Creating Sustainable Web3 Gaming Economies

Finding the perfect business model for Web3 gaming has been a tremendous task that still remains unresolved. The Play-to-Earn experience failed miserably, giving rise to a new contender: Play-to-Own. This model promises to seamlessly integrate Web3 technologies into games while providing benefits for both players and developers. With several games now embracing it, let’s explore the challenges Web3 gaming economies face and determine if Play-to-Own lives up to its promises.

How Are Play-to-Own Economies Currently Designed?

Play-to-Own (P2O) games typically embrace a free-to-play model, emphasizing the acquisition of in-game assets through gameplay rather than direct purchases. These assets are uniquely represented as NFTs on the blockchain, granting players complete ownership. Should players choose not to utilize these assets personally, they gain the freedom to engage in trading activities on various marketplaces.

The underlying vision of P2O is to establish a player-owned economy, shifting the dynamics of trading from primarily occurring between developers and players in traditional gaming to taking place directly between players themselves. As a result, the revenue streams for companies predominantly derive from trading activities and royalty fees, rather than relying on direct sales.

Play-to-Own vs. Play-to-Earn

Play-to-Own games like Skyweaver promise a new paradigm. Source: skyweaver.net

Play-to-Earn provided developers with a clear and straightforward business model, centered around the sale of NFT assets. In Play-to-Own games, revenue streams are not as straightforward. The underlying theory assumes that players will trade in-game assets among themselves, allowing developers to generate income through trading activities and royalty fees. However, the reality is that achieving sufficient revenue solely through this method can pose considerable challenges.

What Problems Do Web3 Gaming Economies Face?

The secondary market doesn’t have enough trading volume

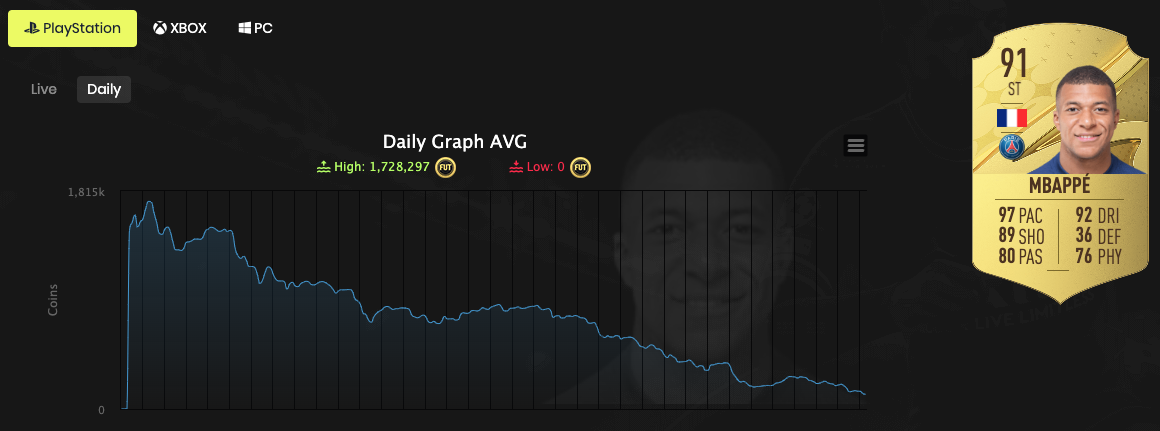

The secondary market could potentially generate substantial revenue, particularly if trading is central to the game’s economy, as exemplified by FIFA Ultimate Team. Numerous gamers in FIFA Ultimate Team engage in player trading akin to stock markets in order to amass more FIFA coins and acquire superior players for their teams. There are YouTube channels boasting well over 600,000 Subscribers and websites providing statistics and price histories exclusively dedicated to trading players in FIFA Ultimate Team.

Average daily price of Kylian Mbappe in FIFA Ultimate Team. Source: Futbin.com

Conversely, if trading is not integral to the game, the generated revenue may be considerably lower. The latter scenario is often the default assumption. For instance, with a 5% fee structure, any item would need to be traded 20 times to generate equivalent revenue to selling it once. The likelihood of every asset being traded 20 times at the same rate as a single sale is improbable in most games.

Based on my experience in constructing financial models for Web3 games, it becomes clear that for most Web3 games to be economically viable, additional revenue sources beyond fees on trading earned assets are essential. These supplementary revenue streams could stem from additional primary sales, a deliberate focus on fostering a thriving trading economy, or by leveraging Web3 technology to capture value through alternative means. We’ll discuss these possibilities later in this article.

