An In-Depth Look at Korea’s Crypto Startup House Nonce

Can’t travel to Asia anymore due to Covid-19? Can’t have that meeting that you wanted anymore with that executive?

As our team receives ongoing questions and pings from our western readers on the things happening in Asia, we are re-surfacing some of the in-depth coverage interviews and write-ups of notable themes, organizations and figures in Asia that continue to be relevant in the cryptocurrency circle. We hope that once travel opens up again, you’ll be more prepared than ever to pursue and learn about the happenings in Asia.

GCR sat down with See Eun Ha, co-founder of Nonce, to talk about Korea and Crypto. We covered so many topics, and See Eun shared many insights that you can checkout individually through the highlighted markers below. We especially enjoyed hearing about the evolution of Nonce and its hacking/engineering-centric community, the backdrop of financial literacy in Korea and what the team is looking to do about it, getting See Eun’s advice for hiring in Korea, his perspectives on Ethereum, Privacy in Korea, and long term outlook for Korea overall.

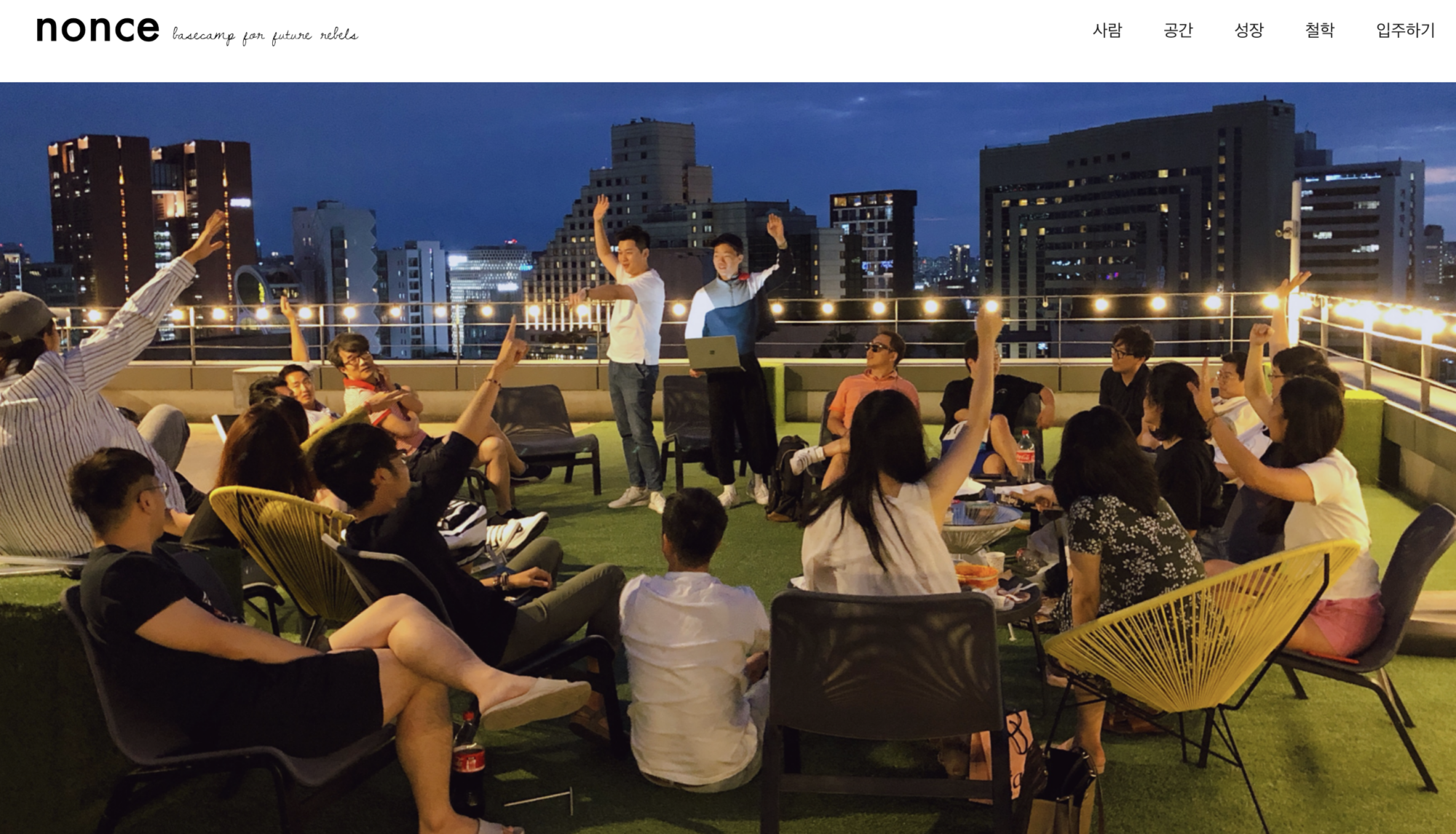

Nonce is a crypto community based out of Seoul, with a physical co-working/living space, with also an incubator. We recently mentioned Nonce in our Asia guide book as one of the community hubs in Korea where many cryptocurrency events have been held. Check out the “The Small Handbook to Asia Crypto: On Local Ecosystems, Trends and Regulations.”

