GCR Market and Investment Trends Review – Q4 and 2023 Annual Overview

Highlights

GCR is a research and investment community. As a collective, we source investments, conduct research and diligence, and make investments together.

This piece lays out some highlights from the past quarter, as well as 2023 as a whole:

- In 2023, the GCR Community deployed over $270K of community-sourced capital across 4 deals.

- The GCR Community saw over 33 investment opportunities in Q4, of which 24, or ~12% came directly from community members and contributors.

- The only top category we invested in was once again Infrastructure.

- During Q4 2023, GCR invested in a total of 1 deal.

- GCR Core Team presents Q4 macro review and shares our outlook for Q1 2024.

2023 Year in Review

At GCR, our mission is to create a community-driven investment DAO where the best Web3 investment opportunities are brought in by the community for the benefit of the community.

Since this new initiative’s inception in March 2022, we have experienced unrivaled success:

- The GCR Community saw over 170 deals during 2023, of which ~34% came directly from the community members, with increasingly more contributions coming from members in Q3 and Q4. This is a testament to the increasing demand and support for a truly community-driven investment platform.

- From our robust deal pipeline, the community invested over $270K across 4 deals in 2023 and invested $42M across 72 deals to-date. Through our decentralized platform, GCR members enjoyed the flexibility to handpick their own investments and invest alongside prominent VCs such as 1kx, a16z, Coinbase Ventures, Electric Capital, Sequoia Capital, etc.

Robust Community-Driven Investing Despite Market Conditions

Q4 2023 Summary Stats

The GCR Community continues to make significant strides, demonstrating unwavering discipline in curating top-notch deal flow and forging partnerships with high-conviction companies.

- During Q4 2023, the community assessed 33 deals, notably lower than in Q3 2023 but still ample. Specifically, approximately 12% of these opportunities were directly contributed by community members and contributors. This figure contrasts with the 65 investment opportunities observed in Q4 2022, where ~35% were community-sourced.

- Q4 2023 saw the lowest volume of deal opportunities in 2023, primarily due to the holiday season.

- When categorizing the opportunities explored by the community, Infrastructure and DeFi/CeFi remain the most prevalent at approximately 37% each, and Gaming and Social at around 20%.

- Furthermore, the community solely focused on investments in the Infrastructure category during this quarter, similar to Q2 2023 as well as Q3 this year.

- In alignment with the prevailing market sentiment and the discerning approach of the GCR Community, GCR executed only 1 deal in Q4 2023, a notable difference from the 6 deals invested in Q4 2022, but slightly down from the 2 deals we executed in Q3 2023.

- Lastly, our own spin-off GCRx started steadily supporting small syndicates and other investment communities by setting up SPVs and handling the operations.

Every quarter, we proudly share our progress to showcase the capabilities of GCR’s community-led investment platform. The GCR Community continues to grow stronger as members educate each other about their specific areas of expertise. If you would like to learn more about how you can be involved with the GCR Community, join our Discord.

