Nansen: Crypto’s Most Powerful Forecaster

The following is by Zachary Roth, professional writer, and Product Manager at Solrise Finance. Subscribe to Zachary’s newsletter, DAOJones, here.

Introduction

Nansen transcends your expectations of a blockchain analytics platform. Their suite of unique metrics is becoming a powerful forecaster in the noisy crypto markets. Having labeled and analyzed the activity of over 100 million Ethereum addresses, you can imagine the sheer quantity of correlations and causations they find.

Nansen combines an intricate backend with real-time dashboards and alert systems for Ethereum and Polygon activity.

Data analytics is an interesting industry because it’s not what’s actually happening. It’s a recording of what’s just happened, almost like a lagging indicator – but it does have an influence on what actually happens next.

This influence is compounded when the data involved rings true to the observers. If 10 principled technical analysts observe an inverse head and shoulders pattern form on a chart, then their next decision is influenced by their understanding of how & why inverse head and shoulder patterns form.

These patterns quickly become self-fulfilling prophecies and crowded trades.

You won’t be looking for inverse head and shoulders on Nansen but you will develop an intuitive understanding of individual market participant’s behaviors while trend following in the aggregate.

Imagine having the exchange API keys to Jim Simmons’ portfolio or having access to your own collection of NFT advisors simply by looking through the most profitable wallets and having notifications of their purchases sent directly to your private Telegram, Discord, or Slack channels.

The power lies in the eyes of the observer with Nansen. If you don’t know what you are looking for, you won’t find it but if you’re savvy, who knows what could happen.

Features

Nansen is not for the faint of heart. To understand all of its features you’ll need at least an intermediate understanding of the crypto market structure, blockchains, digital wallets, smart contracts, stable coins, generative NFT sets, and web3 in general.

It would also be helpful to understand the cultural impact surrounding certain projects, specifically regarding NFTs. Culture is becoming a premium of its own.

For the full range of features, check out Nansen’s website’s resources or tune into their weekly office hours for more information.

