Hedgey – Reinventing Derivatives for Cryptocurrency

Thanks to Lindsey Winder, co-founder of Hedgey, for comments and suggestions.

The team behind Hedgey, including co-founders Lindsey Winder and Alex Michelsen, have been deep in the DeFi space for the last five years. Global Coin Research and its community, alongside other investors, are excited to accompany Hedgey on its journey and support its growth as it is expanding its suite of options and derivatives platforms to help DAOs manage and diversify their Treasuries and enable cryptocurrency investors to generate alpha.

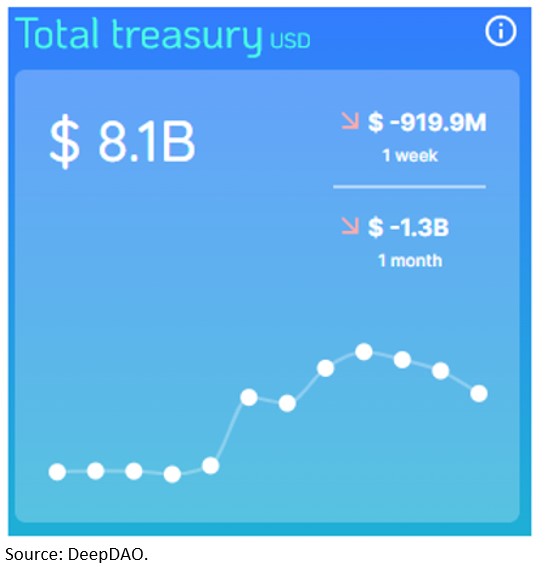

DAOs have had an incredible run in the past year, with numerous launches across a diverse range of themes. The proliferation of DAOs was also accompanied by a surge in the funds held in their Treasuries.

The recent market volatility has, however, caused a decline in the market value of DAO Treasuries, at least temporarily. This volatility raises the need for DAOs to diversify their Treasuries away from their own native tokens, in which many DAOs are heavily concentrated. However, this strategy isn’t as easy as it sounds.

This is what we will call the DAO’s Dilemma. We will outline next what this dilemma looks like and then introduce the suite of tools that Hedgey has built to solve this dilemma.

DAO’s Dilemma

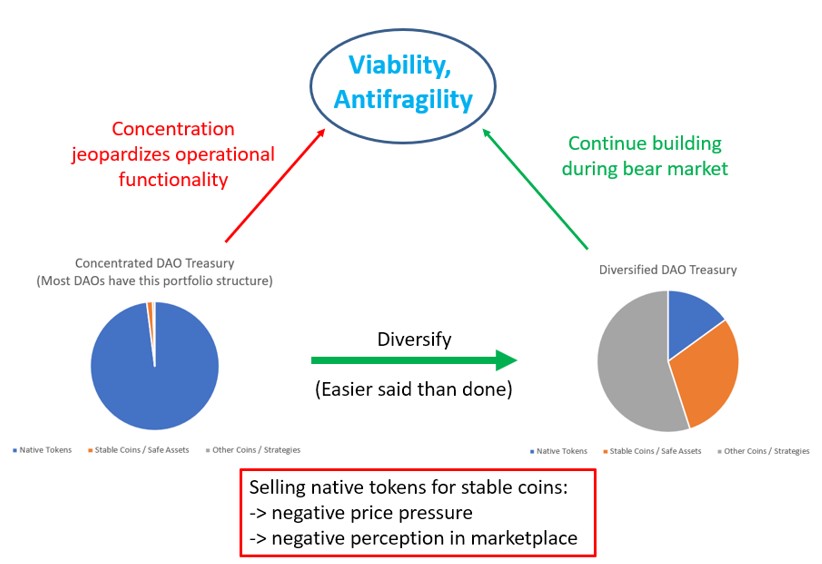

A powerful underlying feature of DAOs is that their community members are also owners. DAO contributors are typically remunerated with native tokens, which allow them gradually build equity and participate in the upside and future success of the DAO. For these reasons, DAOs must hold native tokens in their Treasuries.

At the same time, however, native tokens are exposed to both market and idiosyncratic volatility, which can adversely affect a DAO’s daily operations and long-term viability. Compensating a core group of team members with a fixed salary in stable coins becomes instrumental for the long-term success of a DAO. It is therefore crucial that part of the Treasury is diversified into stable coins.

Selling native tokens against stable coins, however, is easier said than done. DAOs face the risk that markets may not adequately absorb the supply of their native tokens due to the lack of liquidity, leading to a sharp drop in the market price of these native tokens. Furthermore, a sale of native tokens by the DAO itself can lead to a negative perception in the marketplace and among community members.

In theory, DAOs can resort to several non-disruptive strategies to raise cash in exchange for native tokens without directly intervening in the marketplace. These strategies center around the following two Treasury management strategies:

- Private token sales with long-term lock-in schedules: DAOs can raise cash by entering long-term partnerships with investors such as VCs or angel investors, exchanging native tokens at a fixed price for cash following a long-term vesting or lock-in schedule. Similarly, a DAO could raise cash from its community members following similar deal structures.

