Orion Money – Bridging The World Of Stablecoins On Terra

The tools of traditional finance like treasury bills and deposit certificates known to bear yields have taken a backseat with cracks all over. DeFi is that breeze of fresh air aimed to correct the existing systemic flaws.

Brief Overview

The crypto space backed by blockchain technology has become too large to be ignored. It has come a long way from Satoshi’s whitepaper. From its acceptance as a legal tender to the NFT craze or the recent purchases by prominent entities is an affirmation that blockchain and the crypto world are here to stay. Like any other technology, blockchain world is subject to trial, error, and constant experimentation. This phenomenon has led to the creation of a flourishing industry ecosystem home to a myriad of projects, ideas, and innovations.

Moreover, the institutionalization of cryptocurrency has resulted in the rapid development of borrowing and lending activities contributing to the growth of DeFi and yield generating fixed income market for cryptocurrencies such as Bitcoin, Ethereum, and other stablecoins. A key factor in all of this has been cross-chain interoperability, one of the most promising innovations and a holy grail of sorts when it comes to the crypto space. Interoperability enables greater collaboration and ensures the longevity of blockchain as an underlying technology in the development of dApps.

With interoperability at its core and a vision to create a cross-chain stablecoin bank, Orion Money capitalizes on the massive untapped opportunity in the stablecoin savings market. It aims to be a one-stop destination for seamless and frictionless stablecoin saving, lending, and spending?—?all without the hassle of moving assets across chains. It includes a suite of DeFi applications, each with a unique use case. More on that later.

The inexorable growth of the DeFi money market and savings protocols is pioneered by apps like Aave and Compound built on Ethereum. Terra’s native money market protocol, Anchor, was launched in March 2021 offering an attractive and stable 20% APY on $UST stablecoin savings. Anchor’s launch helped fulfill the need for a fixed-income solution in the DeFi market. Anchor provides accessible, safe, stable, and attractive yields for the main street investor, even in the most severe moments of market volatility. It generates a high stable yield on UST deposits by lending out deposits to borrowers who have secured collateral in yield-bearing assets.

Why I Mentioned Anchor and How It Is Related to Orion Money will become clear to you in the following section of this article.

Anchor’s relatively attractive and low volatile lending yields are unfortunately restricted to UST depositors on the Terra network.

ENTER Orion Money

For the risk-averse investor, Stablecoins can be the crypto gateway to enjoy the benefits of income generation if only there was some sort of stability.

Orion Money was introduced with a mission to –

- Provide users direct access to Anchor’s money market protocol.

The stablecoin market is huge with a $130 Billion market cap as of Oct 2021. However, Ethereum based stable coins like USDT, USDC, DAI dominate the market with a share of over 85%. UST which is the algorithmic stablecoin of Terra is fast growing and has a promising future but only a mere 2% share in this market. Moreover, the complexity associated with understanding Terra’s ecosystem coupled with the gas fees, swap spreads, and slippages acts as a major deterrent for people to switch their stablecoins to Terra and Anchor. - Bring attractive returns and high yields on stablecoins across multiple blockchains (Ethereum, Polygon, Solana, and Binance Smart Chain, amongst others).

The 30 days average crypto lending rates have been sitting at a range of 8–12% APY and tend to plummet during periods of massive market drawdowns. Anchor is designed to overcome all these limitations. It offers a clear value proposition over its competitors.

Co-founder of Orion Money, Vol Pigrukh explains “We wanted to democratize the protocol and bring it to all massive chains and provide access to Anchor’s high stable interest rate to any stablecoin holders on their native blockchains.”

Thus, giving birth to the first product of Orion Money- Orion Saver. The other two products are Orion Yield and Insurance, and Orion Pay(more on that below)

Orion Saver

Interoperability unlocks innovation

Launched to address the aforementioned issues, Orion Saver is the first dApp within Orion’s cross-chain stablecoin bank which functions as a cross-chain stablecoin savings protocol projected to convert sizeable volumes of stablecoins from other blockchains like USDT, USDC, DAI into $UST. It allows users to access Anchor Protocol’s deposit yield rates without leaving other blockchain networks or performing any swaps.

