InsurAce launches Full-Spectrum Multi-Chain insurance services

$GCR is a Tokenized Community of Researchers and Investors in the crypto space. Join our community today to get access to all the best investments ideas and deal flow, workshops and direct access to founders and key players in the space.

You will need 100 $GCR tokens to join the Discord members-only channel. You can purchase the token on Uniswap here. Get a feel of the Discord community here.

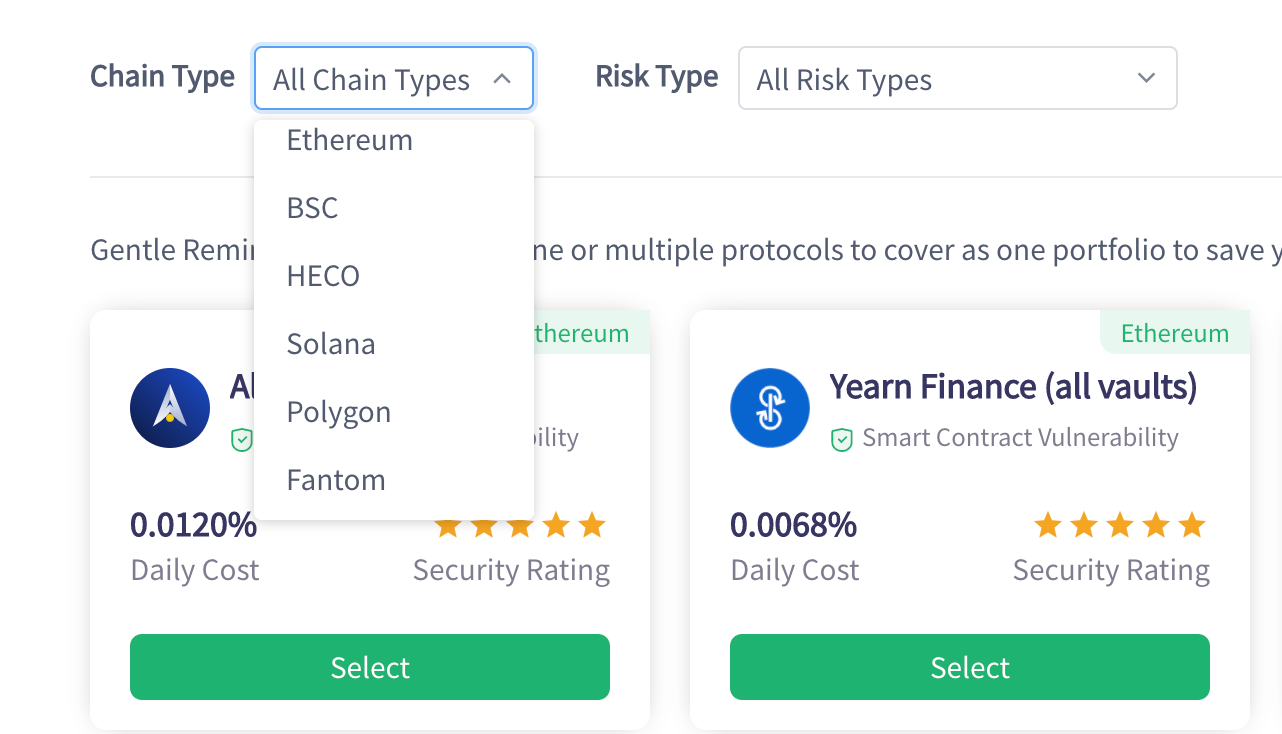

In a move that will change crypto insurance forever, InsurAce the leading DeFi insurance protocol is launching multi-chain insurance services on its ethereum dApp (app.insurace.io), to provide insurance coverages to protocols on a wide range of public chains, including ethereum, Binance Smart Chain (BSC), Huobi Eco Chain (HECO), Solana, Polygon, and Fantom. This marks InsurAce to be the first of its kind in the industry that can offer multi-chain insurance services, empowering and safeguarding the rapidly growing DeFi ecosystem in a multi-chain environment.

