Introducing a Defi Portfolio Management Framework

I`m a professional Defi portfolio manager at Alphanonce (one of Asia’s fastest-growing crypto hedge funds), managing a market-neutral fund registered in Singapore. We generate sustainable double-digit annual returns regardless of market conditions, optimizing through arbitrage and stablecoin Defi strategies. Previously, I worked at a traditional asset management firm and investment bank, mainly covering public equities. While crypto assets and traditional asset classes are different in many ways, there`s significant overlap in how portfolios of these assets can be thought of and managed. Below, I provide a Defi portfolio management framework.

- What`s Defi?

DeFi (or “decentralized finance”) refers to financial activities on permissionless blockchains. Through DeFi, users can engage in various financial activities such as, but not limited to, lending/borrowing, exchange, minting stablecoins, asset management, payments, and more. Since the associated financial applications are built on permissionless blockchains, Defi represents a genuinely global peer-to-peer financial system.

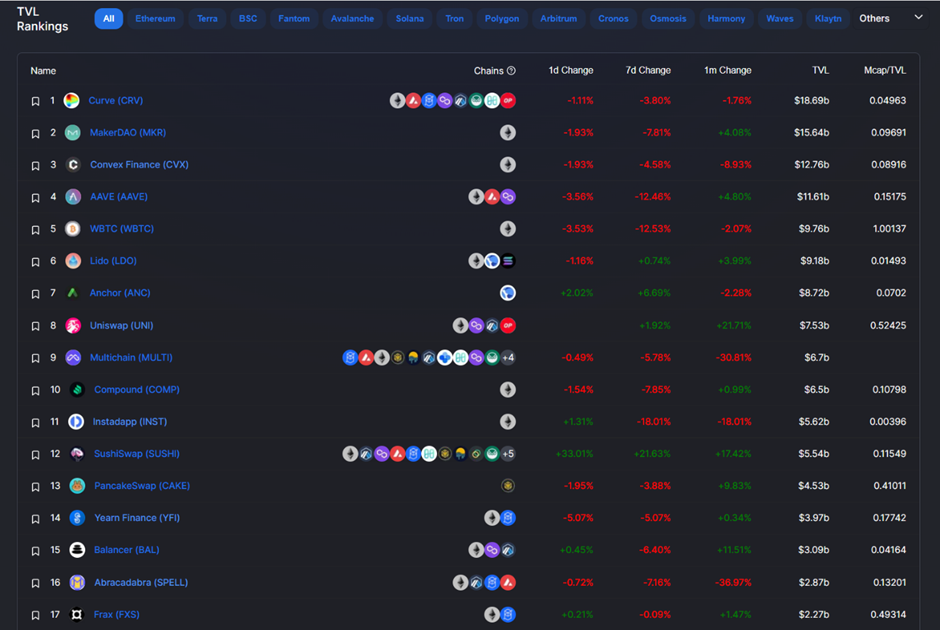

According to Defi Llama, there’s roughly $194 billion of TVL (total value locked) in Defi, 59% of which is represented by the Ethereum blockchain, which pioneered the space. Other than Ethereum, Terra, BSC, Fantom, Avalanche, Polygon, Klaytn, and other layer 1 blockchains are also emerging as significant DeFi platforms.

During 2020-2021, sophisticated Defi users were able to generate triple-digit annual returns thanks to fruitful airdrops and a relatively uncrowded space for yield farming. However, it`s hard to expect triple-digit annual returns going forward, due mainly to the maturation of the Defi ecosystem and the overall downturn of Defi token prices.

Still, you`re an early adopter if you’re reading this article. A report issued by Arcane Research revealed that only 2.3% of Ethereum wallets have interacted with Defi protocols.

2. What`s portfolio management?

On a basic level, a portfolio manager`s role is to maximize the fund`s returns and manage risks on behalf of clients. To do so, he should conduct research, create an investment universe, carefully select assets, and manage risks. Experienced portfolio managers understand risk-return profiles and nimbly execute asset allocation, diversification, and portfolio rebalancing.

Above all things, portfolio managers should comply with the fund`s objectives. In my case, “Don`t lose money” is the first objective of our market-neutral fund

3. Developed market vs. Emerging Market (Blockchain)

So, what`s the overlap between crypto and traditional asset classes? Before I discuss blockchain, let me share how we should distinguish between developed markets from emerging markets. Developed markets include the most advanced economies in the world, with mature, transparent capital markets. Economic growth momentum in developed markets is generally steady. Meanwhile, highly developed capital markets and advanced regulations limit fraudulent activities. Investing in a developed market is like investing in a blue-chip, stable business.

