A Step by Step Guide to NFTs for Creators

By Peter Yang, I tweet about the creator economy and product. Ex-@Twitch, @Twitter, @Facebook. Creator product lead @Reddit

Join the Global Coin Research Network now and contribute your thoughts!

If you’d like to learn about crypto, join our Discord channel and be kept up to date with the latest investment research, breaking news and content, Crypto community happenings around the world!

If you’re a creator, the following numbers might catch your attention:

- A digital flower sold for $20,000

- A looping video clip sold for $26,128

- A sock sold for $60,000

- A Lebron James clip sold for $99,999

All of these items were sold as NFTs or non-fungible tokens.

In this post, I’ll explain what NFTs are and walk through how you can create one to make more money from your content.

Thanks to Phil Murphy from SuperRare for contributing to this post.

What is an NFT?

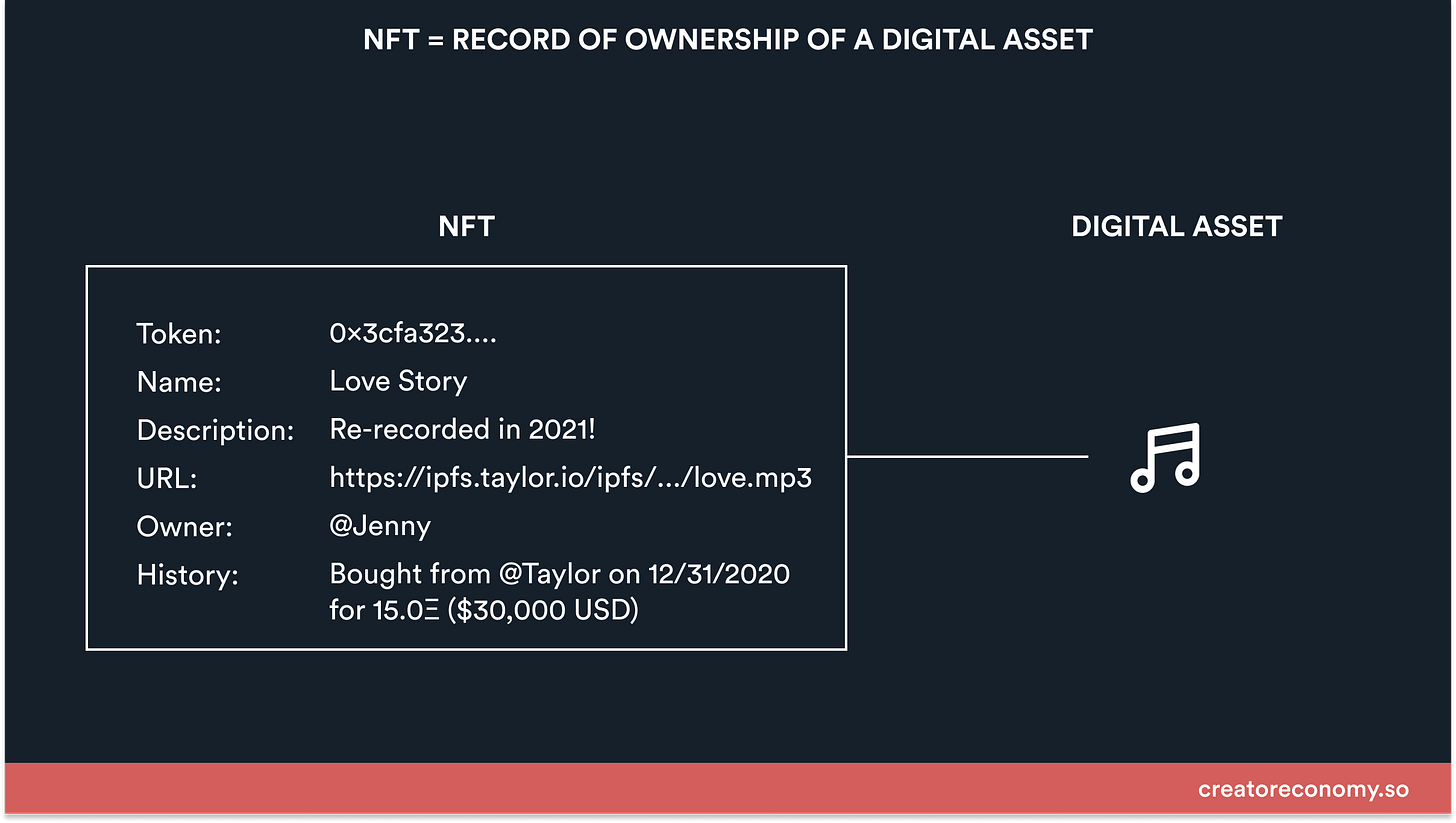

A non-fungible token is a record that shows who owns a unique piece of content. Creators produce unique content such as images, videos, songs, and essays. An NFT is a record that says:

Jenny owns the rights to this song (URL to song). She purchased it from Taylor (the original creator) on 12/31/2020 for $30,000.