Highlight Markers (You can Ctrl-F to go Directly to that Section)

- About Nonce and its Business Model

- Shifting Focus from Real Estate back into Consumer/Retail market

- The Evolution of the Crypto Retail Community in Korea

- Lack of Financial Literacy in Korea

- Teaching Financial Literacy to Folks in Korea

- Engineering Talent in Korea and the Lack of Open Source Culture

- Attitudes towards Ethereum, Zcash and Privacy and Western Projects in Korea

- Hiring in Korea and Building a Community Here- Some Honest Perspectives

- Can a Korean project go global? Thinking about the long term prospects for the country and its dwindling population

About Nonce and its Business Model

Joyce Yang

So let’s start off. I think maybe we just have folks first learn about Nonce and how you guys got started, what inspired you to do it?

See Eun

All right. So Nonce is.… Right now I think is in its fourth iteration. So the first iteration was me and my co-founder, Young Hoonwho’s… I mean, we got into bitcoin at the end of 2014, but we decided to create Korea’s very first cryptocurrency channel and YouTube channel in March of 2017. And we were in two different cities at the time, and by April, we were consulting for a company together. And I moved in with Young Hoonin this 1-bedroom apartment, and all we did was read white papers from morning until evening, just like investigate research. And then any time we had, we like to go on walks, and like always talk about stuff, life and discuss the whole 9 yards.

Joyce Yang

Are you both blockchain engineers by background?

See Eun

No, my co-founder, Young Hoon is a mathematician. I used to program when I was young, then I actually was a professional dancer before I started my YouTube channel. So yeah, I was a professional dancer for about 10 plus years.

Joyce Yang

What kind of dance?

See Eun

Breakdancing=

Joyce Yang

Oh, okay. Nice.

See Eun

Yeah. And our message was really simple. We really thought the technology is amazing and it could change the world. So our message to everyone, we made educational content, tech-first educational content just explaining to people like the basics of crypto. And our message was “Hey, if you are interested in this, we’re studying all the time, so you guys should come to join us.” And then a hacker and an engineer came and started living with us. That was like 4 guys in a 1-bedroom apartment. And then we said, “Hey, we need to move to a bigger location.” So we moved to a 3-bedroom apartment in September 2017. In September 2017, it was just the 4 of us, we started. And then eventually within a year expanded to 15 people living there on average, with upwards of up to 25 people. And from there, it was like we by mistake, we stumbled across building a Silicon Valley hacker house.

Joyce Yang

In a 3 bedroom?

See Eun

Yeah, in a 3-bedroom apartment.

Joyce Yang

You fit 25 people?

See Eun

Yeah, pretty well. Like people were sleeping in kitchens and stuff. And from there we had 4-5 companies startup. And then by the time we hit 10 people, we just said…. And that was maybe April 2018, we said this is too much, we need to move to a new location. And then somebody’s got this crazy idea about “How about we fit like 100 people like us into one building?” Then we started going around talking to all the co-working/ co-living spaces in Korea saying “Hey, you guys have this problem with vacancies, why don’t we do a b2b, b2c type of deal where you hand off brokers and operations over to us and then we’ll manage it. So one of the companies bit, and then we moved in September 2018, to this lovely 4 story building that houses 50 people, so it has 50 beds. Across the street, we have another building which opened in November 2018 that houses 28 people, and including all the people that co-work out of here, and it has upwards of up to like around 100 people. Yeah, and that’s what we have.

Joyce Yang

So the entire time you guys were thinking about wanting to start an accelerator of some sort, to foster startups?

See Eun

No, we didn’t. None of that. Like really nothing. We just wanted to collect as many crazy crypto people as much as possible. We just wanted a lot of them, a lot of people who are crazy enough to do this thing full time, part-time, half time, whatever. And we’re just collecting them curating them one by one.

Joyce Yang

So you saw it’s like kind of a very early space, there are not many people doing it in Korea especially, and then you really wanted to make sure that you got in touch with all of them, had drawled them in, and then encouraged them to build things.

See Eun

Yeah, I guess. But I think that’s kind of like a revisionist point of view. Really in the moment, it really was just people in the space that are driven to other people with similar energies. And like people talk about this stuff nonstop, we just wanted a better way to do it. This was the best way that we could think of.