How this works

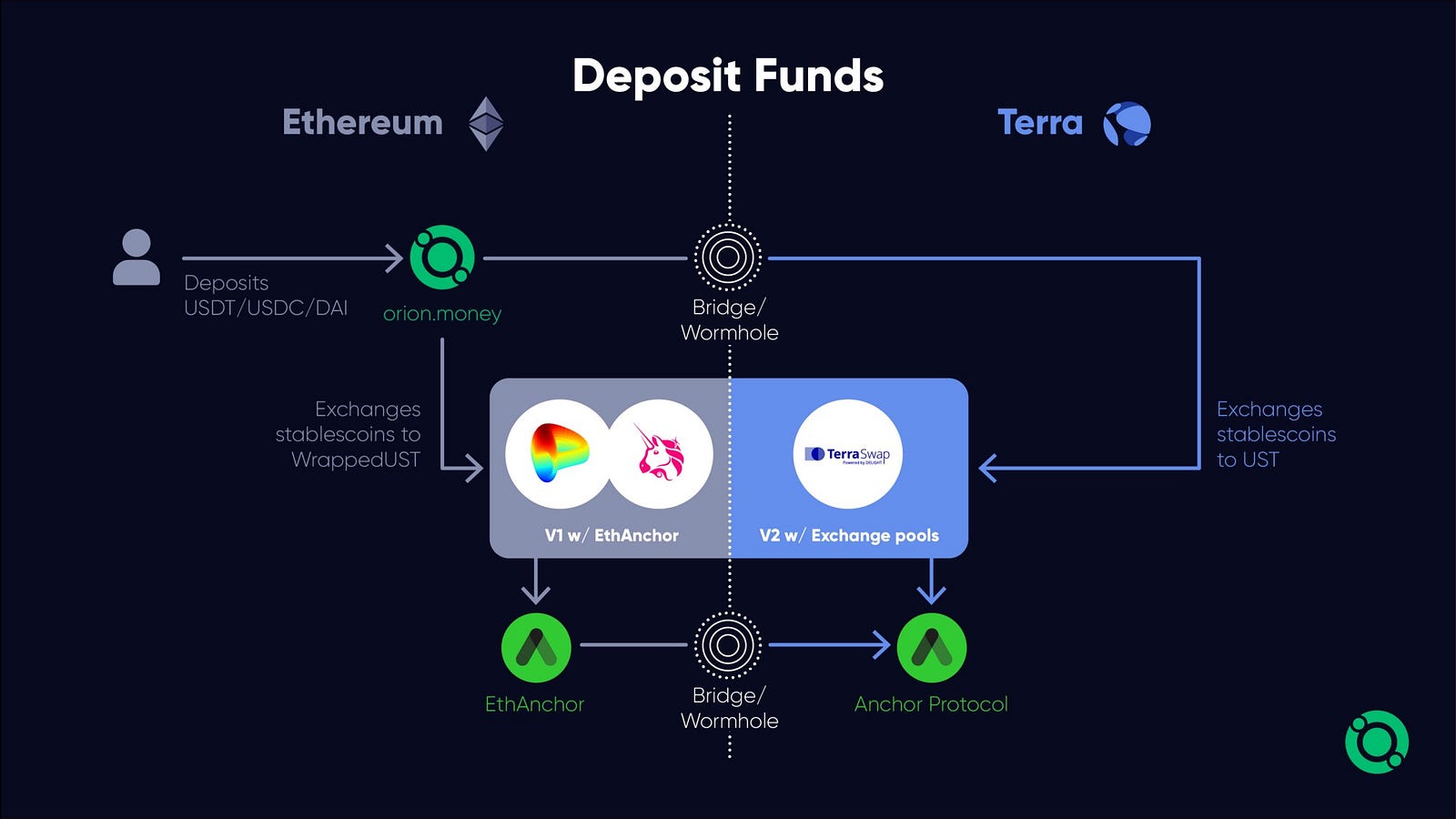

Orion Saver’s smart contract places the user’s stablecoin deposit into EthAnchor which is then exchanged into Wrapped UST and bridged onto Terra depositing UST into Anchor.

Deposits(Stablecoins) ? Exchanged to Wrapped UST ? Deposit into EthAnchor ? Bridge/Wormhole ? Deposit into Anchor Protocol

On Orion Saver V1, stablecoins are exchanged to Wrapped UST using Curve. In V2, liquidity pools will be set up on Terra for Wrapped Stablecoins in partnership with Terraswap.