- Structured deals with options: One strategy that DAOs can pursue is allocating a small portion of their funds to systematic covered call selling against their native tokens. This strategy would ensure a steady stream of cash through upfront premia from the options sales in the form of stable coins. Given that the options markets in the crypto space are still in their infancy and lack liquidity, the premia can be calibrated to a targeted return level, perhaps something like 50-60% annualized. However, given the high-risk profile of this strategy and its poor timing of losses (this strategy typically underperforms during periods of general market stress), the scale of such a strategy is necessarily limited to a very small percentage of a DAO’s funds.

Hedgey has built a platform that allows DAOs to pursue and easily implement both strategies. The scope of these applications goes beyond the management of DAO Treasuries; the tools can be applied by all market participants in the cryptocurrency space for the purpose of alpha generation or hedging.

We’ll now discuss the economics behind the above two strategies and introduce Hedgey’s platform.

“Over-The-Counter” Swaps – With an NFT Twist

Private token sales to VCs, angels, and community members under the same deal provisions are typically “over-the-counter” (OTC). They can be implemented as an immediate transaction or with a time lock. The latter is a typical structure in which an investor exchanges his stable coins or fiat dollars for the native token at a pre-specified price after a pre-set time, often about three years. On the other side of the trade, the DAO has immediate access to stable coins to fund daily operations.

On Hedgey’s platform, DAOs and other crypto projects with native tokens can lock in an OTC deal with a range of customizable features. The underlying protocol is permissionless; all OTC deals are created, executed, and managed through audited, permissionless smart contracts. The user has the following choices to customize deals:

Public and Private OTC: Public OTC deals can be purchased by multiple people. Private deals define a designated recipient.

Time Lock: This is the optional ability to attach a lock period to sold tokens. This period can range from no time lock to 100 years.

Supported networks: The protocol is deployed across Gnosis Chain, Polygon, Fantom, Celo, Avalanche, Ethereum, and Harmony.

Flexible Pairing: Any token across the above networks can be used to create an OTC deal. Any token can be requested as payment.

One innovative aspect of Hedgey’s OTC platform is its NFT minting feature: every OTC deal that results in locked tokens automatically mints an NFT for the buyer. This NFT is unique and solely associated with the OTC deal’s specifics. The owner of this NFT is able to swap it for the locked tokens after the lock-up period ends. The NFT can then be transferred or sold. Each NFT has a unique visual PFP with attributes reflecting the parameters of the OTC deal. Some of the most important features include:

- The NFT is collateralized by the tokens it will unlock after the time lock period.

- The NFT can be resold on standard NFT marketplaces, transferred to other wallets, and integrated with other NFT protocols.

- The underlying tokens of the NFT remain out of circulation throughout the lock period.

Beyond DAO Treasury Management – Secondary Markets for Private Deals

The ability to associate a newly minted NFT with the specifics of an underlying OTC deal and collateralize it with an underlying token makes this product unique in the NFT DeFi landscape. The OTC position is attached to the newly minted NFT, and thus can behave like an NFT while also being a powerful derivative instrument. The owner can move this NFT to another wallet, sell or auction it off on OpenSea, or use the NFT as collateral on another protocol to borrow against. Lastly, the owner can simply hold it until he or she chooses to redeem the deal any time after the time lock period has expired.

Even though the NFT representing a locked position can be transferred and sold, the tokens remain locked away from liquid markets and exchanges until the lock period expires, and the current NFT owner chooses to manually burn the NFT for the underlying tokens at the end of the period.

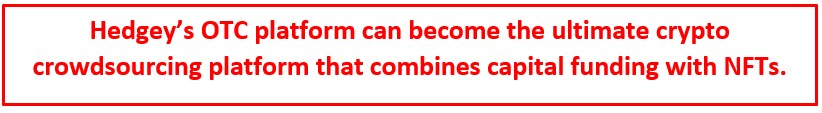

This platform has the potential to create multi-billion-dollar secondary markets for illiquid private VC and community deals with cryptocurrency startup projects. In 2021 alone, new crypto and blockchain technology businesses drew $32.8 billion in funding from venture capital (link). In theory, all these venture capital investments could have been locked on Hedgey’s platform, at least for those projects that raised money from institutional or angel investors through token sales.

In addition, the structurer of the OTC deal can break the deal into multiple smaller pieces and thus fractionalize the VC deal. That way, a private investor or venture capital firm can place a subset of its NFTs on an NFT sales platform for sale, or simply to obtain a pricing indication through incoming bids and get a sense of the deal valuation in this highly illiquid private placements market. This could provide thousands of crypto market participants access to otherwise restricted private deals. Hedgey’s platform has the potential to democratize the funding of private deals.

Lastly, the existence of this OTC platform could trigger a virtuous circle of new startups making use of tokens, raising their funds via Hedgey. Hedgey’s OTC platform could theoretically become the ultimate crowdsourcing platform that combines capital funding with NFTs.

