A Fresh Look At DAOs – The New (Digital) Family Offices

DAOs have had an incredible run the past couple of months. There is not a week that passes by which sees the launch of new DAOs. Their purpose and reason for existing are as manifold and diverse as human interests and activities can possibly be. Some were founded to allow its community members access and co-ownership to otherwise unaffordable NFTs (SharkDao), others were created as a media platform (ForeFront, Bankless), some operate as a research and early stage investment platform (Global Coin Research) or they were initially launched to buy a copy of the US Constitution (ConstitutionDAO). Many earlier DAOs, and today the largest ones so far, are protocol DAOs in the DeFi space (Uniswap, MakerDAO, Compound to name just a few).

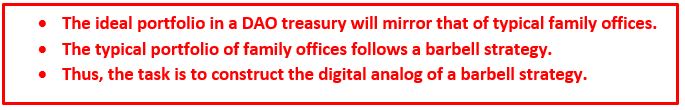

Equally impressive, this proliferation was accompanied by a surge in the amount of funds held in DAO treasuries (see link). As diverse the current DAO landscape presents itself, there is one common aspect that almost all DAOs share: their treasuries are mainly composed of the native token. This concentration, however, comes with certain risks that can potentially challenge their viability in the future.

This article will address the challenges of treasury diversification in three steps:

- Outline the dilemma that DAOs face today: one the one hand, DAOs need to diversify their treasuries away from their native token concentration; on the other hand, they can’t simply sell their native tokens on the open market without moving the market or cause any negative perception by market participants or its community members. We will discuss some strategies DAOs can pursue to address this dilemma.

- Present a long-term portfolio derived from traditional finance that could serve as a template for DAO treasuries pursuing their goals while at the same time ensuring their long-term viability.

- Lastly, introduce a crypto-native analog to such a long-term portfolio strategy from traditional finance.

Our conclusions from this analysis:

DAOs’ Dilemma

One powerful concept behind DAOs is that its community members are at the same time also its owners. This governance structure helps align the interests of the DAO and its members. In addition, remuneration of contributors with native tokens, especially in the early stages, lets community members gradually build equity to then participate in the upside and future success of the DAO. This remuneration structure is reflective of the successful implementation of compensation schemes in traditional startups (link) in the past.

At the same time, however, native tokens are exposed to general market volatilities and are not immune to strong sell-offs during bear markets. It is in such circumstances that the daily operations and functionality of a DAO can be disrupted due to the lack of cash reserves for its regular funding. Partially compensating a core group of team members in terms of a fixed salary in stable coins that is responsible to maintain daily operations and even to continue to build its network and develop during episodes of market stress becomes instrumental for the viability of a DAO. It is therefore important that part of the Treasury is diversified in low risk/safe payoff assets such as stable coins.

Selling native tokens against stable coins, however, is easier said than done. The dilemma that DAOs face is that the markets may fail to smoothly absorb the supply of native tokens due to the lack of liquidity leading to a sharp drop in its price. Furthermore, a sale of native tokens by the DAO itself can lead to a negative perception in the marketplace and among community members even though such a sale is in the best long-term interest of the DAO.

DAOs can resort to several non-disruptive strategies to raise cash in exchange of native tokens without directly intervening in the marketplace. These strategies center around three broad categories of managing a Treasury:

- Operational cashflow generation: generate a steady stream of cash inflows from DAO’s regular activities. For instance, an investment DAO can generate cash from carry operating like a seed level syndicate. A media DAO can generate revenues through paid access to its newsletters. In addition, DAOs could generate a regular stream of cash income through recurring membership fees.

- Private token sales with long-term vesting schedules: DAOs can raise cash by entering long-term partnerships with investors such as VCs or angel investors exchanging native tokens for a fixed price for cash following a long-term vesting schedule. Similarly, a DAO could raise cash from its community members following similar deals.

- Structured deals with options: One strategy that a DAO can pursue is to allocate a (very) small portion of its funds to systematic covered call selling against its native token. This strategy would ensure a steady stream of cash in form of upfront premia from the options sales in form of stable coins. Given that the options markets in the crypto space are still in its early stages with ensuing lack of liquidity, the premia can be calibrated to a targeted level of something like a 50-60% annualized return. However, given the high-risk profile of this strategy and its poor timing of losses (this strategy typically strongly underperforms during periods of general market stress), the scale of such a strategy is necessarily limited to a very small percentage of a DAO’s funds.

