Japan Crypto Snapshot — Spot Market Back on Track, Newer Users only Interested in bitcoin?

This is a contributing article from Yuya Hasegawa, a Market Analyst at bitbank, inc..

Join the Global Coin Research Network now and contribute your thoughts on Asia!

This article is based on official information of Cryptocurrency Monthly Trade Data published by JVCEA (Japan Virtual and Crypto assets Exchange Association), which is a Self-Regulatory Organization named by Financial Services Agency in Japan. Formerly known as the Japan Virtual Currencies Exchange Association, the organization has revised its name to its current one due to changes in Japan’s regulatory rules.

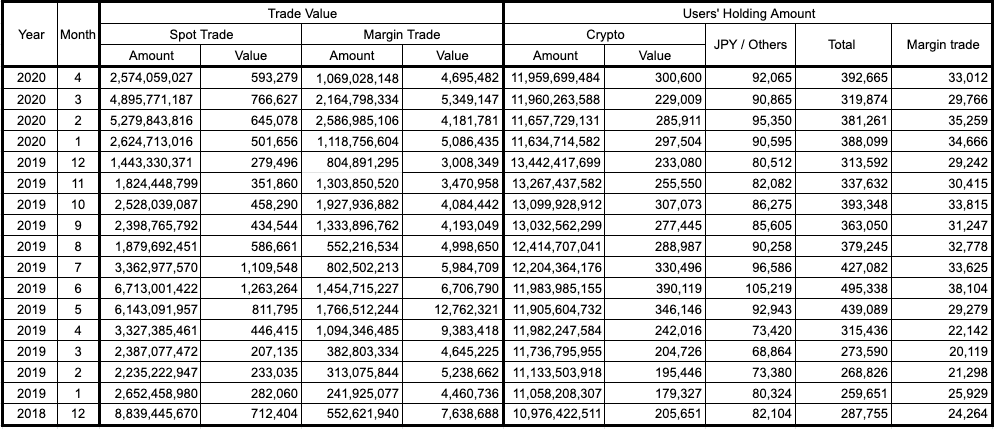

*Value = 1 million JPY