Covered Calls

A second strategy for DAOs to diversify their Treasuries without disrupting the market for their native tokens is the systematic sale of covered calls. This strategy would theoretically ensure a steady stream of cash in the form of upfront premia from the options sales against stable coins.

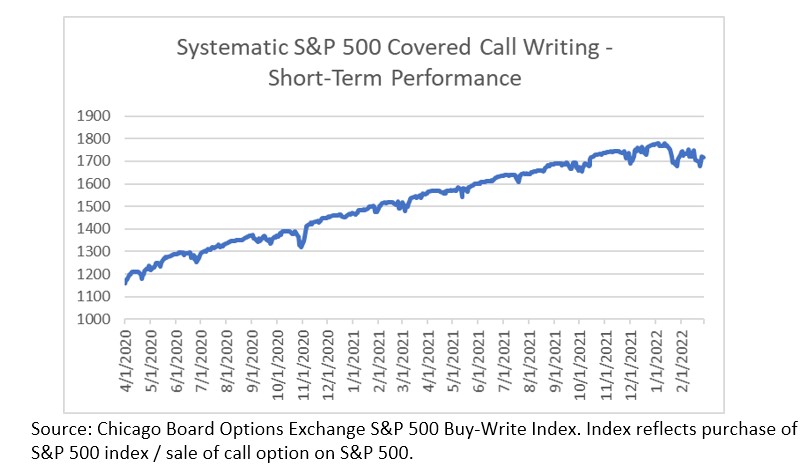

Pursuing a systematic covered call trade is a well-established yield enhancement strategy in traditional finance. Without going into the technical details, the most intuitive way to think of covered call selling is to be systematically “short volatility.” Put simply, when volatility is low, covered call selling performs well and when volatility is high, the strategy loses money.

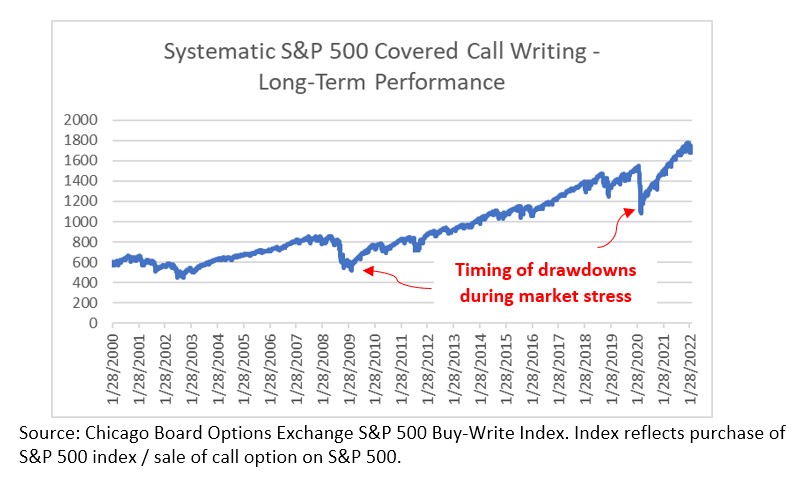

The chart below illustrates the short-term performance of covered call selling.

To assess the profitability of this strategy, it is necessary to take a longer-term view. Examining a graph that tracks the trade’s cumulative profits over more than 20 years reveals that the long-term profitability of this strategy is positive and the strategy is viable. It is, however, worth noting that the losses can be very steep and occur right at the time when market participants are looking for safe, “flight-to-quality” assets. Nevertheless, systematic covered call selling compensates investors in the long run.

Although covered call selling is well established in traditional finance, it’s still in its early innings in the cryptocurrency space. With that comes many challenges, and Hedgey’s Treasury pool platform provides elegant solutions to help enable a swift implementation of the systematic covered call trade.

The main challenge with the options markets in cryptocurrency is that options pricing is virtually non-existent for tokens associated with small cap and early-stage projects. Hedgey’s platform allows users to tease out the right pricing by exposing various payoff scenarios for the buyers of covered calls while also allowing the seller to set targeted annualized returns in a transparent way.

A structured options trading strategy like systematic covered call selling could be seen as complex, opaque, and difficult to understand. It will entail convincing project teams, token holders, and buyers to participate in such a trade. Crypto teams shouldn’t have to expend significant time and energy on this task; their primary focus should be building their project. Hedgey’s platform will enable teams to efficiently and successfully implement this strategy, ultimately helping DAOs to diversify their Treasuries.

References

Hedgey Documentations

Hedgey (2022). OTC Infographics (buyers and sellers).

Hedgey (2021). DAO Treasury/Balance Sheet Management.

Finance

Aydemir (2021). A Fresh Look At DAOs – The New (Digital) Family Offices.

Ilmanen, Antti (2011). Expected Returns: An Investor’s Guide to Harvesting Market Rewards, Wiley Finance.

Institutional Investor. Where Did VC Money Go in 2021? Crypto Startups.

Farhi and Gabaix (2016). “Rare Disasters and Exchange Rates.” Quarterly Journal of Economics.