Blockchain Markets & Venture in 2021

At the time of writing, Bitcoin is still in the throes of a 50%+ retracement since mid-May 2021, sparked by a number of likely factors but most popularly attributed to Elon Musk’s tweet that Tesla would no longer accept payments in BTC. This bloody drop is bookended by the infamous liquidity crunch of May 2020, scarcely more than a year apart, in which holders of BTC experienced more than a 60% drawdown from local highs.

As Bitcoin price is a general bellwether for the greater crypto market, it is difficult to distance ourselves from the frenzied headlines and stark strings of red numbers bleeding across our portfolio apps. Given the extreme volatility in the cryptocurrency space, investors are even more susceptible to base rate neglect, a common fallacy in behavioral finance in which we assign too great of a weight to new, event-specific information and underweight the overall context or earlier data.

This propensity coupled with a basket of other cognitive biases, such as loss aversion, or preferring to avoid losses compared to equivalent gains, negativity bias, where we have greater recall of painful memories, and the Dunning Kruger effect, in which we mis-calibrate our actual ability, puts many investors at the mercy of their limbic systems and unable to make the best decisions for their portfolios.

In these psychologically challenging times, as investors we must remember to circle back to our original data and assumptions and ensure that they are still valid and correct.

In the general cryptocurrency market, we should not be so quick to forget the amount of incredible news over the past year that even individually would have been unbelievable to the average market participant even two years ago.

July 2020: US Office of the Comptroller of the Currency (OCC) approves banks for cryptocurrency custody services

August 2020: MicroStrategy announces $250M purchase in BTC as a reserve asset on their balance sheet. They would go on to purchase an additional $175M in September and so on, resulting in 105,085 bitcoins as of June 2021

Sept 2020: CB Insights, a massive market intelligence and data platform, acquires a blockchain data provider

Oct 2020: Square purchases $50M in BTC; Stone Ridge Asset Management, a $10B hedge fund, acquires $100M in BTC; PayPal enables BTC purchases; JPMorgan publishes a pro-Bitcoin report and launches their commercial repo blockchain; MicroStrategy buys $50M more Bitcoin (can’t stop won’t stop)

November 2020: Grayscale AUM surpasses $10B; VanEck launches BTC ETN; Guggenheim applies $500M to BTC exposure through GBTC; AllianceBernstein reverses stance on Bitcoin, admits it has a role in asset allocation over the long term

December 2020: Standard Chartered announces institutional investor-focused trading platform; DBS Bank launches a cryptocurrency exchange; MassMutual buys $100M in BTC; Ruffer Investments ($23B AUM) allocates 2.5% to BTC; OneRiver Digital ($5.6B AUM) commits 1.5% to cryptocurrencies

2021: Coinbase IPO; BNY Mellon launches crypto custody services; cryptocurrency market cap all time highs…

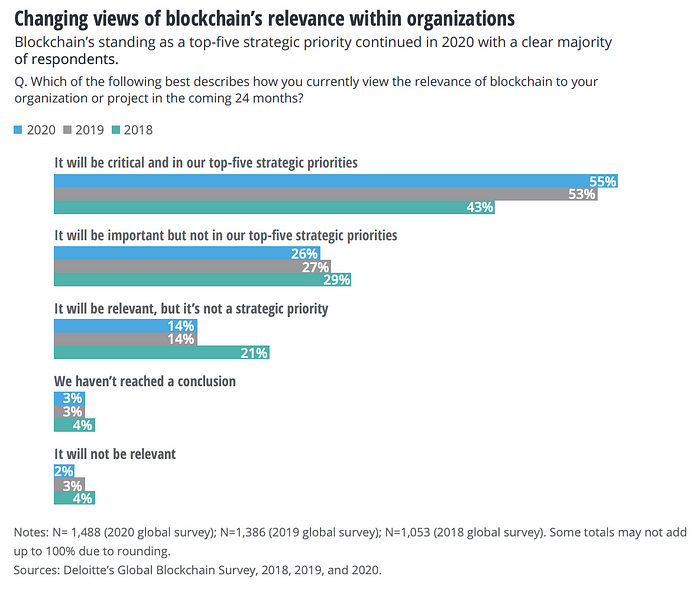

It is worth noting that the above mostly covers North American events and does not even consider the amount of penetration in Europe, SEA, and other parts of the world. Even among senior executives at international corporations, Deloitte’s 2020 survey identifies a clear movement away from “blockchain tourism” to a serious prioritization and focus on permanent implementations.

