Solend: Lending Platforms On Solana

It’s been exciting to deep dive into the world of Web3 and understand the real-world use cases that it is powering. After Ethereum which is the largest decentralized blockchain utilizing smart contracts, Solana is the one that everyone is most excited about given its high transaction speeds of 50,000TPS and improved scalability. With over 400 projects running on the platform, Solana is in a good position to give competition to Ethereum. To learn more about Solana you can check out the links here.

After one understands the terms blockchain and crypto briefly, the immediate next concept that you get introduced to is DeFi (Decentralized Finance). This is because decentralized finance applications are the most widely used real word apps on crypto today.

In this article, I will explore Solend which is a DeFi app for lending and borrowing built on the Solana Blockchain.

What makes Solend interesting is that it was prototyped as part of the June 2021 Solana Season Hackathon where they were winners of the DeFi track! Since then, they have come a long way and today are the leading lending platform on Solana.

Now before we dive into Solend, let’s understand lending a little more –

How Does Lending Work In The World Today?

-

One can borrow money against a specific collateral from an institution like a bank after going through some kind of verification.

-

The money which is lent is essentially money deposited by someone who is earning some interest and the bank as a middleman is taking a cut.

-

The interest rate is centrally controlled and based on several factors including your credit history, nature of the loan, government regulations etc.

-

If you default on your loan, the bank puts in checks and processes to ensure you repay the loan

What Is Lending Like In The World Of DeFi?

- There is no central institution, the platform can connect anyone who wants to lend and borrow on the blockchain opening up access to all.

- All transactions are captured on the blockchain through smart contracts, so there is no need for a middleman. All transactions are transparent and permissionless with reduced fees.

- Interest rates may be fixed or variable but are typically generated through an algorithm as part of the smart contract. https://www.comedianjoshwolf.com/

- You use digital assets as collateral to get crypto currency loans.

Lending in DeFi essentially enables accessible, faster, cheaper avenues of lending & borrowing.

Product Overview

What is Solend?

Going by the definition on their website.

“Solend is the autonomous interest rate machine for lending on Solana”

Let’s simplify that – Solend is a lending platform built on top of the Solana blockchain where interest rates are generated algorithmically. Currently, Solend supports the following – Earn Interest (lending), Borrow, Leverage Long & Short.

Lending

One can deposit or “supply” any supported asset (currently 11 of them) on the platform. The lender earns interest basis the calculated Supply APY (annual percentage yield – similar to annual percentage rates in traditional lending) and additional Supply Rewards in the form of SLND tokens (native tokens of Solend).

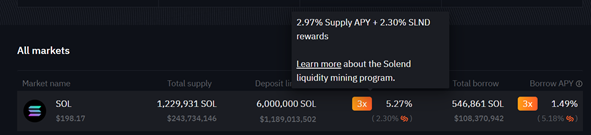

Let’s look at the following example from the Solend dashboard –

As per the current market rate, I can supply the SOL token and earn a total interest of 5.27% which will be split as:

- 2.97% Supply APY which one will get in the original asset supplied (in this case SOL) and

- 2.30% in SLND rewards.

Earning these additional rewards in the form of token of the platform is called liquidity mining. These additional SLND rewards help incentivize users to participate in the platform and improve the overall liquidity of the SLND token. We will talk more about this later.

Borrowing

Users can borrow any one of the 11 assets from the platform. Let’s understand a few more terms before we deep dive into borrower economics.

We know that any kind of loan is usually secured by collateral. In this case, the collateral is the supplied set of tokens. How much collateral do I need to put up?

This is governed by the Loan-to-value ratio (LTV) of the specific token you are borrowing. LTV ratio defines the maximum amount that can be borrowed with specific collateral. The LTV will be fixed and mentioned on the platform for each asset. For example, SOL token has an LTV of 75%. So, in simple words that implies that for 1 SOL supplied, I can borrow a maximum of 0.75 SOL worth of any token listed.

Now you may be wondering, if I already have 1 SOL then why do I have a need to borrow at all? Well, there could be many reasons to do that –

- You can use the token supplied to borrow a stable token like USDC and continue to own the supplied token which may appreciate.

- You also may want to avoid selling your tokens to avoid tax and hence borrow USDC instead,

- You could further use the borrowed tokens to supply more tokens and earn rewards etc. More on this later.

The next concept we need to understand is the liquidation threshold. The liquidation threshold is the point at which the loan is now under-collateralized. If the value of the loan goes above this number, your collateral will be liquidated to help ensure you are able to pay back the loan. This threshold is fixed for each token asset and the values are available in the platform documentation.

The liquidity threshold is generally higher than LTV (in the case of SOL, the liquidation threshold is 5% higher than LTV). This buffer acts as a safety cushion for the borrowers in case of changes and volatility in the supplied token.

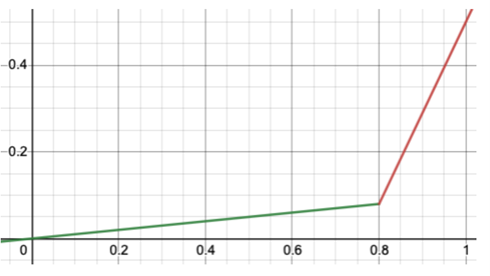

Lastly, let’s understand a little more about the borrowing interest rate charged. This interest rate called the Borrow APY is variable and controlled by an algorithm that produces the following graph:

The x-axis is the utilization rate (total borrowed /total supplied quantity) of an asset and the y-axis is the interest rate.

The borrowing rates increase significantly after a certain utilization threshold limit (80% currently). This is required to ensure that there is enough liquidity in the token pools.

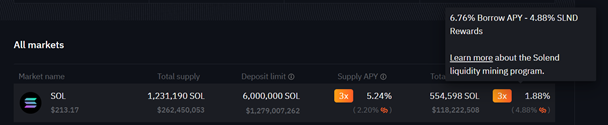

For example in the following screenshot taken from the Solend dashboard, the borrow APY for USDC is much higher than the borrow APY for SOL. This is because the utilization rate for USDC is ~84% (above the utilization threshold limit of 80%) while the utilization for SOL is ~45%.

In simple terms, if any token has a high utilization rate (ie. good demand), it will have a higher borrow APY (simple supply-demand economics!).

Borrowing Economics

Now that we understand some of these concepts, let’s look at borrower economics.

As per the screenshot above, you can borrow SOL at a total interest rate of 1.88%. You may be wondering why this rate is much lower than the lending interest rate as this goes against logic (in traditional finance, borrowing rates are always more than lending rates). The reason this mismatch in rates exists is because of the additional SLND rewards which are given to even borrowers as a way to incentivize participation (more on liquidity mining later in the document).

The final interest rate for borrowing is calculated by subtracting interest earned as SLND rewards of 4.88% from the borrow APY of 6.76%.

Exciting times are ahead for Solend as they look to create differentiated long-term value for users of the platform. Will definitely be watching and participating closely!