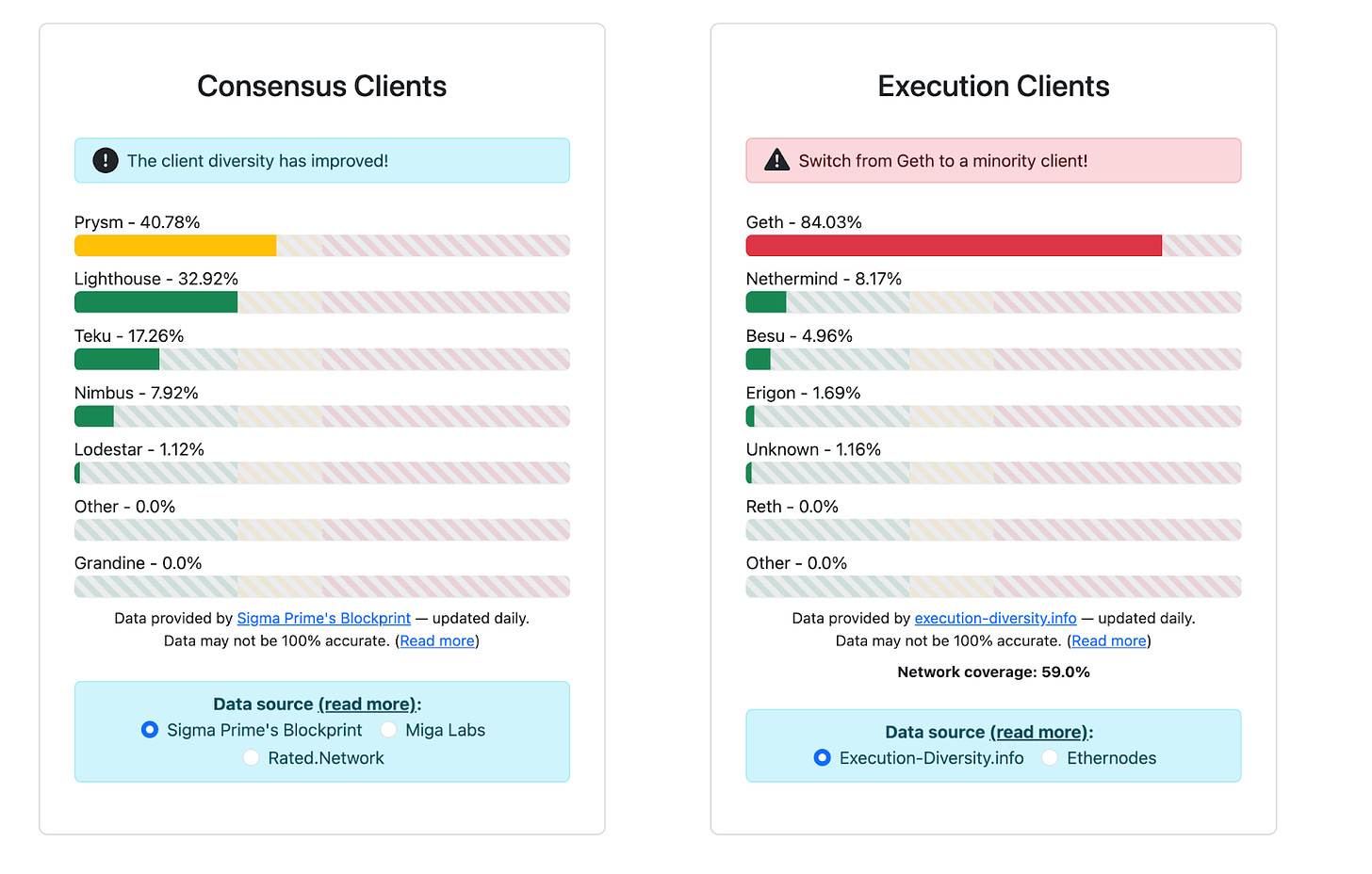

Solana uses multi-threaded execution, whereas Ethereum doesn’t (more on this later). But this approach comes with its drawbacks. Software bugs can lead to liveness failures. The probability of such bugs trend to zero when the clients are diverse. Though Ethereum is almost guaranteed to have a 100% uptime, Solana isn’t. A huge part of fixing this challenge boils down to fixing the clients used by Solana’s validators.

Note: Packy McCormick from Not Boring covered Solana’s early history extensively in this piece. So we won’t be repeating it all over again. We recommend reading it if you’d like added context on the early days of Solana.

Think of a client as a piece of software that allows a computer to function as a blockchain node, the blockchain equivalent of setting up a server to receive emails on a machine. Of course, the computer must satisfy hardware demands. Currently, Solana has two functional clients. Solana Labs built one and is responsible for over 68.5% of the network’s validators. Meanwhile, Jito-Solana is used to run the rest of the network.

Note that Jito-Solana is not an independent client. It is an extension of the Solana Labs’ client. The extension part allows validators to extract MEV on Solana. Firedancer and Sig are still in development. Jump Crypto is building Firedancer, the second independent client for Solana.

Bitcoin and Ethereum, being relatively mature networks, have far more client diversity. But why does client diversity even matter? Think of it like this. If you are a decentralised network, you want all aspects of your functions to be relatively decentralised. If over 66% of the network uses a single node client and the node issues a faulty update or chooses to sync blocks in the wrong order, it affects the functioning of the blockchain. There could be consensus issues on which block was approved first. Both Ethereum and Bitcoin have actively optimised for client diversity in the past.

Source – Link

Solana had three major network outages, along with several instances of degraded performances in 2022 and one outage in 2023. As Jump outlines in this article, Solana network downtime largely results from consensus issues. Low transaction fees are good for users. However, a byproduct is that flooding the network with transactions or conducting a denial of service (DDoS) attack is cheaper.

A chain that should have a thriving DeFi ecosystem needs 100% uptime, and the importance of a robust client infrastructure cannot be understated for Solana.

Historically, two leading causes for Solana network stalling have been the lack of congestion control and network processing delays. Several network upgrades have improved the validators’ robustness against transaction floods, leading to better congestion control. Solana has a 400ms block time.

When a block gets proposed, validators receive packets of information (in the block), independently verify it, acknowledge correctness with each other, and reach a consensus. However, the consensus messages get lost when a validator lags on packet processing.

As I understand it, these messages have a supply chain: origin – hubs – destination. Firedancer has created a messaging framework that bypasses certain hubs, reducing the latency of the network. Because Firedancer was built from scratch by a different team, it will probably not carry the same bugs as the Solana Labs client. Consequently, the same bug will not affect these clients simultaneously. Ideally, validators will run a primary and secondary client, with the secondary acting as a failsafe.

By Solana’s admission, client diversity is a work in progress that they have been gradually improving upon. Like Ethereum and Bitcoin in the past, these things take time. One sign of improvement is the percentage of stake that runs through the Jito-Solana client. Although the Jito Solana client doesn’t help in achieving redundancy, it is an indication that validators will run different clients when they are available.

As more clients like Firedancer and Sig come online, we should see reduced dependency on Solana Labs’ clients in the future. The optimal figure for individual clients is around 33%. So, there is still work to be done.

Source – Link

Fee Model

Healthy fee markets are among the most important factors for a thriving blockchain, as demonstrated in chains like Bitcoin and Ethereum. Bitcoin’s block reward is set to halve from 6.25 BTC to 3.125 BTC per block in 2024. Let’s assume Bitcoin miners need the same incentive. The price must double, or the fee revenue must compensate for the reward halving. Thanks to inscriptions, increased fees offer hope for miners and the Bitcoin security budget.

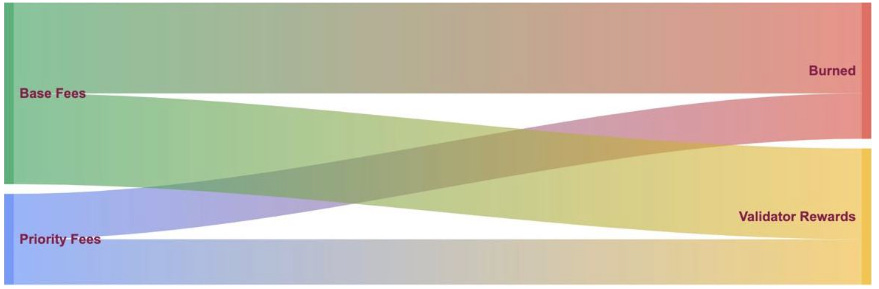

With EIP 1559, Ethereum changed its monetary policy by adding the burning mechanism, ensuring ETH inflation remained in control. With both chains, monetary systems and fee dynamics played a massive role in stabilising chains and aligning stakeholder incentives. The same goes for all other chains aspiring to the same status.

Ethereum has burned over 3.9 million ETH since EIP 1559 went live. This number is 87% more than the issuance during the time, which means that the overall supply of ETH decreased by ~1.8 million. In simpler terms, the supply of ETH began declining in that period, thanks to the amount of ETH burnt in fees.

When Solana started, there were no priority fees. Fees were fixed at 5000 Lamports per signature (per transaction). Lamport is gwei equivalent to Solana, 1 SOL = 10^9 Lamports. Solflare was the first wallet to implement priority fees on Solana in January 2023.

Fees are critical for three reasons:

- Spam resistance

- Validator compensation

- Improved economic stability for the protocol. As fees increase, inflation can be reduced.

Like Ethereum’s EIP 1559, Solana burns 50% of fees. The remaining 50% goes to validators. This standard was set in 2021 and has not changed since.

Source: Umbra Research

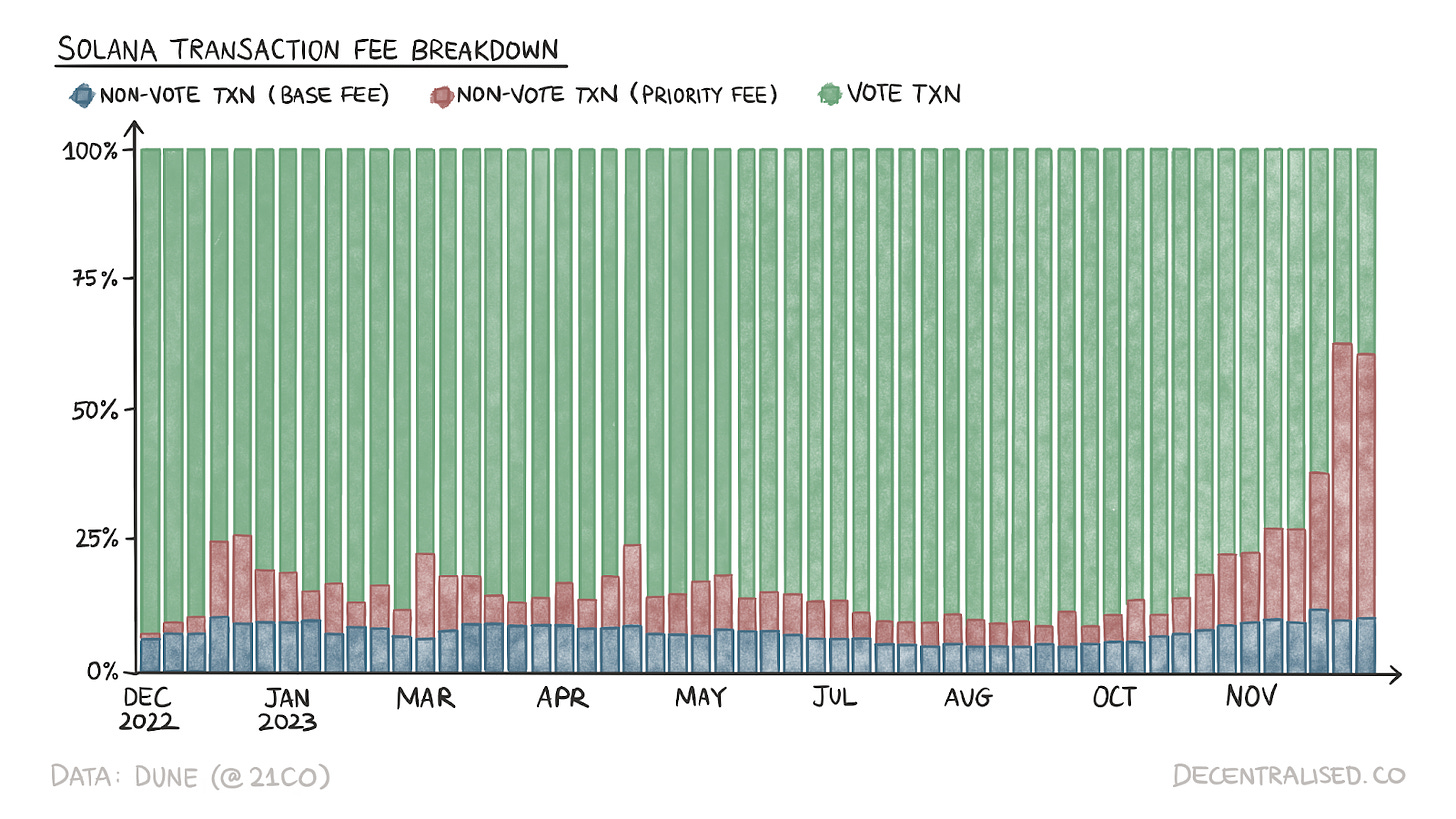

Solana has two types of transactions – voting and non-voting. Voting transactions are related to validators’ signatures for block verification, and non-voting transactions are user transactions. Voting transactions make up ~85% of the transactions. Naturally, fees earned from voting transactions roughly amount to the same number.