Source: Japan Virtual and Crypto assets Exchange Association

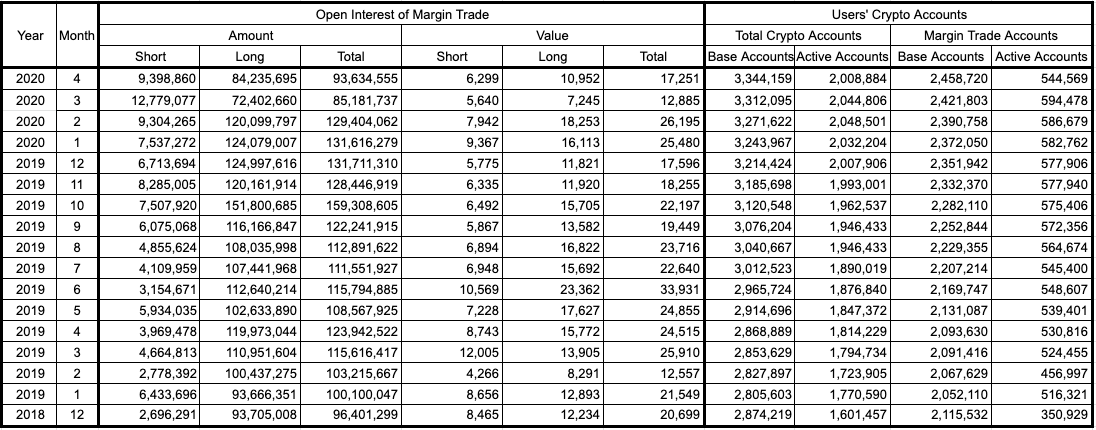

*Value = 1 million JPY

Source: Japan Virtual and Crypto assets Exchange Association

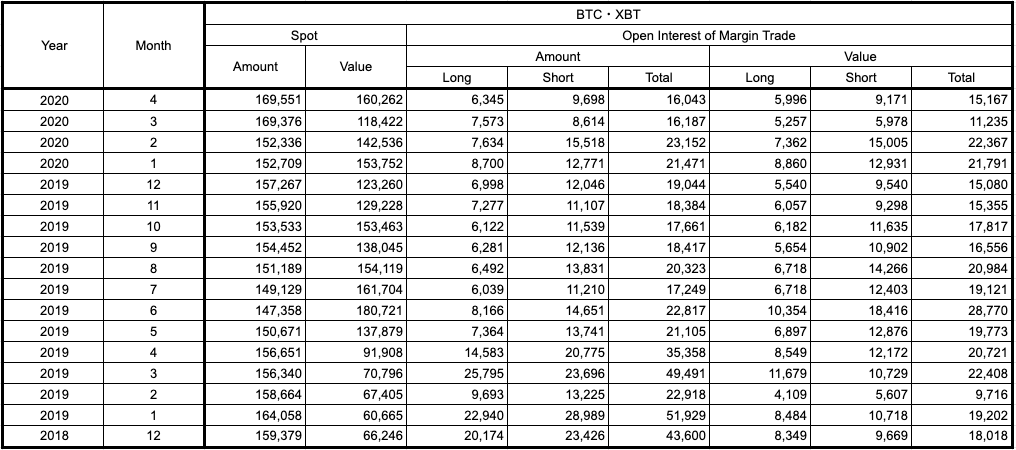

*Value = 1 million JPY

Source: Japan Virtual and Crypto assets Exchange Association

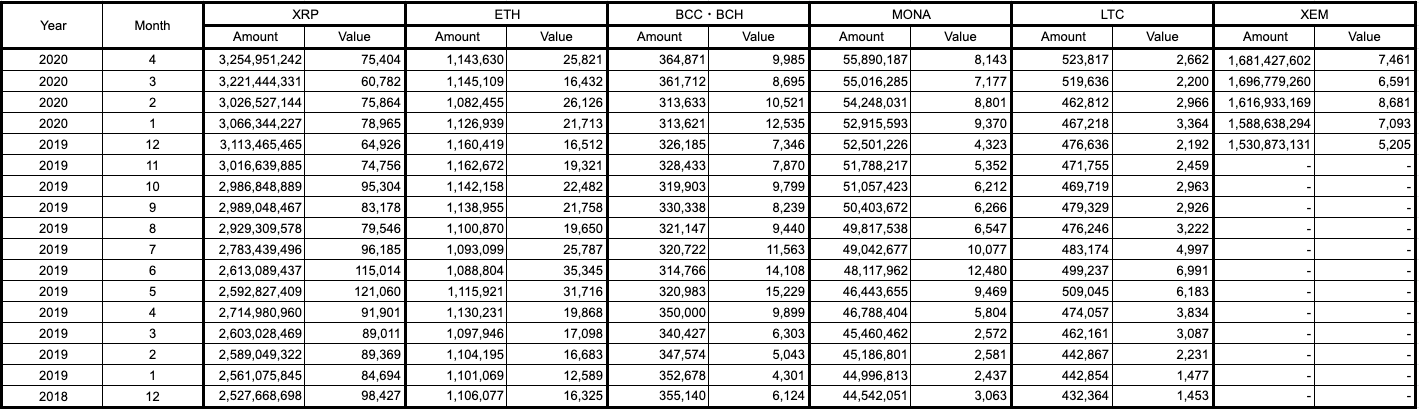

*Value = 1 million JPY

Source: Japan Virtual and Crypto assets Exchange Association

Quick Take

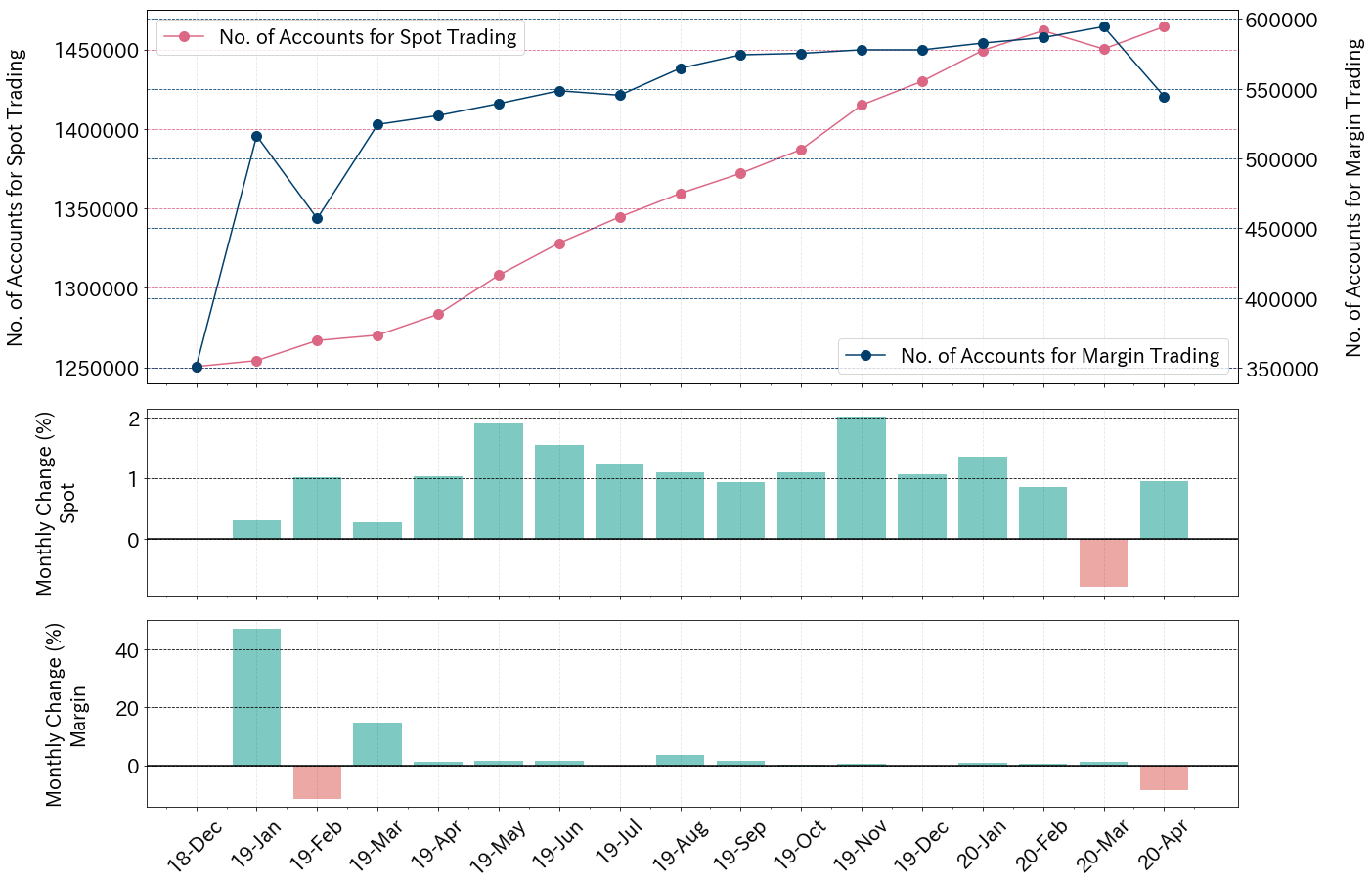

- The number of active accounts for spot crypto trading reached all time high in April, recovering from the dip in March.

- The effect of the March market crash came a month later to margin accounts.

- Bitcoin’s monthly traded value back above 87% dominance. It seems newer users’ main interest is only in bitcoin.

Spot Market Back on Track while Margin Tumbles

To our surprise, the Japanese crypto market experienced the very first decrease in the number of active spot trading accounts back in March. But it seems like the market is back on track. According to the Japan Virtual and Crypto assets Exchange Association, the Japanese spot crypto market added 13,987 active accounts back in April: up 0.96% from 1,450,828 in March, reaching its all time high (Fig. 1).

Back in April, the market started to show a major recovery as worlds’ central banks set out to implement quantitative easings of historic scale. Bitcoin, gold, and stock indices all rebounded amidst the beginning of the liquidity driven market.