1. Wallet Profiler

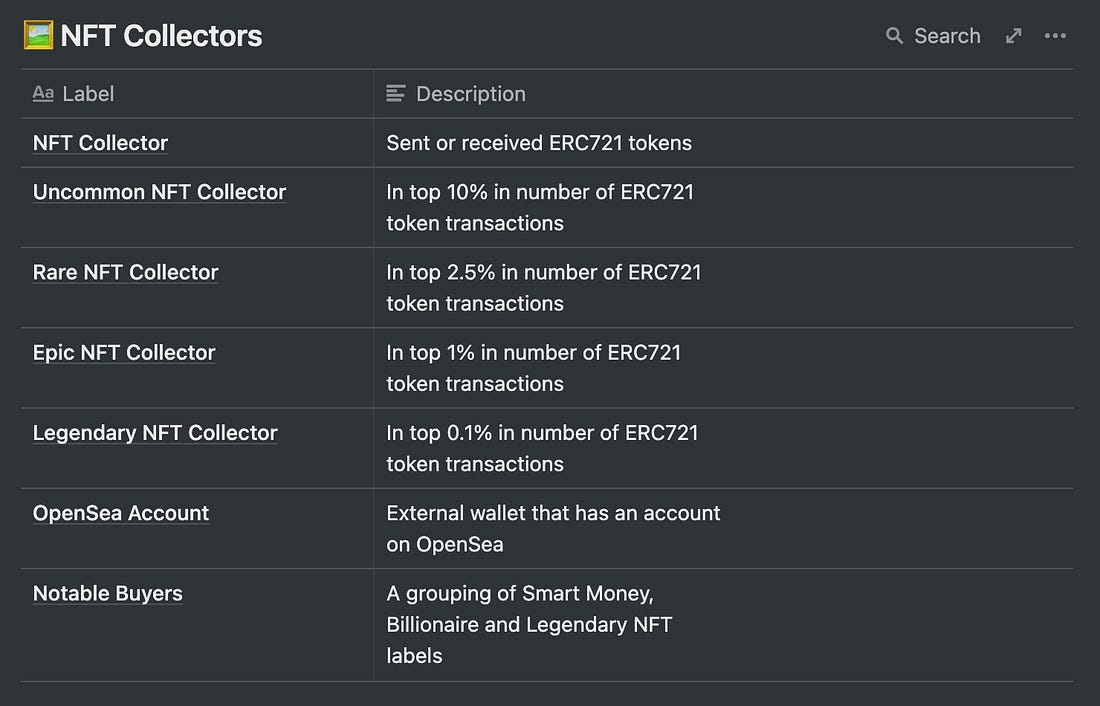

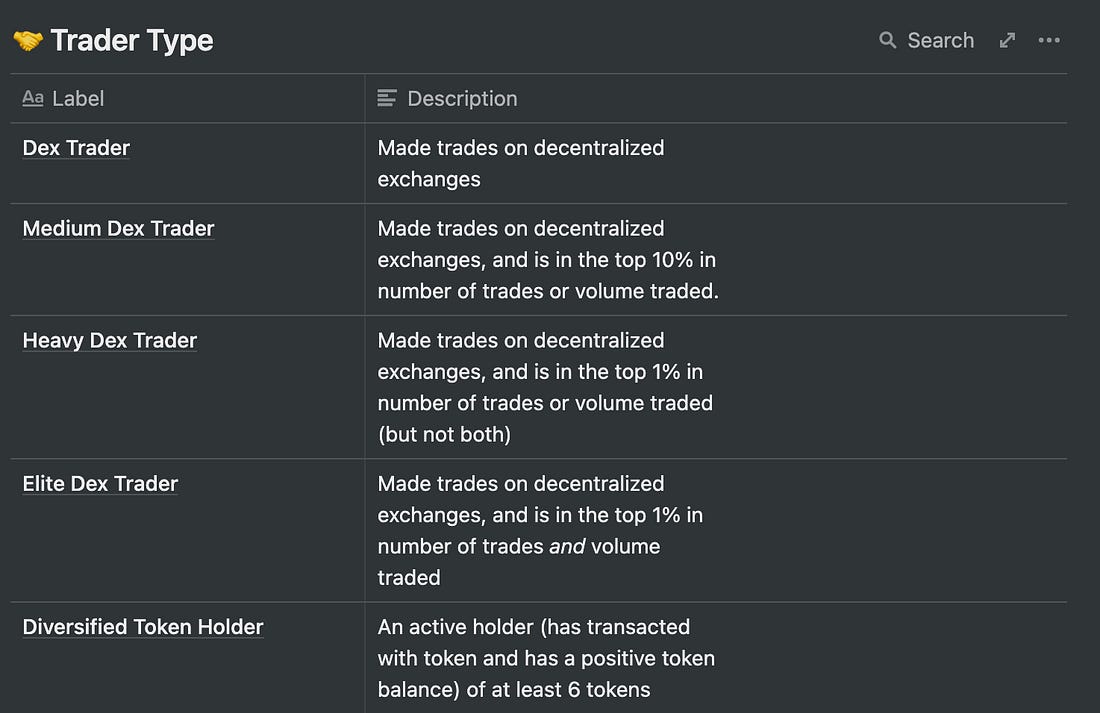

The backbone of Nansen’s platform is its ability to analyze wallets and wallet activity. In doing so, they assign labels to wallets that meet specific requirements or exhibit certain behaviors.

There are 59 labels across 8 categories. Each category has an emoji which you’ll find associated with wallets in that category.

I’ve included a few labels below. To see the rest, click here.

There is a lot that can be learned by analyzing transactions on a blockchain.

For most, the anonymity, or rather – pseudonymity of transactions doesn’t matter, but others may be alarmed by the accurate descriptions these algorithms can piece together.

The world of self custody is a world of transparency. If you choose to use a public blockchain or decentralized application built on a public blockchain, you are choosing to do so publicly. Nansen is just documenting it.

