Range Tokens – Crypto Equivalent of Convertible Debt Bonds

Primer – Range tokens enable DAOs or nascent projects to use the native token as collateral to borrow funds. At maturity, if the debt is not paid, the range token holder is compensated with an equivalent amount of the collateral (the native token) using the settlement price of the native token to determine the number of tokens.

To understand Range Tokens, we must revisit the concept of convertible debt in traditional finance.

What is convertible debt?

Convertible Debt/Bonds are hybrid investment instruments that combine the features of stocks and bonds.

Stocks represent partial ownership or “equity” in an entity. Bonds (Debt) are loans taken out by entities to raise funds. In exchange for the capital received, the lenders receive interest on the loan amount. Investors who want less exposure to risk prefer bonds over stocks as they pay a regular fixed income and are less volatile. On the other hand, stocks are typically riskier but with higher risk come higher returns. Moreover, bondholders have protection against default as they’re paid out before stockholders.

Convertible bonds combine equity-like performance with bond-like protection. They derive reliability from bonds and profitability from stocks. They are debt instruments issued by a company with a conversion option to turn the bond into shares of the company. Convertible bonds offer investors guaranteed income in the form of interest. In addition, converting the bond into shares offers the investor potential exposure to upside equity participation.

These hybrid securities enable investors to reduce their downside risk without giving up on the stock’s upside potential. There can only be two scenarios.

If the price of the stock decreases

- No adverse effects.

- The downside is limited as the investor receives interest earned on bonds and can recoup the original investment at maturity.

If the price of the stock increases

- Upside exposure to the stock comes into play.

- Investors can reap benefits by converting the bond to stock.

Investors tend to opt for convertibles because the company pays them a fixed interest until the conversion is triggered post which they own equity in the company.

Convertible Bonds in the Cryptosphere

Before I talk about the equivalent of convertible bonds in the cryptosphere, I want to talk about UMA protocol. Please read my article to understand the protocol and its offerings better.

UMA is a highly flexible and promising project on Ethereum with solid utility and use cases. This article highlights an offering from UMA’s kitty designed for DAOs to fund their operations and diversify their treasury by allowing them to borrow funds without the risk of liquidation.

“We call this structure a RANGE TOKEN which acts similar to convertible debt in the venture capital world of traditional finance.” – UMA.

Problem

Funding in DeFi is popularized by the sale of the protocol’s native token, which has resulted in several DAOs holding more than 90% of native tokens in their treasuries. However, given the inherent volatility in the cryptosphere, diversification of a portion of the treasury to other assets outside of the protocol’s native token is imperative to mitigate risk and ensure long-term survival.

Immediate sale of native tokens has negative implications. Firstly, it prohibits the protocol from selling its token at a fair price. Secondly, in a bear market, DAOs with a considerable concentration of their native token would be completely exposed to its value, resulting in their treasury being swept clean owing to a massive downward swing in their token price.

Solution

While selling tokens at much lower prices is not the answer, one cannot deny the obligations that DAOs need to fulfill. Hence, DAOs must diversify their treasuries and optimally hedge against volatile crypto markets.

Enter Range Tokens

Range Tokens

Range tokens can be described as the convertible bonds of the cryptosphere.

In traditional finance, there are mainly three ways firms can raise capital equity, debt, and net earnings from operations. However, for the sake of this article, we’re going to focus on startups and small-scale companies. These entities tend to opt for convertibles to raise funds. This type of financing enables them to receive funds without diluting the capital structure.

Similarly, range tokens provide DAOs access to funds (in stablecoins) using their native tokens as collateral without the risk of liquidation. If the debt remains unpaid at maturity, the range token holder is compensated with an equivalent amount of the native token. The number of tokens is calculated using the collateral’s settlement price (the native token). Since DAOs are protected against liquidation, the number of tokens given to range token holders is capped. Sellers have access to a put option to convert at a minimum price. Investors/Range token holders for taking on the risk of default are compensated with a call option that guarantees a minimum number of tokens irrespective of how much the token rallies.

In summary, a range token is a debt instrument backed by the protocol’s treasury and issued by the DAO to raise funds. In this setup, a DAO doesn’t sell its native tokens; instead, it sells the right to buy it within a price range.

