Buyback / Flow Model: A Way to Model Crypto Buybacks Through the $SRM Case Study

$GCR is a Tokenized Community of Researchers and Investors in the crypto space. Join our community today to get access to all the best investments ideas and deal flow, workshops and direct access to founders and key players in the space.

You will need 100 $GCR tokens to join the Discord members-only channels. You can purchase the token on Uniswap here. Get a feel of the Discord community here.

Summary

Buyback / Flow is a framework to evaluate the potential price impact of buyback-burn programs, based on impending supply. To demonstrate this framework, we use the case study of a project with one of the most aggressive buyback-burn programs: Serum.

Serum is a Solana-native, orderbook-based DEX that is looking to build the foundation of the DeFi ecosystem on Solana. Co-founded by Sam Bankman-Fried of FTX and Alameda Research, Serum currently dedicates ~68% of weekly revenue from fees to conduct a buyback-burn.

In this piece we take a deep dive on the interplay of buyback-burns with supply-oriented tokenomics, and the eventual impact on price.

The complete model can be found here: https://cutt.ly/HbmGBZ6

Introduction to Buyback / Flow

Buyback-burns are a crypto-native phenomenon where protocols / platforms dedicate a fixed percentage of revenue to buying back their own tokens on the open market and removing them not only from circulating supply but from overall supply. This exercise is usually conducted on a weekly basis and thought of as a deflationary phenomenon that will positively impact price in the long-run. A high percentage of revenue dedicated to buyback-burns usually leads to a positive narrative around the coin, which in itself leads to positive price action.

However, this simple concept gets complicated when we introduce increasing token supply from vesting schedules for founders, advisors and other currently locked tokens. It is challenging to model how many tokens entering supply via the vesting schedule will be offset by tokens burned via the buyback-burn program, and therefore what the net impact on price could be. This is because net token supply (new supply minus supply burned) impacts price, and price impacts how many tokens can be burned, leading to circularity in logic.

To break this circularity, we propose the Buyback / Flow model, which allows us to measure the potential price impact caused by the opposing forces of buyback-burns and incremental supply. Below is a visual representation of our proposal (Serum specific data points will be discussed in detail later in this report):

The premise behind our argument is as follows:

1/ Let’s split existing circulating supply and new incoming supply for a given year into two separate buckets

2/ We assume that current circulating supply, offset by some level of organic market demand, informs current market prices

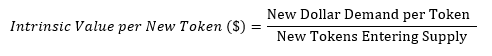

3/ The market now needs to price the new incoming supply, based on demand for these new tokens, which can be approximated using the following formula

4/ We propose that the dollar demand can now be split into two: first, the minimum guaranteed dollars dedicated to buyback-burns and second, any incremental organic demand that is not priced into current market levels

5/ By doing this, we convert the impact of the buyback-burn program from number of tokens to dollar-based demand for new tokens

6/ This allows us to frame the question of: “how much additional organic demand is required to match current price levels based on guaranteed token supply and minimum guaranteed demand from buyback-burns?”

7/ If this number is negative, then we can be certain that the buyback-burns will have positive impact on price, and if it is positive, we can gauge whether these demand levels are reasonable or not

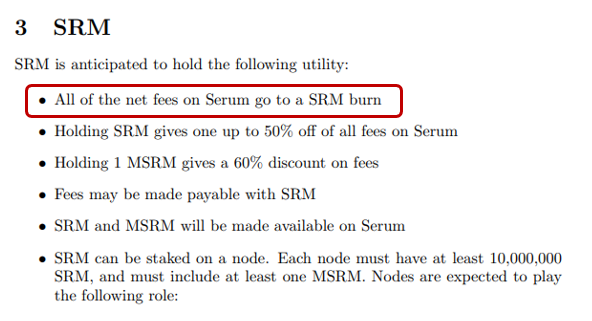

We decided to use Serum ($SRM) as our first case study because it currently boasts one of the most substantial buyback-burns by % of revenue committed. In fact, the top utility of the $SRM token, according to Serum’s whitepaper, is to accrue value through buyback-burns:

Before going through the case study, however, we thought it prudent to spend some time going through the basics of Serum and what it does.

Serum ($SRM) Overview

Serum is a Solana-native DEX co-founded by Sam Bankman-Fried of FTX and Alameda Research. Serum offers a three-pronged value prop :

- Low transaction fees and faster transaction time (particularly vs. DEXs built on Ethereum)

- Order book based system (vs. AMM i.e. automated market maker based) which minimizes slippage

- Oracle-free cross-chain Tx settlement (using a collateral-based model)

Serum’s ambition is to be the epicenter of a high-speed DeFi ecosystem that is ready for mass adoption and can handle over a billion users. Having been famously built in three weeks before launching in August 2020, Serum has gained meaningful traction towards this goal, hitting ~$100M in daily transaction volume in late April 2021.

Serum issues two types of tokens: the SRM token and the MSRM token. SRM tokens can be used to pay fees, avail trading fee discounts, and partake in governance votes. 1 million SRM tokens can be combined to make 1 MSRM token, of which there can only ever be 1,000. The key feature of MSRM tokens is to act as nodes that ensure smooth running of the system.

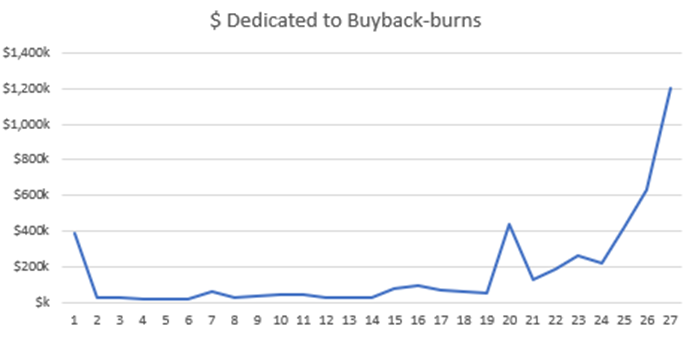

Serum’s growth has also reflected in the trajectory of its buyback program, which has generated a lot of buzz around the token.

However, only ~5% of SRM tokens are currently in supply and the vesting schedule begins later this year on August 11th 2021.

Specifically, SRM has a max supply of 10 billion and an unlocked supply of 1 billion. Of this, 825M tokens are currently set aside for ecosystem initiatives and 125M tokens in reserve. This leaves a circulating supply of 50M tokens, or 5% of max supply.

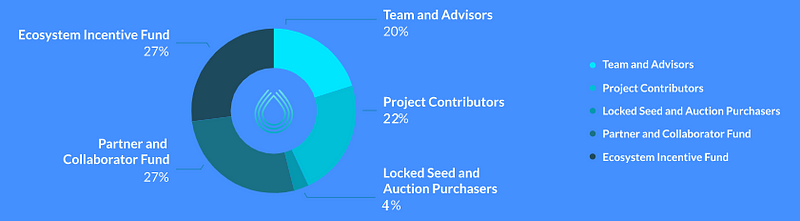

The locked supply is distributed among stakeholders as follows:

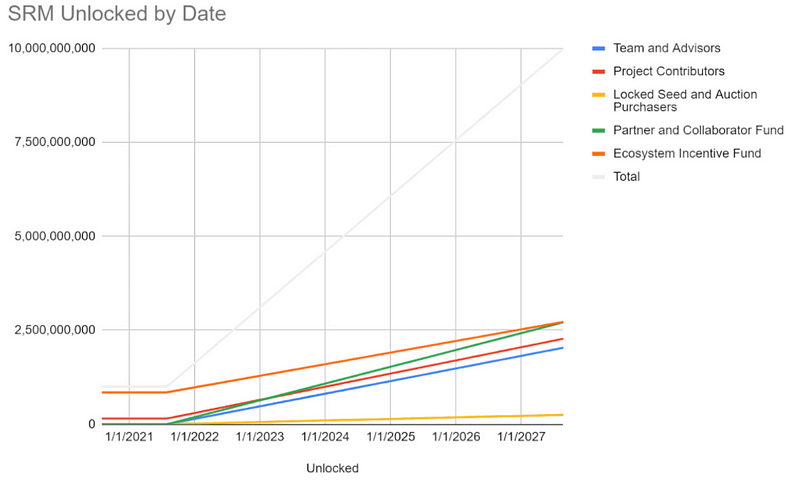

Per Serum’s reports, this locked supply will remain locked until August 11th 2021, when the tokens will begin vesting. The supply is expected to unlock linearly over 6 years at a fixed rate of 4M tokens per day. Given that 90% of the supply will be unlocked during this time, this will play a key role in ability of the aforementioned aggressive buyback program to impact price.