Source – Dune (@21Co)

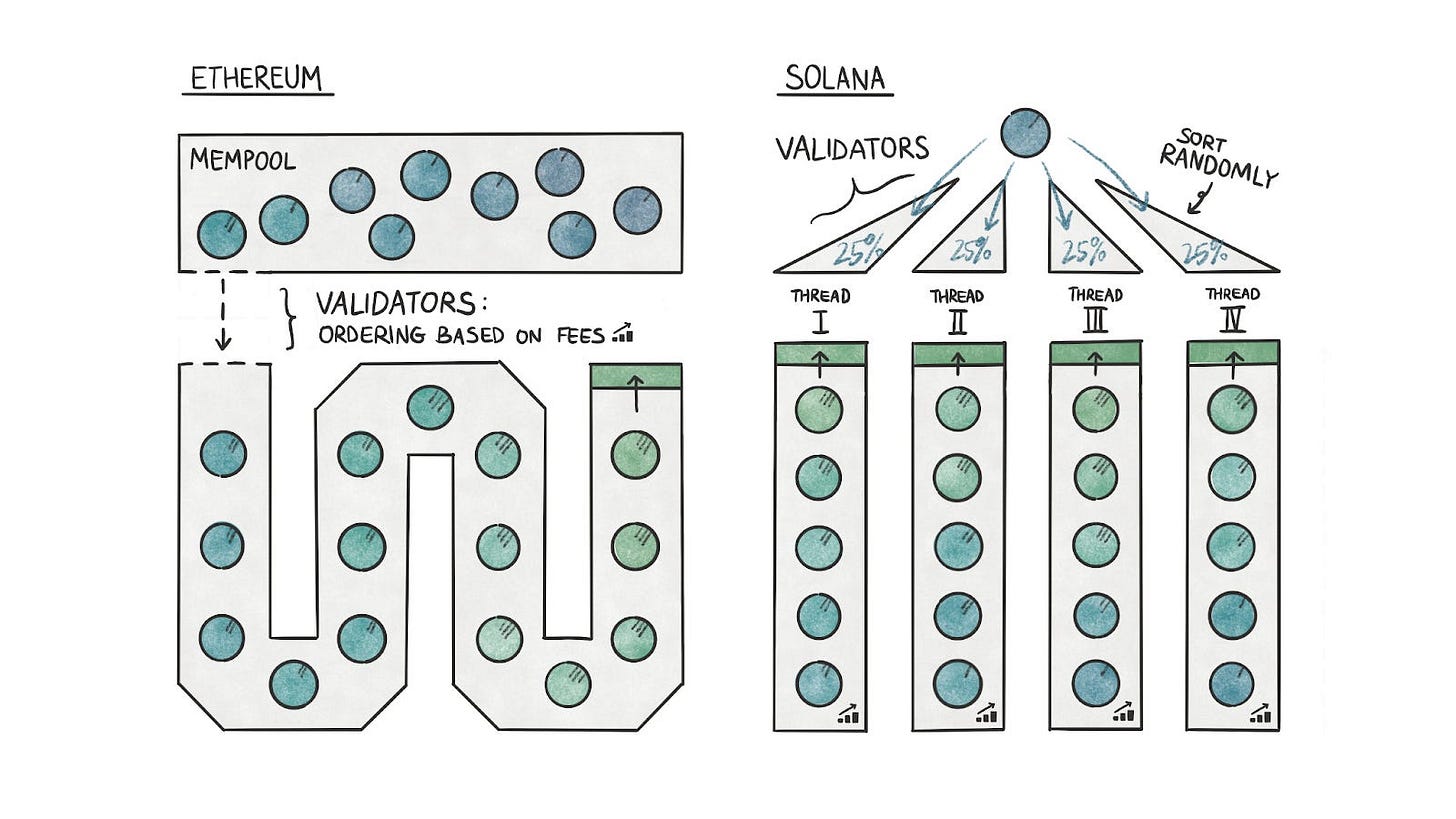

On Ethereum, transactions wait in a memory pool, a.k.a. mempool, before the validator picks the highest-fee-paying ones for the block. Global mempool is created by different validators gossiping about their individual mempools with each other. Here is where the maximum extractable value (MEV) is born.

As mempool is visible to validators and MEV searchers, the latter can identify transactions that can be frontrun and backrun for profit. Searchers are typically bots looking for MEV opportunities. For example, if someone buys a million dollars worth of Token A, a searcher can buy A before this transaction is completed and sell immediately after.

Unlike Ethereum, Solana is multi-threaded, executing transactions in parallel. When signed transactions reach the leader, it validates them and randomly assigns them to threads. Only when assigned to different threads local to the leader are they arranged by priority fees (i.e. transactions with the highest fees get in line first).

Until recently, Solana did not have priority fees. But now, wallets like Solflare allow users to pay priority fees. In fact, Solana transactions have to declare dependencies beforehand, and priority fees gave birth to Solana’s local or isolated fee markets. Unlike Ethereum, Solana transactions must indicate what part of the state they want to read from and write to.

States are a particular snapshot of the balances, smart contracts, and ordering of transactions on a blockchain. For every block, the network accounts for how certain transactions have affected the network balances. A state change, in simple terms, occurs when changes are made to the digital ledger of a blockchain.

The validators on Solana know which state the transaction touches before computation. Ethereum validators know this only after they begin computation. Among other things, Solana transactions need to specify the following:

- The program the transaction wants to interact with (account or smart contract like a DEX or a token contract)

- The accounts/addresses the transaction wants to read from or write to

- The actions the transaction intends to perform (swap, send tokens, etc.)

This information helps Solana identify which part of the state is turning into a hotspot. The total number of compute units (CU) used by any hotspot is capped at 25% (one out of the four cores used for Solana’s multi-threaded execution). This is done to prevent the number of times an account can be updated within a block.

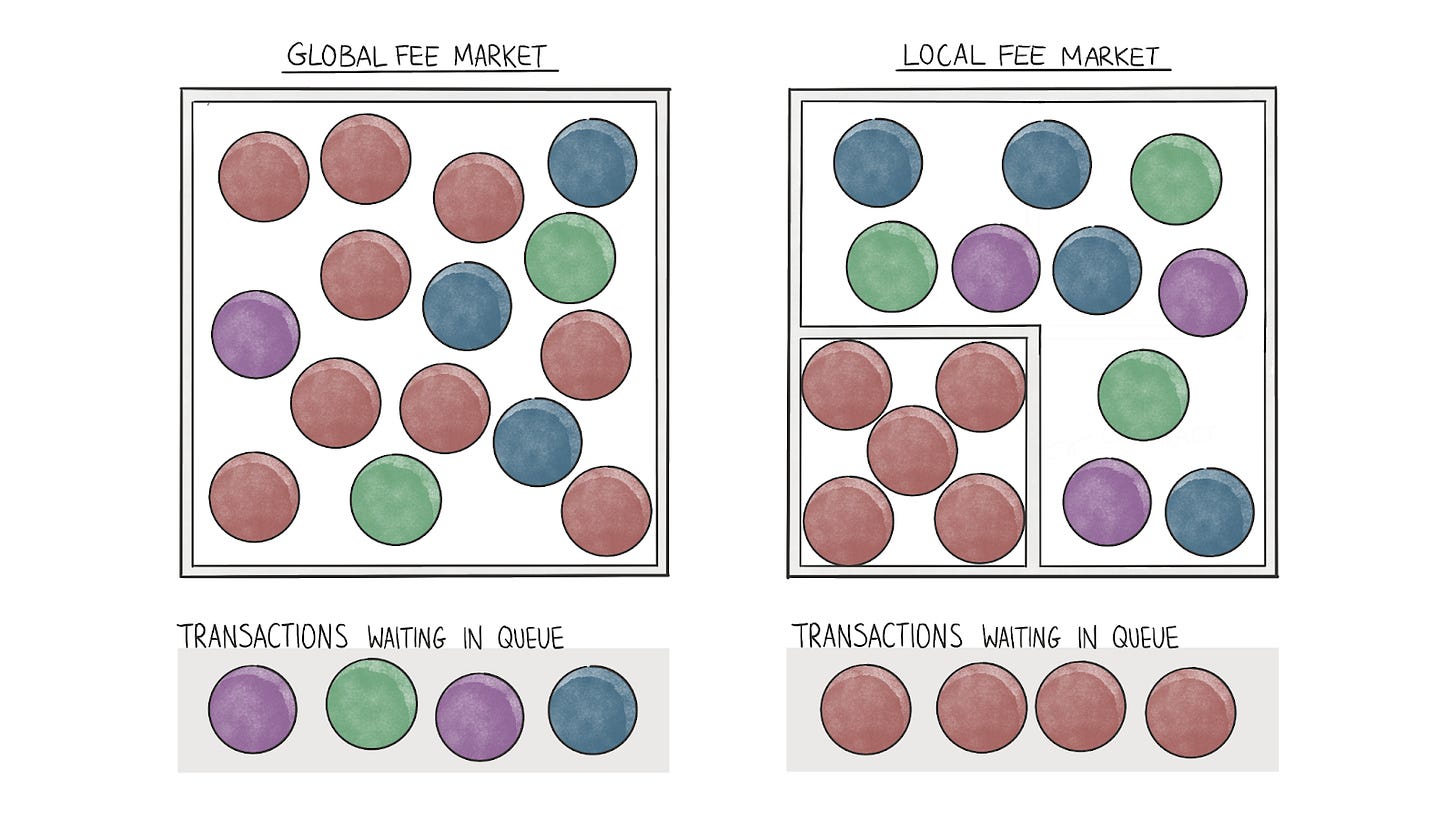

A hotspot is a particular smart contract or account that is seeing a huge influx of traffic all of a sudden. On EVM networks, a single application (like Crypto Kitties) seeing substantial demand can raise transaction fees for the whole network. On Solana, individual smart contracts/applications (like Tensor or Jupiter) have a 25% cap on CUs they can exhaust per block.

(Note: One caveat here is that the same program or smart contract can have multiple accounts underneath it. Hotspots are currently isolated to accounts).

That is, transactions using any specific contract cannot take up more than 25% of the block or 12 million CUs. All transactions beyond this limit have to wait for the next block. So if a standalone application sees a drastic surge in usage, the whole network does not begin to pay more in fees. Only transactions interacting with this application will see a surge in fees. This is what a localised fee market looks like.

What happens if there are 4 or more hotspots? My understanding is that, in that case, Solana looks like Ethereum. There will likely be gas wars between competing hotspots, and transactions with the highest fees will get in.

This is great. Local fee markets seem like an elegant solution to the general fee spike problem. How does it work in practice? Solana’s fee market design leaves a few things desired.

- First, the base fee that transactions incur is the same regardless of whether that transaction is a token transfer, a swap, or a flash loan, which shouldn’t be the case. Transactions should incur fees based on the consumed CUs, which is already being contemplated. CUs refer to blockspace, if you want more space, you should ideally pay more. Since blockspace is finite, getting into a block means someone else doesn’t.

- Second, since there’s no mempool and validators only arrange transactions by fees after they are allocated to different threads, higher-fee transactions may not always succeed. This causes issues that are explained in the next point.

- Third, because Solana doesn’t have a memory pool of transactions waiting in a queue to get into a block, the MEV capture differs from those on chains like Ethereum. Higher-priority fees don’t guarantee transactions get included in a block.

The only way to increase the probability of making it to the final few is to replicate the same transaction. When you have 100 of the same transactions, you increase your odds 100 times. Transactions on Solana are cheap (and also dynamic; i.e., fees are adjusted automatically), so spamming the network is easy.

Because hiking fees doesn’t guarantee a place in a block, the next best way for searchers (those searching for MEV) to extract MEV is to spam the network with multiple transactions and hope the validator picks one of them. Cheap transaction fees and the same base fee of 5000 Lamports per signature make this possible on Solana.

Let me explain how that happens. Say a potential arbitrage could happen on-chain. Multiple people will be vying to make that trade. Moreover, multiple people will replicate the same transaction many times. But only one of those transactions would go through at a certain price point. The other transactions are wasted, leading to a drain on the network’s throughput.

An example will help explain this even better. Say that SOLUSDC is $60 on Orca and $60.1 on OpenBook. Many arbitrageurs will want to sell on OpenBook and buy on Orca, but only one of these transactions will succeed; the rest are failed arbitrage. And because the validator cannot choose or order transactions before they are queued to a thread, it may pick N arbitrage transactions, while N–1 of them fail. Consequently, the validator’s time is wasted.

