The NFT Liquidity Premium – An Annual $3bn Tailwind

The NFT market went through some remarkable developments in the past few months, attracting a lot of attention from the both the crypto and mainstream communities. Besides headline-grabbing episodes such as the $69mm purchase of Beeple’s Everyday NFT collage, or Christie’s surpassing of the $100mm ceiling in NFT sales in late last September, there were three more profound, and for this sector’s viability and establishment more important developments in play:

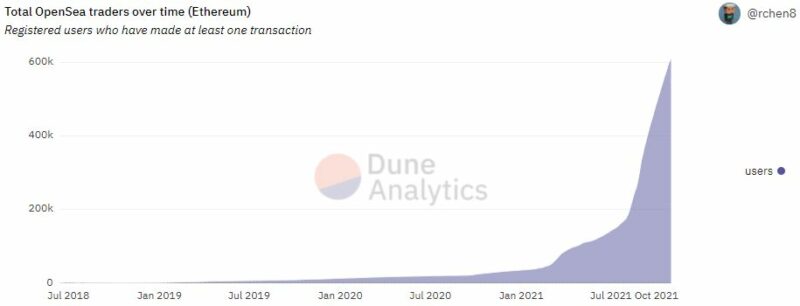

- An explosive increase in trading activity on existing platforms. On OpenSea alone, this manifested itself both in traded volumes with the past three months each easily surpassing the $2bn mark, and in terms of the cumulative number of market participants breaking through 600,000 in late October (see chart below).

- Launch of new NFT trading platforms: some new trading platforms have been launched or are about to be launched near term, the most prominent ones among them perhaps being Coinbase and FTX.

- Launch of fractionalization platforms: Many blue chip NFTs are priced to levels that are inaccessible to many market participants. NFT fractionalization platforms such as fractional.art, NFTFY, unic.ly, szns or Ricks provide solutions to address these bottlenecks.

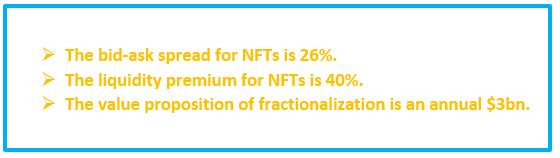

Despite these developments, NFTs are arguably the most illiquid sector for trading and investing. The purpose of this essay is to gauge the liquidity premium that the above three trends can add to the sector. We find in our analysis that:

What does this mean? If the liquidity in the NFT sector progressively improves, NFT valuations will accordingly go up – all else equal. NFTs will never be as liquid as US Treasuries, but even if NFTs reach a level of liquidity comparable to highly illiquid small-cap stocks, a partial materialization of the liquidity premium suggests the presence of a considerable tailwind for the sector. More concretely – and conservatively, we think the businesses that try to unlock the NFT liquidity premium will translate to a up to $3bn value creation annually (if we apply to the liquidity premium not to the flow of NFT sales but to the stock, that value would be a multiple of that $3bn).

Liquidity Premium: Hard-to-Trade Assets

It is well established that the costs of illiquidity affect asset prices as investors and traders demand a compensation for bearing them. Furthermore, because liquidity varies over time, risk-averse investors require a compensation for being exposed to such liquidity risk (think of “flight-to-quality” flows in financial markets during episodes of global macro stress). Empirically, liquidity has been proven an important factor in explaining why certain hard-to-trade securities and assets are relatively cheap; small cap stocks, for instance, that are typically illiquid in comparison to blue chip stocks in terms of their bid-ask spreads systematically generate higher returns (the well-known small firm effect in Fama-French).

Put simply, liquidity is the ease of trading an asset. Illiquidity stems from various sources which often occur simultaneously. One source of illiquidity is exogenous transaction costs such as trading fees, order-processing costs or taxes. Every time an asset is traded, the buyer and/or seller incurs a transaction cost. In New York City, for instance, the seller of an apartment typically pays a 6% brokerage fee. Another source of illiquidity is demand pressure and inventory risk, which arise when not all trading parties are present in the market at all times. This situation occurs for example when a seller needs to sell an asset quickly and the natural buyers may not be immediately available.

