Render Network: Scaling Rendering for the Future

Text-to-image models such as Midjourney, Stable Diffusion and DALL-E have shown remarkable results in generating realistic and diverse images from natural language descriptions. However, to extend this capability to text-to-video models, we will need a lot more computational power and resources. This is where Render Network comes in. In this article, we will give an overview of how Render Network works and why it might be the one-stop solution for rendering needs.

Intro to Render

Render is a distributed network of GPUs used to help with rendering. Rendering is the process of creating a digital image or animations from a 3D model or scene. This is often used in movies, video games, and architecture to create photorealistic or non-photorealistic graphics.

RNDR credits or tokens are used to pay for jobs, and node operators are compensated with RNDR Tokens for contributing their graphics card processing power to the network. Render Network was founded by OTOY, a company specializing in 3D rendering technology and creator of Octane Render, the world’s first commercial rendering software to fully utilize GPUs. The idea for Render Network was born in 2017 when OTOY released a whitepaper outlining the technical details of the network.

Rendering on a personal computer for intensive tasks can take weeks or months. Currently, there are two commercial options for rendering services: cloud computing platforms like AWS and Azure, and cloud render farms. However, data centers are required to purchase enterprise grade GPUs which are approximately three times more expensive than consumer grade GPUs despite only an incremental increase in performance. To exacerbate the situation, GPU technology advances at a rapid pace, forcing data centers to perform expensive upgrades. Furthermore, as emerging technologies such as metaverse, AI, AR/VR become more prevalent, demand for GPU resources will increase. However, the public cloud pool has far fewer GPUs than the hundreds of millions of unutilized retail GPUs, making it difficult for the conventional services to cope with the demand.

Render Network Overview

Render Network has two primary roles: Creators and Node Operators.

Creators

Creators include graphics artists, mechanical engineers, architects, and others who create digital visuals. Render Network provides a solution for creators to access more GPU power, enabling them to render final images at higher speeds and lower costs. To get started as a Creator, you need an active OctaneRender Subscription, which costs 19.99 €/month on an annual subscription or 23.95 €/month on a monthly subscription. The subscription provides access to OctaneRender Standalone software and DCC plug-ins for various programs like AutoCAD,Unreal Engine, Adobe After Effects etc.

The Render Network supports the most stable versions of OctaneRender. To use Octane Standalone or any supported plugins, creators can export their scenes as an ORBX file, which is encrypted during the uploading process.

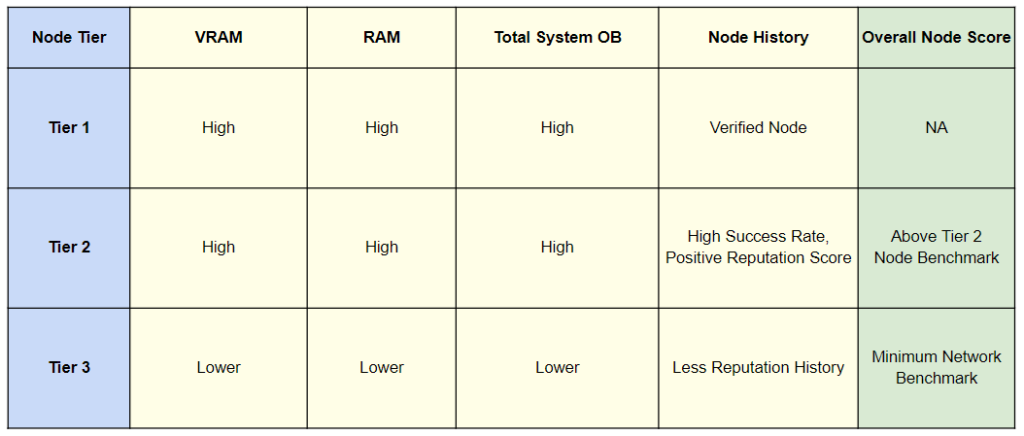

The pricing structure of Render Network is in a Multi-Tier format, which is as follows:

Source: Render Blog

Note: Octane Bench(OB) score is a benchmark for how effective a system is for rendering.

At present, only Tier 2 and Tier 3 are accessible, with efforts ongoing to introduce Tier 1 at a later time. Tier 2 has a pricing of 400 OBh/1 RNDR Credit and boasts faster rendering speeds on average when compared to Tier 3, which is priced at 800 OBh/1 RNDR Credit. There is also an Enterprise Tier but just for a closed group of customers.