According to Jito Labs, in one of the epochs (each epoch is 432,000 slots or ~2 days), 58% of the compute was wasted due to failed arbitrage transactions. The problem here is processing replicated or identical transactions. Once you process one arbitrage transaction, you should not spend time processing similar arbitrage transactions because they will not meet the user requirements.

Okay, there are issues, but what’s being done to tackle them? Enter Jito, protocol aiming to democratise MEV on Solana. Jito has built a validator client that allows operators to capture MEV. Wait, is this a different client? Yes and no. It’s not built from scratch like Firedancer; rather, it is a fork of Solana Labs’ client with a few thousand lines of code that optimises for MEV.

Jito introduced bundles allowing sequential and atomic (all or nothing) transaction execution. When trying to tap into opportunities like liquidations or arbitrage, the transaction order matters, and often, you want it to be atomic. Think of atomic transactions as an instance of where B should happen only if A happens. For example, when I’m going to Dubai, I want to book my flights only if I get a hotel booking.

Transactions are sent to the leader as a stream on Solana. Subsequently, the Jito-Solana validator connects to a relayer and tells the network to send transactions to the relayer. The validator holds these transactions no longer than 200 ms. In that time, it deduplicates (removes identical transactions) and filters transactions to forward them to the block engine. For a sense of scale, 200 ms is roughly the time it takes to blink twice.

Source – Jito

The block engine finds the most profitable transactions for the network (typically the most profitable for the searcher, but also for the validator since searchers have to share a 5% tip with the validator) and creates bundles. These bundles are then auctioned off to the highest bidders. Moreover, this 200 ms delta gives searchers that much time to construct their bundles. Alternatively, they can bid on bundles created by the block engine.

A searcher is any operator looking for MEV opportunities on the network. This 200 ms time difference also means that the block engine and relayer create an approximately 200 ms rolling mempool. Although this stops continuous block production, it allows for efficient MEV extraction. Essentially, Jito’s validator client reduces blockspace filled with spam and more efficiently extracts MEV, acting as a filter.

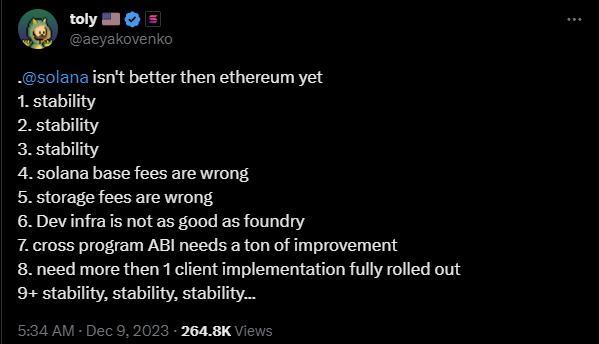

As the activity on Solana increased, so did the MEV opportunities. This gave rise to priority fees going to Jito’s clients to access the MEV. The percentage share of priority fees has increased since November, reaching over 50% during the week of December 11.

Recently, we witnessed an extreme example of Solana MEV capture. Someone tried to swap $8.6 million worth of SOL for $WIF in a low liquidity environment. The price jumped from $0.14 to $3.99. A trader, 2Fast, captured this arbitrage using Jito’s block engine, profiting $1.8 million and tipping $89k to validators in the process.

Vibes

Steve Balmer once said, ‘The key to .net success is developers, developers, developers, developers, developers, developers, developers, developers, developers.’

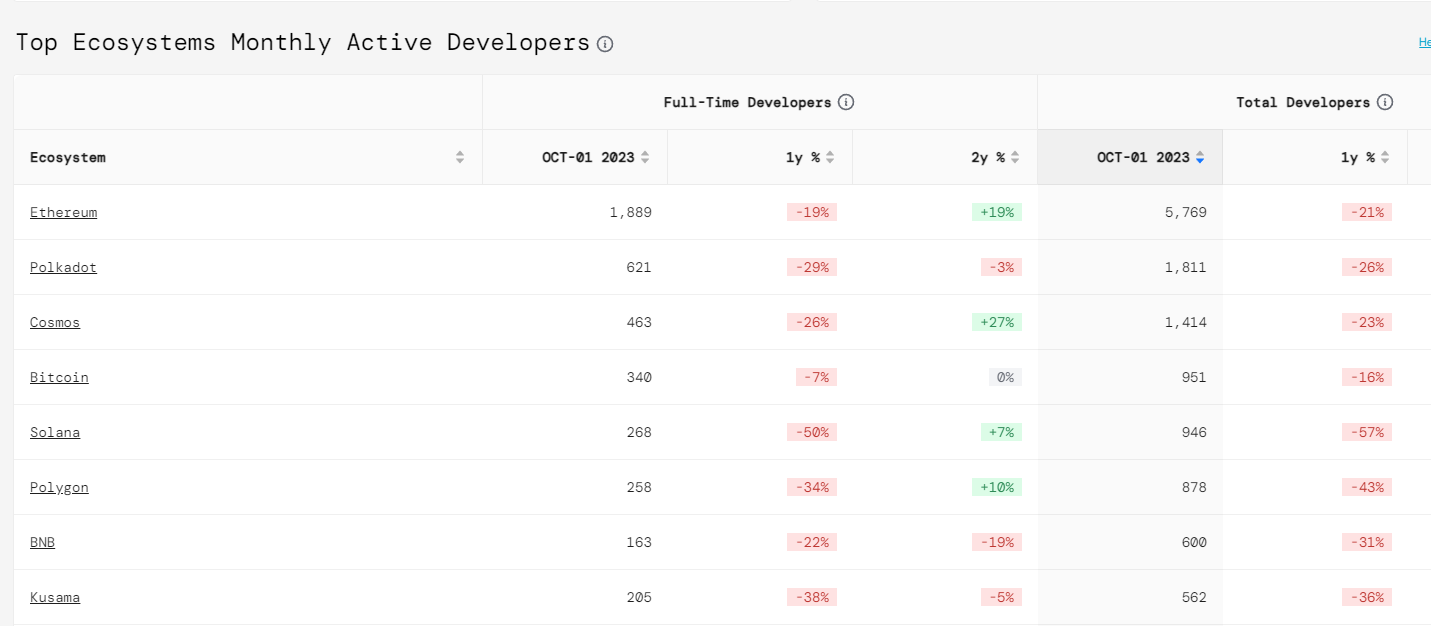

It may not sound like one of those profound statements plastered on a living room wall, but when building new ecosystems, that is the only meaningful metric. A strong network of developers builds applications, which in turn develops use cases that should eventually translate to real users. Whether mobile, desktop, cloud services or blockchains, developers are the pathway to relevance.

Keeping this in mind, I was curious about how many developers build in the Solana ecosystem. There’s one caveat here. Due to FTX’s downfall, much of the Solana ecosystem was initially obliterated. Packy’s 2022 piece ironically mentions SBF as among the strong-suite of characters that makes Solana interesting. When FTX collapsed, the ecosystem lost one of its biggest proponents. New tokens would no longer list, VCs would no longer invest and developer talent may have flocked elsewhere looking for resources.

According to recent data from Solana, approximately 3000 developers were building on Solana over the past year. Consider that this was when SOL had crashed down to $11. Given the recent run-up, more developers may switch to the ecosystem. The metric above considers developers contributing to public repositories but not those building in private repositories on GitHub. So, for what it’s worth, given the huge influx of users to Solana (due to the price rally), this figure may rise considerably.

Source – Link

One (very crude) way to benchmark this metric is by comparing it to Electric Capital’s Developer Report, which says there were over 19k developers in the blockchain ecosystem as of October 2023. If we consider 3k a generous estimate of developers building on Solana that month, the number represents 15% of the total ecosystem. Developers coming from the Web2 ecosystem rarely have a bag of tokens blurring how they think of building.

For them, Solana’s low-cost, high-speed transactions offer a better user experience than most EVM chains today. As the suite of tools around consumer onboarding evolves in Solana, an increasing flock of developers will be building on it.

To build an ecosystem to scale, make the people who build it rich. If developers no longer have to worry about the bills or raise money from VCs to explore niche territories, you will see a period of intellectual renaissance. People will go out, explore new avenues, and build without commercial considerations. This happened for the Ethereum ecosystem in 2017. As ETH rallied, many of the early developers in its ecosystem had newfound wealth. Users in the ecosystem were curious to try new applications, showing the limitations of settling everything on a mainnet.

On the one hand, developers saw how systems break as consumers flocked in. Conversely, these developers were now wealthy enough to explore alternative solutions. This situation birthed what we eventually came to know as the NFT, DeFi and L2 ecosystems.

Solana has undergone a similar transformation. Throughout 2023, part of what incentivised developers to stay in the ecosystem was access to funding and grants for their proof of work. Between the foundation, community hackathons and platforms like Superteam Earn, developers who were serious about building on Solana had avenues to find resources to sustain. For a sense of scale, teams have raised close to $600 million from hackathons in the ecosystem.

Ignoring the price of the underlying asset (SOL), which recently grew over ten times, the number of airdrops targeted specifically at developers will unlock a new crop of talent that can be built without immediate pressure to raise money.

In 2022, 5% of Bonk’s airdrop was allocated to developers. Another 20% was allocated to existing NFT projects within the ecosystem, and a further 10% went to artists and collectors. That 35% is worth $450 million today. I don’t mean to imply all recipients held on to their tokens. It has been a rough year, and people have bills to pay. Recipients likely sold it as soon as they received it. However, those developers who held on would have realised around $500k – or the equivalent of a pre-seed round – as Bonk rallied in December.

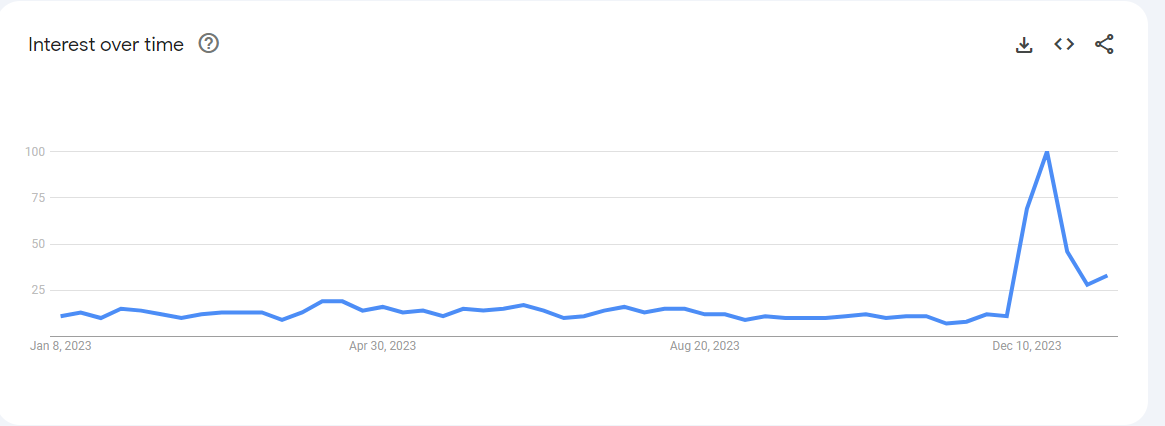

Google Trends search for Saga Phone

You can measurably verify how sentiment around Solana shifted thanks to Bonk by observing how Saga’s sales evolved in the recent past. The phone was famously dubbed the ‘worst phone of 2023’ by renowned tech reviewer (and guy whose channel I spend a lot of time watching) MKBHD. I don’t want to opine on the device itself, as it is beyond the scope of the article.

But here’s what happened in the recent past: Buyers of the device quickly realised that as Bonk’s price appreciated, the phone paid for itself. Owners of the device were entitled to an airdrop for Bonk: you purchased the device, claimed the airdrop, and had a free crypto-native phone.

Since limited devices were released, the phones resembled Bored Ape NFTs or similar collectables. As traders began realising this arbitrage and the possibility of collecting future airdrops, they rushed to place massive orders for the phone. The demand for the device peaked with Saga’s unboxed phones being sold for over $5000 on Solana.

Now, I don’t see this being a measure of how good the phone is or Solana’s marketing prowess. Internally, we believe unless a process can be repeated, most things are dumb luck. But this switch from the device barely being sold to being traded for over $5000 on eBay is a good measure of how sentiment around Solana’s ecosystem has changed.

Bonk was one instance of a meme asset. Other variations like WIF have since captured the public psyche. However, it is hard to claim that meme assets alone help ecosystems evolve. In our understanding, what has changed the mood is consumer appetite for using products in Solana, namely, receiving points and a potential airdrop. Two recent instances stand out: Pyth and Jito.

Pyth Network, a first-party oracle, made ~6% of the supply or 600 million tokens available to be claimed by different users. At ~$0.4 per token, this was $240 million worth of liquidity added to Solana. Pyth intends to use the token to govern the protocol. As such, it provides real-time data via over 400 feeds across more than 45 blockchains.

