Friend Tech and the SocialFi Revolution: Redefining Web3 Interactions

SocialFi has been around for a few years now, and this year it has seen its comeback. From early failed experiments like Bitclout to the latest revival of the narrative with Friend Tech’s success – let’s take a look at how this corner of Web3 has evolved over the years, and how bright the future looks for SocialFi. But first, what exactly is SocialFi?

SocialFi

Social Finance is the merge of two worlds:

- The social layer, which allows users to interact and engage with each other, create and consume content – much like we do in Web2; and

- The finance layer, with its roots in DeFi and the financialization that Web3 enables

By merging both, SocialFi introduces the capability to monetize said content, speculate on the reputation and influence of a given user, and other novel use cases that evolve with each new DApp.

It’s also about data ownership, governance over the protocols behind your Web3 social platform, and other characteristics. This is most commonly known as Decentralized Social (DeSo), which has many intersections with SocialFi, but it’s mostly focused on building social network platforms.

As we focus on SocialFi, it’s worth noting that we are mostly talking about the financial applications that blockchain merged with social interactions enable.

Early days of SocialFi

One of the earliest iterations in SocialFi was Bitclout, a platform that launched tokens from celebrities and notable people in tech. It was one of the first social media platforms on-chain, launched as the beginning of dApps on the DeSo network, a layer-1 created specifically to build decentralized social networks.

But most of these tokens were not necessarily launched by the people they represented. Combined with lack of technical infrastructure to have on-chain social elements, momentum that Bitclout was not able to sustain, and the missing legitimacy that came from tokens not related to the actual people who they were supposed to represent, you have the ingredients for a short-lived platform. At the time of this writing, Bitclout has been sunsetted. However, it was enough to launch a new product category. It also helped popularize a key concept we see in current SocialFi dapps – the social token.

So, what is it exactly that sparked the flame again? A new dApp called Friend Tech.

The Friend Tech Craze

In August 2023, a new platform launched and everyone in Crypto Twitter created their own accounts and experimented with their own, their friend’s and their favorite influencer’s tokens. Or, as Friend Tech calls social tokens in their platform, Keys.

The ease of launching new Keys combined with a user-friendly interface made Friend Tech an instant hit: On the first day of launch, Friend Tech saw an influx of US$ 2MM. With 5% going to creators, and 5% to the protocol’s treasury, the platform made US$ 103k of revenue in the first 24 hours.

Understanding Friend Tech

Why did Friend Tech succeed where Bitclout failed?. While Bitclout was all about speculation, Friend Tech added an actual social component with Keys acting as a token-gating mechanism to access someone’s chat group. Keys could give you direct access to your favorite creator’s DMs, or access to an exclusive channel or group chat (in some way, similar to other creators’ platforms like OnlyFans). The difference is that the gating mechanism here is much more fluid, as you can just sell your Keys and you will leave the chat you joined when you bought them.

Traction

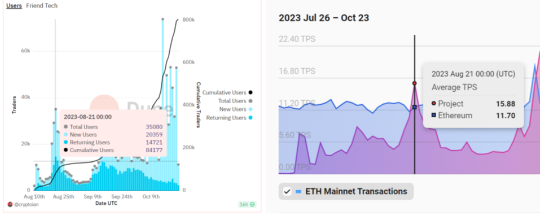

As of October 10th, on its 2nd month live, Friend Tech had made over US$ 21MM in revenue. As discussed before, the protocol earns 5% from every transaction in its ecosystem, meaning total trading activity was +US$400MM