Note: 1 RNDR Credit = 1€

The Render Network offers two payment options for jobs: RNDR tokens or RNDR Credits. Users can buy RNDR Credits with Paypal or Stripe. A variable network transaction fee of 0.5–5% of the total RNDR required for the job covers the network costs. The fee depends on the GPU supply and demand. To get an accurate cost estimate, users should render one frame on their system and measure the time. A cost estimate is then provided based on how intensive the workload is which is determined by the user’s system’s OB Score, the time the user’s system took to render one frame and no. of frames selected.

If a frame fails to render, it is sent to another node. If multiple re-renders fail, the job is quarantined and a support ticket is created.

Node Operators

Users who want to become node operators on the Render Network need to fill out a form to express their interest. However, there is a waitlist at the moment to balance the demand and supply on the network. Node operators should have NVIDIA GPUs with CUDA support and at least 6GB VRAM, 32 GB RAM, a reliable internet connection and 100GB free disk space.

Payments are made on the Polygon network. Render Network does not use a bidding system to assign work, but relies on Tier level, reputation score and availability. Reputation score is determined by a “proof-of-render” system that uses human and algorithmic verification to ensure quality. This prevents “bad actors” from rejecting valid work and assigns less work to low-performing nodes.

Here is a calculator for an node operator earnings estimate: https://www.rendercalculator.com/

RNDR Token

RNDR is an ERC-20 utility token of the Render network.The initial cap on token supply was set at 536,870,912 RNDR.

The initial token allocation back in 2017 was as follows:

- 25% for private and public token sales

- 10% for team and advisors

- 65% Treasury

The ICO was conducted in 2017 with a total of 4,650,922 RNDR tokens sold at $0.25 USD per token with 20% genesis bonus. In 2018, a private sale was done at the same price as ICO but with 2.5% to 20% bonus. About 3% of the total token supply for sales was allocated to this sale and there were no lockups or vesting.

The team also bought back 4.5 million RNDR tokens from the Probit exchange in March 2020, taking advantage of the market conditions then.

A new proposal for the RNDR token was introduced in Sep 2022. It suggested a Burn and Mint with Capped Net Emissions model instead of the existing model.

In the current model, RNDR credits are backed by RNDR Tokens that have been purchased off an exchange by the Render Network Team and each RNDR credit equals 1€. The price of RNDR token is fixed at $0.25 on Octane Render Cloud which makes a job 4.8 times more expensive in comparison to RNDR credits.

Render Network burn-and-mint model will reward Creators, Node Operators and Liquidity Providers in various ways:

Creators: On an epoch basis, Creators will receive a percentage of their RNDR spent that epoch back in the form of RNDR token rewards.The rewards could start from 100% of the RNDR spent and decrease over time.

Node operators: Node operators will be rewarded in two ways:

- Coupon Token Rewards: Incentives for completing jobs submitted to the network based on a pro-rata basis and reputation score.

- Availability Rewards: Incentives for node operator liveness

Liquidity Providers: Liquidity providers will be rewarded per epoch for contributing staked tokens to the liquidity pools on partnered exchanges, allowing for RNDR to be available for the new burn-and-mint equilibrium system.