Q4 Appears to Be Mixed

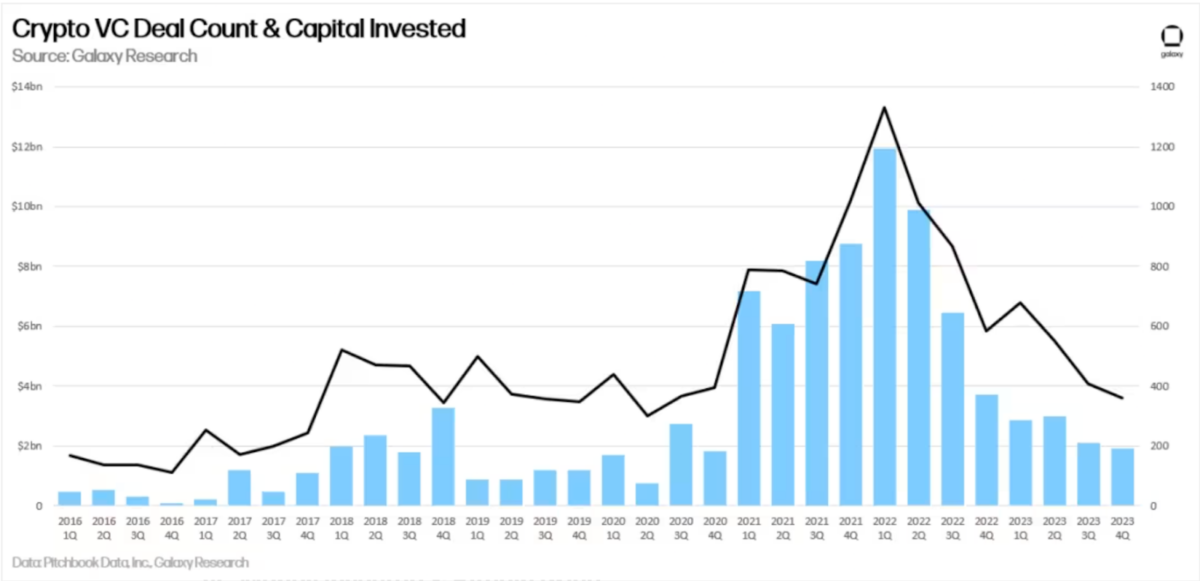

The last quarter of 2023 has seen some impressive but concentrated surge of capital raising for accelerators and Web3 funds. Last year has been the 3rd largest year in terms of VC activity for crypto ever, but significantly less than 2021 and 2022. According to Galaxy, usually, the BTC price and VC activity correlate, however, the deal activity didn’t seem to pick up as fast as the BTC price development.

Topics like AI, Bitcoin Ordinals and direct-to-customer protocols seem to attract accelerators’ interest. According to Cointelegraph and Messari, in the last quarter, there was an 81% surge in deal volume reaching $3.83 billion, dominated by Blockaid with $33 million, Ritual with $25 million, Drift with $23.5 million and more.

On a broader view, it is worth noting that according to GlobalData, venture capital funding in the US decreased notably from January to November 2023. Compared to the previous year, there was a substantial 44.1% decline, bringing the total down to $104.5 billion. The decline in VC funding within this timeframe may have implications for startups and emerging businesses seeking financial support and could reflect broader trends in investor confidence or strategic investment decisions within the tech and innovation sectors.

We remain optimistic about both GCR’s prospects and the future of crypto space. We anticipate more crypto-friendly jurisdictions like Singapore and the United Arab Emirates will continue to foster an active builder environment for crypto.

Along with jurisdictions coming up like Hong Kong attracting and encouraging new developments in Crypto by setting up a comprehensive crypto framework. The framework includes requirements for crypto exchanges and wallet providers, as well as guidelines for DAOs. The government emphasizes the need for consumer protection, Anti-Money Laundering (AML) measures, and maintaining the city’s reputation as a global financial hub.

Source: Galaxy Research

Doing a deep dive on the European side, an update on the Digital Euro has recently been published, regarding the rulebook which has been set up by relevant industries and the European Commission. The aim is to set up relevant and appropriate rules together with affected industries and let them be reviewed by experts. Zooming out, the CBDC topic is being explored by many central banks with different purposes and goals. One key factor that has to be considered is the interoperability of CBDCs with each other. Yet, it is still questionable how the relationship between stablecoins and CBDCs will be – that can be a key factor for adoption.

On the side of tokenization, one topic dominated the news in central Europe, where the first external transaction of a tokenized mutual fund has been completed into an existing retail mutual fund. This was made possible by Union Investment, Metzler, Cashlink, and Fundsonchain. This marks a new chapter for TradFi exploring tokenization in existing retail products.

GCR Portfolio Companies Continue to Ship

We have previously focused our quarterly reviews on highlighting our deal pipeline and funded investments, but since last quarter, we want to take the opportunity to showcase what some of our awesome portfolio companies have been building in the bear market.

GCR now has grown to over 70 portfolio companies that are relentlessly building, we are proud to be backers of these projects building the future of Web3.

Decrypt

Decrypt is building a decentralized publication / media platform focused on crypto and Web3.

- The Decrypt App has arrived to elevate your Web3 experience and immerse you in the latest developments in Bitcoin, cryptocurrencies, and emerging technologies. Extending a warm invitation to all Android enthusiasts to download the app from the Google Play Store. Learn more here.

IntellaX

IntellaX is a Web3 gaming platform that was started by Neowiz (Korean gaming company) that partnered with Polygon, etc.

- Intella X NFT Marketplace has announced its soft launch, providing users with a user-friendly platform for trading NFTs within the Intella X ecosystem. During the soft launch, users can list, sell, and buy NFTs using USDC.e or MATIC for Polygon Network and ETH for Ethereum Network. The marketplace supports gaming NFTs, PFP NFTs, and exclusive art pieces from various Web3 games. Notably, the first NFT collection available for trading is Crypto Golf Impact’s ‘Genesis Ball Marker’. Intella X aims to create the ultimate NFT trading experience, emphasizing user ease and lower transaction fees. In 2024 the platform looks forward to enhancing the NFT marketplace further. Learn more here.