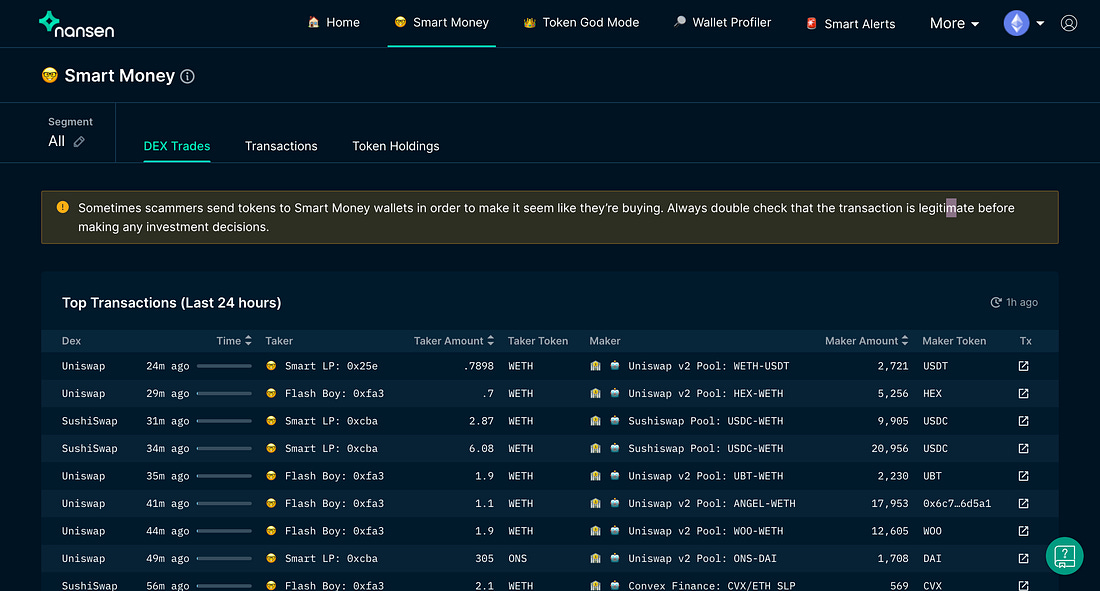

2. Smart Money Dashboards

Another core features are the Smart Money dashboards.

There are 5 ? Smart Money designations.

- Smart LP – Made more than US$100,000 providing liquidity and mining liquidity by staking pool tokens on Uniswap or SushiSwap.

- Flash Boys – Wallets that have made multiple dex trades in a single transaction that are profitable in nature.

- 0x_b1 – https://twitter.com/0x_b1.

- Whale – One of the top 100 addresses by ETH balance without any other labels.

- Fund – Public entity that invests and manages money in crypto.

You can see the last 24 hours of activity, which DEXes were used, recent transfers, and present token holdings of all these wallets.

In this case, 5 of the top 12 token holdings were stable coins and 3 of those were Aave interest bearing.

It’s a safe bet.