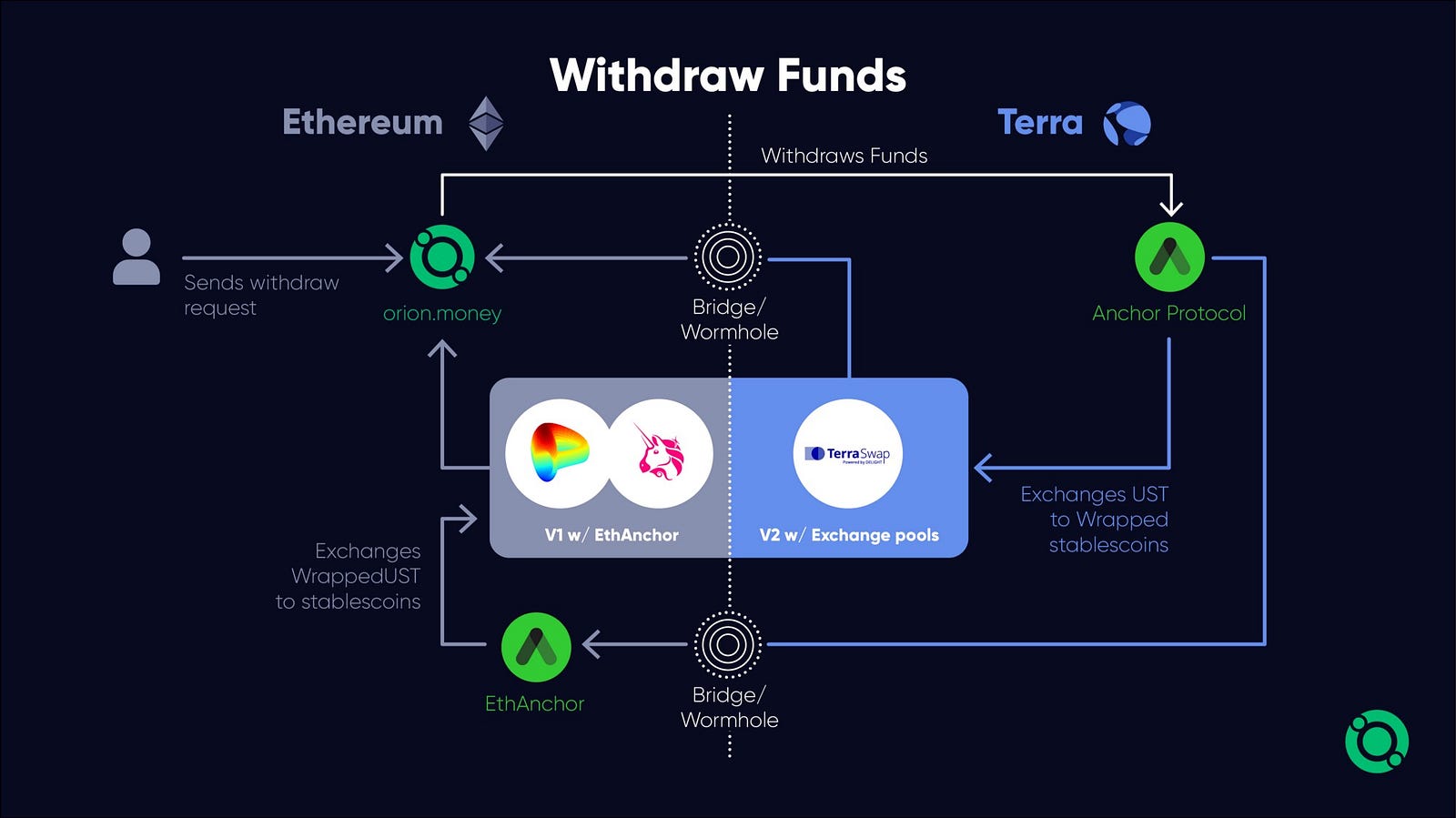

Similarly, when a user wishes to withdraw an Ethereum based stablecoin the deposited UST in Anchor Protocol will be withdrawn and sent back to the Ethereum blockchain allowing the user to immediately get the preferred stablecoin. The swap fee associated with the withdrawal process will be borne by Orion Money and the user.

Orion Money is currently managing and optimizing the EthAnchor gateway. EthAnchor is simply a set of smart contracts that was launched jointly by Anchor Protocol and Orion Saver Alpha. It contributes to the expansion of the Anchor Protocol offering, to Ethereum-based stablecoins, allowing users to deposit a greater variety of stablecoins on Anchor Protocol.

Orion Saver’s currently offering a lower interest than the target APY numbers. The team states “The process involved with providing the service, includes bridge fees, swap fees, and so on, which the protocol is covering so we want to ensure that the system works effectively without getting too much into the negative margin on the revenues before we bring the rates higher”

How Orion Money Adds Value to Terra

The answer to this lies in the basic law of supply and demand. Orion Money converts all stablecoin deposits to UST. The increase in demand for UST is offset by an equivalent burning of LUNA to mint UST and that means, for every UST Orion mints from other stablecoins, LUNA becomes rarer driving the price up.