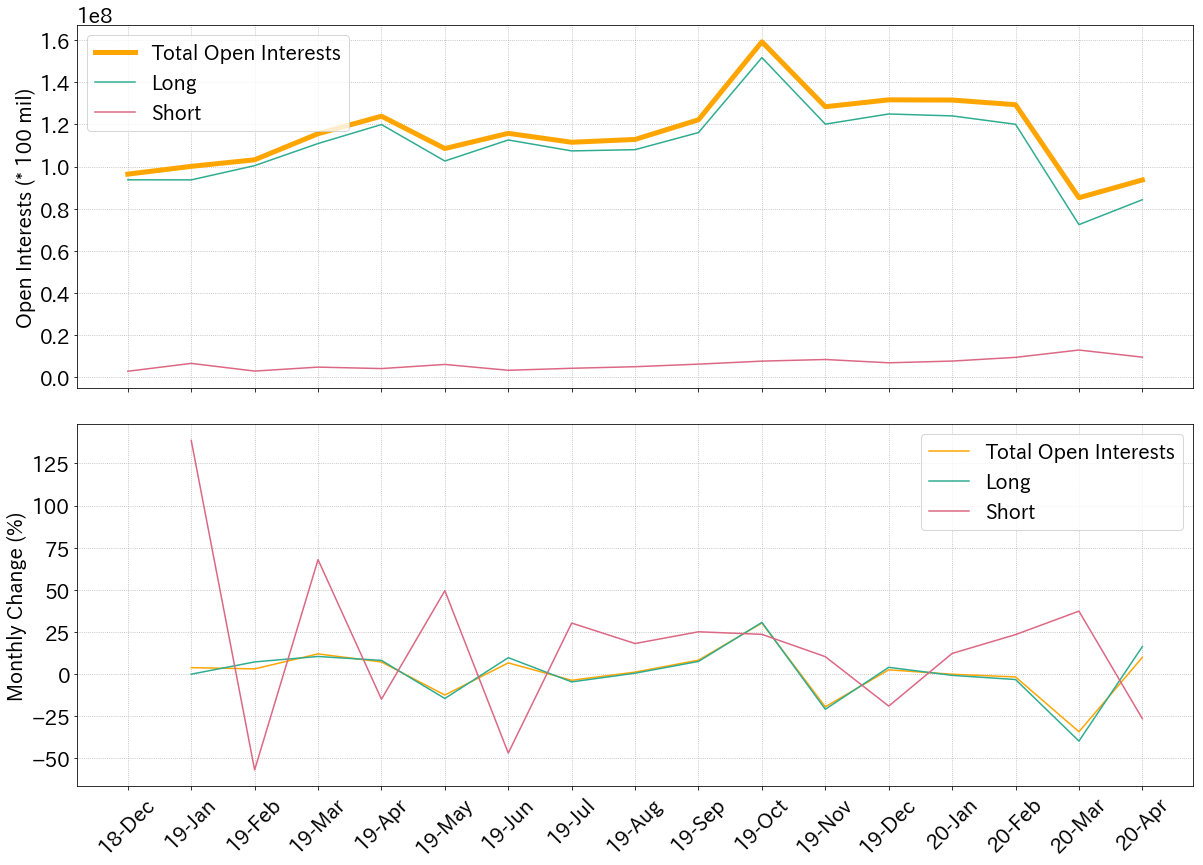

However, interestingly, when we look at the number of active accounts for margin trading, the number decreased by 8.4%, which means almost 50k margin traders did not trade at all during April or had no outstanding balance at the end of the month. The reason behind the decrease is unclear, but the drop in the number of short positions alludes us to think that bears had to go through some struggle this month. Plus, the number of long positions could not recover the pre-COVID19 level either, so a lot of bulls might have been liquidated during March, which counts as a trade, and, given the riskier nature of margin trading compared to spot trading, did not come back in April — hence, the effect of the March market crash came a month later to the margin market than the spot market (Fig. 2).

Source: Japan Virtual and Crypto assets Exchange Association

Source: Japan Virtual and Crypto assets Exchange Association

All Eyes on Bitcoin?