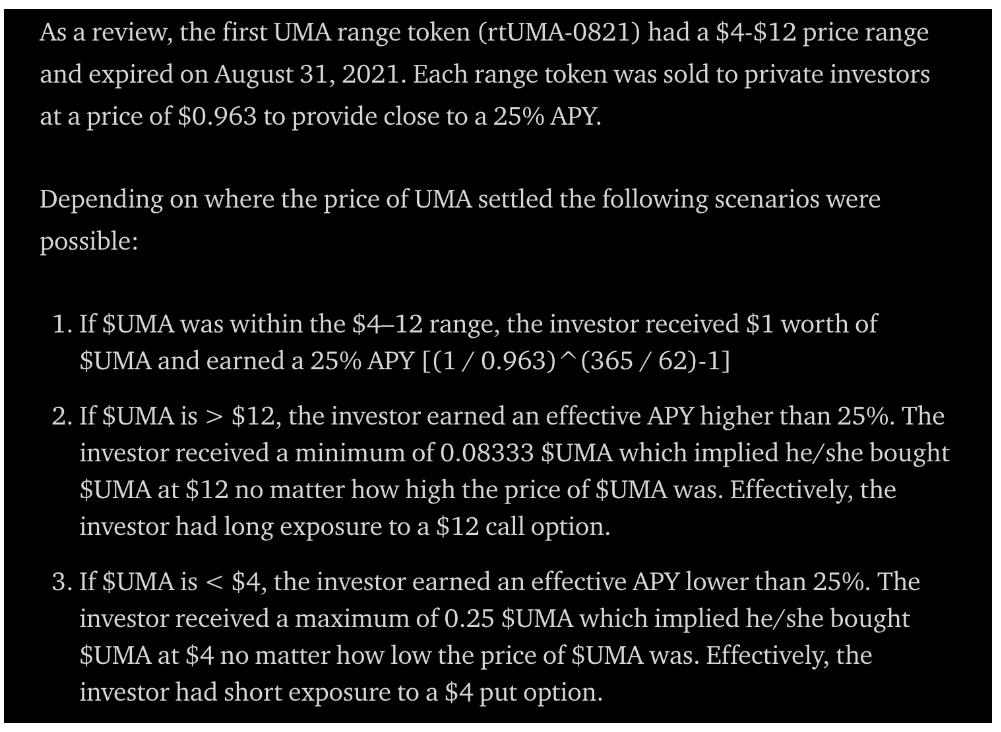

UMA minted and distributed its range token to demonstrate the tokens’ utility and structure. In the following section, we shall go through UMA’s learnings from deploying this token.

Range Tokens – rtUMA-0821

The first range token was minted on June 30, 2021, using $UMA as collateral to raise over $2.6 MM USDC.

The price of $UMA at settlement on August 31, 2021, was determined by Optimistic Oracle to be $12.954.