On December 7, 2023, Jito airdropped 10% of the supply to those who staked SOL in Jito’s validator client and used the liquid staking token (LST) JitoSOL for DeFi activity. Jito had already rolled out a points system where points were distributed based on the size of the stake, the duration, DeFi activity, etc. A total of 100 million tokens were distributed into three groups:

- Jito SOL users (80 million tokens)

- Jito-Solana validators (15 million tokens)

- Jito MEV searchers (5 million tokens).

The Jito Foundation team used anti-Sybil detection techniques to weed out ‘airdrop farmers’ and dropped 80 million tokens across 9852 addresses. These addresses were segregated into 10 tiers (Tier 1 had the lowest points, and Tier 10 had the highest) based on their points. The airdrop significantly favoured small users. Tier 1, users with the least number of points, received 4941 tokens. At the current price of $2.9, the airdrop is worth ~$15,000.

Interestingly, if we consider the lower bound of the tier, tier 1 received 49.41 JTO per point, whereas tier 10 received 0.01 JTO per point. So the lower the tier, the higher the value of the point.

Jupiter, a DEX on Solana, had disclosed airdrop allocation before Jito, but the claim process for the token will be live at the end of January. Although it was known that Jito would launch a token, its magnitude was underestimated, which is probably why the airdrop was not heavily farmed.

Now that all eyes are on Solana, everyone will try to farm the next JTO. Projects like Tensor, Kamino, Marginfi, Zeta, Meteora, Parcl, and others have announced their points programmes. Naturally, these points will later be converted to their respective tokens. Many on CT think these points programmes are not a good idea. However, a counterargument is that they can be viewed as loyalty points and a more transparent way to distribute the token. They unlock behaviours that add value to the product.

For example, Marginfi allots one point per dollar supplied every day but gives four points per dollar borrowed per day. This system makes sense because the protocol needs borrowers. Of course, detecting Sybil activity now becomes highly challenging, as everyone farms for points, but projects like Marginfi and Zeta have a means of detecting it. For example, if a wallet matches wash trading patterns on Zeta, its Z-score (points) is set to zero.

Now, from a cynical point of view, you could ask – what’s cool about all this? Surely, the ecosystem assets rallied, and a few developers built there. Some meme assets increased in price, and users are now Sybilling for airdrops. Why does any of this matter? I laid down these instances because they drive troves of users to ecosystems. In our understanding, ecosystem building consists of two counterbalancing forces. On one end, you need to be able to build culture and excitement. Meme assets, points and airdrops solve for it.

But on the other end, you need a crop of products built so well that it attracts curiosity and retains users. So, whilst I could go further on all of the degen aspects of Solana, let’s instead focus on what these developers have built over the past year.

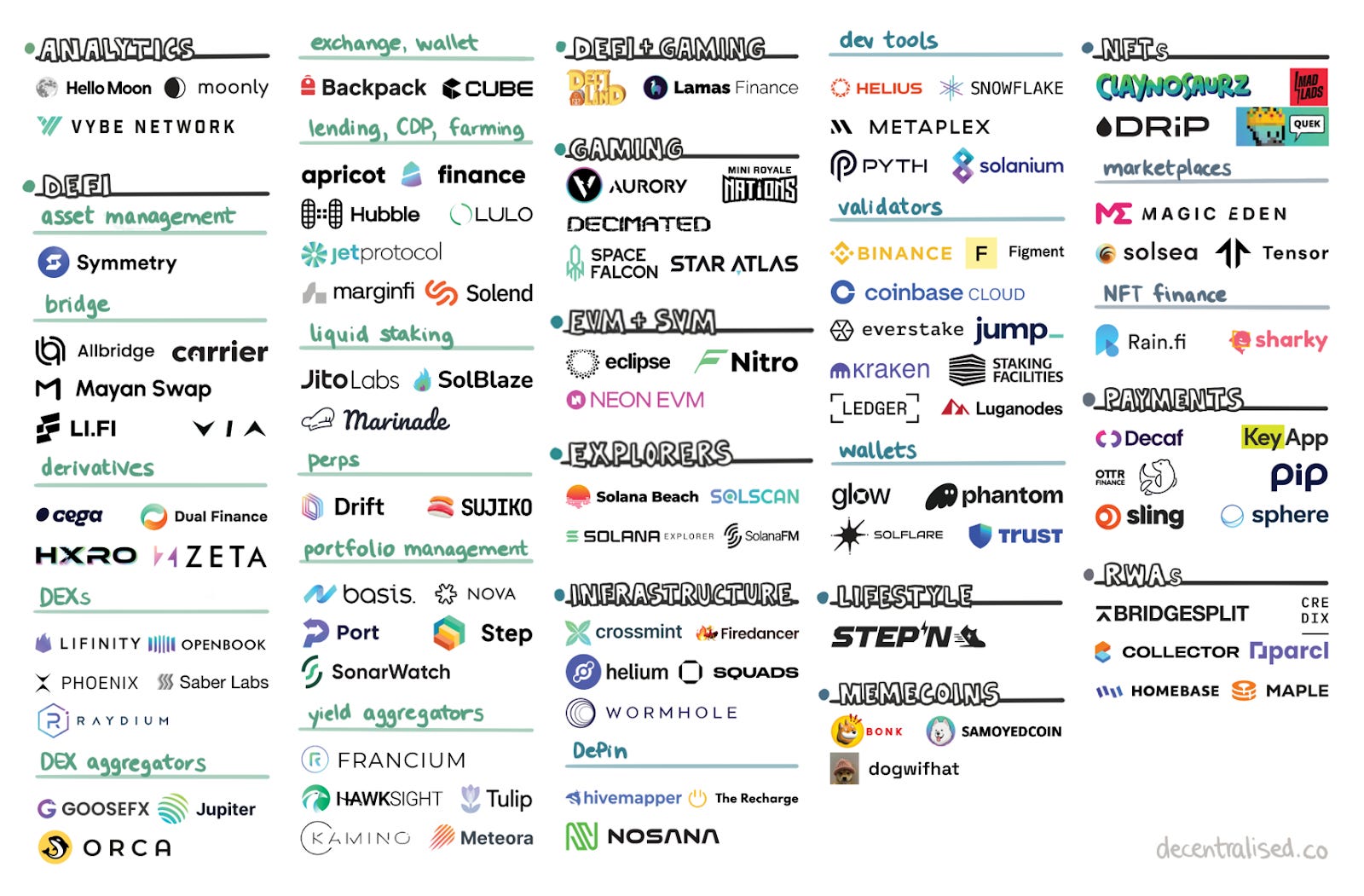

The Ecosystem

Products on the internet have always evolved in tandem with improvements in bandwidth. Text-based interfaces marked the early 2000s as people were on 56 Kbps modems. As 2 Mbps became the global standard, social networks rich with images became the norm. As 3G internet became ubiquitous (and affordable), we saw the rise of video and image-based social networks like TikTok (formerly Musical.ly). We can also see a variation of this with blockchains.

To me, Solana marks a point in time where the throughput and cost of transactions rise to a point where making consumer-grade applications becomes a possibility. For instance, consider that applications like Drip Haus have sent 18 million NFTs to over 800k wallets on Solana as of August 2023 at a fraction of the cost it would have taken on an EVM-compatible chain.

This reduction in transaction costs would eventually translate to developers bearing the transaction cost, much like we saw platforms bear the cost of servers in Web2.

(Yes, you can do account abstraction on EVM chains, but challenges with unit economics remain. Compressed NFTs on Solana allow developers to send a million NFTs for a few hundred dollars.)

As the ecosystem stands today, much of what exists in Solana is an extension of the broader crypto landscape. Think of it as ‘X, but cheaper and faster‘. And that makes sense when you consider that the bulk of crypto’s user base is here for volatility. Building a new suite of applications where you are going against the latent behaviour of users would require tremendous amounts of resources, a fight most seed-stage startups don’t want to pick.

But what excites me about Solana (and I hope others too) is the possibility of how it can change the internet landscape altogether. I’ll go into how that happens towards the end of the piece, but for now, let’s consider what’s currently going on with Solana.

Exchanges

Given Solana’s tangled relationship with FTX, much of the ecosystem in its early days was focused on DeFi. Mercurial started as a stable asset swap on Solana, like Curve on Ethereum. After the collapse of FTX, hackers (who some speculated were FTX insiders) stole tokens worth over $400 million from FTX.

Approximately $800k worth was MER, Mercurial’s governance token. This gave developers a pretext to break apart from Alameda Research. As part of the rebrand, Mercurial was abandoned, and two new protocols were born: Jupiter and Meteora. Meteora is the yield aggregator, whereas Jupiter is the DEX aggregator.

Typically, DEXs are of two types – AMM-based and order book-based. Both have advantages and disadvantages. AMM-based design allows for passive use of liquidity, whereas liquidity provision on order books needs to be more active. OpenBook and Phoenix are order book-based DEXs, while Orca (Whirlpools) and Saber use the AMM design. Meanwhile, Raydium operates with both AMM and order book design. Aggregators like Jupiter and Orca sit on top of this layer and find the optimum liquidity paths for users.