Joyce Yang

Why did you have to live together though? I mean, why can’t you people just go to meetups together?

See Eun

True. So people could do that, but Korea is a weird place because in Gangnam, within a span of 2 miles, you basically have all the crypto companies in Korea, except for about 10.

Joyce Yang

I see. Gangnam expensive, right? Like how do you guys pay off for all this stuff?

See Eun

Yeah, so like I said, we just did like a b2b, b2c, and it pays off. Like we have pretty high retention rate. And sure, there’s definitely a burn rate that we have, but it’s ridiculous, there’s nothing ridiculous. And there’s gravity to it to where the stickiness of the place is very very high. We are actually not like we work or we live, we actually have a curation process. So if you apply for the space, we actually do an interview, and we actually do various pretty in-depth due diligence on you to try to figure out what kind of person you are. And then there’s like a Yes or No. And then if you’re Yes, you’re in. We first had that in place because we wanted to make sure that we don’t have scammers with us.

Joyce Yang

All right, that makes sense.

See Eun

But then later on, it’s also not only scammers but also like “Hey, are you like….” You know, like one of the questions we ask is “What’s your dream?” And usually people who are really into crypto, they’re like “Oh yeah, so let me tell you about the dream” and they get really excited. And then we love that kind of energy. So we really like you to come and be part of the community.

Joyce Yang

Is this something that you guys just kind of came up with while you’re just running the show or is there certain things that inspired you to kind of build this model and ask these questions? I’m curious.

See Eun

Yeah, so the very first thing was…. Everything is so revisionist if you look at it retrospectively. But the very first motivation was just “Yeah, we just want, we love each moment of like studying, and then being able to share what we’ve learned with each other. And we want to do it in the most efficient way possible.” That was our first motivation. And then, there was also this other time where we were looking at some people around us who had somewhat successful companies, who have made somewhat successful investments, but this is based off asymmetric information, right? And we were asking us “okay, let’s fast forward 30-40 years from now, and let’s say it’s just us with our asymmetric information becoming successful. Is that more fun or is it more fun for us to share the joy and the love and the information with everyone? And we thought the latter would create a healthier ecosystem. So that was actually a deliberate choice right there.

Joyce Yang

I see. It’s like you had the choice of just going in, kind of speculating or buying coins, but you wanted to do something more involved with the community and more involved the ecosystem.

See Eun

Yeah, and people were asking us for help and stuff. So projects were asking us for help, and we were trying to help them one by one. Just kind of saw this and decided to do it.

Joyce Yang

What do you help them with mostly?

See Eun

For a long time, there wasn’t really a developer community, because we had out of like 70 people here, about more than half were engineers. So we did another thing. And so at one point, it was like 70 people completely full, other than 65 people were all in crypto, and then from that crowd, more than half were engineers. So I don’t know if you have like this kind of concentration of like engineers from different companies living in one location. So we basically make sure other companies got in contact with our community or like hosting meetups and things of that sort. That’s what we did.

Joyce Yang

Got it. And then you don’t take investments in these companies. Do you?

See Eun

Yeah, so we’ve invested in about 5 or 6 companies. We really didn’t invest in that many companies. So the companies that we did invest in, we did help out, we’re still helping out.

Shifting Focus from Real Estate back into Consumer/Retail market

Joyce Yang

Got it. That’s really cool. That tells me that you have a lot of insights into kind of engineering and the builder of community and Korea which is something that people don’t see very much, it’s like…. In Silicon Valley, they used to have this like rainbow house where a lot of the hackers and entrepreneurs lived. And you know, when you mentioned the story of like everyone living together in a house trying to build a startup, that kind of reminded me of Airbnb. If you follow Airbnb early stories of Bryan Chesky and those guys living in a house rented and then try to create their own Airbnb and you know, provide breakfast and it made it into a big real estate business. So where do you want to take this now?

See Eun

Okay. So Nonce in its essence evolved into 2 pillars. And this was up until about 2 weeks ago. Two pillars; on the one side was community and real estate, and then, on the other hand, was like blockchain. Blockchain and more specifically like financial services that could be built using blockchain crypto. So our plan was… because we had like 70 people maxed out, we wanted to get a bigger building. And I think someone at Coinbase,told a story about like would it be cool to create an SNS where you could export the social graph, and then you can import it into other things and that would really like help to protect your sovereignty.