“The Soviet Union is a good trader”

However, even with the most efficient markets, illiquidity can still remain an issue. In addition to “physical” market frictions for trading, illiquidity can also arise from less tangible sources which can be typically ascribed to the presence of asymmetric information between the market participants involved. Arguably one of the best traders ever, Bruce Kovner once stated that “the Soviet Union is a very good trader … in currencies, and grains to some degree. Why shouldn’t they? They have the best developed intelligence service in the world.“

Less dramatically, when institutional buy-side investors are presented a “gem” by an investment bank salesperson which he just so happened to find in his “vault”, often case it turns out with hindsight that their trading desk knew in advance of a hedge fund that needed to liquidate larger positions with ensuing pressures on market prices. In circumstances like these, market liquidity can quickly dry up, or assets end up in the hands of less informed – perhaps, even gullible – participants.

But how large is the impact of illiquidity on market valuations?

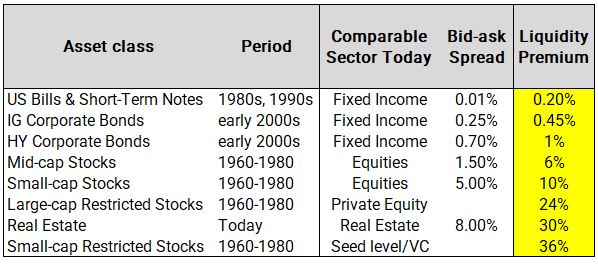

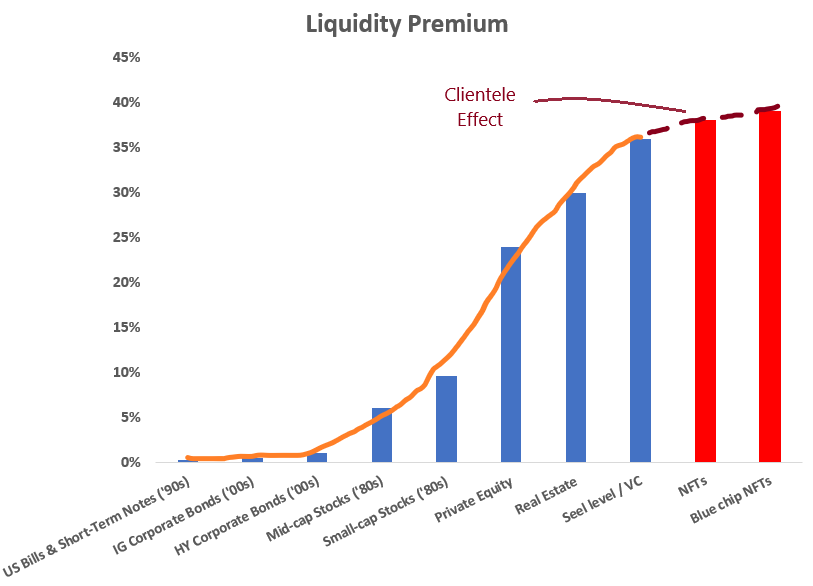

Both a closer look at financial markets that are well-established today thanks to frictionless trading technology and increased market participation but were emergent a few decades ago, and also an inspection into existing illiquid markets such as real estate may give us an idea. As the table below shows, and as expected, fixed income assets from US Treasuries to corporate bonds were characterized by lower bid-ask spreads and accordingly lower liquidity premia in comparison to equities. And within equities, publicly trades ones commanded a lower premium than private equity and restricted stocks. Restricted stocks back in the 1980s are probably best comparable to private equity and venture capital today. Not unexpectedly, real estate also falls into a similar category in terms of liquidity premium commanded as private equity today of a figure of around 30%.