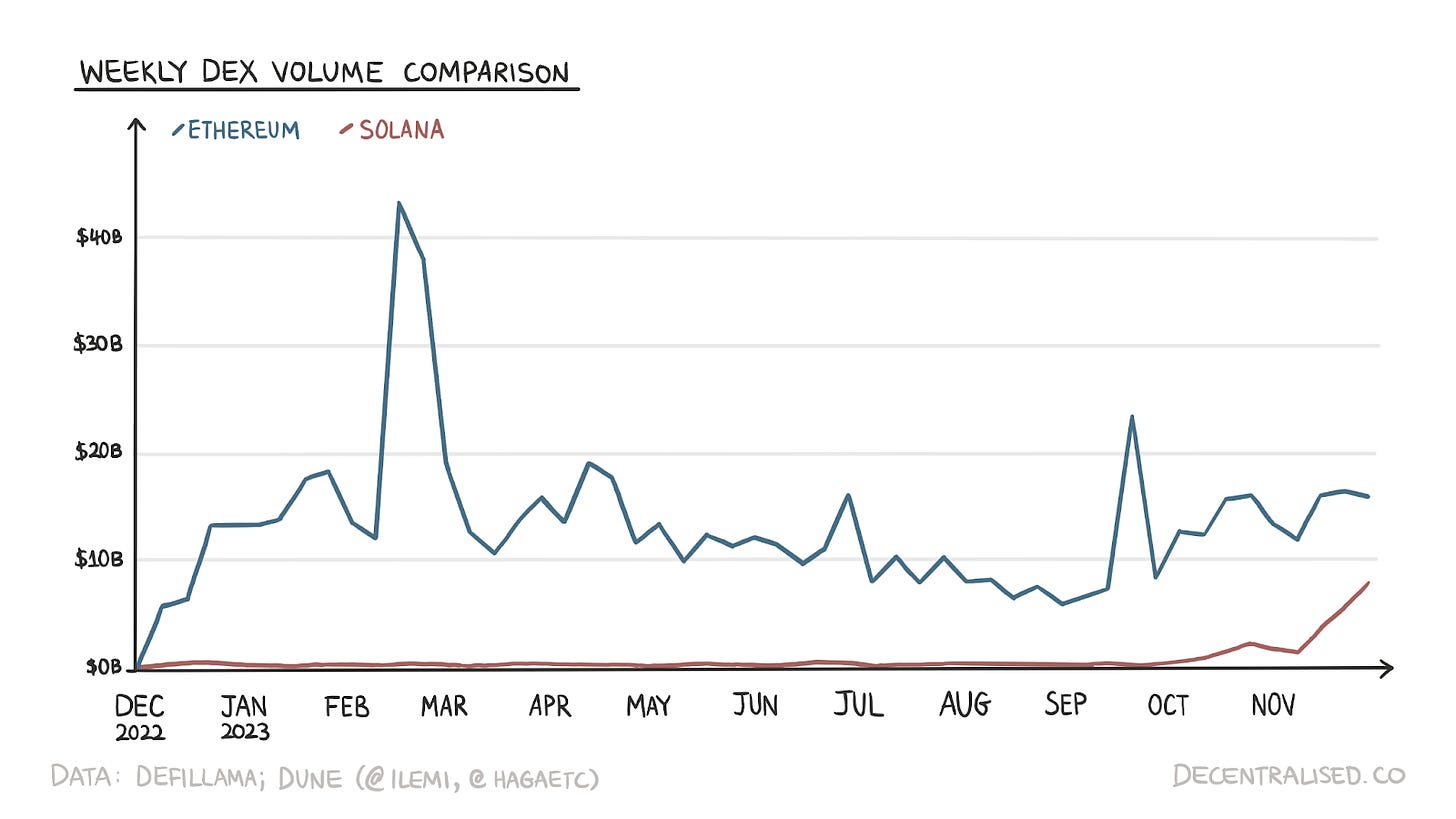

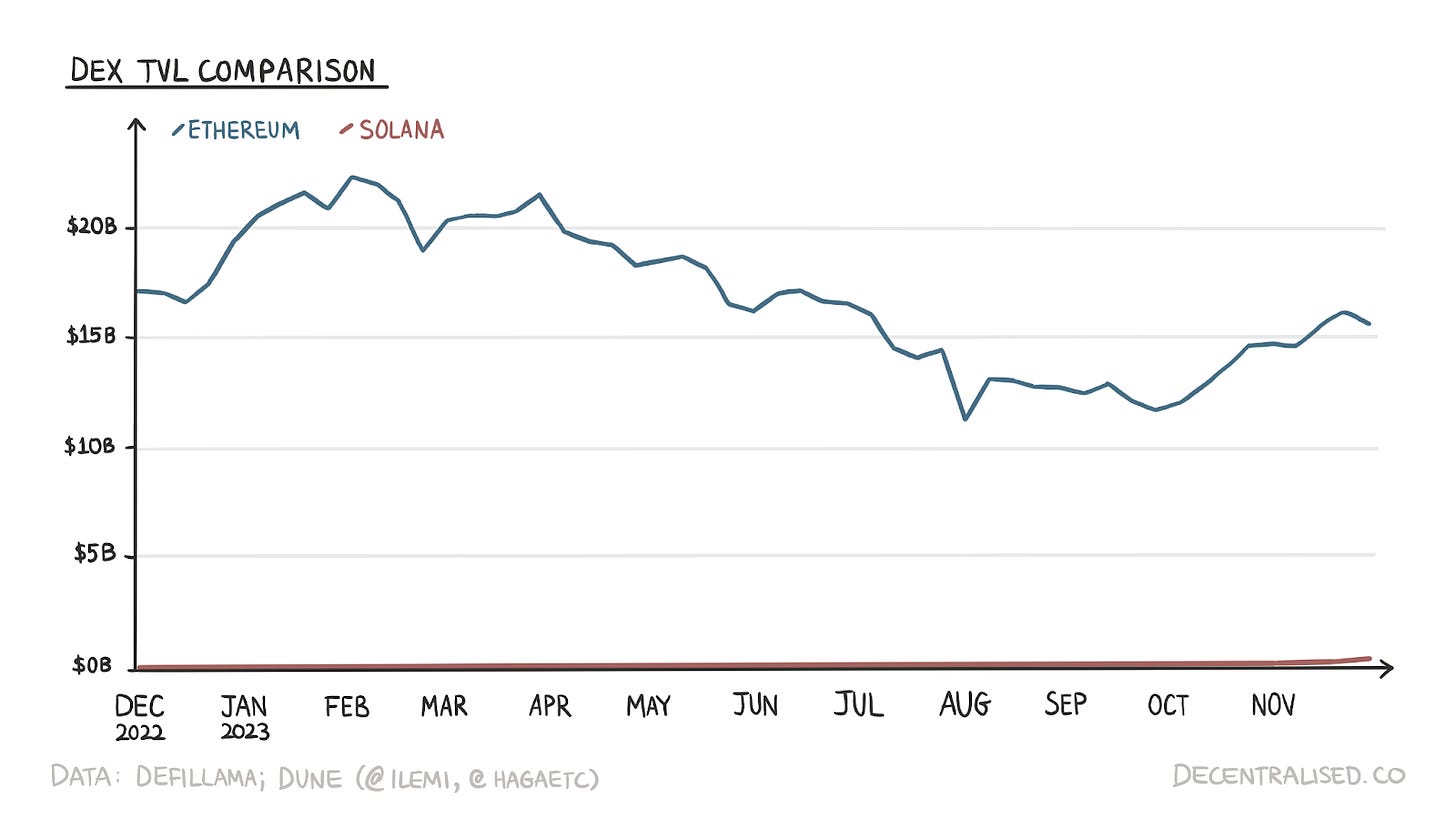

Solana’s low fees make it easier for users to trade with a higher frequency, which can be easily seen with numbers. Three charts tell a story of how trading differs on Ethereum versus Solana. In terms of both volume traded and value locked (TVL), Ethereum reveals superior metrics.

Note: Ethereum had a five-year head start combined with a healthy DeFi ecosystem where multiple underlying tokens are valued at billions of dollars. So, the metric below is a bit flawed. In looking at the charts, conclusions should be made by looking at all three charts and not individual ones.

However, the difference in TVL is significantly greater than in volumes on both chains. After a point, the TVL numbers do not matter as much. The higher the volume-to-TVL ratio, the better the capital efficiency. Solana has significantly outperformed Ethereum recently in this department.

The argument for the recent jump in volume is that users are making these transactions in hopes of getting airdrops. Jupiter announced the airdrop with 50% of the tokens reserved for the community in four different phases. The first phase will likely be live early in January 2024.

Although airdrops are likely fueling the activity on Solana, one must understand that certain designs are impossible on Ethereum. The order book design, for example, is not possible on the Ethereum base layer. Protocols, like dYdX and Aevo (formerly Ribbon), branched into their separate chains. dYdX is a Cosmos app chain and Aevo is a custom L2.

Solana is the only major chain that allows both passive and active liquidity providers. While AMM aggregators support hundreds of millions worth of volume, central-limit order book (CLOB) type exchange Phoenix is also contributing ~$50 million in daily volume. The combination of its speed and low fees means that market makers can make high-frequency transactions on-chain without resorting to centralised exchanges or waiting for performant and optimised second-layer solutions.

Screenshot from Birdeye.so – one of our favorite apps.

There is a different way to think of this. When a user has to spend $1 in transaction fees (to the chain) and, say, $0.05 to the platform (a Dex or AMM), it is unlikely that they would perform a transaction until they knew the $1.05 could be recouped in profits from the trade. It also restricts trading activity for smaller retail users that often trade sums ranging from $10 to $100, which is partly why products like Axie Infinity eventually had to move to their own chain (Ronin).

On Solana, the transaction fees are often as low as $0.002, which means performing 500 transactions and paying $1 in fees.

This change in unit economics of transactions has led to more retail traders doing hundreds of transactions at a much higher frequency. If you’d like to see how this translates in real time, I highly recommend observing a stream of trades on Birdeye for WIF. The reduced transaction fees can realistically lead to more people using decentralised alternatives instead of centralised exchanges.

However, decentralised exchanges alone may struggle to have the liquidity or price efficiency a centralised peer can offer. That is the gap many hybrid exchanges on Solana are attempting to solve.

Screenshot from Cube. One of the applications that are bridging the gap between decentralised exchanges and their centralised peers.

The absence of FTX created a need for fiat onramps to Solana and crypto in general. Backpack and Cube are trying to tackle this problem. Backpack is building a regulatory-compliant exchange and aims to cover ~95% of the world’s GDP by the end of 2024. Both Cube and Backpack are hybrid in that they intend to build exchanges around blockchains, where the proof of reserves is shown not just once a quarter but every day.

Many centralised exchanges today barely touch the chain. Sometimes, when the chain integrations are difficult, they just add the token and disallow deposits or withdrawals for the token. But CEXs are not without merits. Market makers (MMs) still choose CEXs as primary platforms for activity not just because of fees but also due to performance guarantees.

As they say, liquidity begets liquidity. Traders flock to exchanges with the most MMs, as they make it relatively easier to enter and exit large position sizes.

Cube merges the execution efficiencies of a CEX (liquidity, fees) and the self-custody of DEXs. Particularly, it uses multi-party computation (MPC) vaults. When a user creates a Cube client account, the key is distributed among the user, the exchange, and guardians (independent third parties) holding part of the key to the vault.

What this means is that Cube is unlikely to take customer deposits to buy stadium rights, as they cannot take your assets as early. Don’t be evil can now be replaced with can’t be evil.

Lending & Yield Aggregators

On-chain lending markets allow market participants to earn a yield on their assets. Moreover, they allow investors to switch from one asset to another without creating a taxable event. Marginfi is the leading lending protocol on Solana by value, locked with over $350 million in deposits and $80 million in borrows.

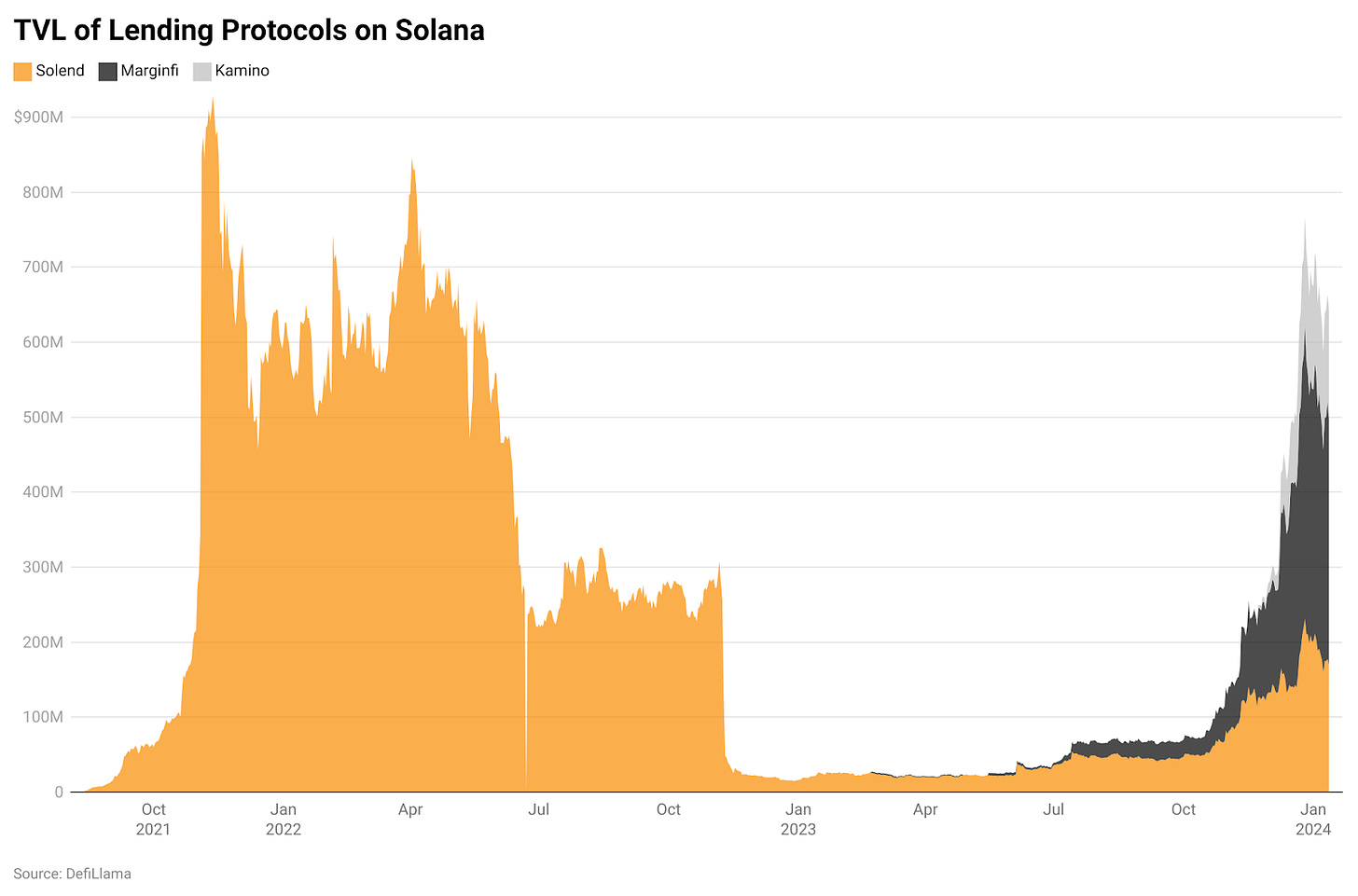

Solend was the dominant lending protocol on Solana before the collapse of FTX. In November 2021, its TVL almost touched $1 billion. In November 2022, when FTX was headed towards bankruptcy, Solana ecosystem token prices plummeted, leading to liquidations of positions across DeFi protocols. Solend’s TVL dropped from over $350 million to ~$25 million in a matter of a week.

As of December 26, 2023, the TVL stands at just over $200 million, yet to recover pre-FTX collapse levels. The collapse of TVL on Solend allowed a new protocol to attract capital. Given that Solend already had a token, just the interest rates were not enough to attract and retain users.

Marginfi grabbed the opportunity and announced ‘points’, signifying that over and above the interest earned, depositors and borrowers would also get an AirDrop at a later date. Marginfi launched points in the first week of July 2023. After October 15, Marginfi witnessed more than 10x growth in its TVL from ~$30 million to ~$485 million in just about two months.

Kamino, the second-largest lender on Solana, is another example of the power of incentives. The protocol announced points (not launched) on December 3, and the TVL jumped over 8x in three weeks to ~$245 million.