On the other hand, emerging markets are faster-growing with less mature, more nascent capital markets and regulation. Fraudulent activities occur more frequently in emerging markets. Thus, emerging market investors should bear relatively higher risks and demand higher returns in exchange.

Let`s map this framework onto the crypto spcae. Applying the developed-emerging market framework to Layer 1 platform blockchains the Ethereum blockchain can be thought of as a developed market while the rest of alternative layer 1 protocols, such as Solana and Avalanche, are emerging markets.

We can apply the same analogy to Defi portfolio management. Ethereum Defi is like having exposure to a developed market. It leads to a global standard and other layer 1s tend to follow Ethereum’s lead. Ethereum Defi provides investors with a relatively safe (I know Defi is not safe), stable return. While Ethereum Defi return is commonly lower than that of other layer 1s, Ethereum blockchain captures more than half of the total Defi TVL thanks to network security and maturity. So, as a prudent Defi portfolio manager, I consider Ethereum blockchain first and allocate more than half of the fund`s capital on Ethereum Defi.

- Example of developed blockchain: Ethereum

- Example of emerging blockchain: Solana, Terra, BSC, Avalanche, Fantom, Klaytn, Near, etc.

*Note: Despite Bitcoin blockchain being the most established, its Defi engagement is negligible now and thus I rule out Bitcoin for the Defi blockchain comparison above.

4. Value Protocol vs. Growth Protocol (Defi application)

In the traditional equity world, investors categorize value stocks and growth stocks. Investopedia provides a useful description of each:

“Value stocks are usually larger, more well-established companies that are trading below the price that analysts feel the stock is worth, depending upon the financial ratio or benchmark that it is being compared to. For example, the book value of a company’s stock may be $25 a share, based on the number of shares outstanding divided by the company’s capitalization. Therefore, if it is trading for $20 a share at the moment, then many analysts would consider this to be a good value play.”

“Growth stocks can be found in small-, mid-, and large-cap sectors and can only retain this status until analysts feel that they have achieved their potential. Growth companies are considered to have a good chance for considerable expansion over the next few years, either because they have a product or line of products that are expected to sell well or because they appear to be run better than many of their competitors and are thus predicted to gain an edge on them in their market.”

Simply put, Warren Buffett’s Berkshire Hathaway invests in value stocks while Cathy Wood`s ARK fund is highly focused on growth stock investments. Each investor has an entirely different investment approach and risk-return profile. So do value stocks and growth stocks.

Utilizing the above criteria, we can analyze Defi protocols. There are many Defi protocols across different market segments, and each protocol has a different risk-return profile. In general, established Defi protocols have high TVLs with relatively low risk-low return profiles. There are 32 Defi protocols that have TVLs larger than $1 billion USD. I define these as “value” protocols. Value protocols are built by smart founders, and they`re well audited. Furthermore, reputable crypto VCs/influencers back these protocols and they have solid track records, which mitigates the risk of fraud. However, value Defi protocols have relatively low expected returns, and it`s difficult for investors to generate a double-digit APY for stablecoin yield farming. Put simply, they are relatively low risk, low return.

“Growth” protocols, on the other hand, tend to have lower TVL but higher expected APYs — some even as high as >1,000%. However, growth protocols are usually more vulnerable to smart contract risks — and the risk of fraud — than value protocols.

- Example of value Defi protocols: Curve, MakerDAO, Uniswap, Compound, AAVE.

- Example of growth Defi protocols: Any protocol with a TVL below $1 billion USD as of Feb 2022.

5. Conclusion

Traditional portfolio managers might believe the Defi space is overvalued (or see no fundamental value in it at all) and view the associated risks as nearly impossible to manage. The Defi space certainly needs more robust valuation frameworks, and the above explanation is not enough alone. Still, significant opportunities abound in the space, and skilled portfolio managers can manage risk through stablecoin farming and other quantitative techniques.

Defi is disrupting TradiFi. I predict that every portfolio manager will eventually deal with Defi, as every asset class in the world will be tokenized on permissionless blockchains. The framework outlined above will hopefully help them understand this rapidly evolving space.

P.S. If you`re interested in the above topics and market-neutral fund, feel free to reach out to me via email jay.han@alphanonce.com or Twitter DM.