Jia

Jia connects capital to small businesses in every corner of the world.

- Jia celebrates the resilience and success of entrepreneur Rebecca Mungai in Katani, Kenya, during the holiday season. With Jia’s financial support, Rebecca transformed her pharmacy, and in the spirit of giving, Jia waived the interest fee on her current loan. Rebecca’s story reflects determination and adaptability. As 2024 approaches, Jia looks forward to fostering more success stories. Learn more here.

LayerZero

LayerZero is a User Application (UA) configurable on-chain endpoint that runs a ULN.

- LayerZero sets its sights on a transformative 2024 with the deployment of LayerZero V2. This upgrade introduces groundbreaking features, including Decentralized Verification Networks (DVNs), Adapters, modular X of Y of N verification, Permissionless Execution, a Security Stack for applications, increased throughput options, enhanced programmability, and unified semantics. The protocol aims to be a fundamental crypto primitive alongside Bitcoin and Ethereum, offering a quasi-aggregator of verification methods and flexibility for application owners. Learn more here.

Manta Network

Manta Network is the multi-modular ecosystem for zero-knowledge (ZK) applications.

- In 2024, Manta Network is poised for continued success and innovation following an explosive year of growth and groundbreaking product launches in 2023. As one of the Top 5 Ethereum Layer 2 (L2) networks, Manta Pacific achieved significant milestones, including hosting the largest Trusted Setup and integrating Celestia’s modular data availability layer to reduce gas fees. Learn more here.

OAK Network

OAK Network is the Web 3.0 Hub for DeFi and Payment Automation

- Discover the functionality of OAK Network’s Automation Dashboard through their latest tutorial. The tutorial guides users on connecting a wallet, creating a delegation, signing a transaction, setting up auto-compounding, and reviewing reward and task history. Learn how to efficiently stake and auto-compound rewards with ease. Watch the tutorial for step-by-step instructions. Learn more here.

t2

t2 is a decentralized social network around reading and writing.

- In 2023, t2 celebrated milestones including the alpha launch featuring territories in Web3 and PopScience, with innovative features like Time Points and sub-territories. The Future of Social Manifesto gained support from 45,000 users globally, while a transformative team gathering in the UK reshaped the company’s vision. Territories V1 introduced key features, and the “Friends Who Write” contest engaged 200 writers. Becoming the official publishing home for Lens Protocol showcased Web3’s composability. With 31 new features, 83,926 lines of code, 10 territories, and a vibrant platform boasting over 2,000 active users and 48,000 members, t2 reflects on a proud journey from its Alpha Launch, including cherished community meetups in London.

Talent Protocol

Talent Protocol is a social and economic platform where builders can share their goals and find the support they need to achieve them.

- In their annual community update, the team reflects on 2023 and sets the stage for an optimistic 2024 for Talent Protocol. They acknowledge the key lesson that speculation is a vital feature, comparing it to the essential fuel for a car in the crypto space. Embracing the symbiotic relationship between trading, speculation, and crypto success, their motto for 2024 is “Play to win!”—encouraging the positive use of financial motivations to support builders in their endeavors.

Global Macro Outlook

The past quarter saw in a rallye fueled by the rumors of the Spot-ETF and the incoming institutional capital resulting in a surge of 160% BTC and 90% ETH. This development is expected to continue due to investment related and economic factors. With the increasing maturity of blockchain projects and increasing collaboration of web2 and web3 industries, more volume will come onto blockchain infrastructure.

Steady but slowly

The narrative “higher for longer” is still valid, where the Fed is expected to cut rates in the second half of 2024, however, slow cuts are expected. According to JP-Morgan, the probability of a deep recession is valued at 25%. Inflation has globally decreased from 10% to a current pace of approx 5%.

Institutional investors are bullish on BTC

Institutional investors are overwhelmingly bullish on Bitcoin ranging from $80,000 up to $200,000 – according to Standard Chartered. It’s all connected to the BTC ETF-approval with the expected inflows of fresh capital from institutional investors. According to the bank, $50 billion to $100 billion could flow into the ETF, which could be parallelled to the gold ETP.