Trying to monetize the wrong users

The Play-to-Own model, where players earn NFT assets through gameplay and trade them on the secondary marketplace, often leads to an unintended consequence of trying to monetize the wrong audience. In free-to-play games, a small percentage of players, typically ranging from 1% to 5%, are the ones who make in-game purchases. These are the players who tend to invest a significant amount of time and achieve high ranks on leaderboards. In contrast, most casual players are content with enjoying the game without spending money on in-game transactions. In Play-to-Own games, where in-game assets are earned rather than bought, this creates a situation where the dedicated players who usually are spending on in-game purchases, unlock the most assets and thus won’t buy any, while the casual players who aren’t willing to spend are the ones that should create the trading volume. This dynamic results in a lack of demand for assets on the secondary market and low transaction volume.

What Solutions Are Possible?

Exclusive cosmetic content

One effective solution to address these challenges is to sell exclusive cosmetic content that cannot be unlocked through gameplay. Players who invest significant time and hold high rankings in the game often value their in-game appearance. By providing exclusive skins or cosmetic items that can only be acquired through direct purchases, game developers can target the players who are usually willing to spend. Fortnite and Counter-Strike serve as excellent examples of this strategy. Fortnite has generated an average of $5.2 billion annually between 2018 and 2022 with one skin alone netting $50 million. The secondary market for Counter-Strike skins boasts prices exceeding $100’000, while Valve is racking up $54 millions per month by selling CS:GO cases. Despite offering no actual gameplay advantages, players in both games spend substantial amounts of money on skins and other cosmetic items. Both Fortnite and CS:GO are among the most successful games of the past decade, making it challenging for any Web2 or Web3 games to achieve comparable numbers. Nevertheless, these games serve as compelling case studies, illustrating that players are willing to make significant expenditures on skins and other cosmetic items if they thoroughly enjoy playing a game.

Introducing seasonal skins that are available for a limited time can be an especially great option for Web3 games, as this creates a sense of urgency for primary sales and later stimulates secondary trading as players seek access to older, rare skins.

Gamers pay up to $150,000 for this AWP skin. Source: ggrecon.com

However, striking the right balance is crucial. Developers must carefully manage the release of new content to maintain player excitement and drive revenue, while avoiding an excessive flood of content that could devalue previously released items. Finding this delicate equilibrium can be challenging.

Although similar issues are faced by Web2 games that allow in-game asset trading among players, the key difference is that the impact of assets losing value is limited to in-game currency rather than real money. Nonetheless, Counter-Strike has demonstrated that when the balance is well-maintained, a healthy secondary market can develop, with rare skins commanding staggering prices.

By leveraging the appeal of exclusive cosmetic items, Play-to-Own games can create incentives for players to spend money, driving revenue and fostering a thriving secondary market.

Let NFTs capture the value of time spent on the game

In games with a progression system like World of Warcraft, players invest a significant amount of time in developing their characters. Max-level characters equipped with great gear hold substantial value, as evidenced by the trading of World of Warcraft characters on platforms like eBay, despite Blizzard’s banning policy. This is because some players, unable or unwilling to dedicate the immense time required, prefer to purchase pre-leveled characters to save time.

Sought-after items like the “scarab lord” made accounts very valuable. Source: topwowaccount.com

With the advent of Web3 technology, developers can capitalize on this player behavior by enabling a player-to-player economy where players can provide grinding as a service to others. As max-level characters demand a premium compared to level 1 characters, the turnover rate of in-game assets mentioned earlier can be significantly reduced. For instance, in a Web3 game, base characters may be sold for $10 each but trade at $100 when fully maxed out. Instead of 20 trades, only 2 trades would be necessary to achieve revenue equivalent to a single sale through trading fees. If said character is traded a third time, the developer’s revenues would already increase significantly. This win-win scenario benefits the developer, the seller who earns money for their efforts, and the buyer who saves time by acquiring a maxed-out character without the need for tedious grinding.

Additionally, Web3 technology opens up opportunities for value creation through special skins earned for achieving specific milestones. For example, in a card game, a card that has been involved in 200 wins could acquire a golden skin, and after 400 wins, it could turn into a diamond version. Although the card’s power remains the same, its new and exclusive appearance adds value to the card on the secondary market.