Before getting into aggregators, it’s critical to understand why multiple lending platforms exist. Aren’t they fragmenting liquidity? The answer lies in the risk management frameworks used by different lending protocols. At a high level, the products offered by these protocols have different risk profiles. For example, Solend allows users to create permissionless pools. Users can define pool parameters like assets, loan-to-value (LTV), maximum borrow APR etc. Marginfi doesn’t have this feature. Kamino offers vaults that give users the option of leveraged yield farming while exposing them to asset depeg risks.

On top of different lending markets sit yield aggregators like Meteora. It has dynamic vaults where users deposit their capital. The vault monitors underlying protocols like Marginfi and Solend and rebalances whenever conditions are met. Meteora’s dynamic liquidity vaults try to maximise capital efficiency by rebalancing between top lending protocols and liquidity pools, allowing liquidity providers to earn from yield and trading fees.

Liquid Staking

Staking is one of the core components of proof of stake chains. While staking allows stakers to earn yield from protocol inflation and fees, it also secures the chain. Since Ethereum’s move to PoS, liquid staking has become a critical piece of infrastructure. Why? Just as a chain should not price out users with high fees, it should have a low barrier for staking.

Liquid staking allows investors to stake any amount and abstracts the technical complications. Investors do not have to run node software (clients), which typically requires a deeper technical understanding.

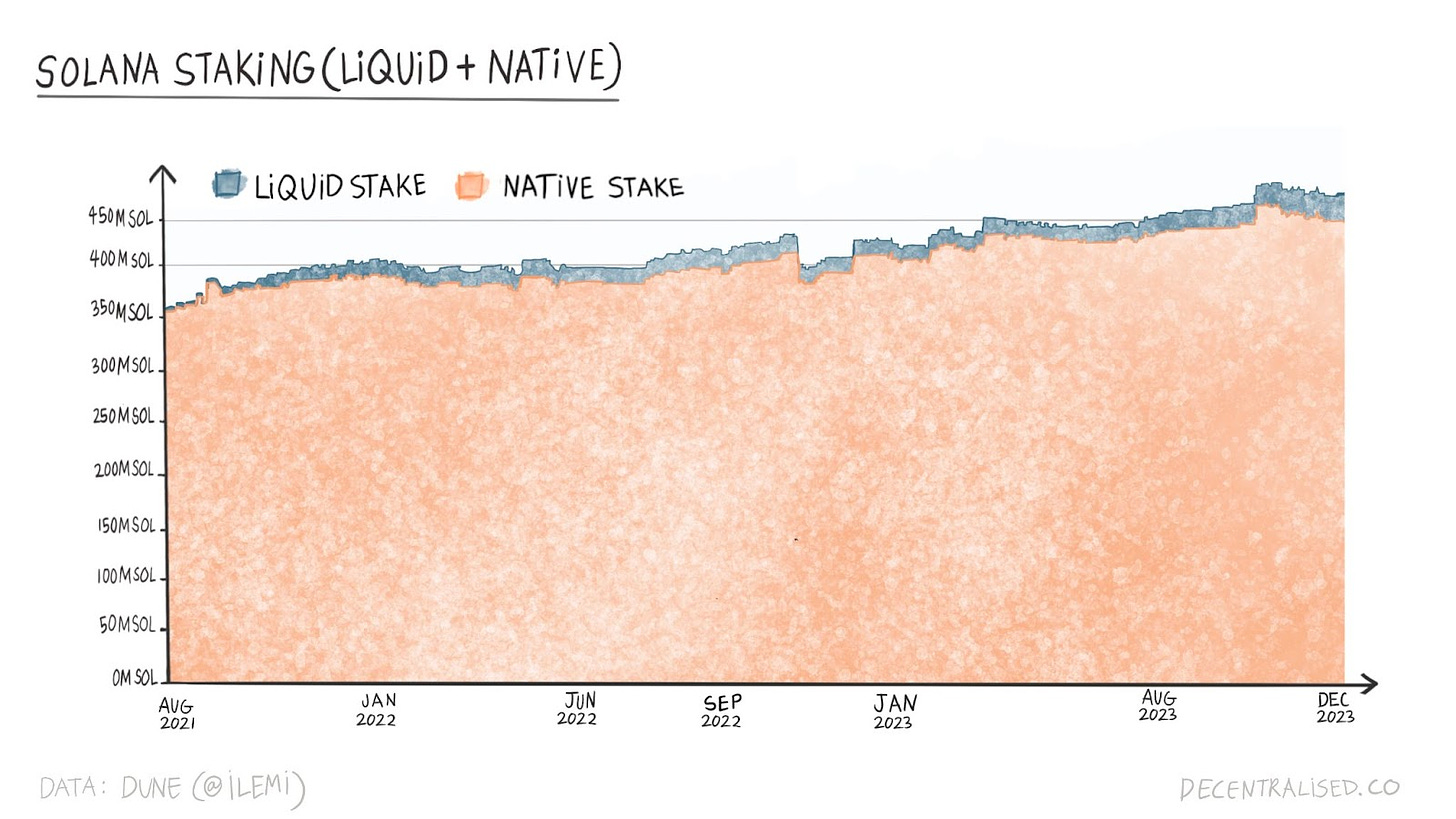

Although Solana validators had to stake SOL from the beginning, and Ethereum moved to proof of stake only last year, the liquid staking sector on Ethereum is far ahead in terms of penetration and usage. More than 383 million SOL is staked (427 million circulating supply, so ~90% of the circulating supply).

Out of this, a whopping 362 million or ~95% is natively staked, which means it is locked and not availing of any staking derivative.

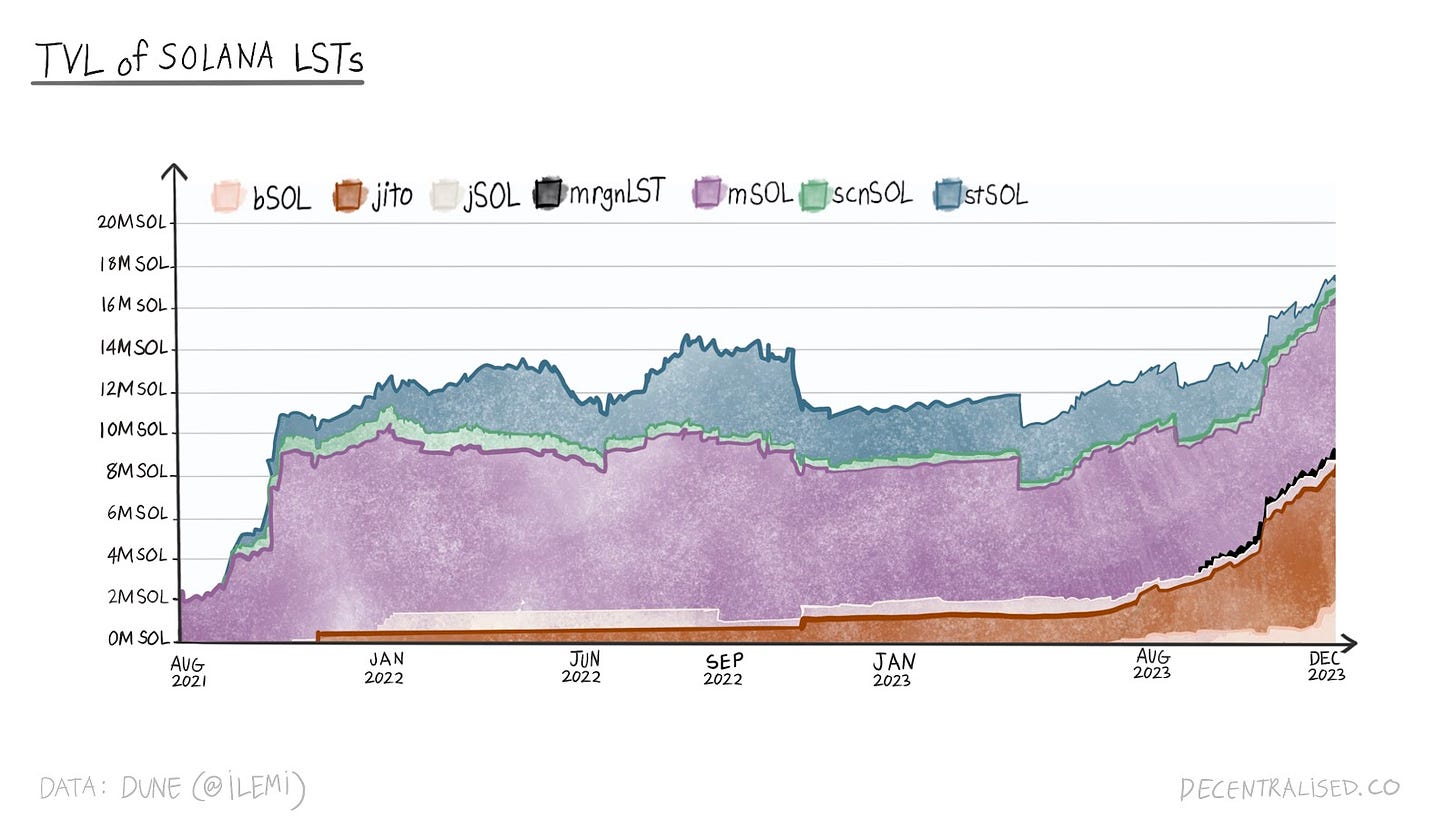

This means SOL is locked with validators without getting any liquid token against it. Users staking native SOL lose out on the opportunity cost of putting liquid token to use in DeFi. If you stake SOL through a protocol like Marinade or Jito, you get mSOL or JitoSOL in return. You can use this token in DeFi applications like Marinade or Meteora. As staking derivatives are relatively new, one can expect users to gradually opt for derivatives and not bear the opportunity cost.

The liquid staking market is only ~20 million SOL. Only ~24% of the circulating ETH is staked, but ~68% (31% LSTs and 37% exchanges) is via liquid staking platforms and centralised exchanges. If we look at the same ~31% staked through different LSTs, Solana’s LST market can be approximated at ~115 million SOL or ~$11 billion.

Born after winning third place in a Solana hackathon in 2021, Marinade was the first liquid staking protocol on Solana. The protocol was launched on the mainnet in August 2021. The solution, like Lido, was simple yet useful. When a user stakes SOL via Marinade’s stake pool, the user gets Marinade SOL or mSOL, which can be used in Solana’s DeFi applications.

mSOL accrues rewards received by Marinade’s stake pool, and its value gets adjusted accordingly against SOL every epoch (~2 days). When a user stakes using the liquid staking option, they must pay the fees to the pool. Liquid staking exposes users to the smart contract risk of the staking protocol.

Marinade also gives its users an option to stake SOL natively. When they do so, users don’t receive mSOL in return. When users exercise this option, they use native Solana’s functionalities, and Marinade simply acts as an interface. The user is the only one who can withdraw their SOL at all times.

The user essentially creates a Solana stake account and delegates the responsibility of managing the stake to Marinade. The stake account receives staking rewards at the end of every epoch. Marinade doesn’t charge users any fees, and they are not exposed to Marinade’s smart contract risk.

Marinade has a TVL of 7.1 million SOL and is the market leader with a ~41% share. Just behind Marinade, Jito is the second largest LST provider on Solana at ~6.4 million SOL and a share of ~38%. Like Marinade’s mSOL, Jito provides users with JitoSOL as the receipt of locking SOL in its staking contract. In addition to the validator yield, Jito also passes on MEV rewards to JitoSOL holders.

