Olympus V2 Migration?—?Explained

What started with DeFi grew into DeFi 2.0 and Olympus is the pioneer of this space. And what exactly is DeFi 2.0, EB?

DeFi 2.0 brought the idea of a protocol owned liquidity so much so, that within months of it, there were numerous forks offering the same. Olympus has already managed to gather a strong community-driven by 3,3 pushing the boundaries and innovations into newer realms and changing the existing paradigms. All this has been done by tweaking rebasing and staking tools that in its entirety are based on the loyalty of its users.

Yield farming brought DeFi to the degen farmer and involves users providing liquidity to protocols in turn for farming the protocol tokens. It changed the traditional understanding of lending and borrowing and in no time DeFi took the center stage with more and more liquidity being pumped into it. Olympus did something which no other protocol had done before. It introduced the idea of protocol-owned liquidity and that changed the whole dynamics of DeFi. It did to DeFi what DeFi had done to traditional finance.

The existing problem of DeFi is the farm and dump strategy. Degen farmers get in early farming at high APYs and the moment APYs come down to lesser exciting and more sustainable rates, they remove liquidity and dump the tokens. That is why protocols want to build communities that would want to stay for the long-term growth of the protocol than the exciting short-term high APYs.

Olympus focussed on this pain point by working on both the high APYs as well as a community-centric protocol where everyone is a stakeholder of the protocol by bringing in 3,3. More on this through the Olympus docs.

Olympus V2 Migration

The Olympus Gods got together on top of Mount Olympus to offer V2.

This article is focused on Olympus’s V2 migration but before we get there, let’s understand what bonding means.

Olympus allows users to trade assets like DAI, wETH, FRAX, or various LP tokens in exchange for OHM. Olympus sells the OHM at a discount through a process called bonding. Instead of buying the tokens through various other protocols, Olympus allows users to buy OHM at a discount. Users can then stake the OHM to participate in governance and earn further rewards through rebases in the value of the OHM token.

Olympus V2 migration entails some key upgrades and these are listed below:

1. On-Chain Governance

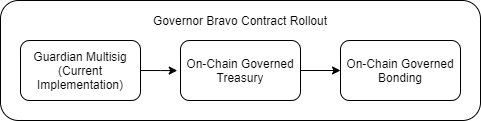

In order for Stakers to achieve full control of the protocol contracts, this would entail a phased rolled-out through the implementation of Compound’s Governor Bravo. This will begin with a guardian multisig, an on-chain governed Treasury, and eventually on-chain governed bonds.

gOHM token will replace wsOHM and will be the on-chain governance token. This will allow users to stake directly into/out of gOHM, saving precious time and gas.

2. Bonds

Bonding is a mechanism for Olympus to acquire its own liquidity. Bonding is a more active investment strategy that has to be monitored constantly in order to be profitable as compared to staking. The V2 migration sees major changes to the bonds.

- Bond payouts are staked at the time of purchase. In order to minimize market pressure and maximize protocol efficiency, bond payouts will be earned by default unlike, where bonders would have to factor in missed rewards when considering a discount. This means that any >0% discount will outperform staking, and as a result, discounts should not deviate far above 0%.

- Bonds no longer vest linearly. Instead, bonders must wait until the end of their term to redeem. This illiquidity is enabled by staking bond payouts and creates a form of locked staking that will save OHMies money by removing the incentive to incur wasteful gas transactions through frequent redemption.

- New bond types are created as isolated offerings. Each bond has a maximum amount of OHM that can be paid or a maximum amount of principal that can be purchased and, once exceeded, the bond is retired. All parameters of the bond are set in stone after initialization. This improves both budgeting and immutability.

- Bonds can be held as NFTs. This enables liquid secondary bond markets.

- Bonds can be fixed-term or fixed expiration. Fixed-term bond is one where the term for a bond is fixed. For a fixed-term bond of 1 week, your maturation date will be in 1 week. Fixed-expiration means the maturation date is the same for all who buy that bond. If a bond has fixed expiration on day 8 and you buy one on day 1, your term is 7 days; if you buy the same bond on day 2, your term is 6 days. This lends itself to composability; fixed-expiration bonds can be wrapped into a fungible token and traded like any ERC20.

- Bonds offer a front-end reward. This will incentivize third parties to run front-ends for Olympus, reducing single-point-of-failure risk.

3. Migration

Enabling V2 will require migration to a new set of smart contracts. The migration will replace all existing contracts, including the OHM token. Users have up to two months to migrate without missing the rebasing rewards. The entire process associated with the migration has been designed to make it as easy and time-insensitive as possible for the OHM community.

Migrating is a single transaction and should not cost much more than staking. Partial liquidity will remain for OHMv1 to facilitate the movement of borrowers.

As for the audits, efforts are underway to enter an audit with Runtime Verification for the smart contracts. The audit status is expected to conclude in four weeks’ time.

Socials

Substack, Loop, Torum, Odysee, Twitter, Youtube, Read.cash, Publish0x, Presearch, Medium, Noisecash

Crypto Taps Pipeflare, GlobalHive, GetZen for some free crypto

Exchange on SwapSpace

For price updates, check Coinmarketcap or download the app on Apple/ Google

Join CMC for Airdrops, Diamonds, Learn&Earn

On Telegram(G), Telegram(EN), Twitter, Reddit, Instagram, Facebook

Create your crypto Watchlist or track your Portfolio on Coinmarketcap