So we had this crazy idea about exporting offline social graph, so we really want to do like bottom-up urban planning. So we thought it wasn’t fair for the government to have a monopoly on urban planning. And we thought, is there a bottom-up way to do it? And that was basically like the Nonce experiment was trying to do that. And so we knew we had 70 people who if we said we’ll move to another location, they’ll move with us. So we were talking with real estate developers about purchasing like a 14 story building that houses about 200 people. And then we’d do a mass exodus of our 70 people plus other people that would be interested in living with us, and then moving to that new location. And then whatever, that was the thing. And then that was 2 weeks ago. Up until 2 weeks ago, we’ve been working on that for about 3-4 months, that ideas itself, because we knew we wanted to move out of this building. But we decided to not go that way. And we decided to take the 2 pillars and completely split it, split them up. So what we mean by that is, we think Nonce and what is trying to solve from like a human problem is like the problem of modern human beings and how they deal with loneliness. So this arm is more like religion. And we’re trying to make people just make a braver world, usher in a braver world where people are free, they feel free and independent enough to be themselves. And we decided “Hey, this is more like an ethos, and you don’t need people to live together to be able to pursue this.” They just need a place to congregate. So kind of like what you said, like what you just have meetups and stuff. So we decided “Okay, that’s what we’re going to do with this.” And on the other hand for blockchain, we decided… because at the beginning when we moved into this new building, our co-living community was way stronger than our co-working community. But then over time what happened was our co-living community and the connections between them became way stronger than our co-living community. I think something with the co-working community was everybody had a shared vision, we’re trying to usher in like a healthier ecosystem that just made everybody come together a lot like made the bonds between them a lot stronger. And we saw that you don’t necessarily need co-living. And then another thing was that in real estate, you can make 2x in 10 years, but in crypto, you could make 10x in 2 years. So honestly, like which one would you like to pursue, given that you have time? And so we decided real estate is always going to wait, and this is a problem, like people feeling lonely. And this real estate bubble, lack of housing, these are all very serious questions that is really important to solve, but we could actually push it back, and we don’t need to go ahead and solve it right now. So we decided that we are going to…. we’re currently in the process of building out the Korean crypto retail investor community, and that’s what we’ll be focusing on. So yeah, we have the religion part, and then on the crypto side, we’re just going to make sure that we build up the Korean retail investor community, and then match them with projects from overseas and projects that are locally incubated out of Nonce.

Joyce Yang

Can you talk about how you’ll do that? And what does that look like?

See Eun

Oh, yeah. So it actually went back 360 degrees. So yeah, building the biggest YouTube channel in Korea. That’s so basically what it comes down to.

Joyce Yang

Oh, interesting. So you used to do videos as well on YouTube?

See Eun

Yeah, when we started out, we were like for a very long time…. Like throughout 2017, we were the biggest YouTube channel in Korea. So even now we have a channel that’s like 14,000 subscribers, the biggest channel in Korea right now has 47,000 subscribers. So for some reason, people can’t get past 50,000, but we are like best because these channels are terrible and we know we could do a lot better.

Joyce Yang

And you’ll do this in Korean?

See Eun

All Korean. There will be parts which interface with people outside of Korea, but right now we want to build the biggest leverage. And I think the biggest leverage ever is just having retail, like an educated retail Korean investor community. There we go!

The Evolution of the Korea’s Crypto Startup Community

Joyce Yang

Yeah. Actually, if you could kind of generalize or just kind of layout a little view of what the general retail community looks like now in Korea, and kind of how its evolved and then where you want to take it?

See Eun

Okay. Let’s see. The retail community, I don’t think it’s ever been educated. Like when I first started our YouTube channel, the reason was my friend’s mom, she took out loans, bought ripple, and came to me and asked me what ripple is. And I was just shocked. Back then, I couldn’t blame her because there was no Korean information on ripple; there was just a ripple on exchanges. Now, there’s some information, but it’s still doesn’t help the retail investors, they’re still under-educated. There’s just not you know, like anywhere in the world, financial literacy. They don’t teach it at schools. And then the people that do teach it, they teach it in like those weird workshop ways where they make you pay a ridiculous amount of money to learn something that everybody should just have basic access to. In crypto, everybody’s interest in IEO, and that’s a primary market thing, that’s not a secondary market thing and that has nothing to do with financial literacy. Everyone is teaching financial literacy. Everybody is just teaching people how to flip. And so in that sense, that’s why there is material, people are still…. In Asia, and people tend to be pragmatic, I think. So they’re going to go for that quick and do with everybody living close together. Jealousy is a motherfucker. Jealous; they’re coveting what other people have, that upward mobility as a motherfucker. So people are going to really, really, really desire that and they’re going to really try to push themselves to get at that. Yeah, that’s how the Korean retail market is. We are just talking about it now, but there are a lot of people…. I’m not going to say all people are like that, but there are a lot of people who invest in crypto who want to learn about crypto. Meaning they don’t know anything about crypto, but because these people who are 40 years and older. So the Korean retail investor community is usually like the older generation, and the younger generation is like the developers and stuff. And actually, it is partially like us, like we don’t…. And its partially them, partially us, because we don’t really like interacting with the older generation, so we’re not really friendly to them. There’s nothing friendly for the older generation, so the only people that are servicing the retail community honestly, and beating them on their own terms…. Like for these people, face time is important, for these people being courteous is important. All this is like the scammers; there’s the scammers and the mafias because the scammers and the mafias would do whatever to get your moms and pops to take out their life savings, and then to dump it into the shit coin.