Tokenomics

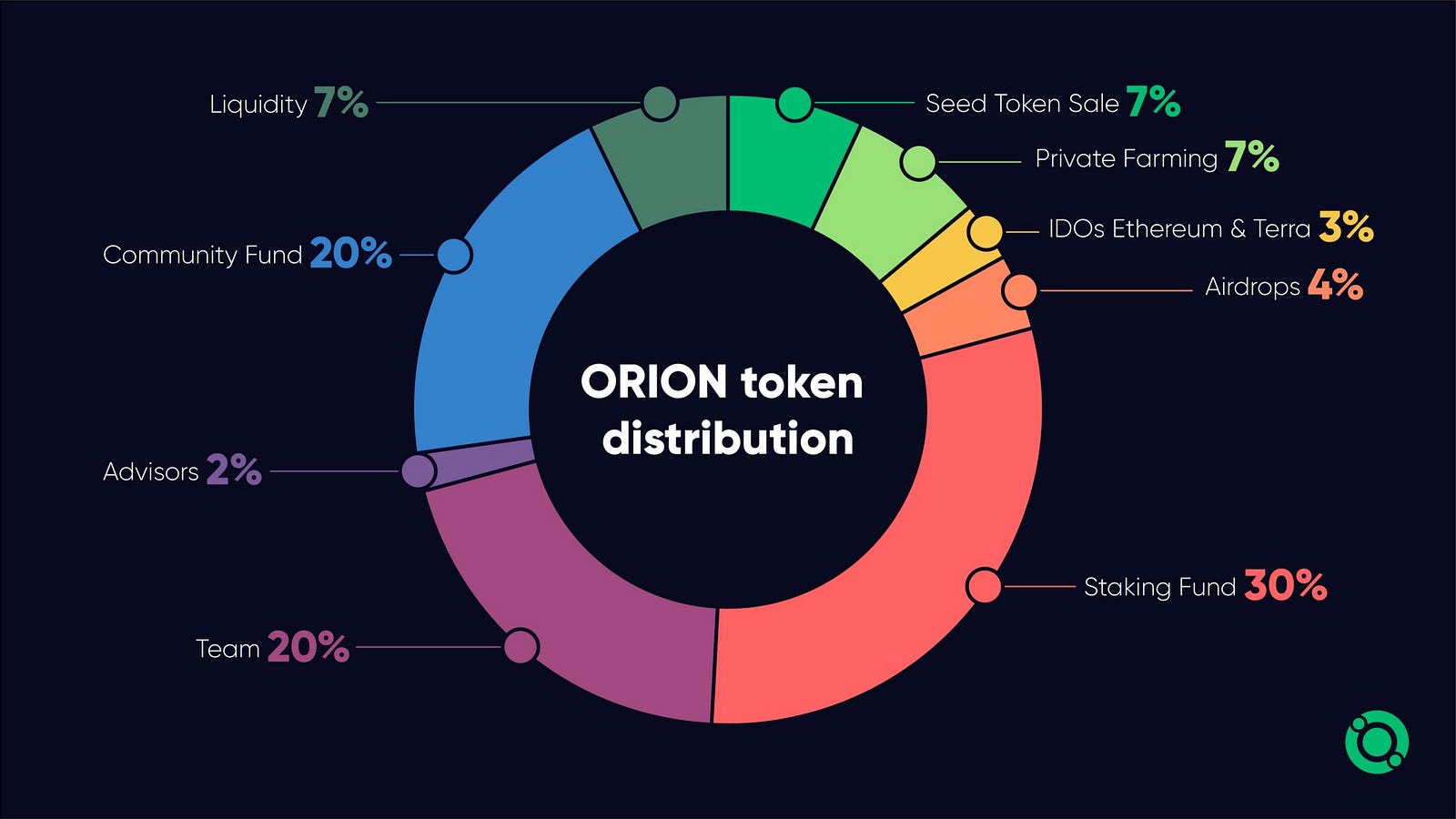

Orion Money’s native token is $ORION with a total supply of 1,000,000,000 ORION.

The ORION token will be minted on Ethereum, a portion of which will be bridged to Terra, Polygon, BSC (and other protocols) to enable the suite of dApps within Orion Money to operate with greater efficiency across multiple networks.

ORION token has been designed with the simple goal of unlocking governance for the protocol and establishing a revenue share mechanism for its users.