These examples highlight the potential of Web3 technology in creating value and incentivizing player engagement by providing alternative paths for progression and customization. By embracing player-to-player economies and introducing unique rewards tied to achievements, game developers can enhance the gaming experience, drive revenue, and offer players more flexibility and options for their in-game journey.

Monetizing user-generated content

Fostering user-generated content presents a significant opportunity for Web3 gaming. Games like Minecraft grant players the freedom to construct their virtual worlds, from elaborate structures and landscapes to intricate contraptions. Taking this creativity to the next level, vibrant modding communities have emerged, developing modifications (mods) that introduce fresh gameplay features, visual enhancements, and custom content. This trend extends beyond Minecraft, with games like Skyrim, Civilization 5, and XCOM2 and many others boasting thriving modding communities. Additionally, in games such as Need for Speed or Forza, players invest substantial time into cosmetically tuning their cars, essentially crafting unique skins to personalize their rides. Leveraging Web3 technology, there are numerous avenues to benefit both developers and players, from facilitating and monetizing such collaborative content creation.

- NFT Marketplace for UGC: Game developers can create an NFT marketplace where players can mint and sell their own UGC as NFTs. This can include in-game items, skins, artwork, music, or even custom levels or quests. Players can retain ownership of their creations and earn royalties whenever their NFTs are sold or traded. Developers can earn a commission from each transaction, fostering a symbiotic relationship where both players and the company benefit from the UGC marketplace.

- Royalties for UGC Contributions: Game developers can implement mechanisms that allow players to contribute UGC directly to the game, with the creators receiving ongoing royalties whenever their content is used or accessed by other players. This can apply to in-game assets, character designs, or any other form of UGC. NFTs can serve as the underlying mechanism to track ownership and automatically distribute royalties to creators.

- Collaborative NFT Projects: Companies can engage players in collaborative NFT projects where multiple players contribute to the creation of a unique and valuable NFT. This can involve collaborative artwork, game modifications, or storytelling initiatives. The resulting NFT can be sold or auctioned, and the revenue can be shared among the contributing players and the company.

Minecraft is famous for its modding community. Source: Nintendo

Overall, the combination of NFT technology and UGC monetization has the potential to reshape the relationship between players and game companies, fostering a more collaborative and inclusive gaming ecosystem and create additional revenue streams.It empowers players to become active participants in the game’s economy and content creation process, enhancing overall player satisfaction and extending the lifespan of the game. By tapping into the power of UGC and leveraging Web3 tech, developers can foster a thriving community, drive revenue, and blur the boundaries between player and creator.

Stick to Web2 business models

While it may not align with the aspirations of ardent Web3 enthusiasts, it is essential for gaming studios to genuinely question whether their game truly benefits from Web3 technology. In cases where leveraging Web3 technology provides limited benefits for both developers and players, a traditional Web2 gaming business model may be better suited. It is crucial to objectively evaluate the feasibility and suitability of implementing Web3 in gaming, acknowledging that it may not be the optimal solution for every game.

Conclusion

The advent of Play-to-Own economies has undoubtedly enhanced the gaming experience for players, bringing the Web3 gaming industry closer to the gaming community. However, it also presents a substantial challenge for game developers. The ability for players to earn and trade in-game assets directly impact developers’ sales and revenue streams. To address these challenges, games must discover ways to naturally stimulate trading volume, ensure the long-term value appreciation of NFTs, or tap into the power of user-generated content. It is important to acknowledge that not every game can effectively embrace these options, and some may find more success by adhering to established Web2 business models. Nevertheless, for games capable of leveraging these possibilities in an organic and mutually beneficial manner for players and developers, an exciting new horizon awaits. Web3 technology holds immense potential for the gaming industry to thrive and evolve.

This article has been written and prepared by Lukasinho, a member of the GCR Research Team, a group of dedicated professionals with extensive knowledge and expertise in their field. Committed to staying current with industry developments and providing accurate and valuable information, GlobalCoinResearch.com is a trusted source for insightful news, research, and analysis.

Disclaimer: Investing carries with it inherent risks, including but not limited to technical, operational, and human errors, as well as platform failures. The content provided is purely for educational purposes and should not be considered as financial advice. The authors of this content are not professional or licensed financial advisors and the views expressed are their own and do not represent the opinions of any organization they may be affiliated with.

*****