Joyce Yang

What are the mafias?

See Eun

Yeah, so obviously just Korean gangsters. Like there’s a lot of Korean gangsters who either run scummy ICOs, or they run scamming exchanges. This is just a matter of fact.

Joyce Yang

Okay, got you. So there’s like groups of people will do it together and kind of like Ponzi scheme.

See Eun

Yeah, it is a Ponzi scheme, but who’s running it? It is like these gangsters. I actually mean people who are like violent. Violent like have had troubles with the police, been to jail.

Joyce Yang

I see.

See Eun

It is not all like that, but there are. I think that’s true in Korea, that’s true in some other parts of the world too.

Lack of Financial Literacy in Korea

Joyce Yang

Yeah, I think it’s really interesting that you’re trying to help the retail community. I mean generally you know, what we see in Asia is a speculative environment. How do you plan to kind of empower them? With what tools? How do they speculate better is how I think about how…? You know, they’ll not be the last one to dump out the tokens, right? Because that’s what we see in many of the kind of token behaviors as well.

See Eun

Yeah. So here is, I think financial literacy and crypto education just need to go hand in hand. I think what’s most amazing about crypto isn’t actually not the primary market investment opportunity. It looks that way in terms of returns, but what’s most amazing crypto is how easily people can access the secondary market. Like you really just need to just sign up on an exchange.

Joyce Yang

And I think especially true in Korea.

See Eun

Yeah. Especially true Korea, but for people being able to access secondary markets, again no financial literacy.

In Korea, retail investors have really high obstacle into entering the derivatives market, and Korean retail is not allowed to trade forex. Which means people already think stock markets, spot stocks, they already think that’s a scam. Like when I first started crypto, my parents were college-educated people. My dad’s a PhD and my mom’s a pharmacist; they straight up told me “Hey, you shouldn’t be doing that, its gambling.” Because they had problems with stocks and equities and securities back in the days, right. But it’s their fault, it’s this their lack of financial literacy that got them there. But in Korea, there’s a tendency to think… because at one point in time, there was a period in Korea where if you were to save, you got like 10% APR over a savings account, right? So people think like the whole thing of “you’ve got to save you know, you got to be frugal, you got to save, and that’s how you retire.” You know, that typical…. I think all Asians do it, but so countries are worse than others. So I heard that all my life and had to unlearn that and figure out that my parents are wrong. And so it really is like “Hey, why is Bitcoin good?” Well, we have this problem in the macroeconomy where they’re continuing to pump up the dollar. And the interest rates continue to drop. And you need to learn how to hedge yourself in some way. And crypto is one of those ways where you can learn to hedge yourself. Now, don’t go run off and put all your money into it, but just take whatever you’re willing to lose, and just do it. Just put that amount of money to see what it does, and then in the meantime, in-between time, please let’s take time to learn about the market. Yeah, and nobody is doing this in like a step by step manner.

Joyce Yang

Yeah, I agree. Maybe I think people are trying to do it in third world countries, but they don’t realize it’s the same problem in first world countries. Because no one really knows either.

See Eun

Nobody knows. And so I just saw something recently I came up with. So all my friends are like hip hop, like kids from the ghetto, from the hood whatever. Some of them made it out. Some of them didn’t, right? And all my friends would be telling me things like, there’s like this book called Richest Man in Babylon. You know, there’s like Robert Kiyosaki; Rich Dad, Poor Dad. So all these books, they’ll be like that the 401k, like the 25%, you need to put at least 20-25% in savings, you need to take like a 10th of that and then you need to put it into something else. All these techniques are techniques that teach you how to get up the hood. It doesn’t tell you how to get rich. And so with financial literacy, I mean like how do I make asymmetric returns in my life, right? And unfortunately even with Asians, because a lot of our parents are people who’ve come out of the hood, right? They were really struggling, they were struggling to survive and they came out. They don’t know how to get rich, but they know how to avoid being poor, which is not the same as being rich. And so when you see these financial tools like nobody was there to guide you and show you the ropes. So I think crypto is a great levy into that. This is going to be an uphill battle for sure.