Real World Assets connect both worlds

The narrative of real world assets (RWA) is around for quite a while, projects are building up infrastructure to facilitate. Both European and US-American players are progressing on tokenizing financial instruments and real estate. According to Bitwise $5 billion in financial instruments have already been tokenized and the biggest player in the market JP-Morgan is planning to set up a tokenized fund to take advantage of DLT settlement. Also across the pond, the German asset manager Union Investment has completed the first tokenized transaction of a tokenized mutual fund into a retail fund. RWAs are set to have a potential up to $16 trillion by 2030 according to the Global Financial Markets Association.

New and refreshed narratives

Besides RWAs, new and refreshed narratives seem set for 2024. Where new narratives like prediction markets are seen as a “killer app”, evergreen narratives like NFTs are seen to be – among other use cases – fan articles. Taylor Swift is using NFTs to interact with her fans and provide unique access to songs, concerts and experiences. One way to use these NFTs is over spotify with the tokengating access to special content.

Furthermore, according to a16z, AI + blockchains will come together. With decentralization, open-source crypto networks will democratize AI innovation that can enable a multi sided training of AI and not leave it in the hands of big tech giants.

Recap 2023 incl. Q4: The Crypto Goliath is Slowly Waking Up

Some highlights according to the Tradingview and CoinGecko’s Annual Report:

- The Total Crypto Market Cap rose +108.1% in 2023, from $829 billion to $1.72 trillion.

- Trading volume increased from $6.7 trillion in Q3 to $10.3 trillion at the end of the year with a gain of 53.1% with centralized exchanges dominating here over decentralized ones.

- Bitcoin saw a surge of 64% in Q4 and 155% in 2023 due to the optimism of the BTC ETF reaching a high of $44,004 not seen since April 2022.

- Ethereum with 34% in Q4 due to an increase in the trading volume and 90% over the year.

- NFT trading volume amounted to $11.8 billion with Ethereum still being the dominant chain here followed up by Bitcoin and Solana. High trading activity in NFTs is partly due to the strong Bitcoin Ordinals trading.

- BTC, ETH, Ripple (XRP) and Dogecoin (DOGE) appear to be the top 4 most liquid coins in Q4 according to TradingView. DOGE flipping BNB in terms of liquidity is probably caused by the news regarding the change of leadership and regulatory concerns about Binance in the past year. BNB is still in 3rd position in terms of market capitalization.

- Solana’s network activity and therefore the price saw a massive increase in the last quarter fueled by meme-coins on Solana. The coin ended the 90-day period marking a 423% increase compared to the previous quarter and over 1000% growth year-over-year, according to AMBCrypto. In contrast, Solana witnessed a minor decrease in staking activity by 5%, a dip possibly driven by a series of unstaking activities by FTX Estate.

Join Us

We continue to be excited about what lies ahead in 2024 for GCR and the rest of the crypto community.

If you are a startup raising capital and are interested in learning more about what it is like to have the support of a community with thousands of members, please reach out to one of our GCR Core Team Deal Leads!

If you are a Web3 enthusiast and are interested in learning about new crypto projects, investing alongside sophisticated members, and sharing investment opportunities, hop into our Discord and join the conversation.

As part of our effort to onboard the next one billion users to crypto, we are giving away complimentary 1-month Gold memberships to people who are aligned with GCR’s core values and are seriously interested in investing with us. If you are interested, please fill out this form here.

Please reach out if you have any questions, comments or feedback! We welcome the dialogue.

[This article has been written and prepared by the GCR Team, a group of dedicated professionals with extensive knowledge and expertise in their field. Committed to staying current with industry developments and providing accurate and valuable information, GlobalCoinResearch.com is a trusted source for insightful news, research and analysis.]

Disclaimer: Investing carries with it inherent risks, including but not limited to technical, operational and human errors, as well as platform failures. The content provided is purely for educational purposes and should not be considered as financial advice. The authors of this content are not professional or licensed financial advisors and the views expressed are their own and do not represent the opinions of any organization they may be affiliated with.

-

if you are having a withdrawal problem or your investment manager is asking you for more deposit before you can withdraw your money from your trading account. Or Do you have funds you wish to withdraw from your binary broker Forex trade or crypto currency account ? or you are having withdrawal problems with your account and you don’t know how to go about it. feel free to email Mr (georgeolsson38@gmail.com) and he will guide you on how to get back your funds in an interval of one week even if you have also lost money to any other company he can still help you to recover any of your lost funds back