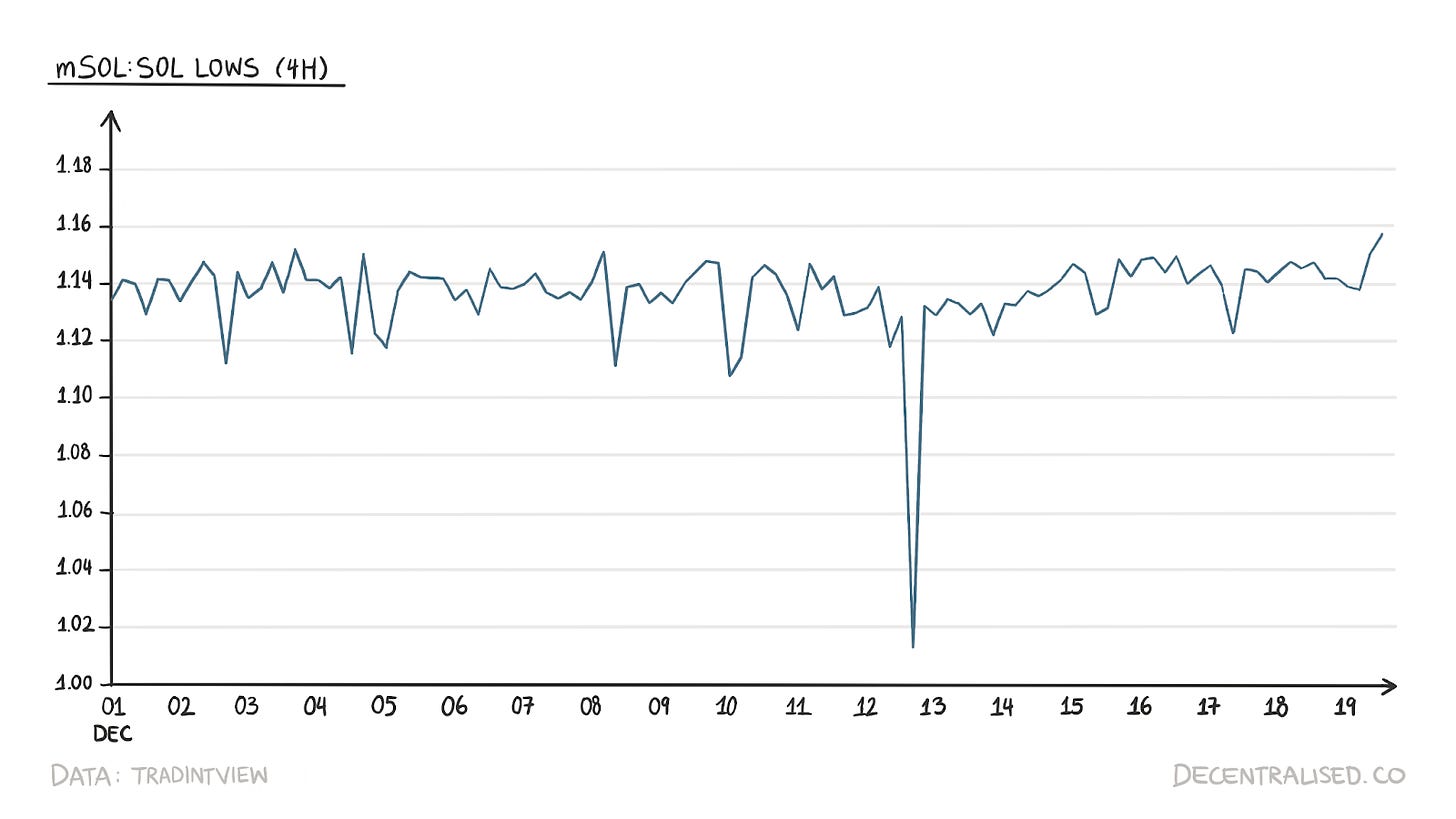

LSTs are convenient for users, but they don’t come without drawbacks. The liquidity of LSTs can be a concern. A case in point is mSOL’s depeg on December 12. When a trader sold large quantities of mSOL, the price dropped from a high of 1.16 to 1.02. For a token that’s supposed to be ‘pegged’, this can be quite damaging. After ruling out an exploit, arbitrageurs ensured that the price returned to its peg. On the one hand, one can say that everything worked as it should. On the other hand, the incident underscored the need to improve the liquidity of LSTs.

A few solutions allow users to shield themselves from such depegs. When users deposit assets into Kamino’s vaults, a bot monitors conditions, and every 20 minutes, a vault can be rebalanced if needed. Regarding LSTs, the Kamino vault performs regular rebalancing around the price. For example, when the price of JitoSOL is 1.08 SOL and the market price goes above 1.08 SOL, the vault will sell JitoSOL and vice versa.

Solana currently has over 10 LSTs, and the issue of low liquidity will likely get worse when (if) more LSTs are launched. Sanctum has proposed a solution to avoid issues due to the low liquidity of LSTs. Sanctum Infinity is a multi-LST pool that allows swaps between all the LSTs in the pool. Think of it as an aggregator layer for Solana LSTs. As such, the solution is expected to go live in Q1 2024.

The NFT Ecosystem

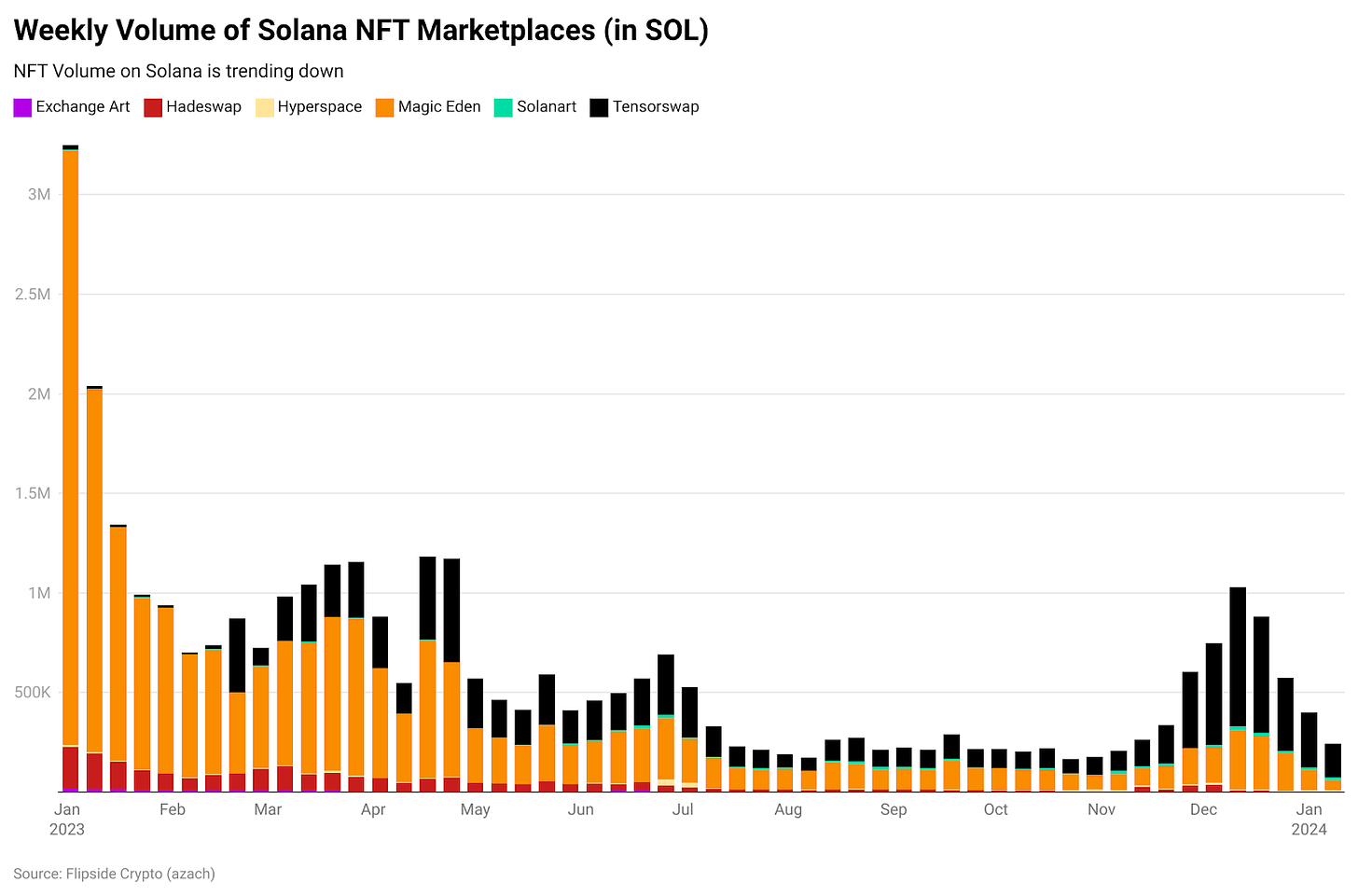

The NFT ecosystem in Solana has evolved substantially over the year. Initially, there was not much to show. To make matters worse, some of the Solana NFT flagbearers, like DeGods and yOOts, chose to migrate from Solana to other chains. Although Magic Eden, the leading NFT marketplace on Solana through 2022, did not leave Solana, it hedged itself by going multichain. Leading NFT collections are critical from a community perspective, so this void had to be filled.

New collections like Claynosaurz and Mad Lads were able to fill the gap, and since they made a conscious choice not to leave Solana for other chains, it created a strong sense of belonging in both communities. A common thread about both collections is that they are a means to the end, not the end itself.

Claynosaurz is a 3D production studio focussing on entertainment IP development. CEO Andrew Pelekis mentioned that ‘The initial focus is on short-form video, and eventually, we plan to explore longer formats through a TV show, YouTube series, or even a movie.‘ In an upcoming game, users will also be able to engage with their collectables. The goal is to expand the Claynosaurz brand through content production not just for Web3 but across traditional distribution channels as well.

Mad Lads is a collection by ex-FTX engineers looking to replace FTX with another exchange called Backpack. The exchange is supposed to fill the void created by FTX while being more compliant and transparent, adhering to DeFi ethos. Mad Lads developed the Solana wallet that leverages executable NFTs or xNFTs, blurring the lines between applications and NFTs.

The following screenshot shows how users can interact with different applications within the Backpack wallet. For example, when you click on Jito staking, the staking application opens inside the wallet application. This helps users manage their assets without leaving the wallet.

Unlike traditional NFTs, which are collectables on a server, xNFTs can execute code. In particular, xNFTs allow users to interact with applications like Jito Staking, Birdeye, Orca, and Marginfi inside the Backpack wallet. Armani Ferante, cofounder of Backpack and Mad Lads, was also responsible for developing the Anchor framework on Solana. Think of any framework as like a toolkit with building blocks.

It allows you to create something complex without creating small components from scratch every time. Hence, Anchor saves developers time and effort.

As the following chart shows, Magic Eden was a dominant NFT marketplace that began on Solana. Magic Eden extended support to Ethereum in August 2022 and eventually added other chains, like Polygon and Bitcoin (Inscriptions). While Magic Eden was expanding support to other chains, Tensor (with 2–3 devs) was laser-focused on Solana, offering added functionality, like TradingView integration and market-making orders.

In addition to these features, Tensor launched a points campaign like Blur’s, where traders will be rewarded with Tensor’s governance token.

Infrastructure

I have been using Solana for over two years, and I’ve experienced the change in infrastructure first-hand during this time. Solana stopped producing blocks (liveness failure) over ten times in 2022 but only once in 2023. Liveness failure is not something you want even once, but new chains experimenting with cutting-edge tech are bound to experience it. Even L2s like Arbitrum have experienced these failures during traffic surges.

Various factors contribute to improving infrastructure, from how fee markets work and client diversity to RPC nodes. Companies like Helius Labs and Triton are helping app developers by providing the following:

- RPC nodes and webhooks to interact with the Solana network. This helps developers because maintaining this infrastructure is time-consuming. Outsourcing this responsibility allows them to prioritise the core problem.

- Enhanced APIs that help developers save time to fetch the data they need. Data is indexed and made available via easy-to-use APIs. These APIs cover data points like transaction history, NFT data, token metadata, etc.

Another change on the infrastructure side has been state compression. Solana uses Merkle trees and stores part of instead of all of the data. It reduces storage costs dramatically. NFTs are among the first use cases for state compression. Developers developed state compression at Solana Labs and Metaplex, but other ecosystem players were also critical in ensuring it was usable. Helius Labs and Triton provide the necessary RPC node infrastructure and indexing services. Wallets like Phantom and Solflare provide a friendly interface for users to interact with the network.

It costs $247 to mint 1 million NFTs on Solana versus ~$98k on Polygon and ~$65 million on Ethereum. DRiP is an NFT platform that sends curated NFTs to users instead of showing them ads. It sends 3 million NFTs a week to different users. The old way would cost them over $300k a week, but compressed NFTs allow DRiP to achieve the same with ~$250.

While these were some efforts to improve Solana, some projects are improving Solana’s connectivity to other chains and mixing the best components of Solana and other chains. Eclipse is using Solana’s virtual machine, SVM, for computations and Ethereum as its settlement layer. Neon, in some ways, is the opposite of Eclipse. It is building EVM atop Solana, which can do parallel processing. Like Eclipse is building an Ethereum L2 with SVM, Nitro is building a Cosmos L2.

DePIN

DePIN stands for decentralised physical infrastructure networks. Whether it is wireless networks, cloud storage, maps, or data sharing, the idea of using decentralised infrastructure by plugging in token incentives has existed for quite some time. An important feature of DePIN is that it blurs the lines between consumer and business devices.