But Where do NFTs Stand?But how large can we expect the liquidity premium for NFTs to be? Or, to put the question in reverse fashion: what can we expect the price appreciation in the NFT sector to be if the aforementioned liquidity improving trends continue and help NFTs become more liquid over time?

A Look at BAYC

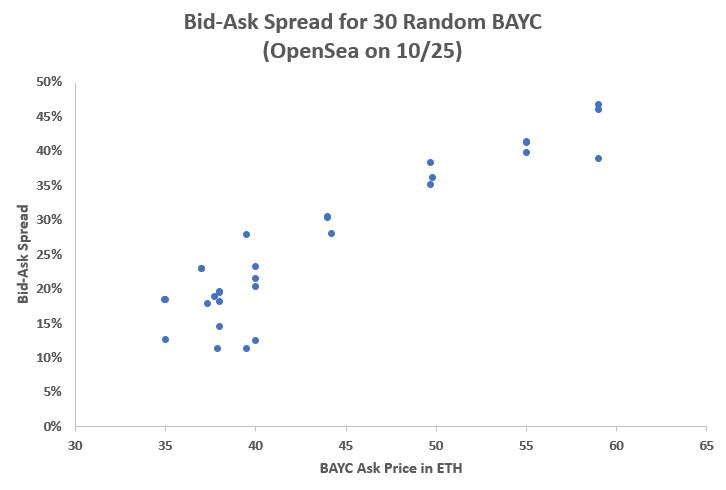

To answer that question, we need to understand where NFTs stand in the liquidity-illiquidity spectrum of the sectors we identified in the table above. One simplistic though useful way to measure liquidity is to measure the bid-ask spread in the market. For NFTs, that’s an incredibly difficult task, given how heterogenous and diverse the sector is – think of generative art, game avatars, collectibles – , and how wide NFT prices range, from less than 0.05 ETH to thousands of ETH. In addition, especially newer projects are shrouded with opaqueness as of their quality and the team involved raising serious uncertainty around the long-term viability. The scope to adequately measure the bid-ask spread for the entire NFT markets is certainly beyond the scope of this discussion here.

Nevertheless, a closer look at a widely known and relatively liquid project (in the sense that those NFTs are traded on a regular daily basis by the community) with a relatively wide price range can give us already a good indication. For that purpose, I sampled 30 Bored Ape Yacht Club collectibles that were on offer on OpenSea on 10/25/2021 and tracked the highest bid placed on the trading platform. This is clearly too coarse a measure for gauging the liquidity of the NFT sector as a whole, but it still provides us with some interesting and perhaps even more generalizable insights about the sector liquidity.

The average bid-ask spread is about 26%. Interestingly, the bid-ask spread increases with the sales price: the further away the BAYC collectible from the floor price, the higher the bid-ask spread, reaching a level up to 45%. This suggests that NFT fractionalization has a material scope to add value to the sector by addressing the liquidity constraints. Compared to the other sectors from the table, this finding identifies NFTs as the most illiquid sector in the asset universe covered here.

The Clientele Effect

So where do we go from here? We identified that NFTs are on the very end of the liquidity-illiquidity spectrum of asset classes measured in terms of bid-ask spreads. Gaining from the insights of earlier empirical research on the impact of the bid-ask spread on the liquidity premium, we can use the data as it presents itself in the table and extrapolate out to get a sense of the liquidity premium currently present in NFT markets.

Before doing that, however, we need to incorporate the clientele effect.

Suppose that investors differ in their expected holding period. For example, some NFT investors are flippers, some are HODLers. Flippers typically have a shorter investment horizon for their holdings and HODLers, on the other hand, probably will never sell. This difference in investment horizon could be because a liquidity shock forces investors differently to liquidate their holdings; some investors “can’t afford to lose” because they’re leveraged, or their net exposure to the sector is too high whereas long-term investors can patiently wait out a bear market or a sell-off as they’re sitting also on a pile of cash that helps them fund their daily activities. Similarly, a short-term rally will make flippers want to liquidate their investment earlier whereas HODLers will sit on their investment betting for continued price increase in the future.