Despite the fact that Ethereum is the breeding ground for today’s prosperous and colourful DeFi garden, its low efficiency, limited throughput and high gas fee remain insurmountable for many DeFi users. To tackle these problems, the smartest brains in the industry have been working on various solutions, among which new chains are practical and thriving approaches, which have attracted the attention and an increased flow of development from the Ethereum ecosystem.

The industry giants have also started to build their own public chains one after another, Binance launched its Binance Smart Chain (BSC), Huobi launched its Huobi Eco Chain (HECO), FTX built Solana, Fantom and Polygon were also developing rapidly and gained substantial adoption. As of this writing, the Total Value Locked (TVL) on ethereum is still dominating at $65.37B, however, the TVL on non-Ethereum chains has been growing to around half of that, indicating a diverse future of multi-chain.

Nevertheless, the risks on these new ecosystems are also rising. Spartan protocol, a liquidity protocol on BSC, suffered a $30M loss from a flash loan attack at the beginning of May. And just yesterday, PancakeBunny, a yield aggregator protocol suffered another attack that caused its price to drop 96% in a short time with a $200m loss. Needless to say, there must be a solution to address such adversities to safeguard the ecosystem, and that’s where InsurAce has targeted its efforts to support these innovations by mitigating these inherent risks.

Multi-chain insurance has been in InsurAce’s initial roadmap since its inception and InsurAce has been working hard to bring it into reality since its mainnet launch in April. The implementation will include 2 phases:

- InsurAce Multi-chain v1.0 (launching 21st May 2021), to provide coverages for risks on other chains relying on its deployment on Ethereum. Users will be able to purchase covers for their assets on other chains using their ETH and stable coins on Ethereum.

- Multi-chain v2.0 (under development, to be released in June), to bridge assets and deploy on other chains so that users can protect any asset from anywhere in the DeFi world.

