Why I Remain Bullish on Bitcoin for 2022?

The beginning of 2022 has been jittery for cryptocurrency investors. Bitcoin has witnessed a sharp correction.

However, volatility is not new to Bitcoin. The cryptocurrency world is still in a phase of price discovery. This phase is likely to be characterized by high volatility. In equities, that would typically be a high-beta investment.

Having said that, I believe that the current correction also presents a good long-term buying opportunity.

Reasons To Be Bullish on Bitcoin

Even with some headwinds, the outlook remains bullish from a medium to long-term investment horizon.

First and foremost, there are concerns that there will be three to four interest rate hikes in 2022. As liquidity tightens, Bitcoin is likely to trend lower. However, it’s important to note that even with four rate hike, real interest rates will remain negative.

Therefore, holding dollars will result in loss of purchasing power. It goes without saying that people will prefer to invest in risky asset classes that help in beating inflation. In simple words, money will continue to flow into asset classes like equities, commodities and cryptocurrency.

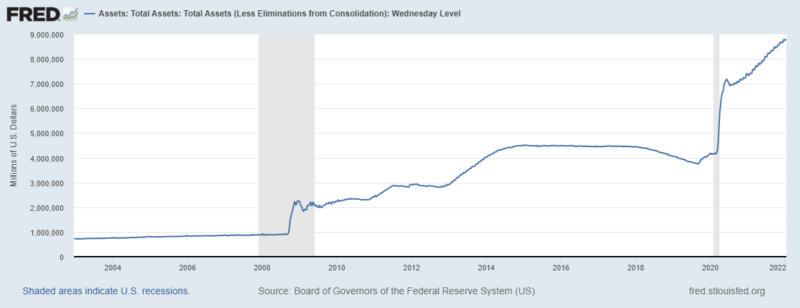

It’s worth mentioning here that as of January 2022, the Fed had assets of $4.2 trillion on its balance sheet. However, the assets have swelled to $8.8 trillion. This is an indication of the ultra-expansionary monetary policy that was pursued in the last two years.

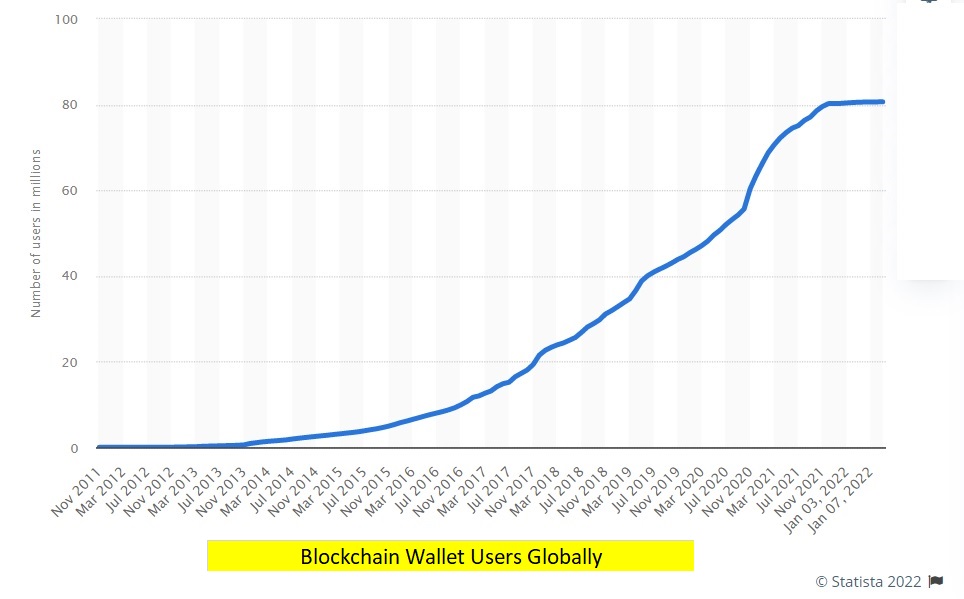

All asset classes that have a limited supply are likely to gain against the dollar or other fiat currencies. Bitcoin has a limited supply of 21 million. More importantly, the adoption of cryptocurrency is on a rise. As of January 2021, there were 81 million blockchain wallet users globally. As a percentage of the total population, there is ample scope for wider adoption. As more long-term investors hold Bitcoin, the demand-supply scenario will take the cryptocurrency higher.

Another factor that makes me bullish on Bitcoin and the cryptocurrency space is institutional adoption. Data indicate that 52% of financial institutions already invest in cryptocurrencies. This number is likely to increase in the coming years. Of course, among more than 12,000 listed coins, only quality coins or tokens will survive in the next five-years. However, the cryptocurrency space is here to stay. There are dozens of tokens that come with a strong utility.

Concluding Views

On the flip-side, government regulations are a concern. However, it’s worth noting that cryptocurrency market capitalization is worth $2.1 trillion. The market is too big to ignore or to be completely banned. At best, cryptocurrencies will be regulated. I believe that the markets are already discounting that factor.

With these factors in consideration, I am bullish on Bitcoin for 2022 and beyond. It’s worth noting that the cryptocurrency has bounced back strongly after each correction in 2021. With the tailwinds discussed, the sentiment is likely to remain bullish.