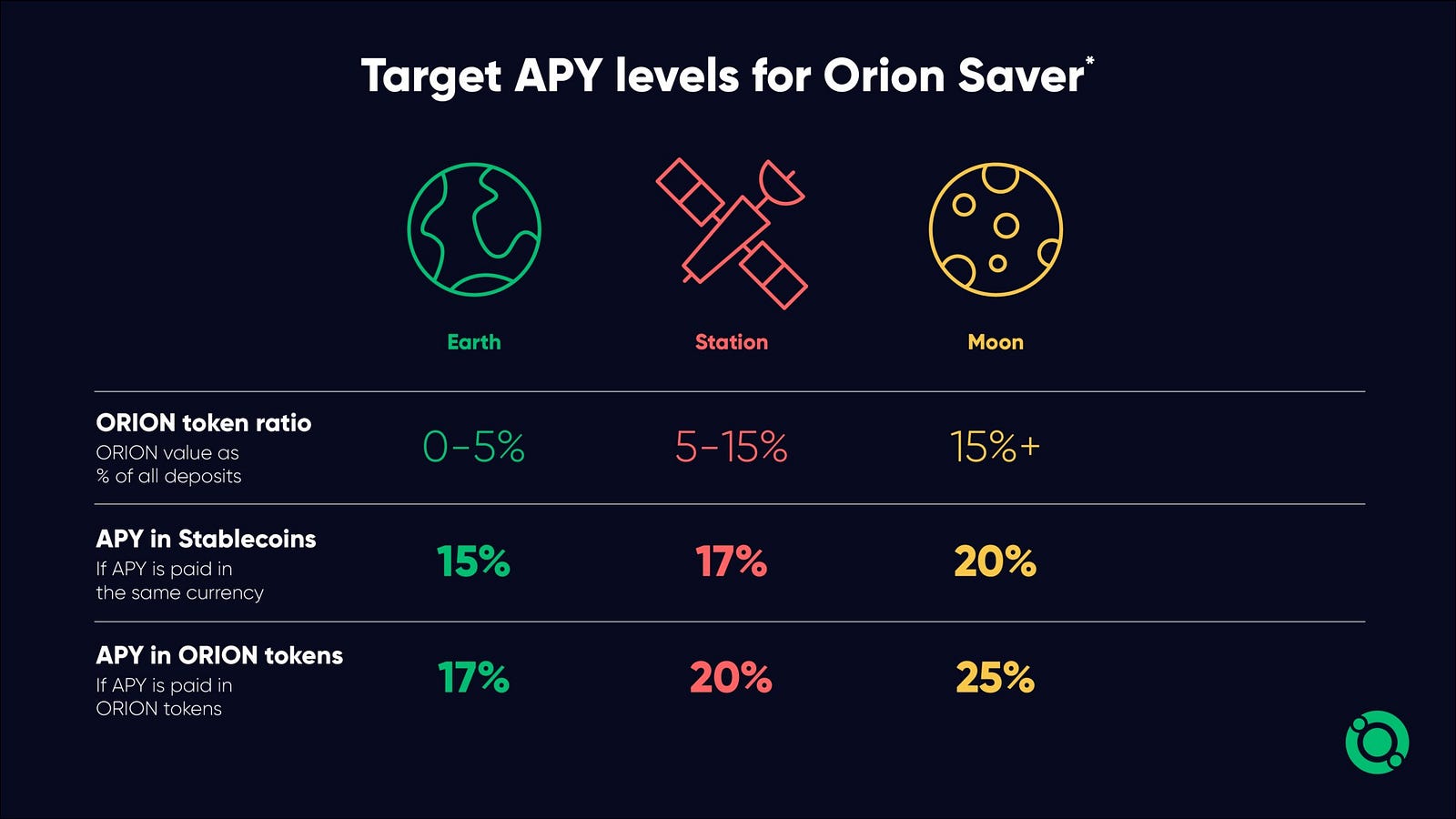

- To increase the APY generated by Orion Saver.

- Share in the revenue generated by Orion Money dApps.

- Governance of the platform.

The project has quite a few sources of fees used to buy back ORION from the market. For example, the fees collected from current and future products of the project as well as the 5% commission obtained from Orion Validator.

Staking in Orion?—?Orion Money’s architecture incentivizes users as well as investors to stake their ORION tokens to avail maximum benefits. ORION holders can stake their tokens and receive xORION tokens. The unstaking period is 7 days. Orion eventually intends to move its governance towards the DAO model which means all the ORION stakers will be responsible for the important decisions through governance voting proposals.

Stablecoin depositors will get boosted yields depending on the amount of ORION tokens staked, while investors or speculators will be incentivized to stake their ORION tokens to maximize the value of their tokens. This methodology will kick-start the Orion Money ecosystem and its underlying protocols while also serving as a growth lever for user retention and adoption. The staking incentivization mechanism will further ensure that a sizable proportion of the ORION token supply is being staked. As the Orion Money ecosystem grows, it increases the value that users will receive from the ecosystem itself.

Future Product Offerings

Currently, Orion Saver is operational on Ethereum network. Forthcoming dApps on Orion include-

- Orion Saver Terra and Orion Saver BSC: Launch Orion Saver on BSC, Polygon andTerra.