Lifting The Barbell For The Long-Term Viability

How much should a DAO treasury hold in cash and how much in native tokens? If we have the longevity and long-term success of the DAO in mind, this question goes even deeper: What should a DAO Treasury that is set it up for its long-term success and viability look like?

To answer this question, we will look at the composition of portfolios of organizations that have similar goals to those of a DAO but that have been around for a long time as organizations and stood the test of time through numerous crises. The aim is that inspection into such organizations will then help us delineate a Treasury composition for DAOs.

We think good examples of traditional organizations that have similar goals to DAOs are family offices and university endowments. Their goals can be broadly categorized along these principles:

- Preserve capital

- Generate gains that exceed operation costs

- Build and maintain strong reputation to attract talent

If we succeed to distill portfolio features that are characteristic to such organizations that distinguish them from average portfolios, then we can as a subsequent step start to think about how to translate such portfolios from traditional finance to a crypto-based counterpart.

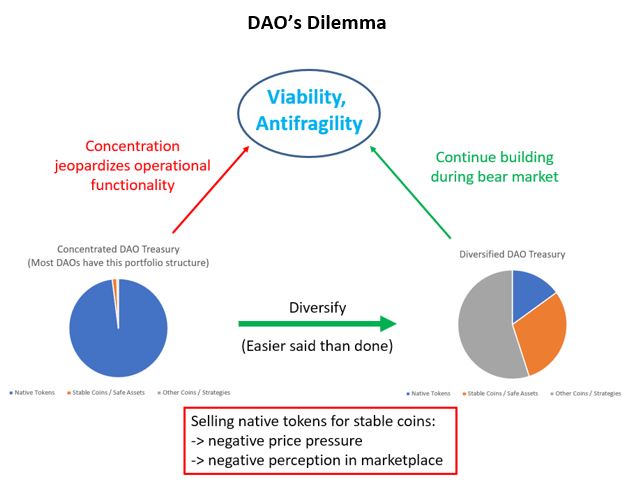

But first things first. Inspection into the composition of the portfolios of family offices and endowments reveals that they invest their funds very differently from average household in the United States, whose majority of wealth is mostly parked in pension funds. There are two distinctive features that are worth highlighting in this comparative analysis:

- Family offices and endowments invest a significantly larger share of their portfolios in safe / low risk assets such as cash and absolute return funds

- Family offices and endowments invest a significantly larger share of their portfolios in very high risk and/or illiquid assets such as real estate, private equity and VCs that have high expected payoffs

Family offices and endowments hold about a quarter of their portfolio in low-risk assets such as cash or absolute return in comparison to only 7% of average American households. Similarly, the exposure of family offices and endowments to very high risk and/or highly illiquid asset classes –alternative investments – such as VCs, PE, leveraged buyouts or real estate is significantly higher at 45% in comparison to only 19% for the average American households. On the other hand, US households hold a massive 75% of their wealth in stocks and bonds compared to only 29% with family offices and endowments.