Source: Ally Zach on X

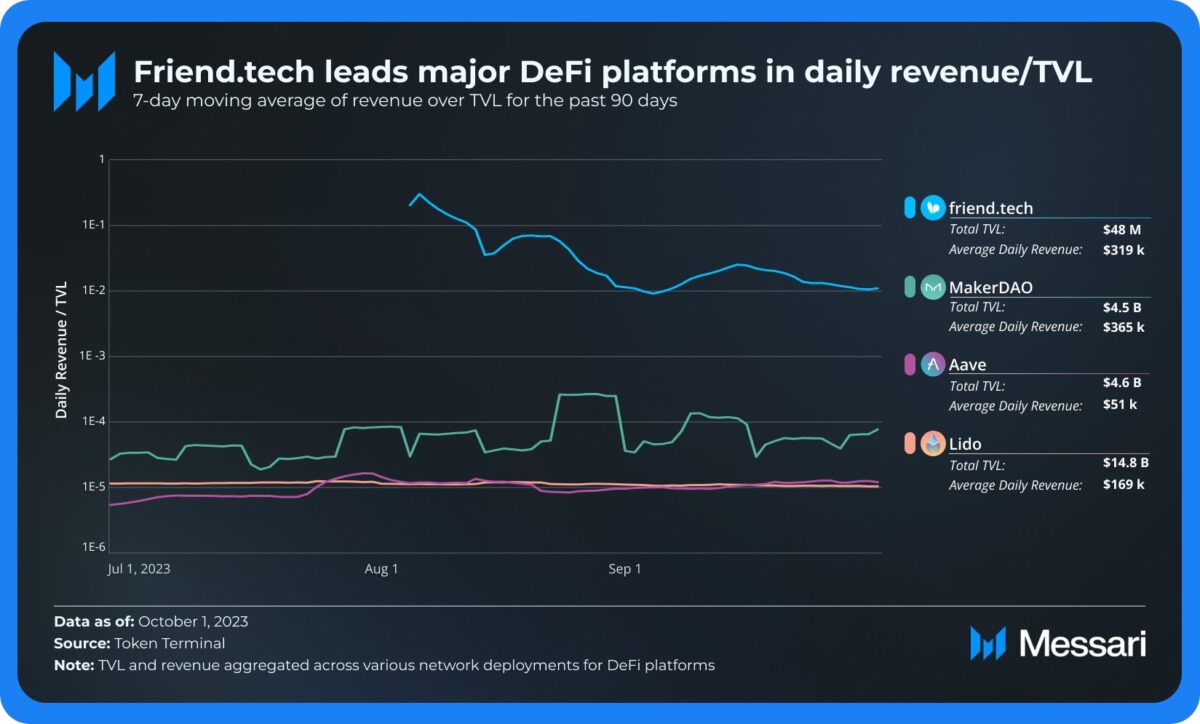

FT’s Average Daily Revenue even topped major OG DeFi platforms, as seen in this graphic by Messari. What made this more impressive was the fact that Friend Tech achieved these metrics in the depths of the bear market.

