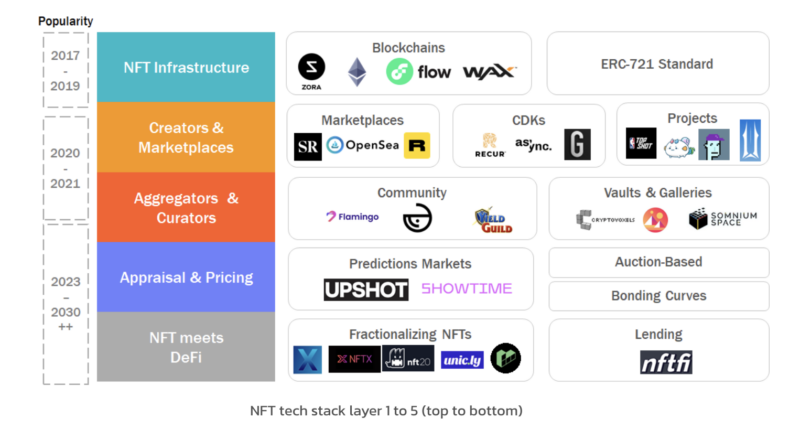

NFT Technology Stack

$GCR is a Tokenized Community of Researchers and Investors in the crypto space. Join our community today to get access to all the best investments ideas and deal flow, workshops and direct access to founders and key players in the space.

You will need 100 $GCR tokens to join the Discord community. You can purchase the token on Uniswap here and join the gated Discord group here.

In the last post we covered what is an NFT and its basic classification. In this article we will cover in-detail the NFT tech stack and some of the use cases that have developed in the last few months.

Layer 1: NFT Infrastructure

The NFT blockchain layer has existed for a long time and has seen success from some exceptional applications like Flow and WAX. Ethereum arguably remains the largest NFT blockchain and created the ERC721 standard.

NFT projects in the past have congested Ethereum (Cryptokitties in 2017) and hence blockchain-scaling solutions are necessary. OpenSea, the biggest NFT marketplace, is based on Polygon. Other projects are building on top of implementations of Rollups like Immutable X or creating their own side chains like Axie’s Ronin. Dapper Labs chose to create their own L1 blockchain called Flow for these purposes.

Layer 2: Creators & Marketplaces

We have seen a real spike in usage of the 2nd and 3rd layer of the stack in this crypto bull run — this is the part of the tech stack that everyone refers to when they say that NFT is the result of creator economy thesis meeting product market fit.

In Feb 2021, primary NFT sales went up to about USD200M. Beeple sold his Everydays: the First 5000 Days for $69.3M and Jack Dorsey, founder & CEO of Twitter sold his first tweet for $2.9M.

In layer 2, the creator and marketplace layer, we have observed the following:

- A liquid market for content

- Content via being priced in creator’s influence/past work

- Accessibility and ownership of fine art

- Commercialization of ‘fine art’

Projects on Layer 2 are a function of their applications/usage. In my previous post, I discussed different types of NFTs based on “actionable” vs. “non-actionable”. These can be further segregated based on the user profile & function of the NFT.

New concepts have emerged and gained popularity like creator development kits, generative art going mainstream & rise of metaverses.

Layer 3: Aggregators & Curators (Community)

Layer 3 is communities, DAOs and platforms like CryptoVoxels that allow collectors to display their artwork. Virtual galleries and real estate are a great example of this as well. Recently, 8 plots of land in the Axie Infinity Universe were sold for US$ 1.5M.

Layer 3 & 5 support a thesis I like to call “Collector’s Economy” — an extension of the creator’s economy. Collectors buy and display art while DeFi powers the collectors to — lend, lease, rent, borrow, collateralize, trade, their NFTs. This effectively would be the communities, platforms and financial products that support art portfolios.

Layer 4: Appraisal & Fair Valuation of NFTs

Layer 4 addresses the pricing & appraisal systems for NFTs. This is essential to have a fair valuation of digital art and for collectors to track their portfolios. Innovation in fair valuation of NFTs and other art forms is crucial for the “collector economy” to function. Financialization of NFTs becomes difficult and a “bubble” without fair valuation processes.

There are multiple experiments on-going in this space like Upshot which uses prediction markets/canonical opinions; showtime uses a different approach — the more “likes” an art piece receives on the platform, greater is its price. The standard pricing mechanism in place uses auctioning. Some NFT platforms are adopting the crypto-native mechanisms of bonding curves wherein the supply / demand (or other designs) is used to determine the price of the next NFT sold from the collection or by the artist.

Layer 5: DeFi meets NFTs

Layer 5 is the financialization of the digital assets to rent, borrow, lend, lease etc.

1. Lend/Borrow: collectors will collect yield.

2. Sell/Lease copies: collect royalties

3. Collateralize: borrow assets against your NFT (portfolio).

4. Index Funds: bring liquidity to your NFT assets

Investing in NFTs is investing in culture. This is evident through NFT representations of digital art, music and video. However, NFTs have far more applications in store for the future.

Use Cases of NFT

The prevalent use cases are in digital art, collectibles & gaming at this stage. However, there are on-going experiments in the field of using NFTs as a new distribution mechanic and channel for sale of merchandise, tickets, real-life assets, in-game assets etc.

Collectibles with limited supplies or strong brand identities sustain long term value.

Marketplaces for Digital Art & Collectibles have been at the forefront of 2021 NFT buying spree. Collectibles with generative art and a unique IP will sustain the long term- value. The average price per piece could be seen as a measure of long-term value of an NFT.

It is unlikely that Beeple’s Everydays will lose value drastically 10 years down the line.

According to Credit Suisse’s 2020 report, 5% of net wealth for most HNWIs is stored in collectibles and fine art. NFTs such as the Everydays are digitized versions of the same.

Hashmasks and CryptoPunks have a limited supply of 16k and 10k respectively. The NFTs have a strong brand identity and in response have seen trades with average price of 2.4k and 16k each.

Long-term value

In the long term, we see creator economy taking over with the rise of monetized user generated content, creator toolkits and NFTs strengthening its position in the media & entertainment industry. Integration of AI into NFTs could be another interesting trend on the rise similar to virtual real estate, virtual galleries etc.

Commercially, NFTs can see a strong use case for merchandising materials, ticketing systems (DevCon has been already using this) and possibly as a representation to trade commodities as well (Centrifuge & Persistence).

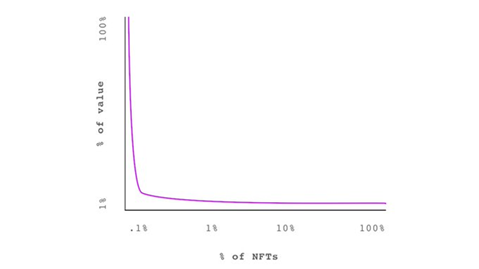

1% of all NFT collectibles will hold 99% of the value generated in the market.

This article was first published on IOSG medium on April 7th.