Meanwhile, on-chain metrics are steadily bullish, with spot exchange outflows hitting a yearly high as of early July, while bitcoin whale addresses signaling the largest daily accumulation spike of 60K bitcoins in all of 2021.

This is all amidst a backdrop of low stablecoin supply ratios and low funding rates — all extremely positive signals for the long-term case for Bitcoin and cryptocurrency markets.

At the macro level, a long-term bullish orientation on cryptocurrencies should not appear merely reasonable and rational, but nigh incontrovertible. While price may be one indicator, it would be irresponsible to ignore the massive investment of capital, energy, and attention into cryptocurrency infrastructure and portfolio allocation dwarfing that of any prior year. From the narrower vantage point of venture, the picture is still brighter.

DeFi in 2021

Suffice to say, we have come a long way from the crowdfunding-focused experimentation that started in 2017. Since the explosion of decentralized finance and the advent of the governance token, blockchain platforms finally found a bedrock of liquidity on which to build increasingly useful and complex products. The successful incentivization of liquidity providing uplifted decentralized exchanges (DEXes) to a level where they could compete with the likes of Coinbase and Binance, and the corresponding tendrils of value flow, which initially trickled through those DEX ecosystems, quickly became an all-out tsunami of which both veterans and the newly-minted, crypto-curious were quick to take notice.

New Market Entrants

A veritable eruption of interest and enthusiasm for the potential of decentralized finance (DeFi) products across multiple ecosystems is occurring this year, at a magnitude that one would seldom come across in a generation. Unlike the initial coin offering (ICO) bubble of 2017, we along with our partners are witness every day to a tidal wave of non-crypto-native, often serial entrepreneurs entering the space, bringing not only fresh ideas but institutional connections and operational experience.

It is no coincidence that these builders, savvy about the ins and outs of traditional assets and businesses, are likewise bringing serious institutional capital and attention. When massive hedge funds and family offices are allocating percentages of their portfolio to cryptocurrencies, when crypto venture funds are raising billions in AUM, and when regulators, banks, and custodians are working together to launch exchange-traded products for cryptocurrency exposure, they are not doing so as an experiment. This is, full stop, a direct reaction and response to overwhelming demand from their clientele. Two to three years ago, cryptocurrencies were regarded as a niche, fringe asset. Today, respected investors such as Paul Tudor Jones and Ray Dalio discuss it seriously as a reserve asset on mainstream television.

![AV Companies and the Threat of New Entrants – rAVe [PUBS]](https://www.ravepubs.com/wp-content/uploads/2017/05/business-competition-0517.png)

In the world of blockchain venture, this great awakening in the realm of digital assets manifests in a wealth of new projects seeking to bring institutions into DeFi. One of these savvy builders is Mike Cagney, the former CEO of lending giant SoFi and now the founder of Figure Technologies, which recently announced a massive partnership with Apollo Global Management to use its DeFi-focused blockchain technology, Provenance. As of June 2020, Apollo has a staggering $414B in assets under management. It is no longer the little leagues.

What we see happening is a perfect storm of capital, talent, and connections. Unlike the ambitious stream of “institutional plays” such as security token exchanges, blockchain-based carbon credit swaps, and consortium-focused supply chain platforms of 2017, for the first time our industry has a significant chance that many of these new, connected operators can make these use cases and intentions a reality.