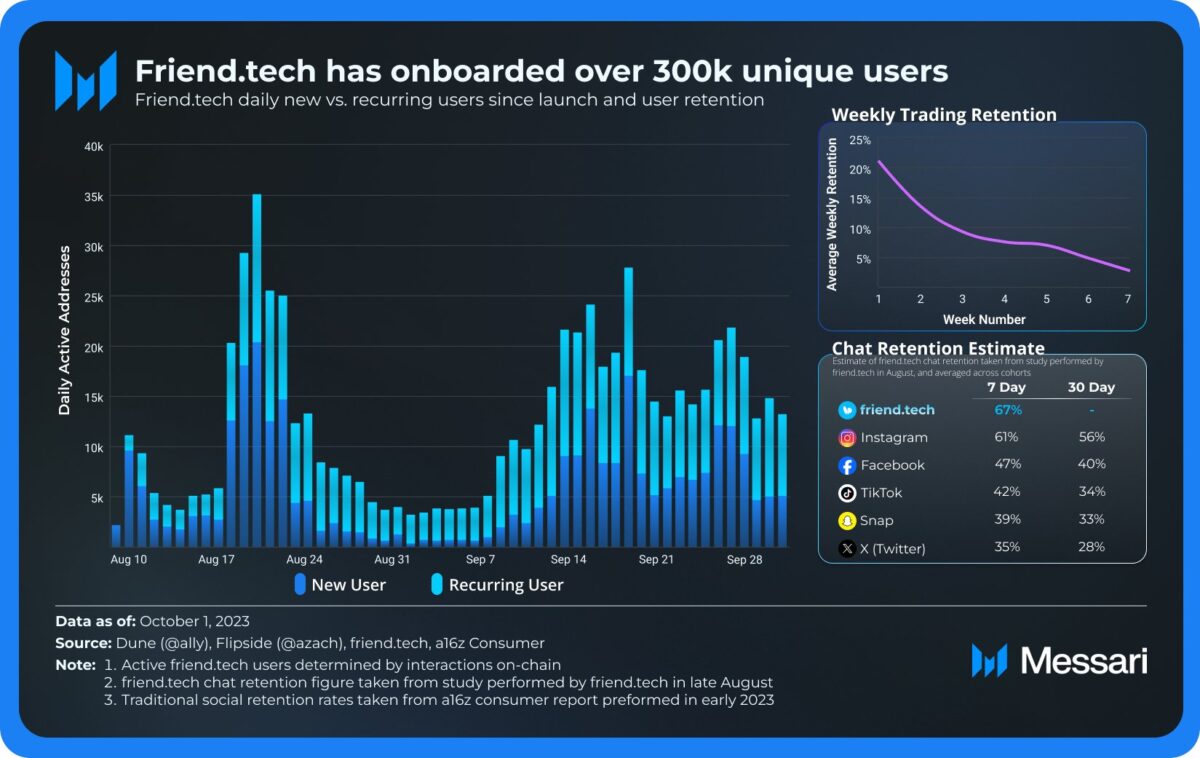

Apart from strong revenue growth, FT has also seen an impressive influx of users, onboarding +300K unique accounts in less than 2 months. According to Messari, although the chat retention numbers might be decreasing (this is something normal in traditional social media), Friend Tech’s chat retention still surpasses its Web2 competitors, at least in the early days of the platform.

Source: Ally Zach on X

According to the team, users are going back to the app to actually check their chats and spend 30 minutes hanging out. Indeed it appears that the social layer is working as intended.

Funding

As announced in their twitter profile, Friend Tech secured their Seed Round with Paradigm, a major crypto VC fund. Not much has been officially disclosed about the valuation or the specific amount, but it was enough to drive the resurgence of interest from users that led to a new all-time-high in terms of active users (as seen in the last graphic).

Source: Friend Tech’s profile on X

Friend Tech Token and Weekly Airdrops

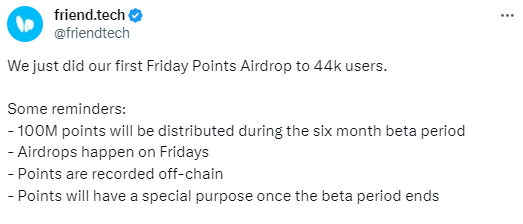

On the same day of the funding announcement, the platform started its Friday Points Airdrop. As it has clarified, these points are off chain, and no information has been shared on what they are going to be used for. Expectations, however, are that they get converted into a future platform token.

With over 44k users in its first week, the airdrop program is expected to end after the end of the beta period, six months after its start in August. The exact amount of points each user can get and the mechanisms behind are still unknown.

Source: Friend Tech’s profile on X

Friend Tech is Based

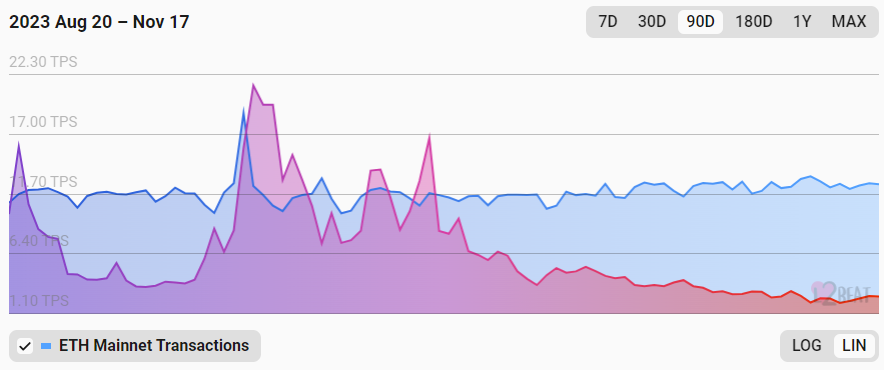

Friend Tech has been built on Base, and the surge in its activity has been high enough to impact the underlying settlement layer.

