A Fundamental Deep Dive on Yearn Finance’s $YFI Token

Summary

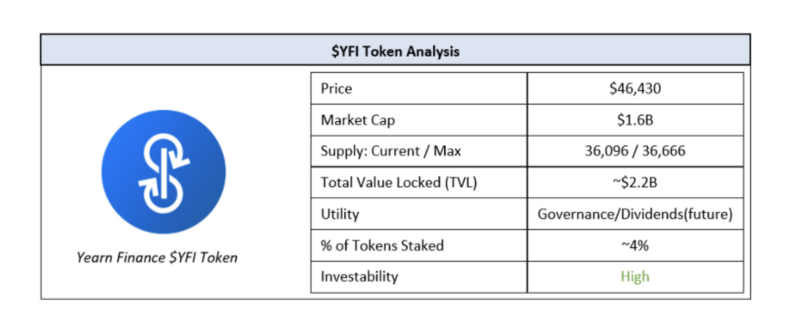

Yearn Finance is an automated yield aggregation platform that has become a DeFi heavy weight in less than a year, after launching in July 2020. Yearn makes the process of yield aggregation across DeFi platforms, such as Compound, Curve and Aave, easier by minimizing gas fees and maximizing yield. In exchange, Yearn charges its users a management and performance fee. After paying costs, the remaining proceeds are deposited in Yearn’s Treasury. Treasury funds are currently mandated to buy back $YFI on the open market and re-distribute it to the community to incentivize further participation. In the past, these proceeds have also been used to pay $YFI token holders dividends.

Currently, $YFI tokens are basic governance tokens, however, tokens are expected to resume being dividend-yielding in the future once the platform is more mature. Based on the estimated present value of future Treasury cash flows, we expect the $YFI token could be worth at least 2X what it is today.

The complete model can be found here.

Overview

Yearn Finance is an Ethereum-based yield aggregation platform that helps users maximize yield from lending their cryptocurrency across various DeFi protocols. It does this by shuffling its assets under management across various yield generating pools on platforms such as Compound, Curve and Aave.

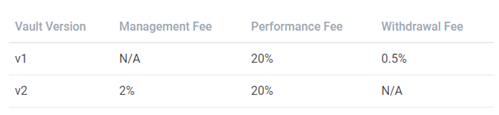

Yearn’s selling point is twofold: 1) automated yield maximization and gas price reduction and 2) ease of use. In exchange for this service, Yearn charges depositors a performance fee, as well as either a withdrawal or management fee, depending on the product in question.

Despite being less than a year old, Yearn’s success rate has been impressive. Its products currently generate a return between 25–35% on average, which is attractive given the relatively low risk associated with most of these lending protocols.

How Yearn Finance Works

On Yearn’s platform, users can deposit their idle cryptocurrency in a variety of algorithmically managed investment vehicles to earn a yield. There are currently four categories of investment vehicles which have several pools within them: 1) Vaults, 2) Earn, 3) Iron Bank and 4) Experimental. In addition to this, Yearn also offers a product called Zap, which allows users to access various lending platforms such as Compound, Curve and Aave from a single access point. Of these products, Yearn Vaults are currently the only one that Yearn monetizes?—?this will be the focus of our analysis.

There are two types of Yearn Vaults: Vault 1 and Vault 2. The primary distinction between the two is the fees charged. The recently introduced Vault 2 charges a management fee rather than a withdrawal fee, so as to tie Yearn’s incentives with capital entering the system vs. exiting the system.

Within these vaults are various pools, which represent a range of yield maximizing strategies. A majority of these have been created by Yearn’s founding team, however community members can propose their own strategies to be added to the platform.

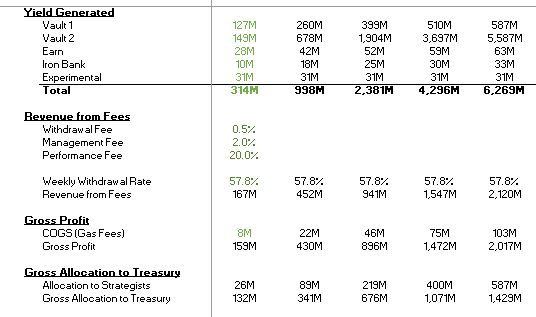

Once gas fees are paid down, 50% of the remaining revenue is distributed to the strategist, incentivizing more community participation and engagement. Of the remaining proceeds, 50% goes towards operating expenses such as team salaries and security audits, while the remainder goes into the Treasury.

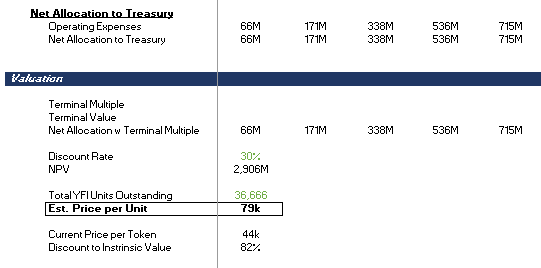

This is where Yearn’s native token $YFI comes in. Token holders can stake their tokens to vote on governance decisions and, until recently, also received a portion of the Treasury proceeds as a dividend. While dividend distribution was overturned recently in YIP-56, and funds were redirected to buying back $YFI tokens on the open market, the system is likely to return to a dividend distribution mechanism once the platform is more mature. This means that the treasury value is similar to an enterprise value that we would calculate for a traditional company, allowing us to estimate the intrinsic value of each $YFI token. Another factor that makes this approach plausible is that all ~36k tokens are currently in supply and all are owned by members of the community; no tokens were reserved for founders and VC investors, unlike with other protocols.