Joyce Yang

It’s not that hard. When you tell people you’re going to make money on this. Or you’re not going to be poor on this, I don’t think it’s going to be hard to make money. It’s going to be an uphill battle, right?

See Eun

Yeah, but I think investing is like about how you feel. It’s not about the charts moving up and down. It’s about if the chart moves up, how do you feel about it? If chart moves down, how do you feel about it? And people have never like had that metacognition. If this chart moves up and I put my life saving into it, how do I feel about it? Like is that important this is moving up? But it’s hard for them to step back and learn, like to ask themselves that. And then you get burnt, and you say “Oh, it must be that this is gambling when it’s not.” You just don’t understand yourself and you put in more than you’re willing to lose.

Joyce Yang

I see. So it sounds like you’re introducing crypto as a way to help folks better understand generally financial literacy. And how do you like transfer these skill sets across other investing channels as well?

Teaching Financial Literacy to Folks in Korea

See Eun

Yeah. Now that’s what we’re thinking, that’s how we’re planning to build the retail investor community, a healthier retail investor community.

Joyce Yang

Yeah, that’s very interesting and I think a very meaningful thing to do.

See Eun

Also one more thing. So it seems like a lot of people are…. Well, it could be me, it could be me. But I get the feeling that the holy grail of crypto is mass adoption, right? We talk about it all the time. And let’s say back to fidelity coming, we have all these institutional investors. Is that really the way we’re going to adopt, like get mass adoption? Because something I also think about a lot is Generation Z and beyond. These kids don’t give a fuck. Like they’re wired so they really want to watch videos, and they not wired the same way that we are. I think the exchanges right now are not solving the hard question. All the exchanges or many of them are probably trying to get their…. In Korea especially, like 40 years old plus customers on board, right? But 10 years from now, these 20 something year old kids are going to have money to start investing. And you really expect these kids to read candlesticks. So it seems like we’re saying like the financial market, the finance, financial interface, as we know it now, is going to remain the same. But honestly, how can we teach financial literacy to Generation Z? And how can we introduce it to Generation Z and beyond, and how can we introduce it in a way that’s meaningful to them? Because all of us are saying like “Hey, crypto is going to benefit Generation Z and beyond the most, but nobody’s really thinking about it.” So that’s another one of those things where I think we don’t…. The retail that’s coming, that’s nothing, right? There’s more retail to come in, but the question is, how are you going to educate these retailers when they’re coming in, especially the younger kids? That’s my little rant.

Engineering Talent in Korea and the Lack of Open Source Culture

Joyce Yang

I just wanted to kind of quickly turn the topic a little bit and ask you a little bit more about the entrepreneurial and engineering landscape in Korea as well, because people don’t really focus on that as much as mostly on the speculative market. But at least outside of Korea, I think, and I know there’s obviously a lot of really interesting things being built and kind of ideas being scored. So kind of if you could talk about how that’s evolved in the last few years and what folks are kind of thinking about on, and interested in building on?

See Eun

Yeah, so I’ll talk about like the crypto space. Engineering wise, I think one of the weaknesses in Korea is that we don’t have a lot of scientists. We really shot ourselves in the foot with distributed systems and cryptography.

Joyce Yang

But that’s not in every country.

See Eun

No, not every country. Israel did it. Israel clearly did it. Ukraine and those Eastern European countries have a very strong cryptography community.

Yeah, So every country is good at something. Every country is good at something, but obviously distributed systems and cryptography weren’t like that big of a deal in other places. And then when crypto came along, then it’s like “oh, this is a really big deal.” But Korea, it’s always been where we got the fast follower strategy. So we look at somebody’s doing and we’re good at taking that thing and copying that thing coming over and then like tweaking it and making it better. And we were really in those like the services industry, so everything is like Apps, services, you have to solve a problem. And usually the problem is something that deals with customers, not something that deals with technology, right? And so even now when you look at Korea especially in this protocol phase where everybody is working on protocols, not that many people to be honest. There are probably more people hired by Kakao Klatyn, So GroundX, and then Line, there are probably more people hired by them building out the infrastructure than people who are outside those companies who are actually building out protocol infrastructure stuff. That’s one. There’s also the thing with open source. So right behind me, there are like 3 people who are ex Samsung Engineers, right. So they were each and Samsung for at least 10 plus years. When they came out of Samsung, because everything that Samsung is top secret. When they typed in the stuff they worked on to Google it, and then like one code base came out. Meaning it is not open source. Everything is very still proprietary software. And you’re talking about the biggest electronics company in Korea.

Joyce Yang

Yeah, that makes sense, I guess.