As new users came to try the platform for the first time, they had to bridge funds to Base Chain, and send funds to a fresh wallet created on the dapp, and even buy some Keys in order to get to try the app. It was all the push Base needed to even surpass Eth Mainnet for the first time, and of course, reign over other L2s in terms of TPS.

This impact was big enough to gather attention from other chains, who were quick to realize the potential that SocialFi could have for their own ecosystem’s success.

Rise of the Clones

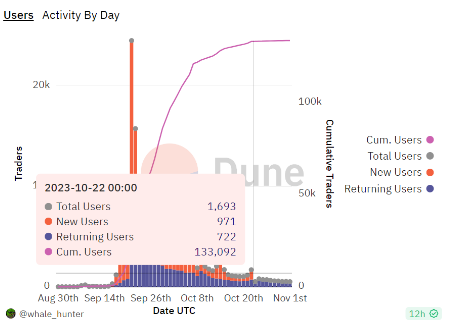

As is the case with most successful crypto applications, it wasn’t long before a wave of similar apps started emerging across multiple chains. Post Tech for example launched on Arbitrum, featuring a compensation given to users who not only collect social tokens, but also those creating content and interacting socially with anyone on the dapp, with “epoch” airdrops that compensate the most engaged. The project, however, hasn’t been able to maintain its users, as seen in this graphic:

The rush to find the next version of Friend Tech on a wide variety of ecosystems can be understood if on-chain activity on the original version is taken into account. As we have seen, a successful “fork” could bring more active users than an OG DeFi protocol on nascent ecosystems.

SocialFi is hot again because of the promise of network effects, the result of having an engaged user base coming back every week and spending their money not once, not just for pure speculation, but regularly, for fun and connection.

The Outlook for SocialFi

It’s been a long time since the early days of Bitclout. And it’s easy to forget that Friend Tech is not even 3 months old at the time of this writing. While FT is at the moment one of the most successful SocialFi in Web3 with undeniably remarkable metrics, in our opinion the challenge is for the platform to sustain them in the long run, and continue having users engaged.

And as this thread from a former Bitclout employee described, the formula behind Friend Tech inherits lots from its predecessor, and so challenges are expected to be similar.

While FT User engagement has already fallen and risen following waves of speculation around the airdrop of the platform. It’s too early if the strategy around doing weekly airdrops is going to prove effective, or what happens afterwards. But at least these first weeks of experimentation prove to be a nudge in the right direction to revive user interest in coming back to FT, or trying it for the first time

As the SocialFi space continues to experiment with new platforms and strategies, it is worth keeping an eye on the metrics that indicate hints of possible paths to sustainability. Whether Friend Tech or another dapp discovers how to keep users engaging and consuming, one thing is certain: SocialFi has proved the impact it can have, making its place as one of the most promising verticals in crypto

This article has been written and prepared by Renato Martinez and GCR Research Team, a group of dedicated professionals with extensive knowledge and expertise in their field. Committed to staying current with industry developments and providing accurate and valuable information, GlobalCoinResearch.com is a trusted source for insightful news, research, and analysis.

Disclaimer: Investing carries with it inherent risks, including but not limited to technical, operational, and human errors, as well as platform failures. The content provided is purely for educational purposes and should not be considered as financial advice. The authors of this content are not professional or licensed financial advisors and the views expressed are their own and do not represent the opinions of any organization they may be affiliated with.