Cornering the Ethereum Fee Market

Join the Global Coin Research Network now and contribute your thoughts!

If you’d like to learn about crypto, join our Discord channel and be kept up to date with the latest investment research, breaking news and content, Crypto community happenings around the world!

Gas reflexivity and feedback loops

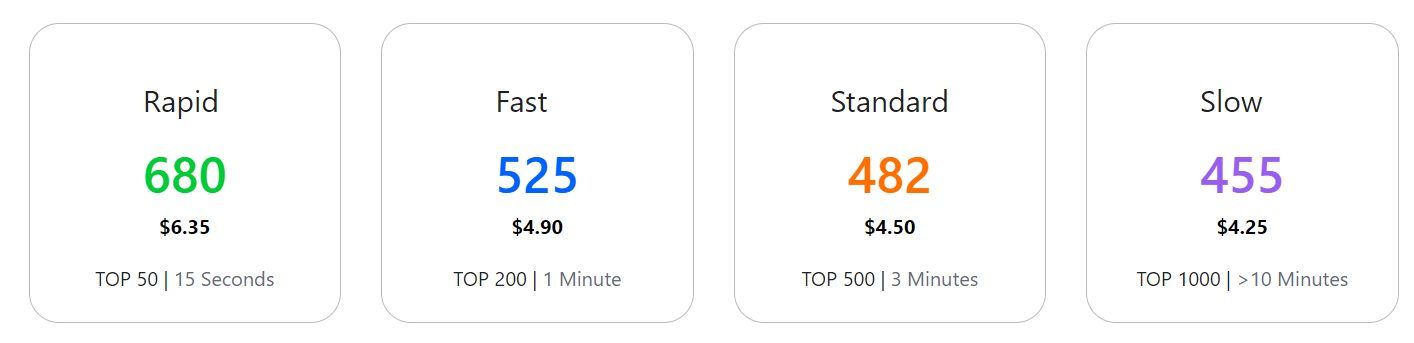

Ethereum block space is probably the most scarce resource right now. The rise of liquidity mining and yield farming over the past couple of months have led to a sharp increase in gas fees, with averages currently in the 400–600 Gwei range(!).

Gas Tokens

Gas tokens are essentially tokenized rent for block space. They take advantage of the storage refundmechanism in Ethereum; when you mint gas tokens, you are saving data into contract storage, and when you free (spend them), you are burning the tokens and freeing up the storage element previously saved. This in turn gives you a ‘refund’ on the transaction, translating into gas savings. This is particularly useful for on chain arbitrage, deploying smart contracts and any sort of batch transaction which otherwise would consume a lot of gas. Active network participants can mint/buy gas tokens when gas is cheap, and releasing it at high prices in order to smooth out average fee spend over time.

Think of gas tokens as tokenized proxies for fees. Fees up, gas tokens up. Fees down, gas tokens down (generally). The two gas tokens used by the market currently are GasToken GST2(https://gastoken.io/) and CHI by 1inch. As gas prices have gone up, so have prices of GST2 and CHI:

GST2

CHI

Positive-feedback loop

Consider 2 extreme scenarios:

- The liquidity mining / yield farming craze continues at current pace. Gas remains elevated and network congested. In this environment, gas tokens remain bid.

- We see a market correction and large unwind of the aforementioned positions, resulting in a rush for the exit. This creates a scramble for block space and fees remain elevated. Gas tokens remain bid.

Now consider an actor that mints a large amount of tokens. This will waste substantial block space, which is already extremely scarce. At start of this year, the average utilization of Ethereum blocks was between 60–80%. Currently, it is consistently at>95%.

This has the potential to create a positive feedback loop, which has previously been mentioned on https://gastoken.io/:

It is possible that widespread use of GasToken will waste substantial block space, driving up gas prices and in-turn driving up GasToken usage, in what has the potential to become a positive-feedback loop.

Phil Daian has also previously outlined:

The result

Outright large purchases of gas tokens in the market would use up further block space. As prices of gas token prices go up and deviate away from “fair value”, anyone can mint new tokens to sell into the higher prices, which in turn pushes up block utilization further, driving up gas. As fees continue to increase, demand for gas tokens increase, pushing prices higher, which in turn creates more minting. The minting process consumes more block space…which results in higher gas fees…and so on.

In the current market regime, this is a very real possibility. With CHI tokens (the most liquid gas token), the maximum minting amount is 140 CHI. Large minters would therefore have to continuously mint clips of 140 CHI, which eats up block space and clogs the network further. Secondary market liquidity is thin, with a combined market cap of GST2 and CHI at <$5mm. With DeFi TVL in the billions and the “market caps” of new protocols trading in the hundreds of millions, it is not unimaginable to think we could see a drastic repricing of GST2 / CHI tokens, potentially kickstarting this positive feedback loop.

What if…

…yield farming / liquidity mining pools start listing gas tokens (or LP shares) as supported assets…?

DISCLAIMER

The information contained in this post (the “Information”) has been prepared solely for informational purposes, is in summary form, and does not purport to be complete. The Information is not, and is not intended to be, an offer to sell, or a solicitation of an offer to purchase, any securities.

The Information does not provide and should not be treated as giving investment advice. The Information does not take into account specific investment objectives, financial situation or the particular needs of any prospective investor. No representation or warranty is made, expressed or implied, with respect to the fairness, correctness, accuracy, reasonableness or completeness of the Information. We do not undertake to update the Information. It should not be regarded by prospective investors as a substitute for the exercise of their own judgment or research. Prospective investors should consult with their own legal, regulatory, tax, business, investment, financial and accounting advisers to the extent that they deem it necessary, and make any investment decisions based upon their own judgment and advice from such advisers as they deem necessary and not upon any view expressed herein.