[Projected Date: Q4, 2021]* - Orion Yield & Insurance: Orion Money will provide high-yield savings to its users, and use the liquidity to invest in diversified strategies. In exchange for underwriting the insurance for depositors, stakers will receive a share of the extra yield generated.

[Projected Date: Q1-Q2, 2022]* - Orion Pay: Orion Money aims to develop fiat on-off ramps, crypto-to-fiat direct payments, and launch a crypto debit card to allow users to easily spend their earned interest.

[Projected Date: Q2-Q3, 2022]*

*These dates are subject to change.

For any further information, Please refer to the Litepaper.

Step by Step Guide On Using Orion Saver

Let me guide you through a simple walkthrough of using this dApp.

First Step

To begin with, you need to connect your wallet to the Orion App. Choose your preferred wallet and connect to the Ethereum core network to proceed further.

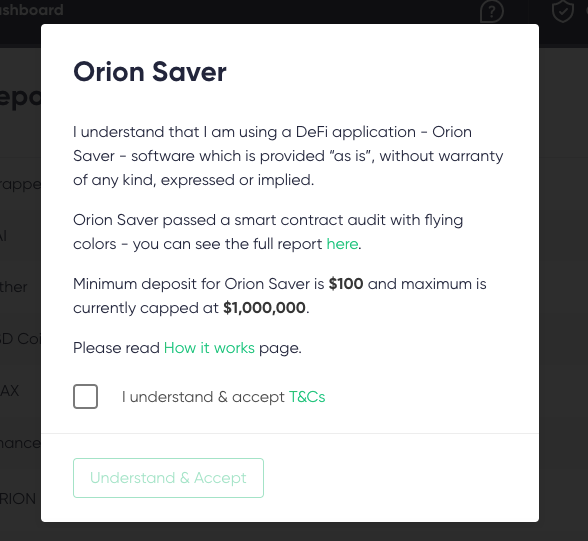

Do note the minimum and the maximum deposit amounts and accept the related terms and conditions.