Meanwhile, non-institutionally-focused projects on established public blockchains benefit from higher quality teams across the board. Our connections at universities have informed us that the level of excitement and base understanding of blockchain technology among students is unlike anything they have ever seen before. We believe there is a huge gap insofar as well-funded blockchain organizations making outreach to these universities internationally to capture these wellsprings of talent, and it will be a particular focus area for Valhalla Capital in the years to come.

Ecosystem Consolidation

Network effects are the heart of blockchain technology. For the first time in human history, the blockchain token has managed to combine the roles of investor, marketer, and user all into one. Given the social nature of our species, we posit that blockchain ecosystems will always take precedence as a religion or tribe rather than a business or tool. Governance tokens in particular are a further step down this natural inclination toward community and the instinctual formation of in-groups and out-groups; their capacity to provide voting and direct engagement further cements holders’ commitments to “their team.”

We have already witnessed the resilience of blockchains and decentralized application (dApp) communities that continue to linger, albeit in a half-life state, even in situations of fraud or where development efforts have all but halted completely. In this way, given their decentralized nature and focus on communities, blockchains are difficult to “kill,” and we believe this characteristic will only become stronger as the Lindy Effect for well-funded protocol ecosystems continues to grow.

Today, builders enter the space and generally choose an initial tribe with which to align, such as Alameda Research / Solana, Polkadot, Algorand, the Binance Smart Chain community, or more recently-minted L2 giant Polygon. These ecosystems have one thing in common — their backers and core contributors have massive war-chests, and they are putting them to use in the traditional world through lobbying, massive marketing programs, and charity.

Not unlike the growth vectors of tech giants such as Google and Amazon who branched far out from their initial products to form massive, multinational conglomerates that continue to consume many traditional, smaller competitors, we see something similar happening with blockchain ecosystems.

Given the amount of resources already garnered by these influential tribe leaders through the tremendous transfer of value into cryptocurrencies over the past years, it is more than likely that the future is not winner-take-all but multichain, and that founders, users, and investors will not prioritize the incremental technological advances between one platform and the next, but instead value network effects, home-field advantages, and interoperability.

Our Investment Philosophy

Based on our observations in the current state of venture and the overall crypto markets, we have crafted our investment philosophy. Unlike crypto tax accounting, our theses are very straightforward.

Invest in People, No Matter What.

There is no better time nor better industry to meet more incredibly intelligent, gigabrain founders than in 2021. We prioritize above all else investing in people who share our values, and who we believe can execute and stay agile in a rapidly-evolving market.

The Future is Multichain and Interoperable.

To that end, we focus on projects seeking to solve the next generation of complex computing problems, achieve new milestones in interoperability, and increase capital efficiency in DeFi ecosystems.

Concluding Thoughts

On our end, we decided to start Valhalla Capital to take an even more active role in the extraordinary DeFi journey and revolution unfolding before our eyes.

The Norse conceptualized Valhalla, an afterlife for warriors who died in battle, to encourage the people to live bold, courageous, and adventurous lives. To die of old age was a luxury of complacency, the mark of a man who did not live his life to the fullest.

Valhalla Capital derives its namesake from this concept — we aim to help the founders of today who are building the vessels to bring us all toward this ineffable, sublime, multichain future. Over the course of our journey, we pledge to leave every founder that we meet better off than before, whether or not we choose to be a passenger.

We want to give back and play a part in enabling the smartest minds — pouring into blockchain from every corner of this world and from every discipline — to build those bold, courageous ideas and embark on that adventure.

Announcing Valhalla Capital’s Investment in Algomint

We are delighted to highlight our recent investment in Algomint, a product focused on bridging digital assets on other blockchains onto the Algorand network, alongside leading industry partners.

Algorand has certainly hit many milestones since its launch two years ago, including the recent announcements of a major healthcare payments processor in Bermuda adopting the network to handle $800M+ in payments, hundreds of millions in new and continued investments in the ecosystem, and a significant update to its virtual machine that simplifies dApp development and expands functionality for developers.