Evaluating the $YFI Token

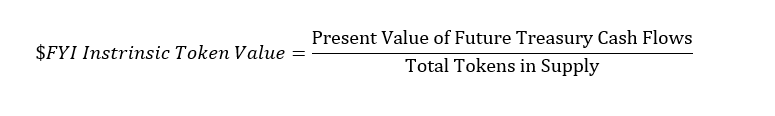

The basic function we want to get to, in order to evaluate the $YFI token, is the present value of all future cash flows that the Treasury might generate divided by the total number of tokens. The formula would look something like this:

Methodology

To estimate the present value of future treasury cash flows we need to follow 6 simple steps:

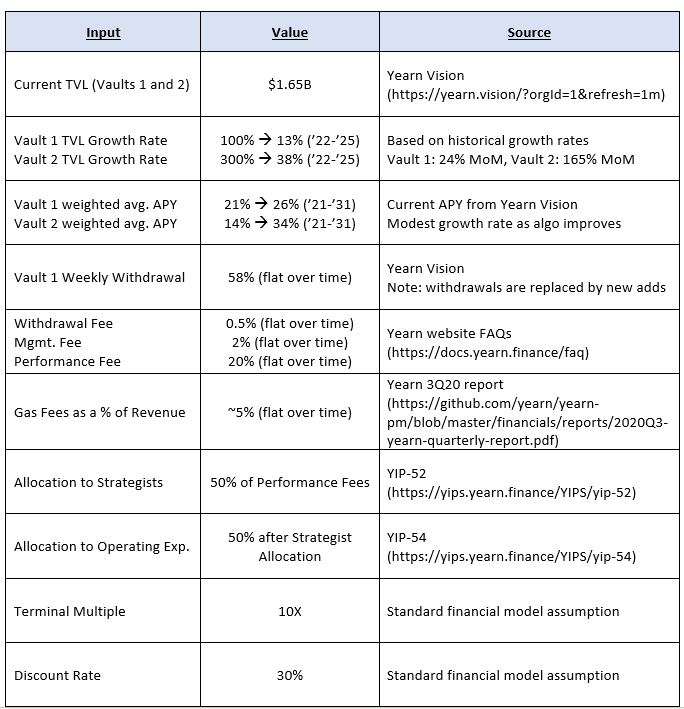

1. Pull current TVL in Vaults 1 and 2 and forecast it, based on run rate growth

2. Calculate annual yield based on weighted avg. APY from current pools

3. Estimate fee-based revenue:

a. Vault 1 withdrawal fees based on recent withdrawal rates

b. Vault 2 management fees based on TVL

c. Vault 1 and 2 performance fee based on annual yield

4. Remove gas fees to calculate Gross Treasury Proceeds

5. Exclude Allocation to Strategists and Operating Expenses to estimate Net Treasury proceeds

6. Calculate present value based on a 10-year forecast + terminal multiple and discount rate

Key Assumptions

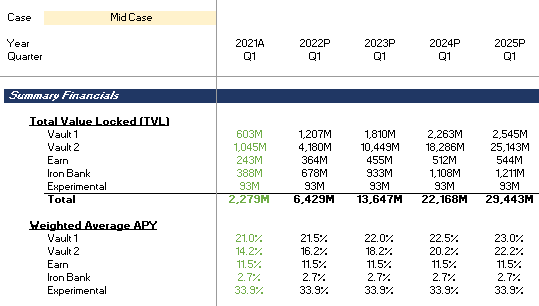

Results

Based on these parameters, the estimated value of the $YFI token is ~$79k (71% higher than the current price of $46k per token). It is important to note that we are currently assuming relatively modest TVL growth rates, especially given that Yearn is still in it’s infancy. A growth rate of 300% per year for Vault 2, which grew 165% just this past month is nothing if not conservative.

If we were to assume more aggressive growth rates, the value of the token could be as high as $300k per token. DeFi’s current cumulative TVL is $51B and it is not unreasonable to assume that a nascent protocol like Yearn (currently ~2.2B in TVL across all products) could eventually capture a larger share of this growing pie.

Below is a summary view of our work. The entire model is available here.

Other Considerations

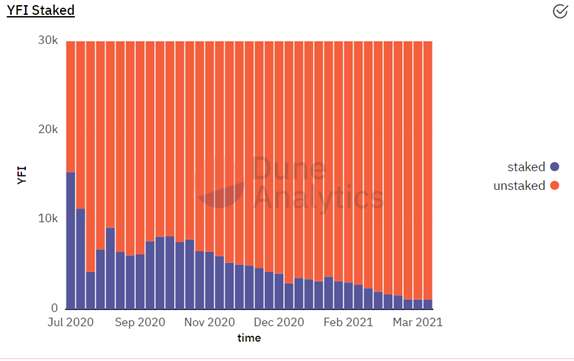

The only yellow flag with Yearn is that the percentage of tokens staked for governance (the current use case of the $YFI token since YIP-56) has reduced over time.

This would have been somewhat concerning from a demand POV, except for the fact that Treasury funds are now being allocated to buying back $YFI tokens. This ensures a meaningful level of demand, given that Treasury reserves are substantial and growing. Bought back tokens will then be reallocated to the community over time, who may then choose to stake these tokens.

In the future, once the stabilizes, we may expect a return to the original divided system, which would help the $YFI token realize the full potential of its equity-esque properties.

Conclusion

Yearn has developed a strong business model and has become a heavy weight in the DeFi space in less than a year. Yearn’s intrinsic value lies in its Treasury?—?these reserves are currently being used to buy back $YFI tokens on the open market (positive for demand) and may also be used to pay $YFI token holders dividends as has been the case in the past.

Based on Yearn’s current run rate, and the assumption that $YFI token holders will be financially rewarded by Yearn’s success in the future once again, we estimate that the value of the Yearn token could be at least 2X what it is today.