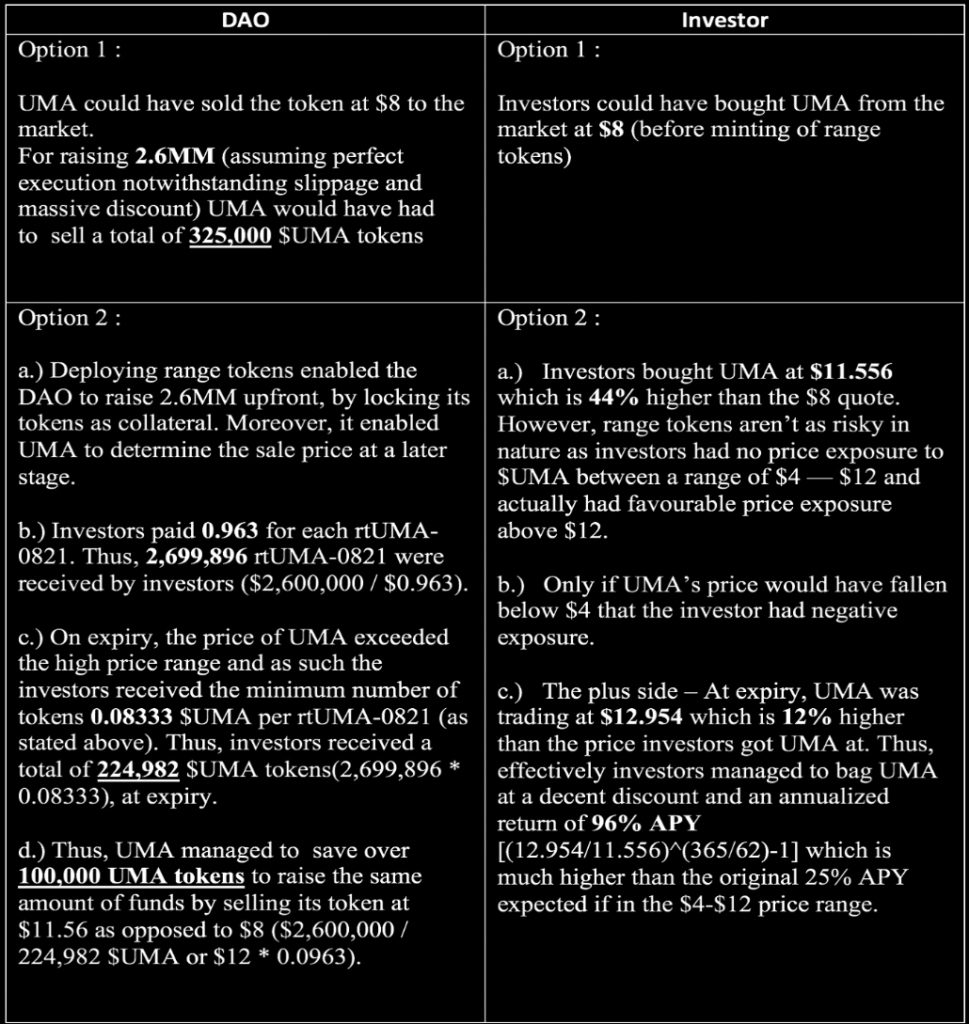

The following table lists the two options available to the DAO and Investor.

Option 1 – No range tokens issued

Option 2 – UMA range tokens issued

- It is vital to note that deployment was a success; however, it could have had the opposite effect if the price of UMA had gone down during the life of the range token.

- A disadvantage of buying range tokens (for investors) is the lack of liquidity. Due to its newness, the inexistence of a range token market poses a significant challenge.

Learnings from rtUMA-0821

Listed below are the learnings from deploying the rtUMA-0821

- DAOs were thrilled with the likelihood of raising funds without the risk of liquidation and betting on the success of their protocol.

- Feedback from investors, on the other hand, has been mixed.

- While they acknowledged the benefits associated with issuing range tokens for the DAO, they believed the structure catered more to people who were looking for a fixed yield and had a low-risk appetite.

- While some believed the range token would be more suited for later-stage investments or “blue chip” DeFi projects that have already seen a significant rise in their token price and could arguably have less volatility and upside relative to younger projects.

Conclusion

The deployment of Range Tokens enabled UMA to gather sufficient information in the form of feedback that contributed to the launch of Success Tokens. Success tokens are aimed at younger DAOs looking to build partnerships with VCs so they can leverage their resources. On the other hand, range tokens are designed for established projects, like UMA itself, that boast existing partnerships with investors.

A range token is a security blanket that protects DAOs/protocols against liquidation by limiting the collateral at risk to a fixed amount. It’s an innovative and comparatively inexpensive debt instrument that enables protocols to raise funds and diversify their treasury.

Moreover, it allows investors to lend funds to the DAO/protocol and participate in their growth in exchange for a constant dollar payout that helps offset price declines during market dips within a given price range. However, the investor is exposed to the volatility of the underlying token outside said range.

EverythingBlockchain—In pursuit of simplifying the different blocks of the chain metaverse.

Please consider supporting through donations, referrals, or following on social platforms.

Donation address – 0xe9f581e005cbB94752A96198052088F206ac73b1

Referrals

Braintrust, Presearch, Odysee, Binance, Kucoin

Socials

Substack, Twitter, Youtube, Medium, Reddit

Any or all of the information provided through this work is intended solely for educational purposes and must not be treated as investment advice. Any lapses in presenting any of the information correctly are ours alone. phentermine online arizona https://waldofleamarket.com/ buy phentermine topiramate extended-release We disclaim any liability associated with the use of this content.