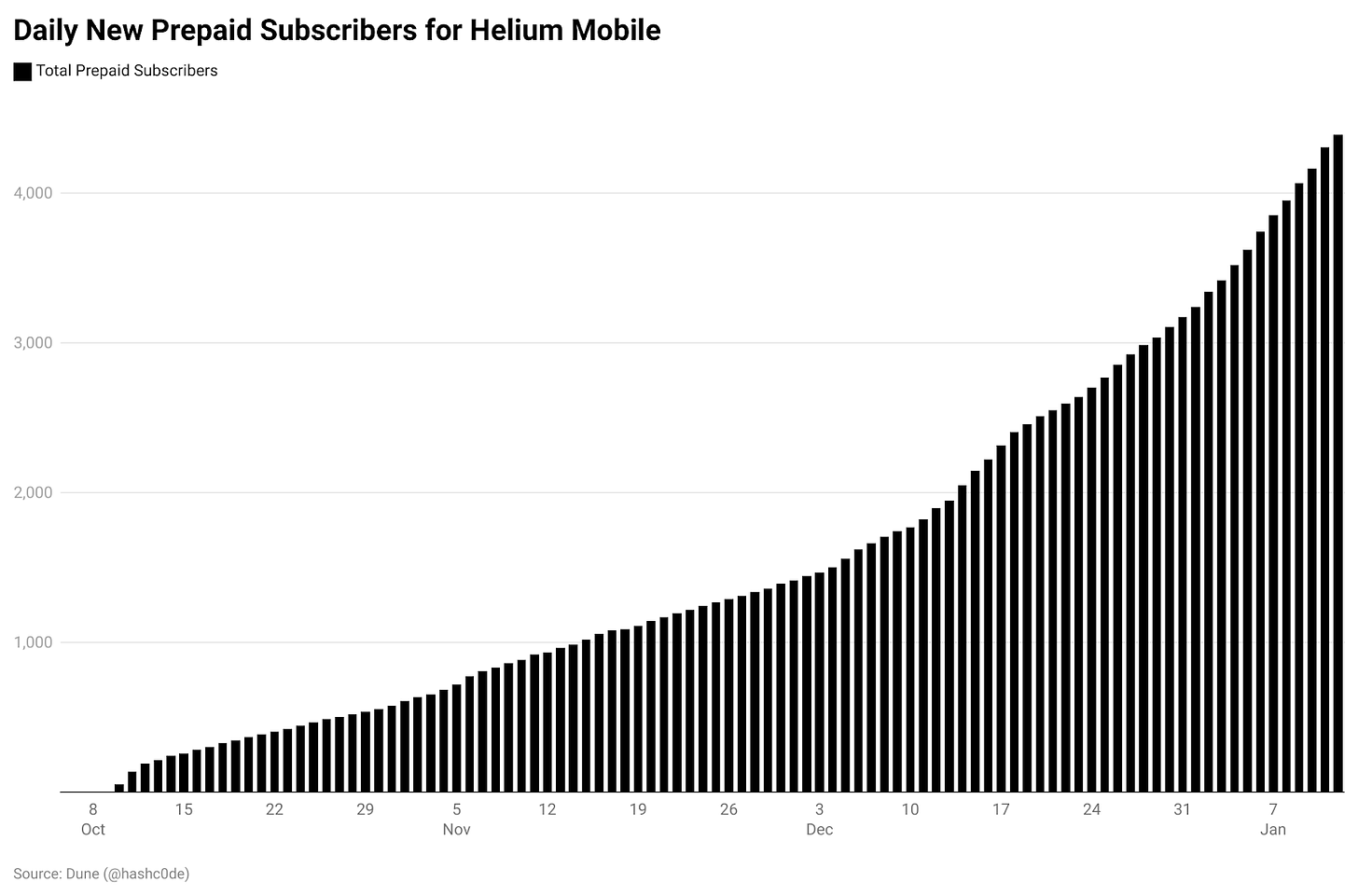

A car charger or a pollution measuring device may not be the most necessary for a household, but when you can make some revenue when the equipment is idle, you tend to look at it differently. Helium and Hivemapper are some examples of DePIN on Solana.

Helium started with a mission to create a decentralised wireless infrastructure to support Internet of Things (IoT) devices. Large players dominate the internet service provider market. Moreover, the internet is often patchy in many parts of the world. Helium’s devices serve as hotspots, and on average, around 50 hotspots are enough to provide internet connectivity to a city. Anybody can host a Helium hotspot.

Helium had its own blockchain before migrating to Solana in April 2023. The Helium Network grew to over one million hotspots. To support this growth and provide for further scaling, Helium would have to make its blockchain more robust, which would mean incurring infrastructure-related costs.

Instead of spending resources on non-core tasks like infra support, the Helium community voted in favour of outsourcing these tasks to Solana instead of spending more on making the network more robust. Solana offers scale and supports more sophisticated proof of coverage algorithms.

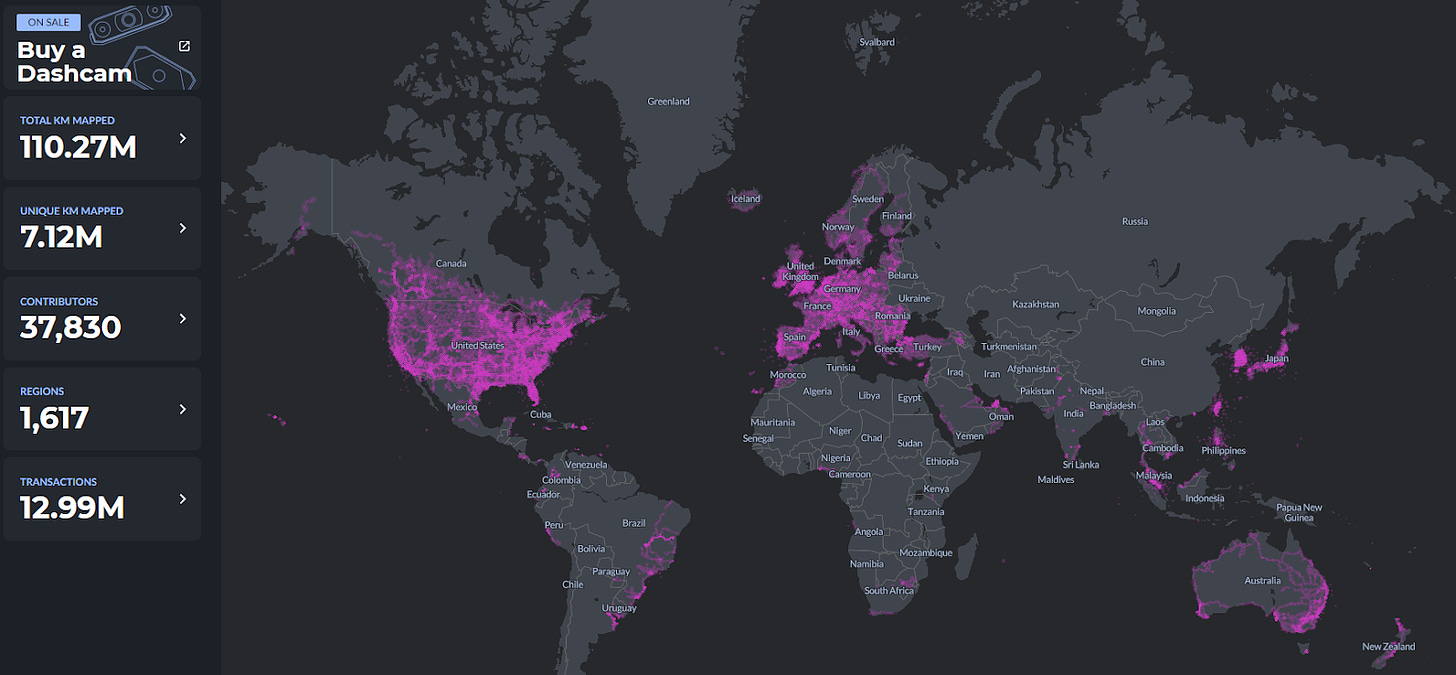

Hivemapper is another example of a DePIN application built on Solana. It works like a beehive where instead of honey bees flying around and collecting nectar, people help map the world by installing dashcams in their vehicles. While some drive around with dashcams, others also train the AI to look at the pictures and identify objects. Hivemapper incentivises these people with HONEY tokens. So far, 100 million kilometres’ worth of roads have been mapped, with 6.6 million kilometres being unique to Hivemapper.

Source – Hivemapper

Hivemapper licences map data to customers, which is a revenue source for contributors. Companies like Google have dedicated mapping vehicles which cost, per vehicle, around $500k per year.

According to Hivemapper’s head of operations, “It’s really expensive, and it’s also very centralised. The places that have good maps are determined by where those companies are willing to invest their resources. Meanwhile, people and businesses rely on that data to make decisions, even when it’s really out of date.” Millions of people with the potential to map roads travel daily, but they lack the incentives to do so.

Hivemapper uses incentives powered by web3 infrastructure so that regular people can install a dashcam and start mapping. Ride-hailing services like Uber and delivery applications like Zomato can use applications like Hivemapper in the future the way they now use Google Maps. This can happen for the simple reason that using Hivemapper requires fewer permissions.

The End Game

Technological adoption happens when the cost of interacting with a product reduces drastically. My generation witnessed this first-hand when cheap, ubiquitous Nokia devices replaced landline connections with mobile ones in the early 2000s. Much of the world came online through mobile devices thanks to a mix of Moore’s law and the development of Android. To my mind, Solana’s offering is fine-tuned to onboard the masses.

You can ignore everything in this article and try receiving $1 in Phantom wallet on Solana to see what I mean. I recall the first time I experienced it. The speed and experience felt closest to what I had seen with PayPal in the early 2010s. Solana’s unit economics is such that developers can pay for on-chain user interactions without burning a hole in their balance sheet. If that is true, then Solana’s breakout applications won’t look like what existed in the past.

Let me explain. When we obsess about decentralised exchanges or lending products, we are trying to tap into the behaviour of existing users in crypto. Using a DEX or taking a loan is accrued behaviour. But the number of users who want to speculate on-chain is far smaller than those who want to be entertained or communicate. This disparity is why Robinhood has a far smaller user base than Meta’s suite of products. Solana’s unit economics makes it possible to build consumer-scale apps that go beyond the realm of today’s crypto-native users.

This is not to suggest that products like MarginFi or Jupiter are irrelevant. They are crucial infrastructure that opened my eyes to what’s possible on the network. Given how close blockchains are to money and finance, degens and risk takers are often the first set of users; without use cases that cater to them, onboarding the first cohort of users is challenging.

Replacing existing financial infrastructure is a worthy and difficult cause. But when I look towards the next decade, the Facebook and Substacks of our era are not yet built. And unless they are built, we will struggle to become relevant beyond an increasingly small number of speculators.

Blockchains are financial infrastructure. In their current form, we overemphasise the user’s trading instead of making the value exchange occur in the back-end. You may think this does not happen on the internet today, but each time you view an advertisement, the brand and platform are exchanging value without you being aware of it. The question is what forms of value exchange (with users being unaware) blockchains like Solana can enable. Can they be packaged as a social network or a dating app? We don’t know. The answers are beyond the scope of this article.

In our view, much of what makes Solana interesting is that it has attracted a critical mass of developers who have now found wealth, either through airdrops or holding SOL through the bear market. Bitcoin and Ethereum had similar trajectories where their builders had sufficient runway to no longer care about the bills. Many in Solana’s developer ecosystem just crossed that chasm.

That makes us hopeful of what the ecosystem can produce. At the same time, we see bits of exuberance and early victory laps from within the ecosystem.

As with most price rallies, an inability to focus on the main thing (building) and obsessing about price leads to losing a network’s momentary advantage. For instance, work must be done to create more bridges between the SVM and EVM ecosystems. Products like Eclipse are pioneering that function, but more work could be done there.

Solana’s infrastructure is arguably better than many of its EVM comparables but when it comes to benchmarking against peers like Nasdaq or NYSE, the network still has work to do. Lastly, as I mentioned, all networks are at risk of playing out like Nokia or Blackberry unless they can deliver on use cases beyond trading.

Looking at Solana today feels like Apple in the early 2000s – and no, I don’t mean to imply Raj or Anatoly is Steve Jobs. The network has had its share of hype much like Apple did in the 1980s. It then got sidelined and saw EVM networks take mindshare whilst the price tumbled, much like Windows in the 1990s. It has been on the come-up with a mix of price action, hardware, and better user experiences.

The question now is whether this can transition to an iPhone moment for Solana, a period where consumer experiences are so markedly better than their peers and a situation where the network is the default choice for developers looking to build things on-chain.

For that transition to occur, the foundation would have to change gears from competing against EVM peers to looking towards consumers. It would need a new crop of VCs that are comfortable betting on consumer crypto applications working with founders that have built in web2 in the past. That approach of looking elsewhere while the market doggedly competes for a share of 10 million active on-chain users could put Solana on a different trajectory altogether.

In an efficient market, where competition is working just as hard – if not more – Solana finds itself in a place of relative strength. Whether that transitions to meaningful moat and consistent tractions is unclear. But for now, here’s what’s evident: the SVM approach has advantages when developing a network, developers are building cool things in the ecosystem, and the community cares.

None of these things occur overnight. Solana has gone through hell and returned. Where it goes from now remains to be seen.

[This article has been written and prepared by Jaiya Gill, Siddharth, Joel and published by the GCR Research Team, a group of dedicated professionals with extensive knowledge and expertise in their field. Committed to staying current with industry developments and providing accurate and valuable information, GlobalCoinResearch.com is a trusted source for insightful news, research, and analysis.

Disclaimer: Investing carries with it inherent risks, including but not limited to technical, operational, and human errors, as well as platform failures. The content provided is purely for educational purposes and should not be considered as financial advice. The authors of this content are not professional or licensed financial advisors and the views expressed are their own and do not represent the opinions of any organization they may be affiliated with.