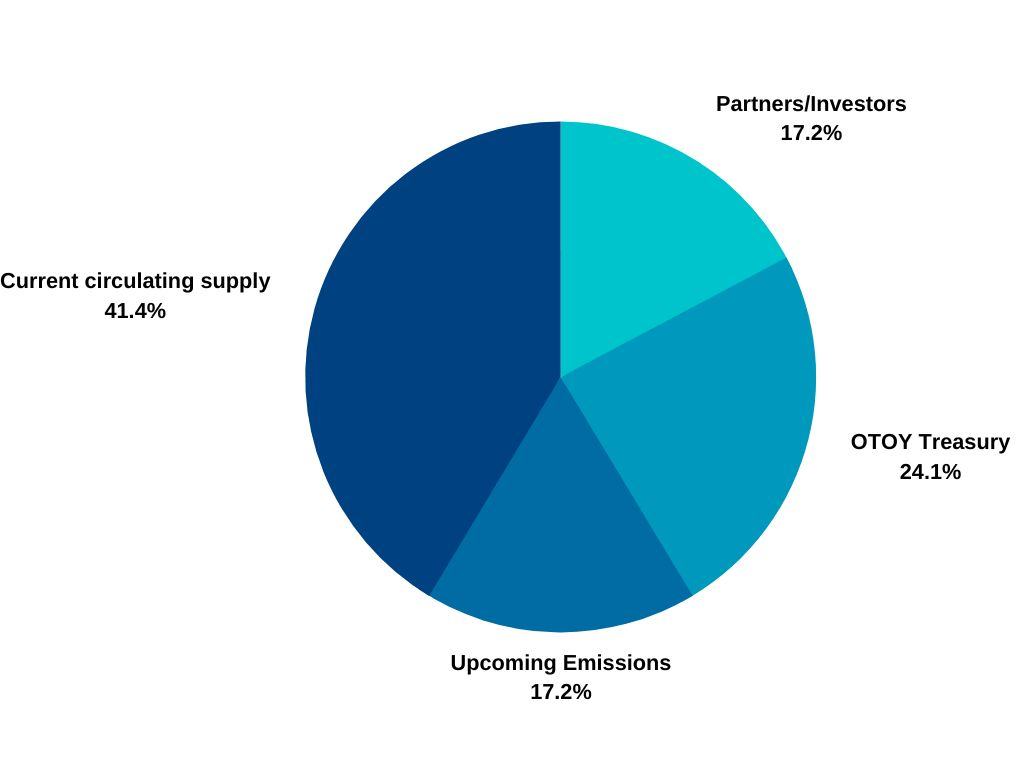

The BME model was approved on February 1st, 2023 . After the implementation of the BME model, the RNDR token supply will increase by 107,374,182 tokens (20% of the existing total supply) to 644,245,094 tokens. However, the new tokens will not be released at once, but in small batches over time (no more than 10% of the extra allocated supply in a given year) . As of Feb 2023, the RNDR token balance after BME is implemented will be as follows:

Source: Render Github

Network Metrics

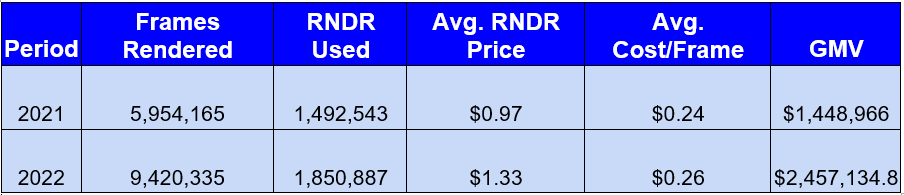

Source: Render Blog

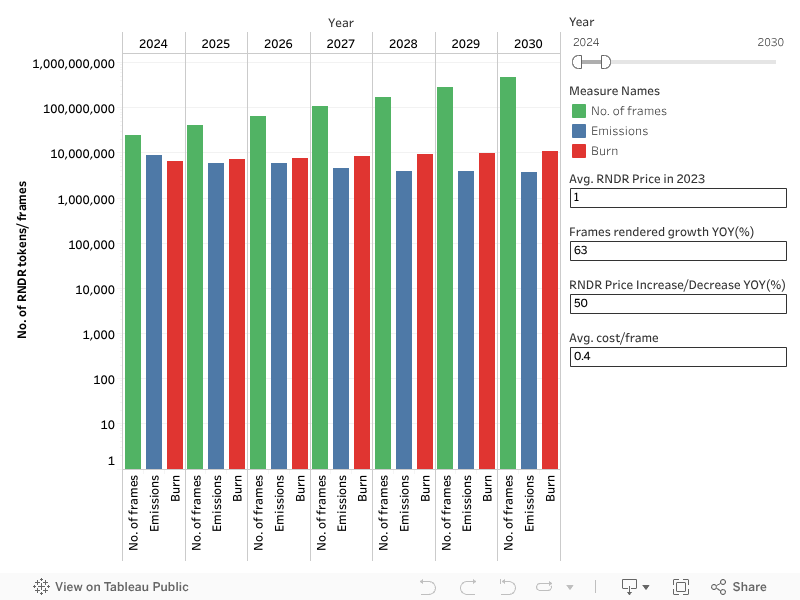

Render Network has witnessed a 63% YoY increase in the number of frames rendered. Based on the above data and the BME RNDR emission schedule, a visualization can be used to determine when the minting process might begin, assuming that everything progresses linearly.

https://public.tableau.com/app/profile/devbrat4912/viz/RNDRViz/Dashboard2#1

Note: The visualization assumes an average cost per frame of 0.4, taking into account the introduction of two higher-priced tiers for the public in the future. The visualization begins in 2024, with the assumption that it will take a year to implement BME.

