XRP Go Brrr!!!! While Bitcoin is on a Slow Recovery?bitbank Market Report

By Yuya Hasegawa, a Market Analyst at bitbank, inc..

January Highlights

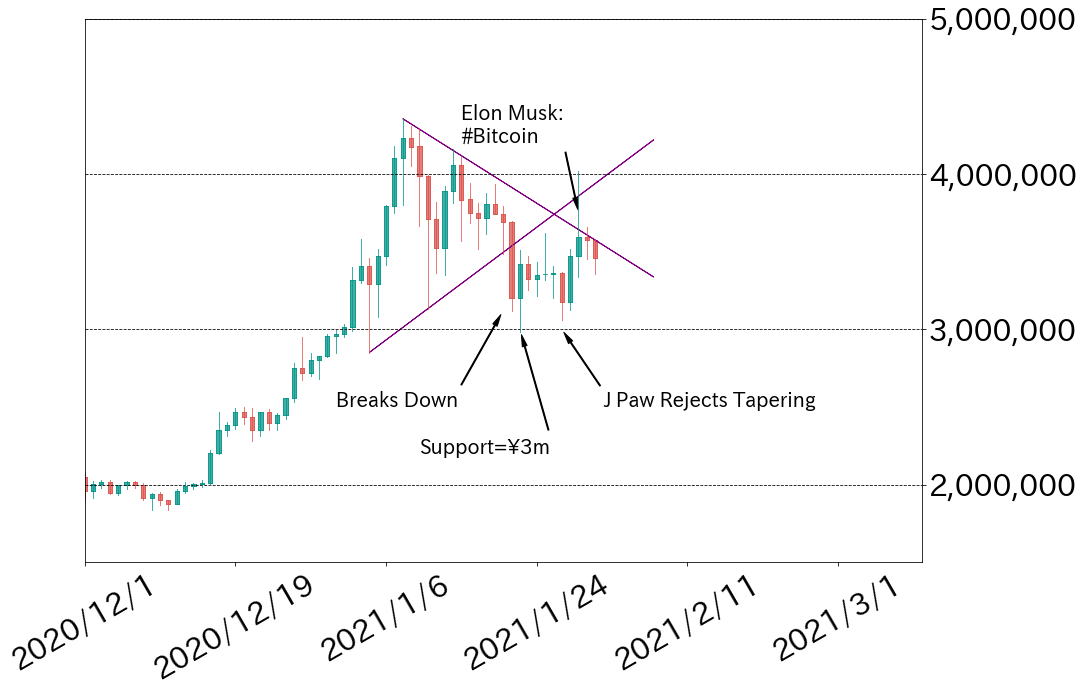

- Bitcoin Breaks Down the Triangle

- Tapering Scare Alleviated

- Dogecoin and XRP Go Brrr!!!

- Elon Musk: will he Buy Bitcoin? https://riwaqalazhar.com

Source: bitbank.cc

Bitcoin closed the month of January with a somewhat disappointing price action, given it started the year with an impressive rally that sent its price above ¥4million for the first time in its history and then closed the month below ¥3.5million. From a purely technical, price-pattern perspective, bitcoin broke down the symmetrical triangle pattern on January 21, which is typically a sign of trend continuation. But strong selling pressures from Ether forced bitcoin to defy the textbook pattern and sent its price to ¥3million.

Again, from a technical perspective, this puts bitcoin in a bad position, as this could be a sign of trend reversal. However, the price of bitcoin sustained the ¥3million psychological level thereafter and started to show some signs of recovery.

First, there was Jay Powell’s press conference after January’s FOMC meeting, where he reassured that starting a discussion on asset purchase tapering at this point is too early, relieving the market’s biggest concern in regards to US monetary policy. This, of course, somewhat guarantees that there will likely be no changes in policy

Second, there was the Dogecoin ‘fever’, where redditors rushed to buy Dogecoin in an attempt to bring the coin’s price to $1 and also to recreate an impressive short squeeze of Gamestop (GME) stock price. They were not successful in achieving the former (so far ? ), but they sure did surprise the market and showcased what they are capable of. Furthermore, once the Dogecoin fever subsided, redditors quickly shifted their target to XRP and made it go ‘brrr!!!’ (quite literally I might add). Even though the reddit-fueled pumps were only temporary, the events somewhat contributed to better market sentiment.

Source: bitbank.cc

Third, there was Elon Musk’s ‘#Bitcoin’ statement on his Twitter profile, which came out of nowhere and took the market by surprise. This incident only mounted to an ephemeral euphoria in terms of short term price action, but has some positive implications to bitcoin in the long run. First of all, given Musk has officially declared his support for bitcoin in the following days, he might be seriously considering either or both investing in bitcoin as an individual or investing in bitcoin as a reserve currency for one of his companies.

Some famous investors and financial commentators, such as Stanley Druckenmiller and Mad Money’s Jim Cramer, have publicly admitted that they are holding bitcoin, and not to mention some american tech companies are purchasing bitcoin as their reserve currency since last year. So, it will not be a huge surprise if Musk decides to buy the coin, but it will be a huge marketing campaign for bitcoin and likely to push others to join the club.

What to Look for in February

- US Stimulus

- Ether Futures Starts Trading at CME

All in all, from a technical perspective, bitcoin may have seemed to have started a down trend on the chart, but its long term fundamentals are still in its favor.

In addition to the Fed’s easy monetary policy, the new Biden administration is pushing to pass the $1.9 trillion rescue package, which will include a $1,400 check. Many Republicans have opposed the bill and a much smaller plan has been proposed, but the Senate Democrats have already started the reconciliation process this week and they are inching closer to passing the bill without any buy-in votes from the Republicans. The timetable is still uncertain but if everything goes smoothly, the bill can go to Joe Biden’s desk in the coming weeks, and every progress the Democrats make will lighten up the market’s mood and riskier assets like crypto could benefit from it (also the crippling sovereign debt will continue to shed light on bitcoin).

There is also Ether’s debut at Chicago Mercantile Exchange (CME) on 7th of February. CME has become one of the most prominent bitcoin futures markets in the past year and there is a lot of expectation that institutional money will flow into the newly starting Ether futures market. Ether really has become a hot commodity these days thanks to the growing DeFi space, and Grayscale has recently been increasing its Ether holdings. So there should be a lot of demand for speculation and, more importantly, for risk-hedging from institutional investors and having a reliable market like CME will likely to facilitate the market’s and the asset’s growth, just like it did for bitcoin.

There is a possibility that this event might trigger a ‘sell the fact’ situation for Ether, but considering the coming network upgrades, growing DeFi space and its popularity, and strong fundamentals for bitcoin, even if that situation occurs, the effect will likely be short term.

English disclaimer is also posted on medium.com.