Second Step

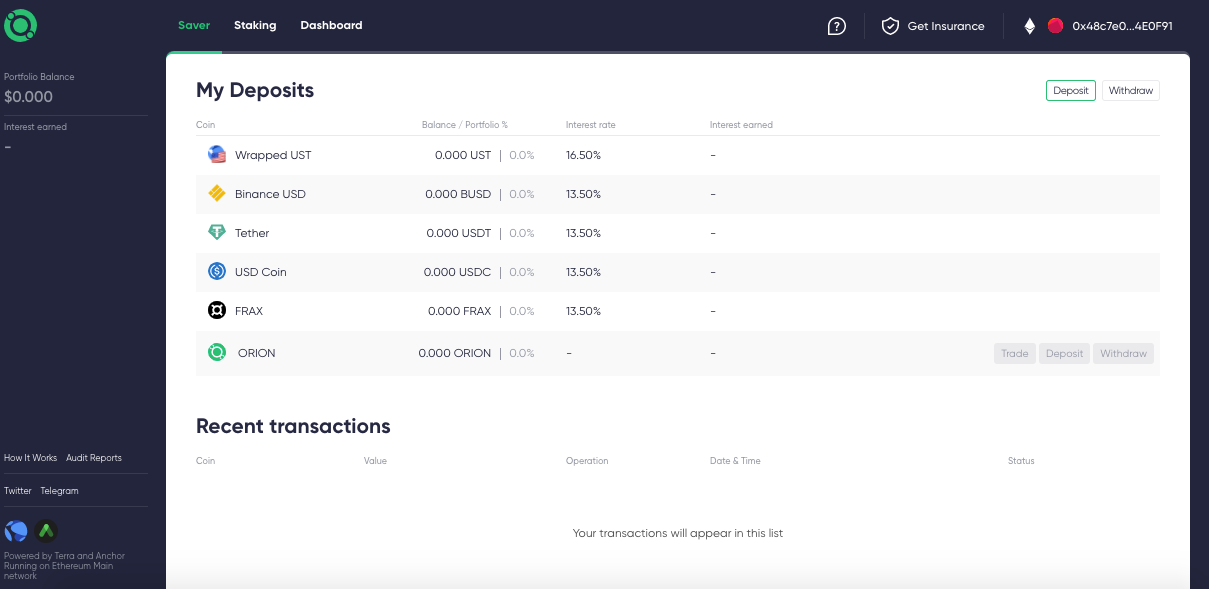

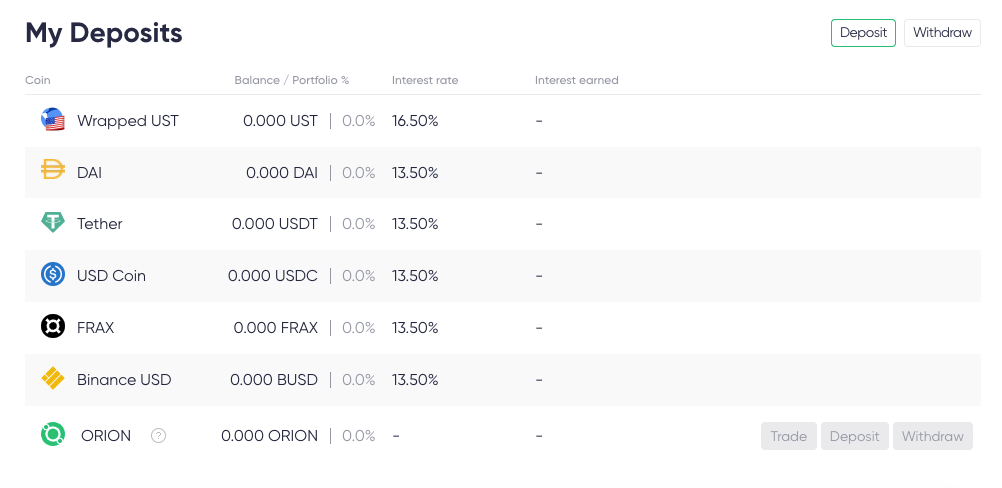

On the main panel under the Saver tab, you will be able to see your deposits and under the Dashboard, you will be able to see how the network is working and the Total Locked Value (TVL) locked in the application. As of publishing this article, the staking feature has just been launched.

Third Step

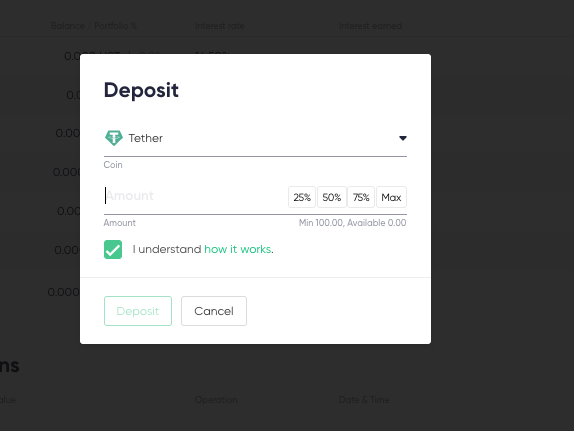

This is where the real work begins?—?Choose a stablecoin to deposit. Since Orion Money is currently operational on Ethereum, the choices include USDT, USDC, BUSD, and DAI. Click on Deposit on the top right corner. The minimum deposit is 100 UST.

It’s important to point out that the APY on stablecoin deposits can be increased to 20% depending on the amount of ORION tokens staked on the Orion Saver dApp. The stablecoin deposit APY will further increase to 25% if the interest payout is chosen in $ORION.

Your APY will fall anywhere between 15–25%.

Fourth Step

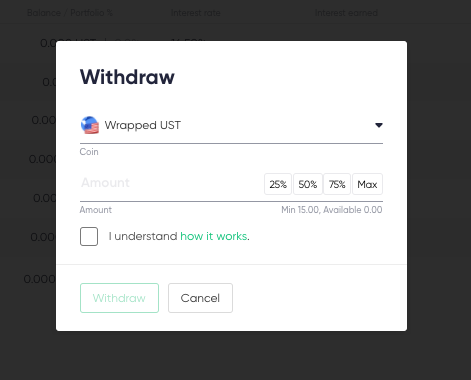

The withdrawal mechanism is similar to the deposit mechanism and can be accessed by clicking on withdraw on the top right corner. The minimum amount for withdrawal is 15 UST.

*It is important to take note of the Ethereum gas fees at the time of withdrawal and deposit.