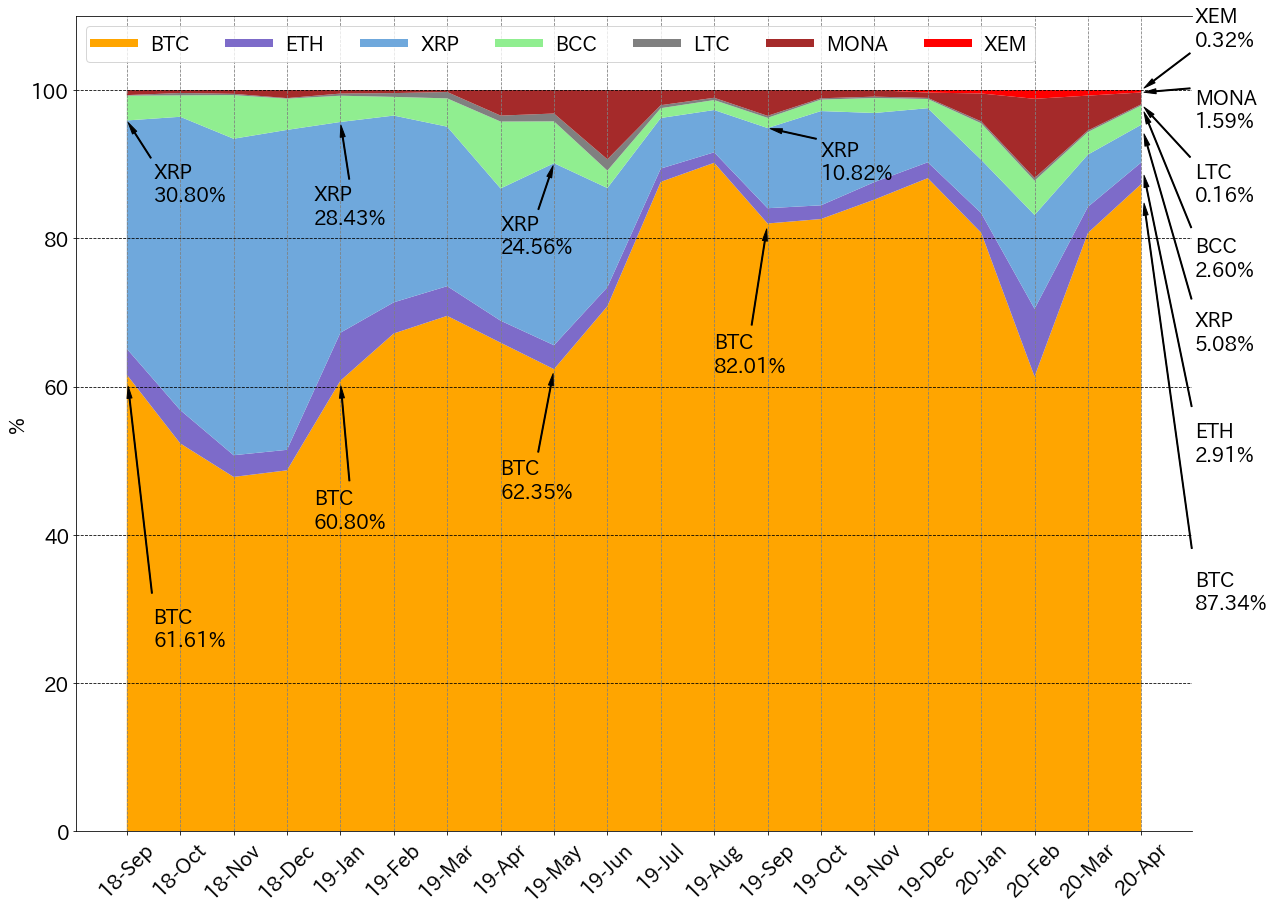

Ripple’s XRP once accounted for about 40% of monthly traded value in the Japanese crypto market, but the dominance structure rapidly changed since the summer of 2019 as bitcoin rose above 80%. The spike in MonaCoin’s volume pushed bitcoin’s dominance below 70% once this February, but its dominance quickly recovered and marked 87.34% in April, while the rest of the coins’ dominance read about 5% or lower (Fig. 3).