I already own my content. Why do I need to make an NFT?

Do you really own your content?

Suppose you’re Taylor, a talented musician. You upload a new song to Spotify and it gets 1 million plays (a hit!). Unfortunately:

- Intermediaries take most of your earnings: Spotify only pays ~$4,000 for 1M plays. After other intermediaries (e.g., record label, management) take their cut, you’re left with just $800.

- Intermediaries own your content rights: Like many new artists, you gave up your song’s rights to the record label. Without your song’s rights, you can’t even perform it live to fans without your label’s approval.

- Intermediaries control how many fans see your content: Spotify can change its discovery algorithms or even take down your content at any moment.

Intermediaries help you create content, reach fans, and make money. But they also capture most of the value from your content. Even the real Taylor Swift had to re-record her songs to own her music.

I don’t want intermediaries to take my money.

How can NFTs help?

Suppose you’re Taylor again, but this time, you create an NFT for your song that says:

Taylor created this song on 12/1/2020 (URL to song). She’s selling its ownership to fans for $30,000. Each time fans resell Taylor’s song, she gets 10% of the sale price.

A fan buys your NFT for $30,000. The marketplace takes 15%, so you earn 85% or $25,500. After a month, she resells it to another fan for $40,000 (you make 10% or $4,000 in royalties). Instead of only making $800, you’ve made $29,500 from just two transactions.

Why would fans spend money to own my content? Anyone can copy it online for free.

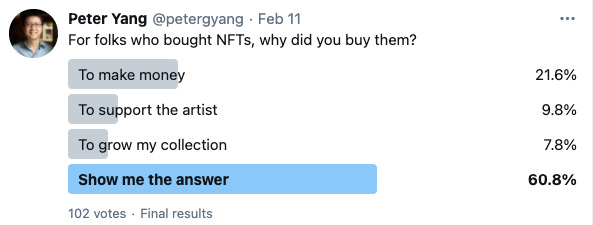

According to my (non-scientific) poll, most people buy NFTs to make money:

In the super fan flywheel, we defined a super fan as someone who spends money to have authentic interactions with the creator. NFTs make it possible for super fans to make money by owning content that can appreciate in value with the creator.

Suppose you paid $30,000 to buy an NFT from an unknown artist. If that artist became famous a year later, you can sell the same NFT at a much higher price.

Like stocks, NFTs let fans make a bet on the creator’s potential.

So only a creator’s super fans are buying their NFTs?

Not at all. I think some buyers could care less about the creator and just want to make a quick profit. For example, someone bought Lindsay Lohan’s art NFT for $17K and immediately put it back on the market for $78K.