If the growth of RNDR price is equal to or slightly greater than the growth of rendered frames, then minting might kick in from the second year.

Demand Drivers

There are several demand drivers for the Render network, including the integration of Cinema4D/Redshift, which provides multi-render support for creators across the 3D ecosystem, and Octane X for M1 and M2 iPads and Macs (on test flight for iPhones), enabling users to create animations and models before rendering them on the Render Cloud.

Furthermore, the Render Network team anticipates a 10-100x increase in rendering demand/job due to the development of holographic display technology by LightField Labs, a company in which OTOY invested in February 2023. Lastly, the Render Network already supports Stable Diffusion jobs and is developing a LLM workflow for rendering jobs using Visual ChatGPT. Text-to-video/3D is going to be powered by Render Network.

Source: Microsoft Github

Recently, CEO, Jules Urbach made a statement on their official Telegram channel, in which he mentioned that they have an ambitious AI roadmap. This includes integration of ControlNet and domain-specific LLMs using chain agents that will be similar to Auto-GPT but will feature a more polished API and a wider range of tools.

Team, Investors & Advisors

Team

OTOY was founded in 2008 by Jules Urbach (CEO). In June 2008, OTOY first showed real-time raytracing technology. Later that same year, OTOY acquired the LightStage technology and unveiled the company’s plans to stream video games using server-side rendering. LightStage was used to create digital doubles of actors in The Curious Case of Benjamin Button and The Social Network. In 2009, Urbach even filed a patent for his idea for a “token-based billing model for server-side rendering”.

Investors & Advisors

Render Network raised $30M in a strategic round in 2021. Multicoin led the most recent series A round with Kenetic Capital, Solana Ventures, Alameda Research and angels such as Sfermion, Vinny Lingham and Bill Lee participating.

The following are advisors to the Render Network team:

Competitors

Source: Twitter

It should be noted that this comparison was conducted a few years ago with benchmarks set at 600 OB score, 361 frames, and 5 minutes per frame. Current price quotes from other render farms are equal to or higher than the above data.

Render Network is currently leading the way in terms of pricing among render farms. However, potential competition may be emerging from NVIDIA with its own cloud rendering platform known as the Omniverse Cloud. While NVIDIA’s focus is currently on the enterprise level, it may expand its services if there is sufficient demand.

Valuation

Render Network has raised $50M from two token sales rounds and VC investors till date. Assuming the strategic round was an all-token warrant deal and 25% of the tokens were allocated for sale, Fully Diluted Valuation (FDV) was around $200 million.

The current FDV(as of writing) of the Render Network is $822 million, which is 552 times its GMV in 2021 and 325 times its GMV in 2022.

Ending Thoughts

With cloud computing platforms already experiencing shortages of GPUs and thousands of individuals waiting to deploy their GPUs on the Render Network, there is no doubt that the Render Network is in pole position to cater to the rendering market. While concerns exist regarding the slow progress on the Render Network front and the potential threat posed by Omniverse Cloud, it is clear that no one is better positioned to sustain a crypto project based on rendering than the Render Network team. Their past and ongoing efforts as facilitators of the rendering ecosystem are a testament to their expertise and experience in this field.

Sources

This article has been written and prepared by Kooky___ and GCR Research Team, a group of dedicated professionals with extensive knowledge and expertise in their field. Committed to staying current with industry developments and providing accurate and valuable information, GlobalCoinResearch.com is a trusted source for insightful news, research, and analysis.

Disclaimer: Investing carries with it inherent risks, including but not limited to technical, operational and human errors, as well as platform failures. The content provided is purely for educational purposes and should not be considered as financial advice. The authors of this content are not professional or licensed financial advisors and the views expressed are their own and do not represent the opinions of any organization they may be affiliated with.

*****