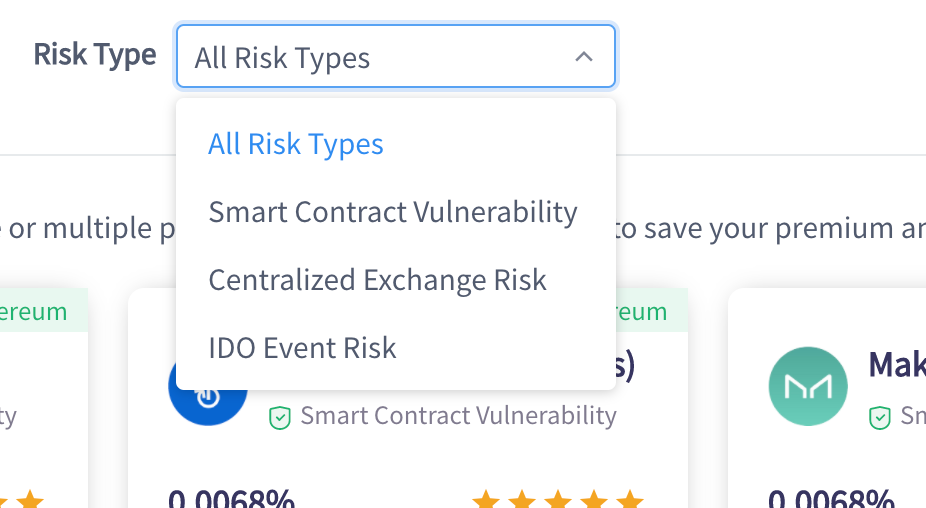

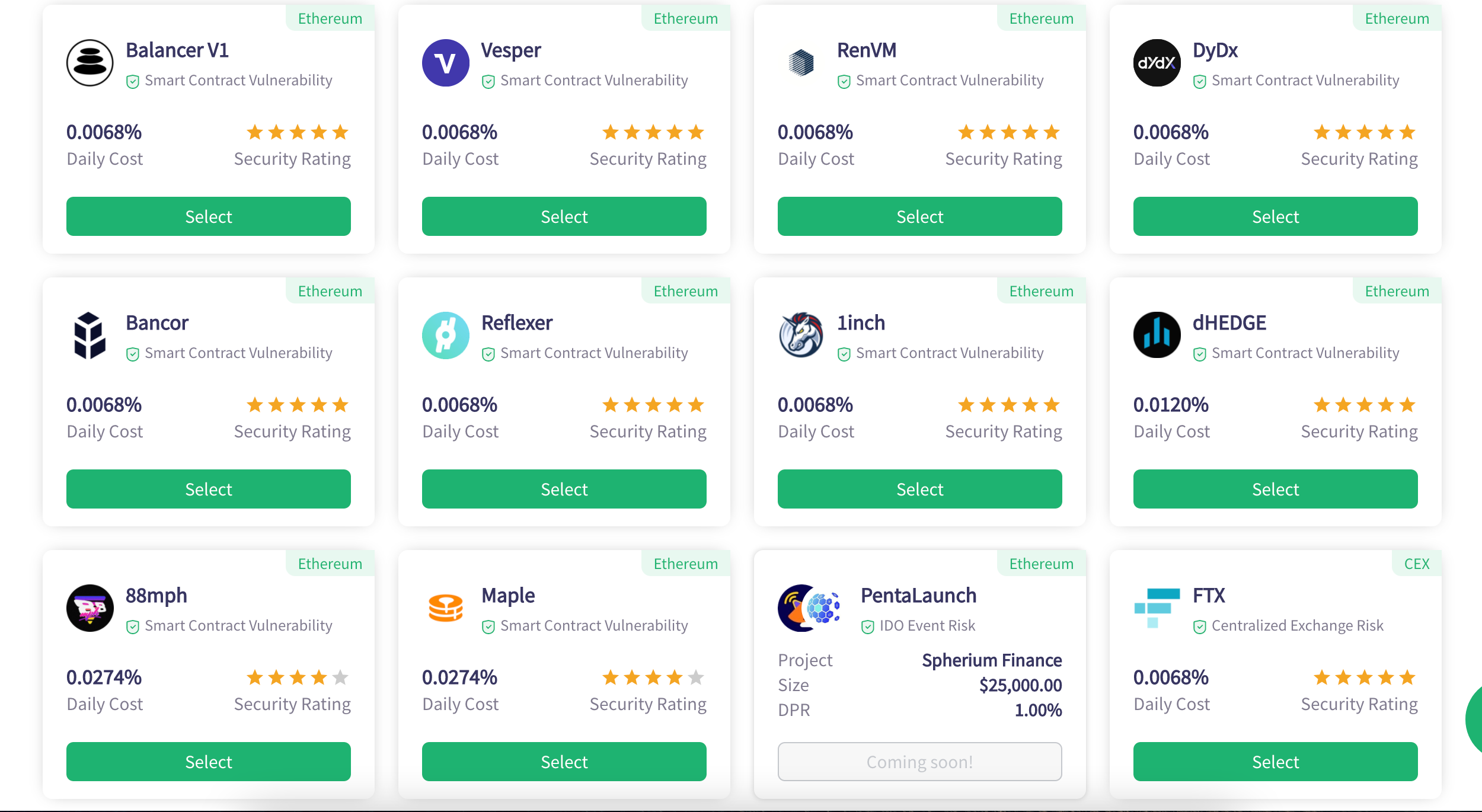

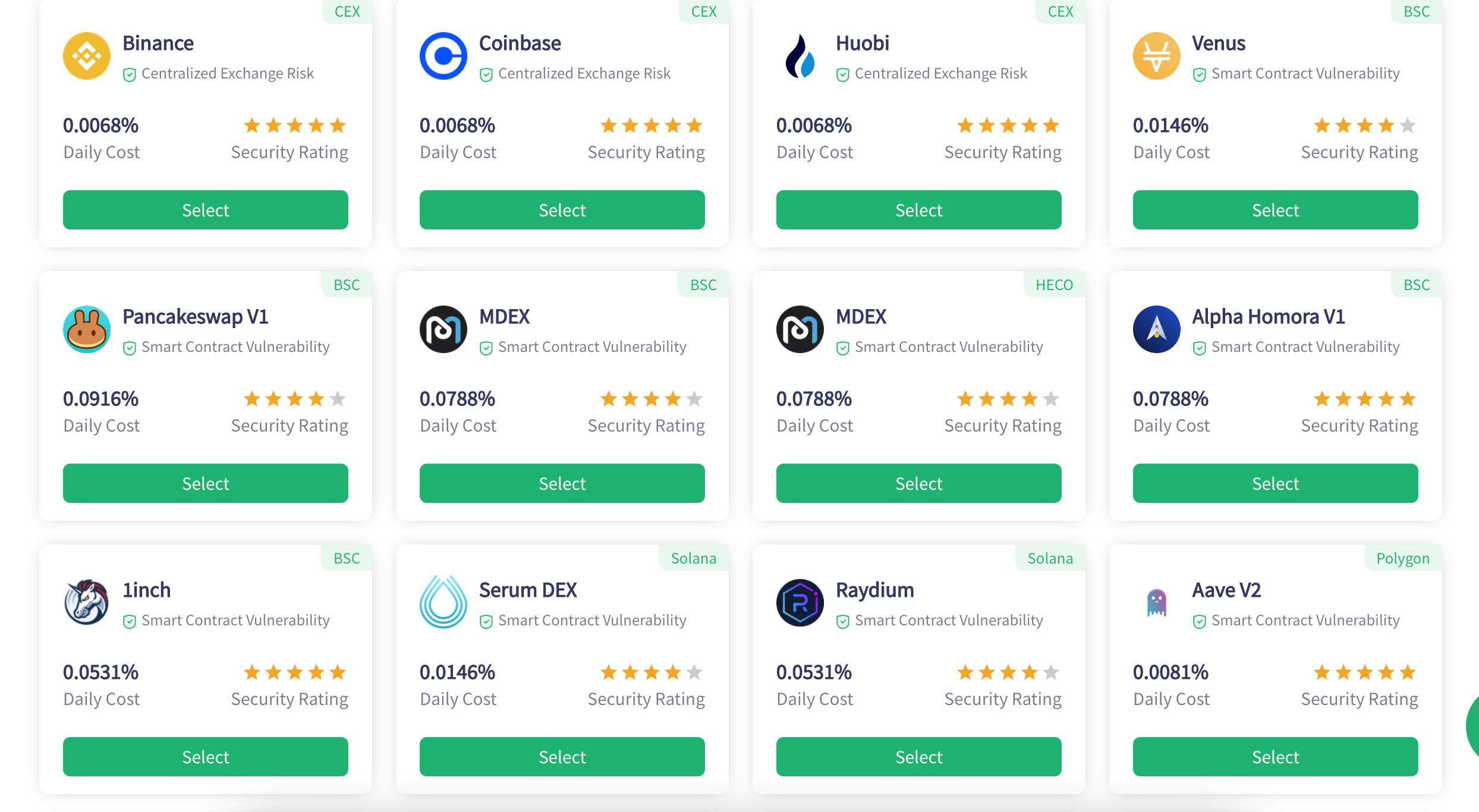

With the launch of multi-chain v1.0 today, InsurAce will now be able to insure users’ assets on protocols built on chains such as BSC, HECO, Solana, Polygon and Fantom, as well as their existing protocols that they service on the Ethereum network. One additional exciting feature is the ability to cover CEX (Centralised Exchanges) assets against risk such as loss due to any criminal or fraudulent takings or appropriation of assets, or suspension of asset withdraw from CEX in a certain period of time. Together with the industry’s first IDO insurance product launched on Wednesday, InsurAce has become the true leader of DeFi insurance sector, providing users with the widest coverage of possible risks, and yet, they are working tirelessly to design and offer more.

Users will be protected against Smart Contract Vulnerability (from hacks and bugs), Centralised exchange risks, as well as risks from IDO launch events. The first example of an insured IDO launch will be on Saturday 22nd May with the launch of Spherium, a mobile-first cross-chain wallet solution, hosted on PentaLaunch, which is a product of DoraFactory, proud partners of InsurAce.