See Eun

So the whole idea of open source, that’s still very foreign in Korea. And so continually when you’re talking about crypto, talking about open source is already small, then you’re trying to find people who are doing crypto, that’s even smaller. In terms of that, like hardcore protocol community, small, but in terms of like the services and making apps and stuff, that stuff is big. Which brings us to the entrepreneurs. So because in Asia, at least in Korea, it wasn’t an ethos driven thing. People weren’t driven by the ethos of Bitcoin, or the ethos of the Ethereum or of decentralization.

They were primarily driven by just other people, people next to them becoming rich, right. And the whole thing of like tokennomics, which is…. I write tokennomics and I read really bad, badly designed incentive systems. But there was a whole slew of reverse ICOs. So either established companies weren’t doing that well, using ICOs to get a boost in funding, or startups who got their seed money who are who don’t want to do a series A and then they do an ICO to get funding, and then the very next year they pivot away from the blockchain. So that’s kind of what happened in my opinion with the entrepreneurs and the engineers. However, not all hope is lost. There are still like the Korean Ethereum community which is ridiculously strong.

Yeah. I think the Korean Ethereum Community is doing great.

Attitudes towards Ethereum, Zcash and Privacy and Western Projects in Korea

Joyce Yang

Do they do like building stuff on Ethereum, they’re exploring defi for example?

See Eun

Yeah, that’s definitely helped me. That that’s the biggest developer community. There’s others like Tezos, they’re doing a pretty good job reaching out. The Korean Tezos team, they’re really reaching out in terms of crypto education and stuff. Let’s see. Other than that, like Bitcoin, there’s actually zero Bitcoin contributors in Korea. There’s probably like less than 5 people who’ve ever contributed to Bitcoin in Korea, which is really sad. There’s no active contributors. So Bitcoin, there’s like the expat… there’s the Seoul Bitcoin Meetup which is led by like the expat community out here in Korea, and then there’s like the BSV, Satoshi’s Fishing Community led by Koreans. There are situations like that. Projects like see Zcash or Grin, like Grin or beam, sure the miners are interested. But again, for like Zcash, it’s like people generally don’t think about privacy at all. That’s not nearly as popular or they’re not even deemed that important. People are not aware of privacy enough to focus on those.

Joyce Yang

Yeah. I think in China, people just don’t care about their privacy. Is that the same in Korea?

See Eun

Yeah. People tend to…. I think in China, they know that the government is big brother, but there’s nothing that they can do about it. But in Korea, people generally trust the government. There’s a higher trust for the government.

Joyce Yang

That’s, great.

See Eun

One more thing. I feel like there are factions in Korea namely; there’s a very heavy China influence within Korea itself. So you’ll have community of like these Chinese projects. And they’re pretty big in Korea. But like in terms of like the defi stuff or like the DAO stuff, projects like Aragon or like Gnosis or like the…. I just think of them as more like Western projects or like they’re staying true to the vision of decentralization. Those have zero presence in Korea. No community at all.

Joyce Yang

You ever tried to reach out to them to ask them to come?

See Eun

So one of the people that we worked with for this western project was like the PD. And he was working, but to no avail yet, because there’s so many of them. I wish there was a stronger presence of Western projects. But I understand, because if we think of it in terms of economics, if I’m a Western project raising money, Korea will probably be at the end of their list. And then if they think about someone they’ll be like “Oh, we could get money from Hashed.” And then hashed may or may not invest in them, which means later on when they open things up, then the Korean community is probably way down the list. And I understand there are priorities; the country’s not that big. It is much better…. If you have a Chinese community, then you could have like a huge amount of people contributing, but Korea’s not that big; there’s only so much attention in the number of people that you can get on board.

Joyce Yang

But you have so many more proportionally enthusiastic people. You see Chinese people go into Korea for example, right, there’s a reason for that. They’re not allowed to do as many things in China, for example, so the come top Korea.

See Eun

Yep.

Hiring in Korea and Building a Community Here- Some Honest Perspectives

Joyce Yang

That’s obviously one of the things, one of the great value propositions of Korea, and Japan is a little harder to navigate through, I think from my understanding. Korea is a lot more readily and obviously very crypto welcoming as well. So which is why I see a lot of Chinese folks coming in. And that’s interesting that you say that, because I think maybe people will think about Korea as a speculative market, and they may not understand that there’s engineering… and like people building and trying to actually make an effort to kind of create and kind of follow this ethos of like decentralization and building. We’ve been talking about Klatyn for a while in our platform because there’s someone who actually is trying to do something more, as a larger project that has pretty profound effects on the actual real use cases of what people are doing.

See Eun

Yeah, the interfacing. I think it’s really important. Just like simple, right? Like how do you communicate? How do you localize, and this is where me and Daniel really connect. We have so many engineering talents here in our industry, but not many communicators and not many people who are willing to go between borders and really make things happen in like flatten the informational asymmetry.