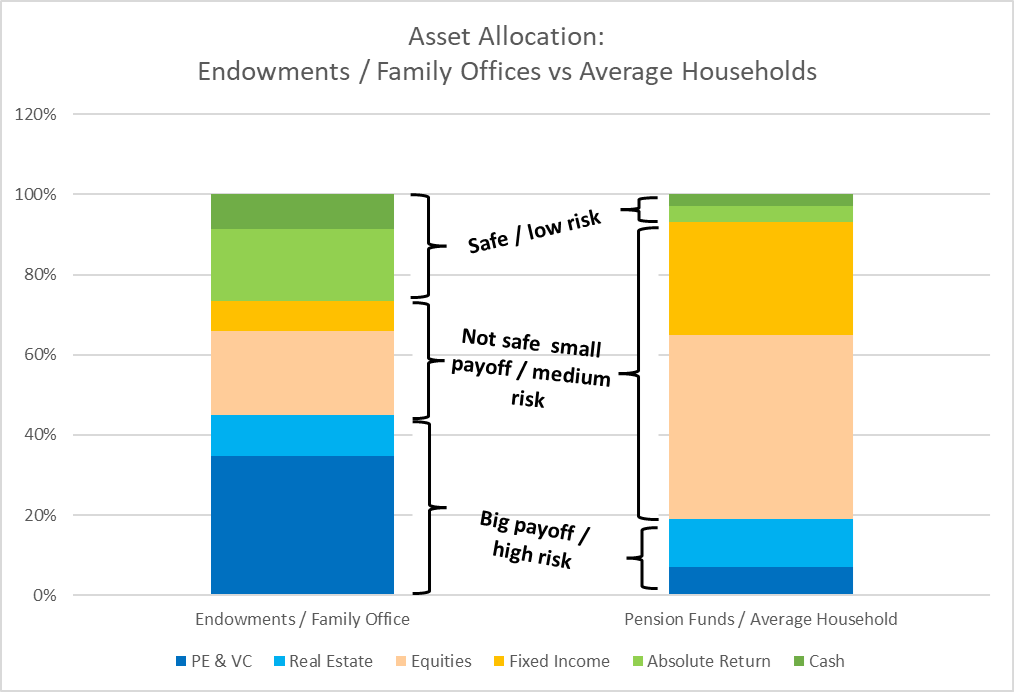

Considering these findings, the portfolio composition of family offices and endowments can be best described as a barbell strategy. Theoretically, ex ante, every investment can be located on a risk spectrum that ranges from risk-free to highly risky. Between these two extremes, you have a large middle ground where risk is moderate.

Now imagine this risk spectrum as a barbell. On the far-left side, you will have cash and absolute return investments; on the very right side, you will find PE, VC, real estate and other alternative investment vehicles that are associated with big payoffs and high risk. The wide middle part of not so safe, small payoff and medium risk is populated by traditional assets classes such as equities and fixed income.

Now in analogy of a barbell, the best way to lift this risk barbell is to hold it at both ends, never in the middle. More concretely, the main characteristic of the barbell strategy is that capital is not evenly distributed across the risk spectrum. Instead, a very large share of the funds is allocated to the one extreme, very low-risk assets. That way, family offices and endowments protect their business and wealth from potential ruin, but also ascertain that they can enter new investments at very attractive levels during periods of financial distress. At the same time, a barbell strategy allocates funds to the other extreme, to very high-risk investments. This way it exposes the portfolio to few volatile opportunities that can lead to massive paydays. In other words, the barbell strategy makes uncertainty your friend.

Allocating funds to moderate risk-taking, in contrast, is the least attractive strategy: the upside is never high enough to produce life-changing gains and the downside is often large enough to keep you up at night. But this is predominantly the investment strategy of pension funds and thus of a vast majority of households in the US.

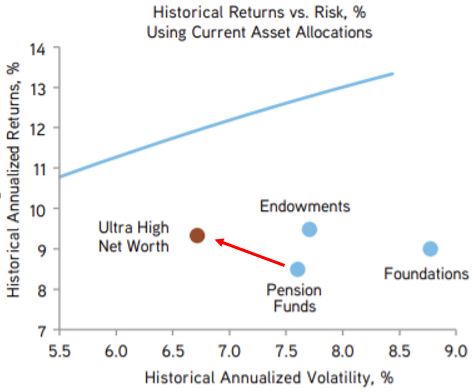

There are nuances in structuring the barbell portfolio strategy, of course, and the differences in the outcomes manifest themselves mostly in the risk level of the long-term performance (if we accept volatility as an appropriate risk measure, which typically is not a good idea). Endowments and foundations often follow a similar investment strategy as family offices and Ultra High Net Worth households but are characterized by higher volatility in their performance. What unifies them however is that, on average, they outperform pension funds by 1% to 1.5% annually often with the same, or even lower amount of risk. This may not seem to be a big difference, but it starts compounding in the longer term: 5x vs 6x after 20 years, 11x vs 17x after 30 years, 24x vs 42x after 40 years.

A Digital Portfolio For DAO Treasuries

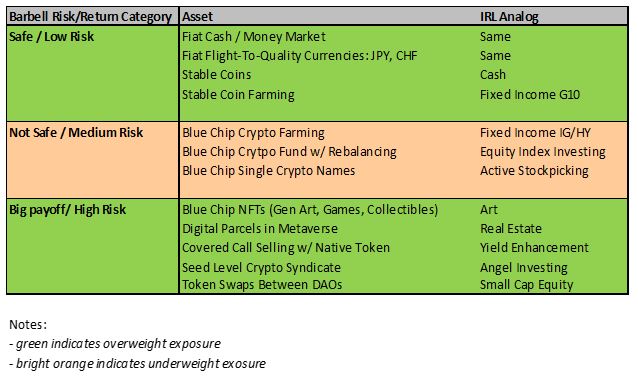

One important conclusion studying the long-term performance of family offices and endowments versus pension funds is that the pursuing of the barbell investment strategy over time will lead to superior returns at much lower risk. The central question for a DAO in this context then becomes: what is the digital counterpart to the barbell strategy in the traditional financial world? We try to address this question by mapping the real-world investment strategies that is associated with each section of the barbell in today’s family offices and endowments to its digital counterpart. A possible answer to this question is summarized in the table below.