DeFi Insurance has been shown to benefit more established crypto users by eliminating unnecessary risk from the protocols. By offering insurance, protocols also stand to increase their own intrinsic value as a show of confidence and protection for their community. A fantastic example is a recent partner of InsurAce, 88mph:

1. You deposit $100k $DAI @ 2.6% Fixed APY and 43% staking rewards.

2. Buy an InsurAce cover @ 8% premium

3. Earn $2.6k interest

4. Earn $43k $MPH (net APR)

Result: (100k-8k)+2.6k+43k=137.6k with initial capital fully insured against Smart Contract risks ( risk not incl.)

These new multi-chain insurance services will be available to a handpicked selection of protocols on each chain to begin with. Some notable projects include:

- BSC: Venus, Pancakeswap, MDEX, Alpha Homora V1 and 1Inch;

- HECO: MDEX;

- Solana: Serum, and Raydium;

- Polygon: AAVE V2, Curve, Quick;

- Fantom: Spirit Swap, Spooky Swap.

Apart from the above chains which are the first ones to be covered, InsurAce will expand to more chains such as Elrond and Tezos, as well as bringing more DeFi projects under their umbrella.

New protocols wishing to be listed on the InsurAce Dapp can apply via the InsurAce website (www.insurace.io). They will be asked to submit a risk assessment form, after which the team and community will perform thorough risk assessments on the protocols from multiple levels, give a security score, decide on the premium price and finally, have them onboarded successfully.

The claims process remains simple via the InsurAce Dapp where the user can submit simple claim requests with proofs. Claims are processed by a mixture of the community governance and insurance experts.

The InsurAce community can submit suggestions and request changes to the protocol through the InsurAce community and tech channels. Details on these are in the notes of this article.

InsurAce recently announced a new strategic partnership with Dora Factory, to offer the industry’s first IDO (Initial DEX Offering) insurance product on PentaLaunch, an IDO platform owned by Dora Factory. The first event to be covered is the IDO held by Spherium Finance, an innovative mobile-based, cross-chain wallet solution.

“Our team have been working tirelessly to bring this product to market. Ahead of releasing native tokens on each chain with bridges to our main token on Ethereum, we have been able to develop this fantastic product to offer insurance services to a far wider range of protocols than anyone else in the DeFi Insurance industry. We know this product will be a huge step forward for InsurAce and the industry as well as a part of our grand mission to make crypto a safer place.” Oliver Xie, founder of InsurAce.

This multi-chain insurance launch comes as part of the wider roadmap for InsurAce, working with the right chain ecosystem and protocols to build sustainable growth, and offering industry-beating insurance services.

About InsurAce

InsurAce Protocol is a Singapore based DeFi Insurance protocol that has quickly become the second-largest protocol in DeFi insurance. At the time of writing, the protocol has a $40 million market cap based on a circulating supply of 11 million INSUR tokens. There is a maximum release of 100 million INSUR Tokens which can be mined through staking on the protocol.

InsurAce is a new decentralized insurance protocol, to empower the risk protection infrastructure for the DeFi community. InsurAce offers portfolio-based insurance products with optimized pricing models to substantially lower the cost; launches insurance investment functions with SCR mining programs to create sustainable returns for the participants, and provide coverage for cross-chain DeFi projects to benefit the whole ecosystem.

InsurAce is backed by DeFiance Capital, Parafi Capital, Hashkey group, Huobi DeFiLabs, Hashed, IOSG, Signum Capital and a dozen of other top funds. In the three months since its first testnest was released, several high profile partnerships have been established. Information to be released in separate releases.

The project lead for InsurAce is Oliver Xie. Oliver started to work on InsurAce project since September 2020, and prior to that he worked as the CTO in one of the three largest Singapore-based licensed derivative Exchanges and Clearing Houses. Oliver entered the crypto space back in 2017 where he led a team to research crypto derivatives and blockchain technology and has gravitated towards blockchain-based Open Finance for the past few years. He identified an opportunity for a unique approach to providing insurance for DeFi smart contracts and users, and InsurAce was created.

For press enquiries and assets please contact: dan.thomson@insurace.io

Join our community:

Email: contact@insurace.io

Telegram: https://t.me/insurace_protocol

Discord: https://discord.com/invite/vCZMjuH69F

Twitter: https://twitter.com/insur_ace

Forum: http://forum.insurace.io

Read More about InsurAce: