The State of Crypto Assets Investors in Japan

bitbank, inc. (Head office: Shinagawa-ku, Tokyo, President: Noriyuki Hirosue) announces that we have released our online survey results on crypto assets investment targeted at Japanese investors. There were 4,506 valid respondents.

Quick Take

- BTC was chosen as the most promising crypto assets by Japanese crypto investors.

- XRP is a popular crypto asset among Japanese investors especially older than 40 years.

- 62% of Japanese investors expect that BTC price will hit ¥7,000,000 in record high in 2021.

- In proportion to investment experience in crypto assets, the Japanese investors expect BTC price to be more promissive.

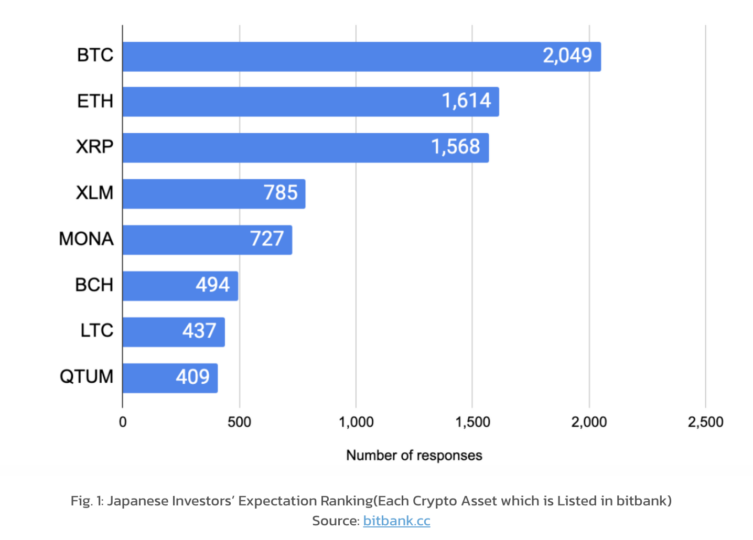

Japanese still favor BTC in its price as always

Among the listed crypto assets in bitbank, we consequently found that BTC is the most expected one in its possibility of the price increase. ETH and XRP follow the king and first born asset in this space.

Source: bitbank.cc

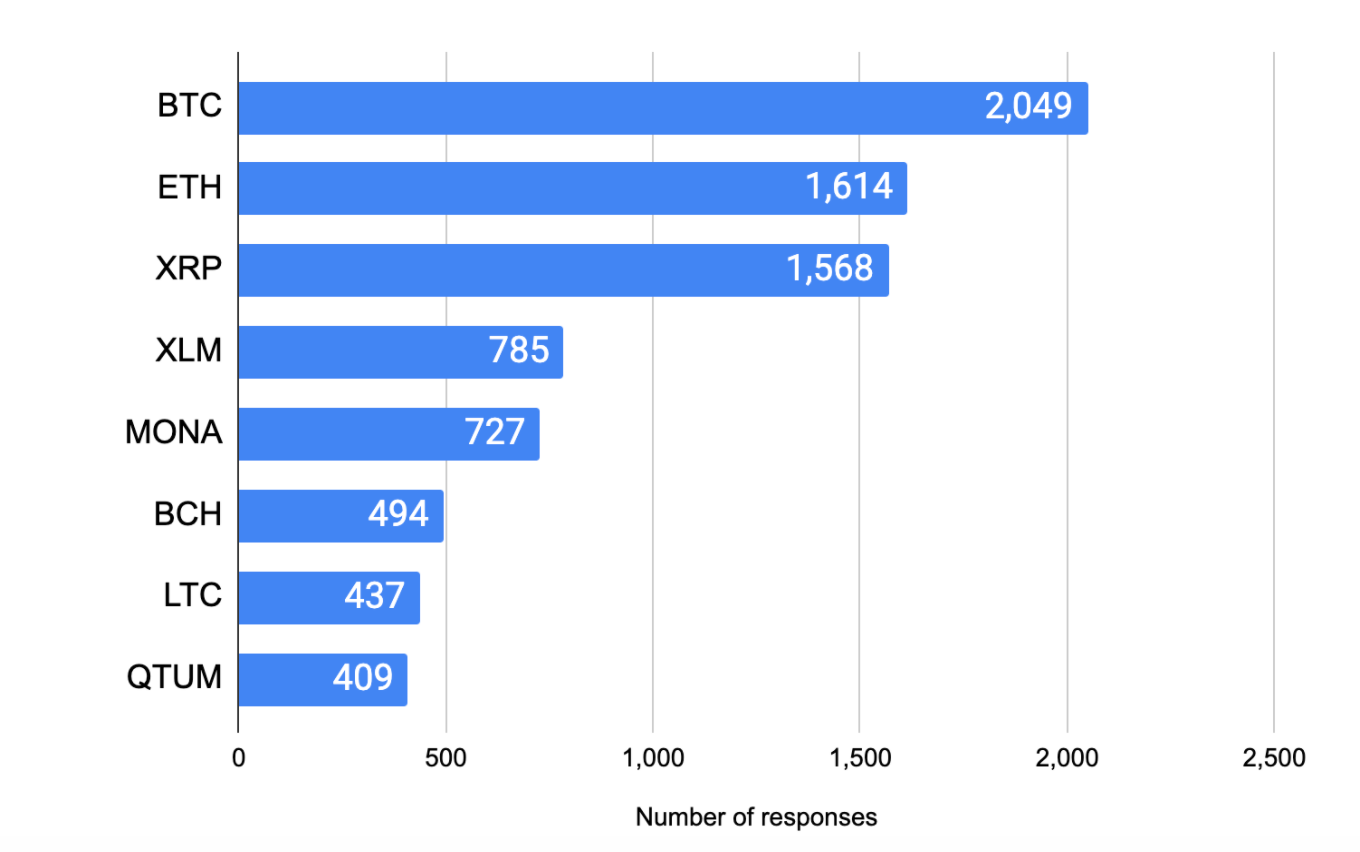

Elder Japanese investors favour XRP

As can be seen in Fig. 2, two crypto assets seats the second position among five generation categories. Without saying that, they put BTC as the No.1 asset as the most prospective crypto asset in terms of its price. To put it more clearly concerning the second crypto asset in each generation category, the investors in their 20s-30s expect ETH secondly but the investors in their 40s or older expect XRP secondly.

Source: bitbank.cc

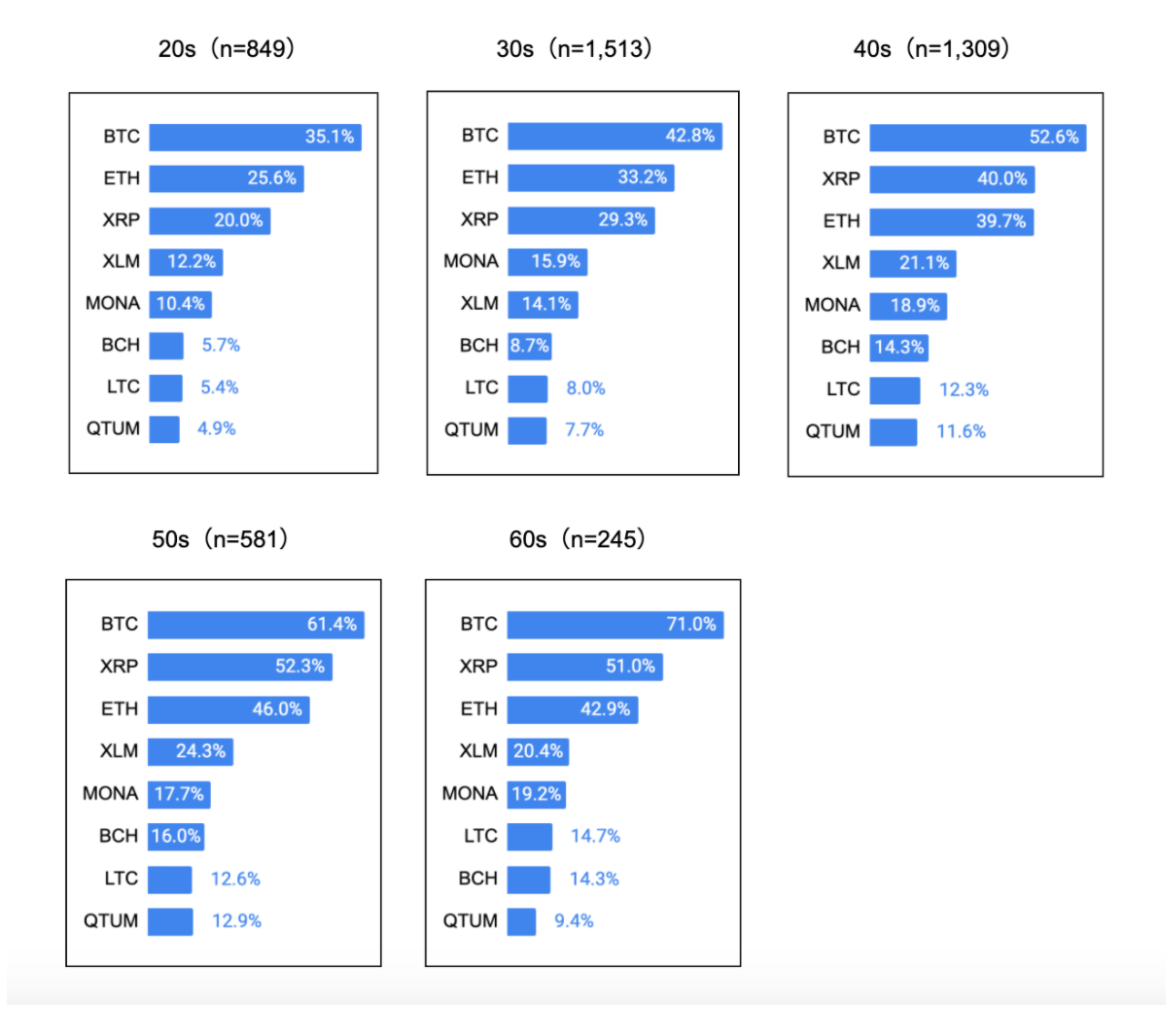

Over a half of the respondents see BTC price to hit at least ¥7,000,000

We gathered the BTC’s price expectation in 2021. As you can see from Fig. 3, 62% of Japanese investors expect that BTC price will hit at least ¥7,000,000 in 2021 and will consequently record All Time High (ATH).

Source: bitbank.cc

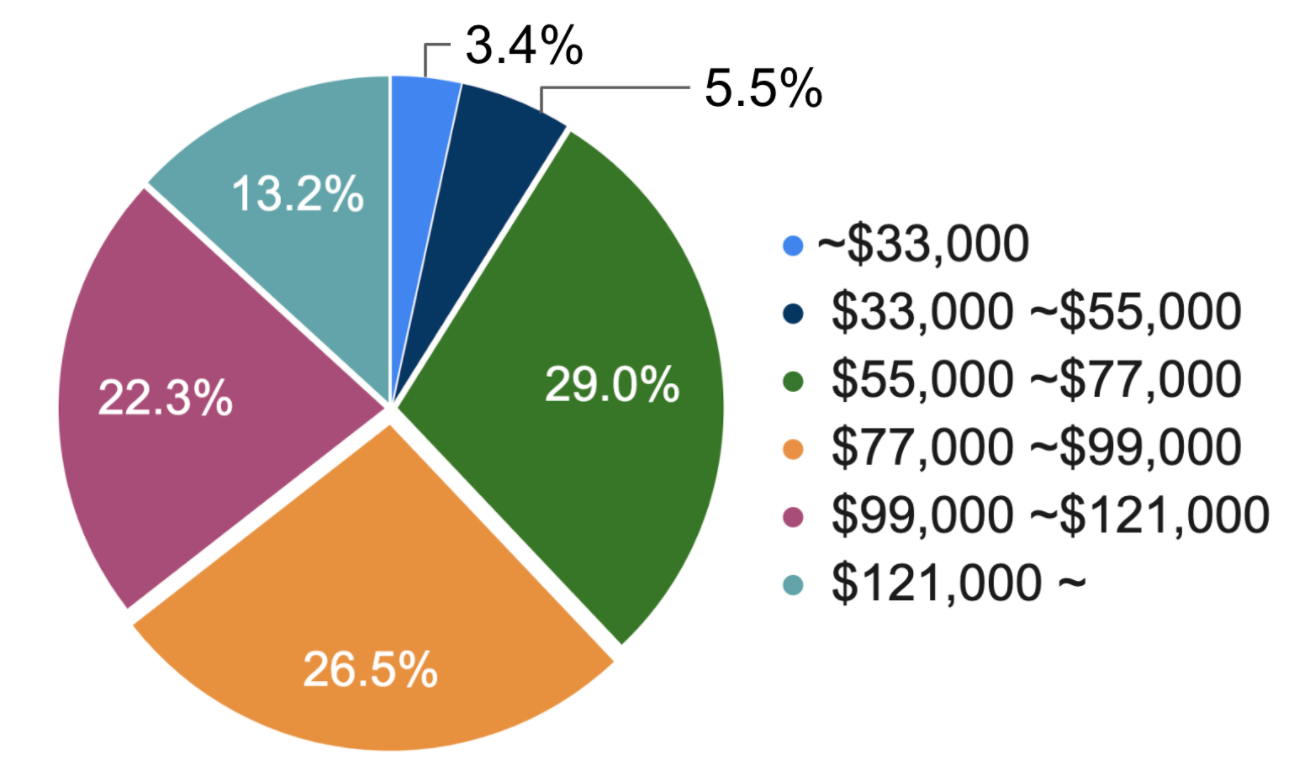

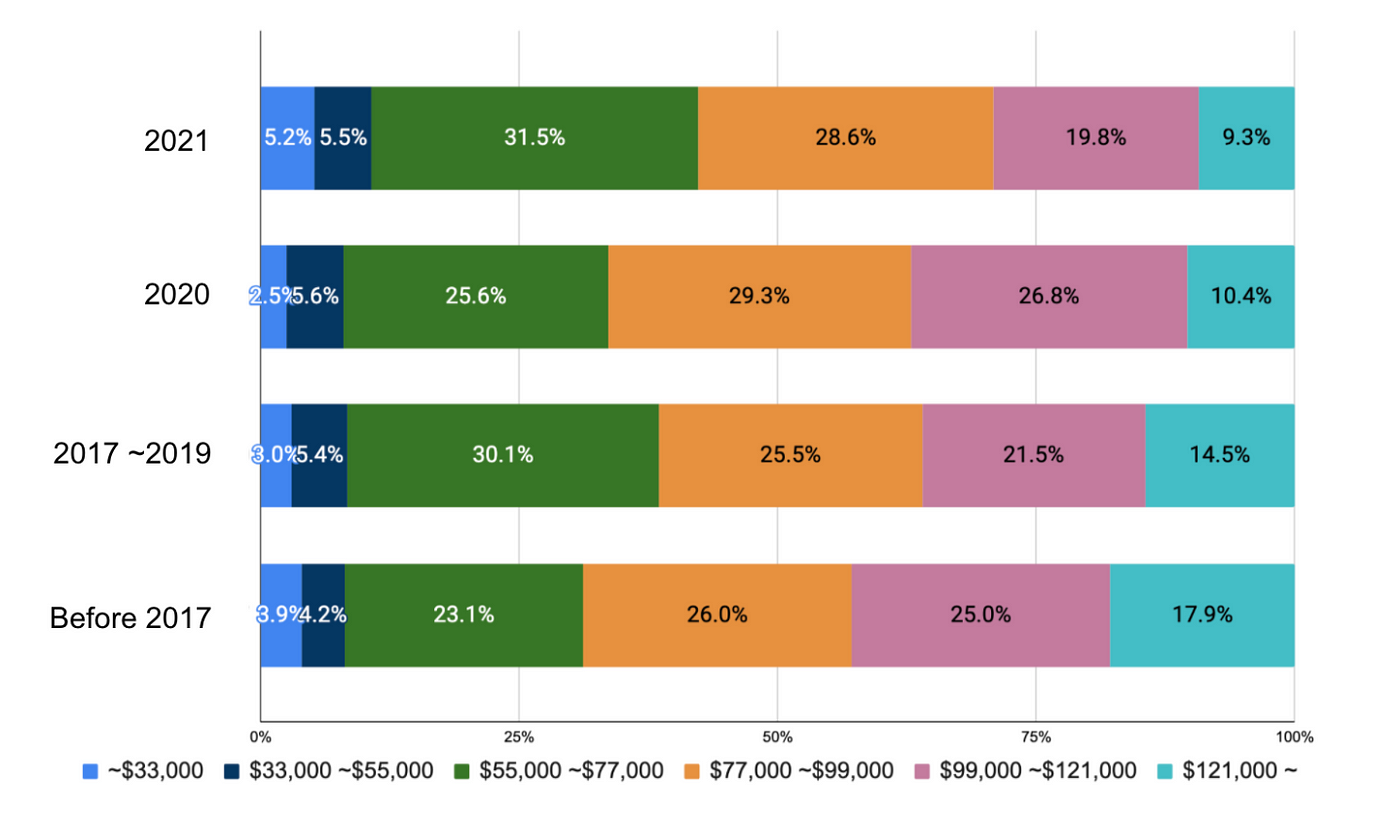

More experienced see the BTC’s price expectation more prospective

Fig. 4 shows that investment experience in crypto assets proportionally affects the Japanese the extent of the expectation in BTC price to be more prospective.

Source: bitbank.cc

? Attribute Information Of The Respondents ?

- 99% of the respondents have invested in crypto assets.

- 96.9% of the respondents have experienced spot trading in crypto assets.

? Attribute Information Of The Respondents ?

- Survey period: March 4, 2021-March 11, 2021

- Target group: Japanese Internet users (n = 4,506)

- Survey method: WEB questionnaire survey

- Survey language: Japanese

*When using the survey results of this release, please specify [Survey by bitbank, Ink.].

*We counted only crypto assets listed in bitbank on this survey but we didn’t count Basic Attention Token (BAT) because we conducted the survey before the listing of BAT

[Company]

bitbank, inc.

[Business description]

Crypto Assets exchange and Financial instrument exchange operator. Registered Cryptocurrency Exchange Operator (Registration No. 00004, issued by the Director of the Kanto Local Finance Bureau)

[Membership]

Japan Virtual and Crypto assets Exchange Association (JVCEA)

Japan Crypto Asset Business Association (JCBA)

Blockchain Collaborative Consortium (BCCC)

*English disclaimer is also posted on medium.com