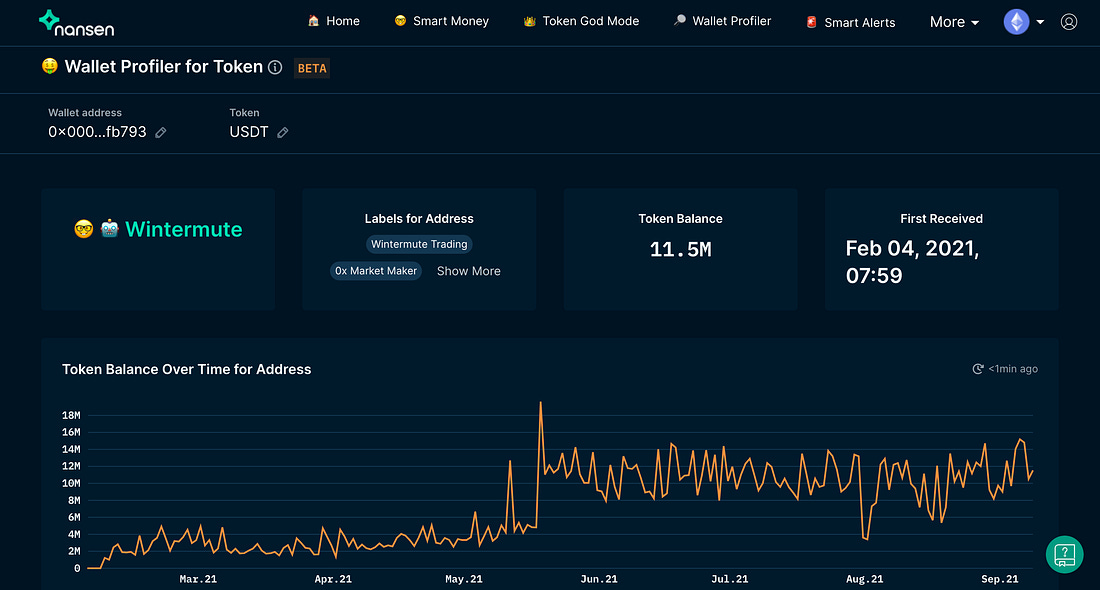

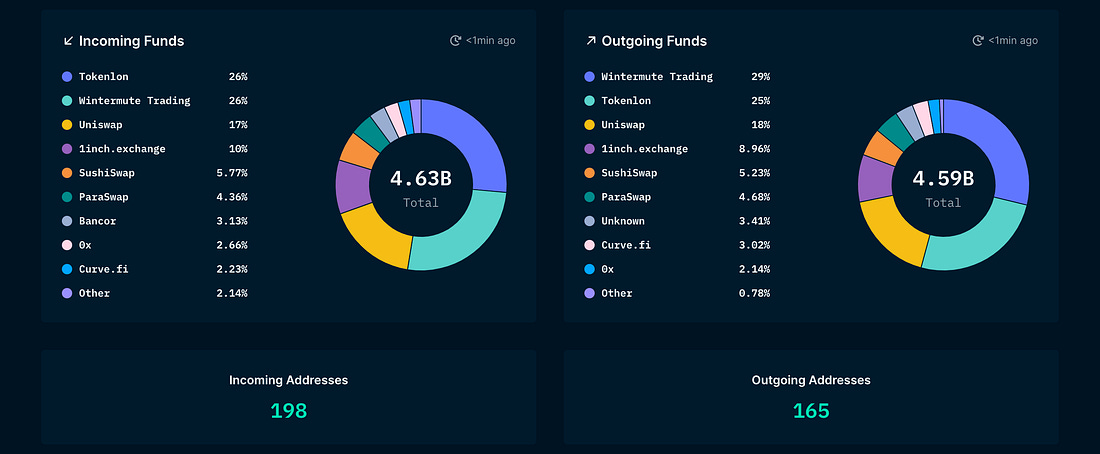

You can see the data in the aggregate, as pictured above or you can select individual wallets, like Wintermute’s pictured below. The following data sets are drawn from the activity in the Wintermute wallet involving the USDT token.

These are institutional flows. Retail investors never have access to this granularity in detail in traditional equity markets. For the most part, banking and market-making is opaque to the public.

For traders who know how to put 2 and 2 together, you might like Nansen. These screenshots are the tip of the iceberg in terms of sorting through the options and data sets.

3. NFT Paradise

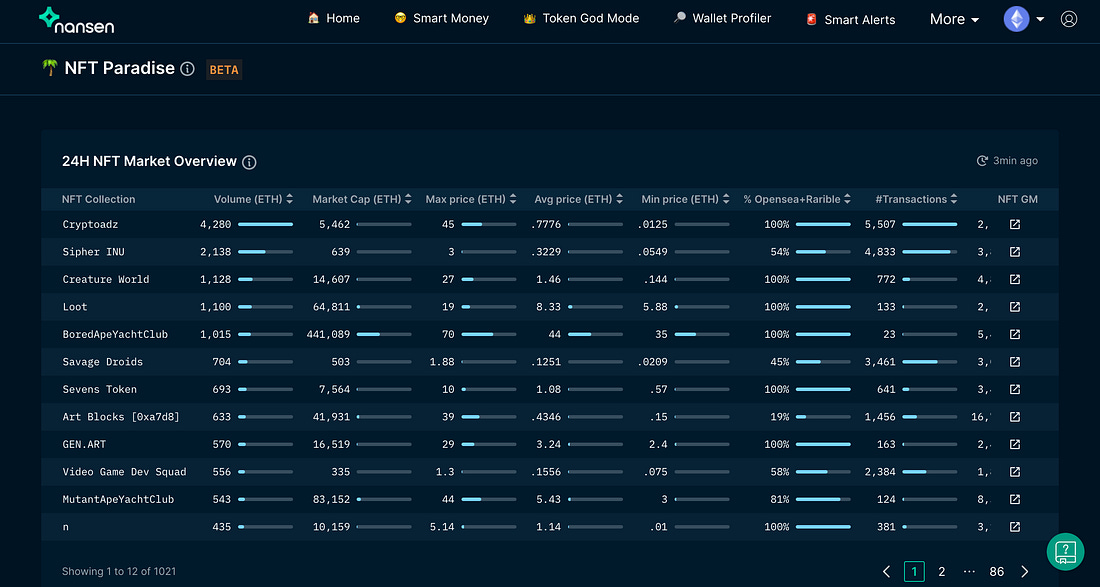

NFT Paradise begins with a simple data-driven explanation of the top project’s activity in the last 24 hours. In this case, there were 1,021 included.