Joyce Yang

So you’re saying like, if a project wants to come hire, it’s actually kind of hard to get those folks to work with them?

See Eun

Well, that and also, how are you going to know? How are you going unless you hire the right person? Maybe this person just wants to get that token bonus or whatever. There’s not an easy way to do due diligence on this person. Maybe they’ll be with the project until they fundraise, and then they’ll dump the tokens and maybe they won’t respond. How do you punish those kind of people? How do you even draft up a contract and how do you enforce that contract? These are all difficult questions.

Yeah, I just think the risks are larger for hiring remove workers in in crypto because if I am a remote worker and I’m getting paid by wages, then there’s no chance of me flipping. I’m just getting paid wages, so I just need to go do a good job. But in crypto, especially in the fundraising round, I can tell you or make up stories and you obviously do not know the Korean language, the Korean landscape or whatever. I can tell a very good story, and then I can make a flip.

See Eun

Oh, by the way, I’m not trying to be cynical, I just see it as hit is.

Joyce Yang

I mean, that’s pretty cynical. You’re pretty salty.

See Eun

I’m a pretty positive person, I do want to warn people that there are dangerous.

Can a Korean project go global? Thinking about the long term prospects for the country and its dwindling population

Joyce Yang

my last question is, basically how do you think crypto in Korea will kind of be able to go beyond Korea and go outside of Korea? Could we see native Korean projects and native crypto people from Korea go out side of the country?

See Eun

Okay, if a Korean project goes global, I don’t think it’s going to be an Enterprise Project. Reason is like not agile, and like the global first mindset, I don’t think…. Oh, let me just give an example. So Ground X is part of Kakao, right? And Kakao’s only success in the market outside of Korea is Kakao Friends, which is… for those listeners that don’t know, it’s their little dolls, their characters, right. So they opened the pop-up store in Japan, and they didn’t know it’ll go viral, but it did. That is only their…. Up to date, that is their only success when it comes to making something successful outside of Korea. So Klatyn kind of gets the same thing, which is Ground X at the end of the day is to get permission from Kakao, right? And Kakao is very very very cautious when it comes to overseas expansion. Back in the days, they tried to expand into Southeast Asia, they took the smartest people from Kakao, they sent them over, and then I think they spent around 100 mil USD, and then though to no avail. Line just absolutely dominates in Southeast Asia, right. So these enterprises, so Korean enterprises tend to go inwards a lot, and they tend to focus on the local market, making it very…. Korea is kind of like a Galapagos, right. Just cut off from everybody else.

But I do think projects like Terra, or Tokamak or even projects like Crossing Goal which is like a disclosures registry. So these projects are going above and beyond to try to reach out beyond Korea, and then just communicate with the outside world. So I think these projects actually have a shot.

Joyce Yang

I think ultimately it depends on whether you believe that you need to go outside of Korea, right? It’s like if you have a good ecosystem in Korea and you’re able to sustain it well with better financial literacy, decentralized protocols that are enough to span across Korea that actually is useful and adopted, are you going to be happy with that?

See Eun

So the Korean population is falling day by day. I don’t think there’s any future in staying within Korea. For us, it’s like expand or die.

No, no, in the long run. These protocols, we’re not creating like a protocol that you’re going to use for 5 years. A lot of people are creating protocols that we’re going to use for 20 years, 30 years, at least till 2141. But the population and Korea is dwindling, obviously, you need to go outside of Korea for a bigger market. And I mean, our world is being more connected, people are working more remotely. If there’s a better place to start a company, people are doing that. I think that’s awesome. So maybe like a company that’s locally born, maybe that’s not the company that takes the Korean brand globally. It might be a company that a Korean founder started somewhere else and it just happens to find better product-market fit there. If it’s just within Korea, our population decline is a problem. I don’t see how we can overcome that.

Joyce Yang

What’s the rate at which the population is declining by? I’m curious.

See Eun

I think we have less than 1 kid per family. Yeah, that’s pretty bad. It doesn’t take that long before your population is just… because it’s going to be a lot smaller than before.

Joyce Yang

Yeah, and this ties back to the financial kind of hierarchy that people are stuck in and not being able to even buy their own homes, settle down, have enough money to raise kids.

See Eun

Yeah, our parents you know.… With our parents, if you went to college, that was a golden ticket, you did very well in life. Even like someone who’s like maybe 10 or 20 years older than me, go to college does pretty much a golden ticket in life. You’re halfway through life and you’re doing pretty well. But our generation, you will go to college and you get all these college loans and our parents told us that this would be our golden ticket while it wasn’t. Not that they were evil, but they couldn’t see that far, and now you have to make your own decision.