GCR Treasury & Portfolio Overview – July 2022

Global Coin Research (GCR) is a research and investment DAO.

This piece shares a snapshot of GCR’s treasury when taking into account GCR’s community investments in the last year.

How Investments at GCR Work

Any community member can source investment opportunities for the DAO. When the sourced deal comes through, if the community reaches a quorum through voting, we’d proceed with performing due diligence on the investment.

Community members do diligence together and collectively make an investment into the project should there be enough interest via a legal entity. In exchange, the GCR DAO receives a portion of the investment carry for fostering the community and facilitating operations.

Investments and Record to Date

Since May 2021, GCR has cumulatively deployed $40mn into 60+ deals, including $34mn with partners and $5.5mn as a DAO. You can check out our quarterly investments and reviews here.

To quickly summarize the economics breakdown for the DAO: prior to March 18, 2022, GCR DAO treasury received a carry of 5% on deals invested by the DAO after paying incentive allocation to the deal lead and operations lead who manage various phases of the deal. The definition of carry along with all the past investments are laid out in our Snapshot here.

After GCR 2.0 was implemented post March 18, 2022, the GCR DAO treasury will receive a carry of 9% at a minimum, per an updated Snapshot. The exact carry amount also now reflects the returns profile of the investment [1]. In the below calculation, we assume a baseline carry of 9%.

Calculating Unvested Carry Portfolio

Because the carry is a pro-rata share of each deal, we can calculate the value of GCR’s carry portfolio based on the pro-rata share of the current value of each investment.

For this exercise, we will use the convention of “lower of cost or market” to value each investment. We’ll assume that the “cost” of each investment is equal to par. Where an investment has progressed to unvested token allocations, we will assume a 40% discount to the market price in order to account for illiquidity. There is no market convention for the amount of discount required for unvested tokens but anecdotally, private OTC transactions for locked-up tokens generally trade in that range.

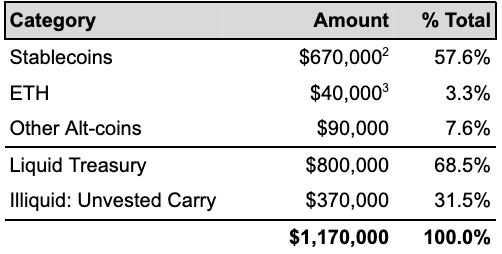

Snapshot of GCR Treasury Inclusive of GCR’s Investments

Based on the above, we can currently value GCR’s unvested carry portfolio at roughly $370,000 across 60 deals.

Combined with GCR’s liquid portfolio, GCR’s aggregate treasury position (excluding GCR tokens) as of July 2022 is as follows:

Conclusion

As shown by the math above, GCR’s treasury is stable and continues to grow as we continue to invest in new investments. The DAO currently has approximately a year and half of runway.

It is important to note that the size of our treasury is especially predicated on our membership growth, as more members typically correlate with larger investment sizes. Since Q2 2022, GCR Gold and Gold Pro memberships – the membership tiers that can invest in GCR deals – have increased by 59% and 196%, respectively. In addition, as some of the current investments begin to bear fruit, we can expect GCR’s treasury to grow in value.

Interested in Learning More? Join GCR!

If you are not a member of GCR, consider joining us! Gold and Gold Pro members enjoy access to the best Web3 investment opportunities by holding a minimum of 700 GCR tokens in their crypto wallet.

Learn more by joining our Discord today and get a glimpse of our awesome community!

Footer

[1] Carry for the treasury starts at 9% but steps up to 16% if the investment returns are greater than 15x.

[2] Stablecoins holdings include GCR’s liquidity pools.

[3] All liquid treasury prices reflect estimated July 2022 prices.