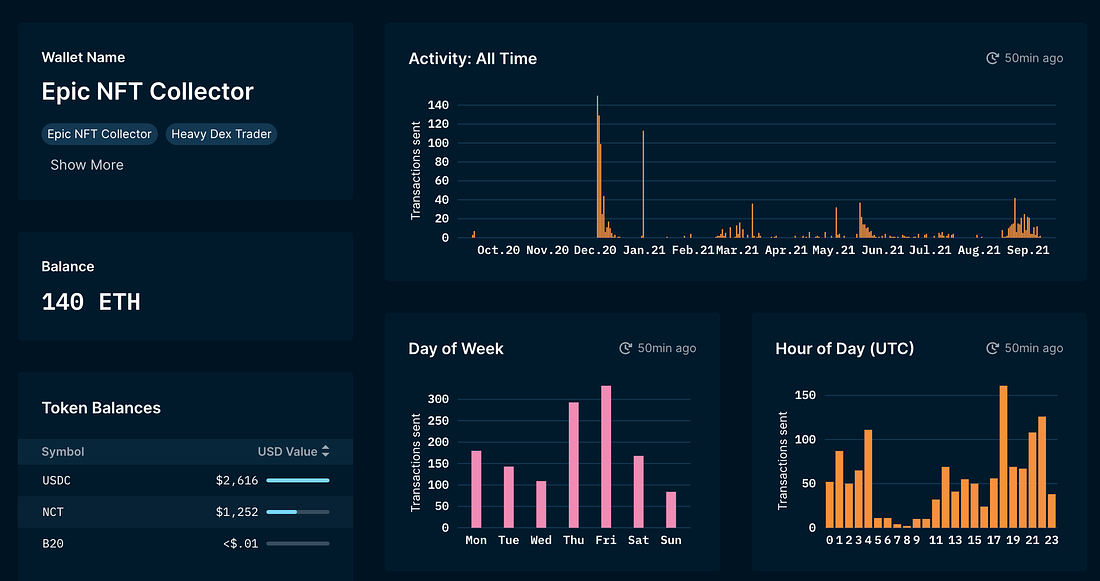

The NFT Profit Leaderboard displays the all-time profits of a wallet.

The Epic NFT Collector, in 2nd place, has in total turned $836,000 into $10,909,500 with ETH at a price of $3,500.

You can view all 950 transactions that have led to this 1,202% profit margin. You can also view the top interacting wallets, the history of incoming/outgoing tokens & ETH, exactly how much capital they have, and all the NFTs currently in the wallet.

One thing to note. You can see the Epic NFT Collector made a massive amount of transactions in December 2020 and January 2021. I seem to recall Art Blocks beginning to enable the minting of many of their famous works at that time.

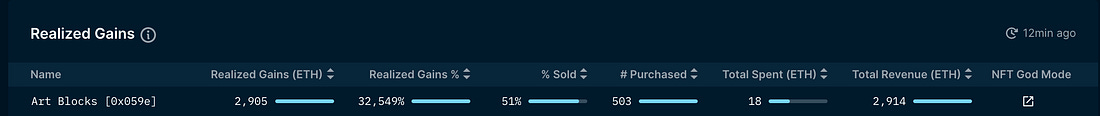

Well, I checked the Realized Gains section and…

A nice 32,549% return of $10,167,500 in 9 months on Art Blocks NFTs.

4. Smart Alerts

Nansen’s Smart Alerts let you know right when an event you are interested in occurs.

You can create simple price alerts or more complex ones like when a specific address creates a new contract, when tokens are transferred, or when transactions of a certain size are made.