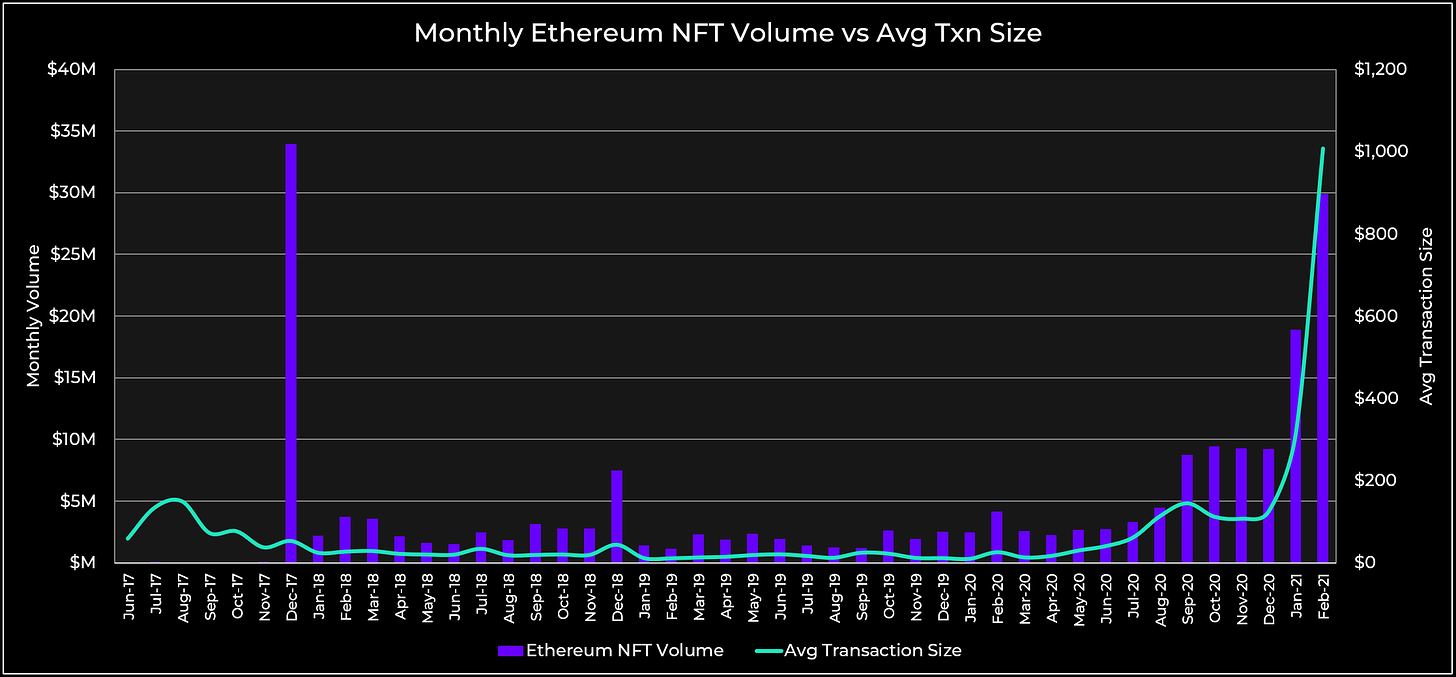

NFT trading volume is entering the frenzy stage, and many people want to ride the market to higher profits:

But speculation isn’t always a bad thing. Long term, speculation leads to more interest from entrepreneurs and builders in this space.

Ok I’m interested, how do I create an NFT for my content?

Here’s a step by step guide:

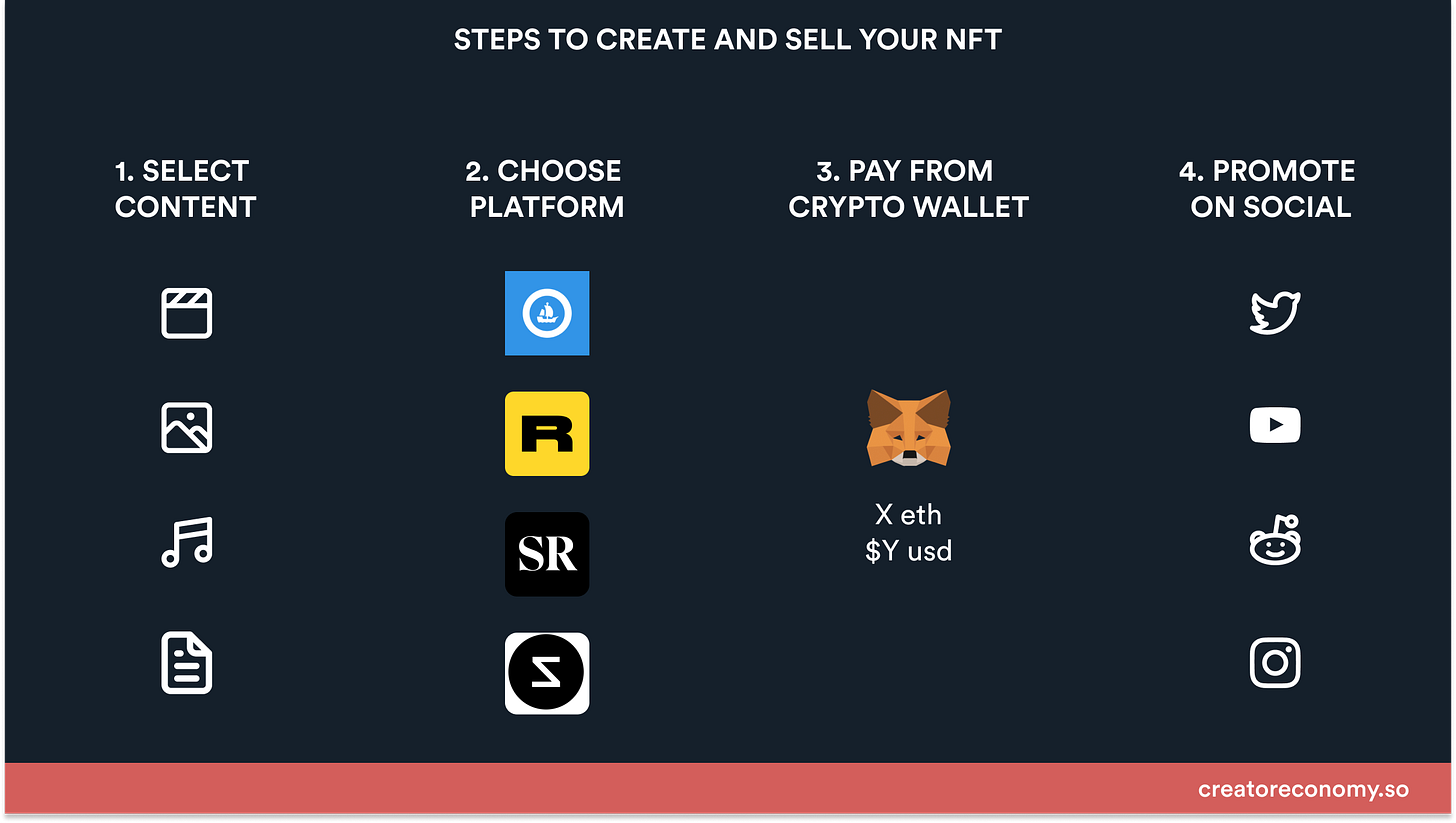

1. Select the content

The most popular NFT category is digital art (typically a PNG, GIF, audio clip, or video clip). However, creators have also made NFTs for everything from domain names to virtual gaming items.

2. Choose an NFT marketplace

There are two types of marketplaces:

- Self-service platforms (e.g., Rarible, OpenSea) let anyone create an NFT. You just need to upload your photo, audio, or video file and fill in what percent royalty you want to charge for each sale. The downside is that these marketplaces often have copycats and fakes.

- Curated platforms (e.g., SuperRare, Foundation) only let approved creators mint NFTs. These platforms usually focus on NFTs for high-quality digital art vs. simple collectibles. The downsides are higher transaction fees (15% vs. 3%) and less flexibility in your royalty percentage (typically 10%).

3. Pay from your crypto wallet

I purposefully did not bring up ethereum or blockchain until now. As a creator, all you need to know is that you creating an NFT costs you ether (a cryptocurrency like bitcoin). You can purchase ether from a digital wallet like Metamask.

Now here’s the big catch with NFTs (at least for now). Due to limitations with the ethereum blockchain, it costs the ether equivalent of ~$70-100 USD to create an NFT. So if you want to make a profit, your NFTs typically need to sell for over $100.

4. Promote on social

Just like with your content, you need to promote your NFT to fans on social to help them discover it.

How many NFTs can I release?

Most platforms allow you to create an unlimited number of NFTs. However, you should think through how many editions of the same NFT you want to issue:

- 1-of-1. You only issue one copy of the NFT, which makes it more valuable. Think Mona Lisa – there are many copies of the painting, but there is only one original piece hanging in Louvre.

- Edition. You issue many copies of the same NFT. Think of it like releasing a merch drop where you have a limited amount of the same hoodie to create scarcity and hype.

This sounds really good, but what are the risks?

If you want to create, buy, or sell NFTs, be aware of these risks:

- Have the right expectations: If you don’t have a large following already, chances are you won’t be able to sell your NFT for tens of thousands of dollars. The average sale price of an NFT in January 2021 was $864.

- There’s a lot of speculation in the market. In December 2020, the average sale price of an NFT was $126, which shows how fast this market is growing. NFT sales are also affected by price changes in ether. Be careful buying expensive NFTs that might not hold value over time.

NFTs are an exciting new way for creators to make money. The let fans own a creator’s content and directly invest in a creator’s success.

The bottom line is: In the creator economy, most of the value should go to the creator and the fans, not the platforms.

NFTs and crypto will make this a reality.

Phil and I will be hosting an NFT 101 room on Clubhouse this Sunday night at 8 PM pst to discuss this article. Sign up now and tune in Sunday!