We’ll next discuss the individual assets separately for each sleeve of the barbell strategy:

Safe / Low risk:

- Fiat Cash USD & Flight-to-Quality Currencies: Even though the emphasis for a DAO treasury is put on a composition of digital assets, there are good reasons to maintain some exposure to fiat in form of some money market investments. Interest paid on these instruments are abysmally low – for instance the one-year US Treasury Bill yields 20bps as of this writing – and the real return is negative. However, these instruments present themselves as most suitable to the safe/low risk sleeve of the barbell strategy as long as regulatory uncertainty continues to loom over stable coins which could lead to eventual haircuts of such holdings. The same arguments holds even more strongly for fiat currencies that proved to be particularly strong hedges during times of global financial distress, such as JPY and CHF.

- Stable Coins and Farming: Following the very spirit of DAOs as crypto-native institutions, a large portion of the safe/low risk asset allocation would go to stable coins. Furthermore, some fraction can be farmed to generate yield for the DAO treasury, although the decision around the portion of stable coins to be farmed and the choice of the farming platform should be driven conservatively by the dictate of low risk exposure.

Not Safe / Medium Risk:

- Blue chip crypto fund with rebalancing / farming: A moderate size of the DAO treasury can be allocated to the largest maybe top 5 or 10 crypto projects. With the strong volatility and large differences in the relative performance of single coins (such as BTC vs ETH, or BNB vs SOL), a frequent monthly rebalancing of the holdings, for example, will ensure a more accurate exposure to the broader crypto market. This investment is best described as a low-cost S&P 500 ETF in traditional finance, and can possibly be implemented and managed by a crypto index provider such as Index Coop. As for farming, a portion of the blue chip crypto holdings can be deployed to farming to generate extra yield, ideally in stable coins.

- Blue chip crypto single names: If the DAO community has a strong view about a certain project or is somewhat associated in its activities and involvements with a certain ecosystem, some exposure to single projects can also make sense (for instance, ETH, SOL or MATIC).

Big Payoff / High Risk:

- Blue chip NFTs and land: Even though some blue chip NFTs have reached price levels that are perhaps unattainable for many DAOs, and their upside potential could be somewhat limited, the NFT space offers interesting big payoff opportunities both in gaming, collectibles or generative art. Just to name a few, possible examples of some of the more established NFTs that are still accessible and potentially have a very large upside are Parallel, Treeverse, Aurory (gaming), BAYC (collectibles), some of the Art Blocks Curated series such as Subscapes, Aerial View (generative art).

- Covered call selling: We have been discussing this strategy within GCR as a yield enhancement that has the additional benefit of generating returns in form of stable coins off the native token without the need for selling latter in the market place. It’s very important to highlight that a DAO Treasury exposure to covered call selling needs to be very small as covered calls can generate significant drawdowns with the worst timing. These challenges can also be compounded by the nascent nature and the resulting lack of liquidity in the small cap tokens options markets. Anticipated annualized returns on the other hand can be 50-60% on deployed capital. (Strictly speaking, mathematically, this strategy doesn’t fit into this segment of the barbell as its payoff is highly concave instead of convex versus “volatility”).

- Seed level crypto syndicate: DAOs can leverage on their vibrant community of crypto enthusiasts to partner up with crypto start-ups in form of raising capital from the community for part of their equity and or tokens pre-TGE. In addition to the community’s fund raise, part of the DAO’s capital can be invested in these startups. This exposes the DAO to a considerable upside and participation in the next wave of crypto innovations.

- Token swaps between DAOs: This is another way to obtain diversification away from the native token concentration in the DAO treasury. At the same time, this strategy can help the DAO expose itself to a large payoff if the DAO ecosystem as a whole grows and performs well. Such a token swap was for example implemented in the past between FWB and WHALE.

References

On barbell investment strategies:

Nassim Taleb, The Black Swan, 2007.

Master Your Business Risks Using the Barbell Strategy.

On investment strategies of family offices and university endowments:

Yale Investment Office, Yale’s Strategy.

KKR Insights, The Ultra High Net Worth Investor: Coming of Age, May 2017 .

On discussions of DAO treasuries:

Bankless Newsletter, April 2021.

Treasury Management In The Age of DeFi, July 2021.