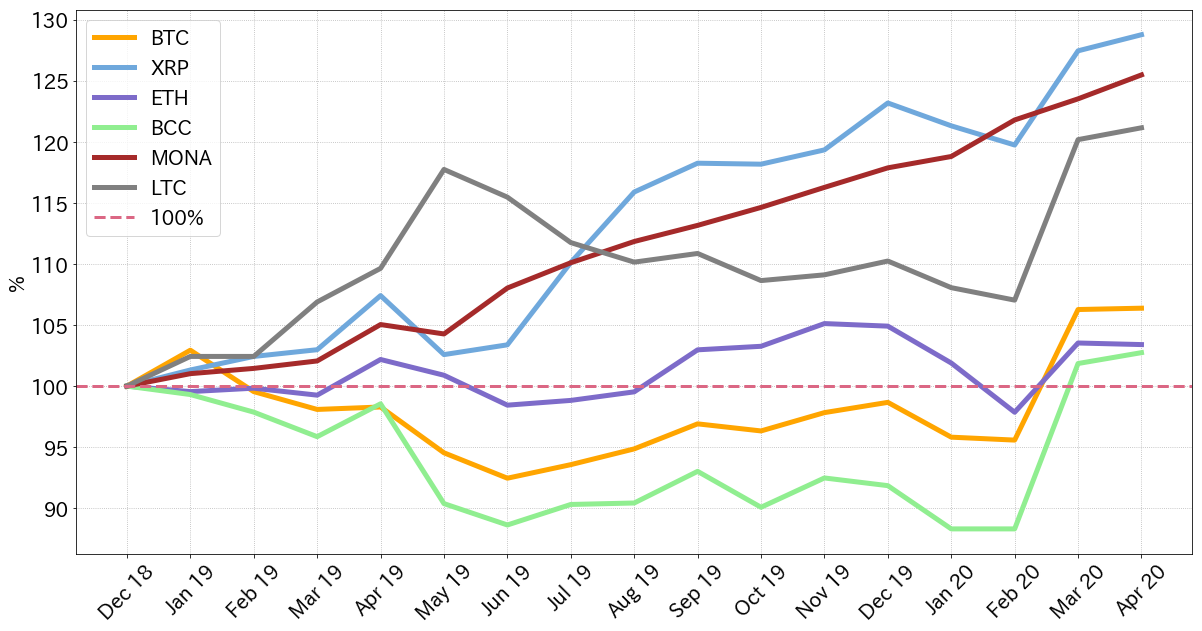

Traded value represents actual value in JPY exchanged, so it is a more timely and possibly accurate metric to measure user interest and market size than user holdings at each exchange. In fact, users’ XRP and MonaCoin holdings (actual amount, not value in JPY) have actually kept an upward trend since the beginning of the JVCEA’s statistics (Fig. 4), but we already have established that the increase in user holdings does not necessarily translate to the increase in their prices, and in some cases, it even has an opposite effect.

So, with that in mind, it seems like Japanese investor’s overall interest in altcoins has been shrinking over time relative to their interests in bitcoin, and given the growth in the number of active accounts, the vast majority of the newer market participants in Japan, particularly since last summer, are likely to be interested only in bitcoin.

Source: Japan Virtual and Crypto assets Exchange Association

Source: Japan Virtual and Crypto assets Exchange Association

Notes

On Table .1 and Table .2

“Trade Value ‘’ includes a numerical value by trade agencies to the other cryptocurrency exchanges. “Amount” and “Value” of open interest of margin trade don’t include a numerical value by trade agencies to the other cryptocurrency exchanges. “Base Accounts” includes the accounts for the purpose of agency trade to the other cryptocurrency exchanges. “Total Accounts” includes the series of accounts for the purpose of compatible use of spot trade and margin trade. “Active Accounts” means the accounts by which users trade at least once in each month, or by which there remain some amount of cryptocurrencies or JPY. “Trade Value ‘’ and ”Open Interest of Margin Trade ‘’ were aggregated apart from one member company of JVCEA. Lastly, “Trade value” is a numerical value calculated from the first day to the last day of each month. “Users’ Holding Amount”, “Open Interest of Margin Trade”, and “Users’ Crypto Accounts” are as of the last day of each month.

On Table .3

This table is a series of data of users’ monthly BTC holding of each month. “Spot” is the amount of BTC deposited by users and its evaluated value. “Open Interest of Margin Trade ‘’ is the amount of open interest held by users and its evaluated value. This table excludes the result of trade agency to the other cryptocurrency exchanges. Each numerical datum is as of the last day of each month. ”Open Interest of Margin Trade ‘’ was aggregated apart from one member company of JVCEA.

On Table .4

“Value” of each cryptocurrency is the aggregation of the valuations reported by each JVCEA member company. Each JVCEA member company calculates the valuation on the deposited amount by users multiplied by each companies’ final valuation rate. This table is based on the types of cryptocurrencies, which three or more JVCEA member companies list. The types of cryptocurrencies will be reviewed once a year. This table excludes the result of trade agency to the other cryptocurrency exchanges. Each numerical datum is as of the last day of each month.