Buyback / Flow Model

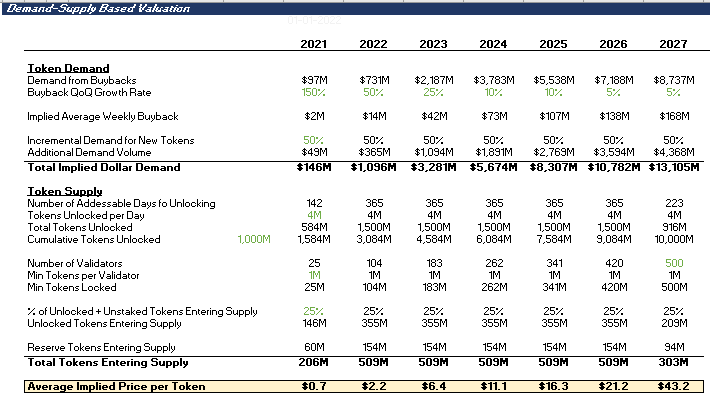

This gives us all the details we need to implement the Buyback / Flow model for $SRM. The following are our assumptions:

Based on our initial results, we found that, for current price levels to sustain once unlocks begin, either: 1) almost no vested tokens must enter the market as supply or 2) organic demand for the SRM token must be extremely high.

Another way to think about this is that, despite being very aggressive, the buybacks are not strong enough to offset the incoming supply, which is a risk for any token that plans on vesting 95% of its supply over 6 years.

This brings us to the question of how strong organic demand for the SRM token might be. Given that the use cases of the token for anyone holding less than 1M tokens is essentially platform discounts, it is unclear whether the organic demand will be particularly aggressive.

One realistic possibility, however, is that vested token holders collectively agree to withhold supply from the market and offload their tokens very carefully over a much longer period of time so as to maintain price stability. Given the well reputed team behind the project, it is not unlikely that they will do everything they can to support token price.

However, this essentially means that, after August 11th, SRM token holders from the current circulating supply will be entirely at the mercy of vested token holders.

Our complete model can be found here: https://cutt.ly/HbmGBZ6

Short-Run Outlook

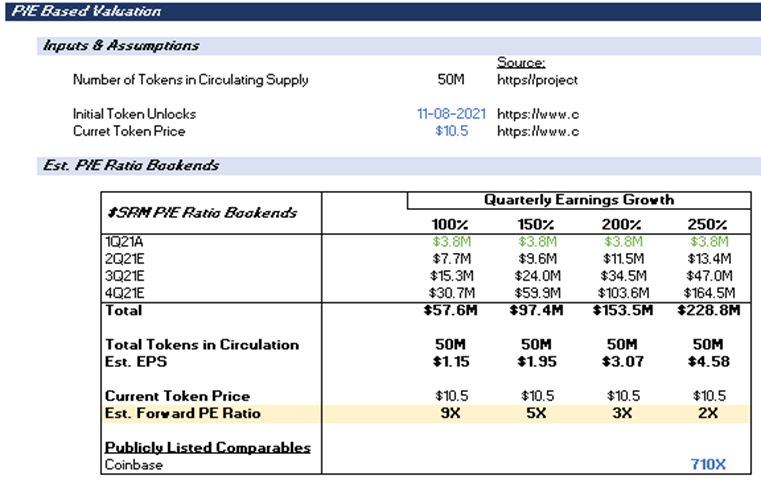

If we narrow our timeframe to the three months between May-August, which is a meaningful window of time in crypto, the story looks quite different. Because of the fixed supply, the buybacks become extremely powerful, implying an annualized forward P/E ratio of ~5X at the current price of ~$11. This is particularly attractive when compared to the 710X P/E ratio that Coinbase stock is trading at.

Conclusion

In the short-run, it is possible to enjoy the power of Serum’s buyback-burns as a token holder. However, from August 11th onwards, it will be important to proceed with extreme caution as supply begins to flood the market. From that point onwards, investors will likely have to rely on team and advisor selling restrain, assuming that they will be interested in maintaining market prices.

-

The weakness in this analysis is the assumption that the pending unlocks aren’t at least somewhat reflected in the current token price. In my opinion it would be trading much higher if it weren’t for the pending unlocks, which means to some extent it’s priced in.