Consequently, each investor considers differently the impact of transaction costs on the return that she requires. A long-term investor can depreciate the trading cost over a longer holding period. But while all investors prefer assets that are associated with low transaction costs, such assets are particularly demanded for by short-term investors who incur transaction costs more frequently. Long-term investors on the other hand tend to opt for assets in which they have the greatest advantage, assets that are costliest to trade – illiquid assets. Consequently, liquid assets are held by frequently trading investors such as flippers while the illiquid assets are held by HODLers where they can earn a premium in holding such assets.

Thanks to this clientele effect, the relationship between the liquidity premium and the illiquidity of trading the asset is concave. The expected asset return increases with illiquidity but at a progressively slower rate: the most illiquid assets are allocated to investors with longest holding periods and this in turn mitigates the compensation that they require for the costs of illiquidity.

@richerd’s Punk #6046

This observation is not merely of theoretical relevance. On the contrary, we see this play out both anecdotally and empirically.

On October 15th, the founder of Poap placed a bid of 2,500 ETH to @richerd, the holder of punk #6046. The 2,500 ETH at the time amounted to $9.5mm USD! Long story short, @richerd refused the offer, even though he publicly admitted that the 2,500 ETH was way above what he perceived as the current fair market value of his NFT: “My punk is not for sale.”

In below Twitter thread, he outlined his reasons for holding on to his punk, many of them being related in some ways to his “reputational capital”. At any rate, this is a powerful manifestation of the clientele effect where @richerd held on to a highly illiquid asset based on his (arguably very) long expected holding period.

To come up with an estimate of the liquidity premium for NFTs, let’s go back to the table from earlier that summarizes the bid-ask spreads and the liquidity premiums associated with various financial asset classes. When we visualize the liquidity premium by asset class, we can clearly see in chart below that the clientele effect is at play. Sorting asset classes from left to right by the degree of ease to trade them with the most liquid sectors on the far left and small-cap restricted stocks (a proxy for seed level VC today), the most illiquid asset class, on the far right, we can see that the liquidity premium increases with the degree of illiquidity, but at an increasingly slower pace. “Connecting the dots” and extrapolating for NFTs can then give us an idea of this sector’s liquidity premium. With this we can see that the liquidity premium for NFTs amounts to 40%.

A $3bn Annual Tailwind

With this insight, we are not saying anything about which direction the NFT market will be heading, or by how much it will grow over a certain period. But what we can do is to make an all-else equal statement. As NFTs become more common-place and more participants buy and sell their JPEGs on more and more available trading and fractionalization platforms, trading frictions will be successively removed and the liquidity and transparency in this sector will naturally increase. The upside of this evolution is a natural tailwind of a potentially 40% upside in NFT valuations as they are transacted as of today.

It’s hard to justify that NFTs will ever be as liquid as the Fixed Income markets. However, it’s not out of the ordinary to assume that NFTs will eventually be transacting at comparable levels as illiquid small-cap stocks back in the 1960s-70s. That would still amount to a liquidity premium of 30% (40% for NFTs minus 10% for small-caps). With close to $10bn NFTs traded volume on OpenSea in 2021 so far, a 30% liquidity premium priced into the sector amounts to $3bn. Not bad for a collection of JPEGs.

References:

- Amihud, Mendelson, Pederson, Liquidity and Asset Prices, Foundations and Trends in Finance, 2005 (https://pages.stern.nyu.edu/~lpederse/papers/LiquidityAssetPricing.pdf)

- Dune Analytics (https://dune.xyz/rchen8/opensea)

- Jud et al., Price Spreads and Residential Housing Market Liquidity, Journal of Real Estate Finance and Economics, 1995.

- Market Wizards, Interviews with Top Traders, Jack Schwager, 2012.