Fifth Step

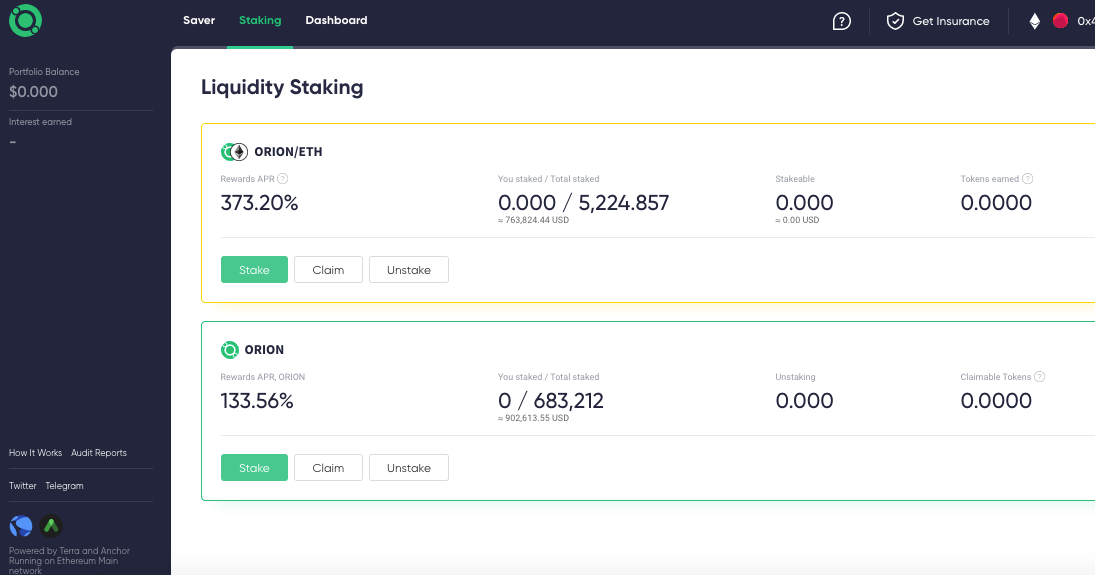

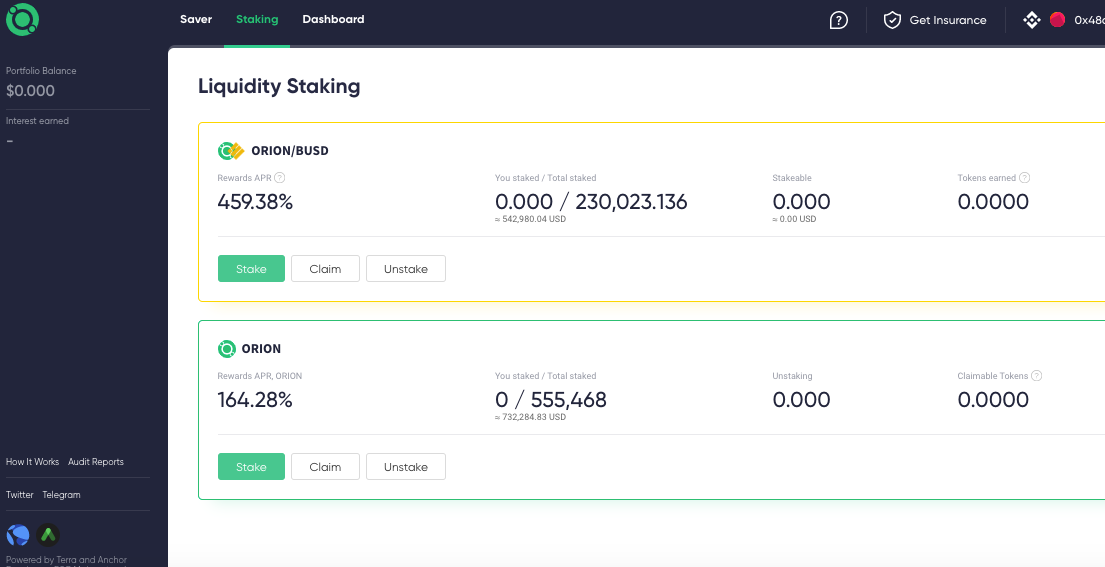

Orion Saver has just launched the staking feature, and when I say just, I mean as of this moment. Staking is live on both Ethereum and BSC with pretty good APYs. Click on staking after you have selected the network, ETH or BSC. It will soon be expanding to Polygon and Terra to allow users to deposit with lesser gas fees.

Summary

Although we’re still in the nascent stage and it’s far too early to predict future outcomes such as mass adoption?—?the blockchain world today exists like scattered islands. Any technology that connects these different silos of the blockchain transferring value from one chain to another will create a strong use case. Orion Money solves a major problem bringing diverse ERC-20 stablecoin market to Anchor thus offering a high-interest rate that is unheard of in the ETH world. While doing so, it removes the complexities and the barriers of understanding a new ecosystem, saves on expensive gas and swap fees or the associated slippage.

Its goal is to increase the size of the crypto savings market and focus on mass crypto adoption while bringing value from outside Terra into it. At the same time, it also helps the risk-averse investor by investing in stablecoins to earn a high yield.

The only thing that needs to be seen is how seamlessly it manages to build the on-chain infrastructure required to bring Anchor’s yield rates across multiple blockchains and bring in as many stablecoins as possible.

Partnerships with heavyweights like Delphi Digital, InsurAce to back, only reinstate the faith in the security and safety of this project. The project has successfully passed three audits and provides insurance coverage for Orion Money smart contracts and UST peg.