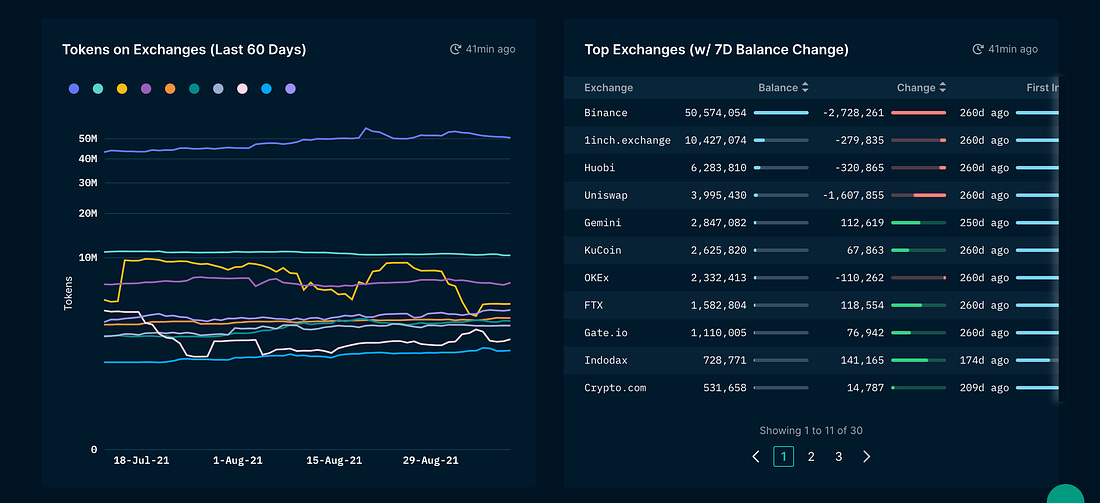

5. Token God Mode

With tens of thousands of tokens out there, it can be hard to know what they’re up to. Token God Mode enables you to see all the exchange (CEX & DEX) inflows and outflows, notable holders, Hodlers, and recent trades.

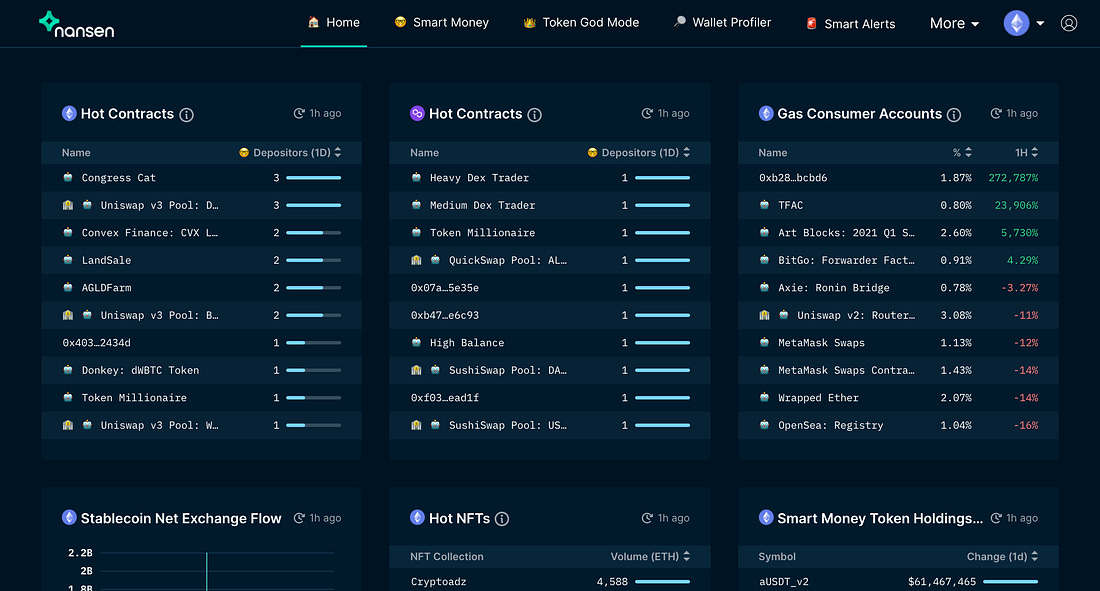

6. Hot Contracts

Hot Contracts are only for VIP users and they could very well be worth your while.

You can sort the deposits by Smart Money to see exactly what they’re doing and potentially why they’re doing it.

Each contract is linked to Etherscan so you can verify the source of the projects and decide if its legitimate. This is self custody, DYOR.

Pricing

Nansen is not free.

To write this, I started their 7 days $9 trial and it’s been well worth it. Their plans range from $149 – 2,500 / month or $1,400 – $27,500 / year.

For all the details, check out their monthly and annual pricing here.

Conclusion

The main goal that Nansen achieves is helping users find new opportunities.

These can be found through observing NFT minting activity, Smart Money movement, Hot Contracts, setting Smart Alerts on wallet addresses associated with Smart Money, etc. The platform is built for any institutional or retail investor whose aware of the revolution happening with digital assets.

While there are many competitors in blockchain analytics, even other wallet labelers, Nansen stands out. They have unique offerings and achieve a relative niche product-market fit at a scale and level of quality I haven’t seen elsewhere.

With the 100s of millions of data points available, you can be sure you’ll find something if you just keep looking.