A Look at The Largest Crypto-Backed Lenders in Asia- Matrixport, OKEx, Binance, Babel and more

This post shares a history of crypto-backed lending in Asia, and we layout the lending rates, liquidation levels for the top businesses in this space.

Introduction to Crypto-Backed Lending in Asia

Cryptocurrency-backed lending, in simple terms, is to pawn out digital currencies such as BTC to borrow money.

In the current landscape, we see a number of North America and Asia based lenders arise. In North America, one of the largest players is Genesis. In China, there are many domestic players, including as Zhenfund-backed Babel finance, Bitmain baked Matrixport, and veteran wallet and one of the largest OTC lenders RenRenbit. At this point, there are at least 10 sizeable lenders operating in China.

Digital currency-based lending began to emerge in large numbers during the bear market at the end of 2018. Its first successful market target in China was the miners.

There are two main reasons for miners to borrow: first, they go through the volatile market crypto cycles on an ongoing basis, but they are reluctant to sell their Bitcoin while still having daily expenses. Secondly, often for miners, a large amount of working capital is needed in a short period of time.

Subsequently, financial products were conceived to meet the borrowing needs of miners who were not willing to sell their coins but needed fiat to pay various fees and business costs. So while the demand for IEO borrowing and speculation has dwindled, the scale for borrowing has grown day by day.

According to Chinese media publication Odaily, centralized crypto borrowing businesses in China has amounted to a loan size of 400 million to 500 million US dollars since 2018.

At this point, as Bitcoin price goes sideways and the sales of mining machines staggering, major miners have also began offering their own lending service, or partner with an existing lending service provider to provide favorable terms to their customers, including terms such as zero-initial-fee, installed payment.

Most recently at their customer thank you event December 7th, Bitmain announced a new payment offering with install payments. Based on the number of orders, customers can enjoy up to 20% discount on their purchase of the mining machines.

Just 2 weeks later, mining machine producer Canaan also announced their install payments offering through their partnership with Babel finance. They also implemented a zero down-payment policy. Currently, the way these miners reduce the risk on these loaned purchases is by hosting the purchased machines on a designated mine. Other than miners, some large mining machine distributors such as Wayi and cloud mining providers are also providing similar services.

Aside from the miners, Global Coin Research has learned that OKEx had launched a lending business a month or two ago, and has been targeting areas with concentrated miners in China, such as Sichuan. Earlier in August 2018, CZ, the CEO of Binance, also announced that Binance would also be launching a lending business.

Overview of the Top Chinese Lenders

Chinese domestic lenders can be roughly divided into three different category of players. There are-

- Cryptocurrency financial services provider such as Babel and Matrixport

- Wallet / custody service providers such as RenRenbit and Bixin

- Exchanges such as OKEx, Binance and Gate.io.

As mentioned above, OKEx’s lending business was recently launched in stealth, while Binance and Gate.io have activated the loan feature when providing leveraged borrowing on their respective exchanges.

It makes sense as exchanges are inclined to do this to serve the needs of their customers, otherwise customers who want to borrow may likely withdraw their money and find alternative platforms.

Early Players in Crypto Lending

Babel Finance was one of the earlier players who entered the space. Near the end of 2018 during the bear market, in midst of trading volume continuing to shrink, numerous lending business against cryptocurrencies sprung up overnight.

After some research, Babel found that most of the existing lenders’ traffic, and as a result, their customers, are geared towards retail investors. “But the paradox is that borrowing is not just for retail investors. Retail investors want 100x on their returns, not working capital for their businesses.” says Flex Yang, the CEO of Babel.

As a result, Babel turned to the major currency holders and miners. According to Babel Finance, as of April 2019, the platform claims to have $27million in outstanding loans, of which 90% of the borrowers are miners.

One large borrower that Odaily interviewed mentioned that when he decided on which of the lending services to use, he paid attention to three main aspects- the security of lending platforms, interest rates, and the liquidation levels.

The reputation of the platform and how it is hosted is directly related to the perceived security of the business. In this regard, different domestic lenders have slightly different advantages.

For example, Babel Finance is endorsed by strong local investors such as ZhenFund and Lightspeed China. The company escrows tokens by using offline multi-signature to store private keys. And in some business scenarios, it will create co-managed wallets with compliant third-party escrow agencies such as Cobo / Onchain. They’ll then provide their customers with an address to monitor their assets.

Matrixport’s escrow is it’s own self proclaimed “bank-level” multi-signature management solution. It entails physical security at the vault level, distributed across three continents. Since inception, it claimed to have “securely managed one-billion-dollar of assets [presumably assets owned by Bitmain across its various businesses].

But when it comes to the scale of funds custodied, exchanges such as Binance and OKEx are far larger. Binance also continues to offer the promise of “100% compensation under theft of coins”.

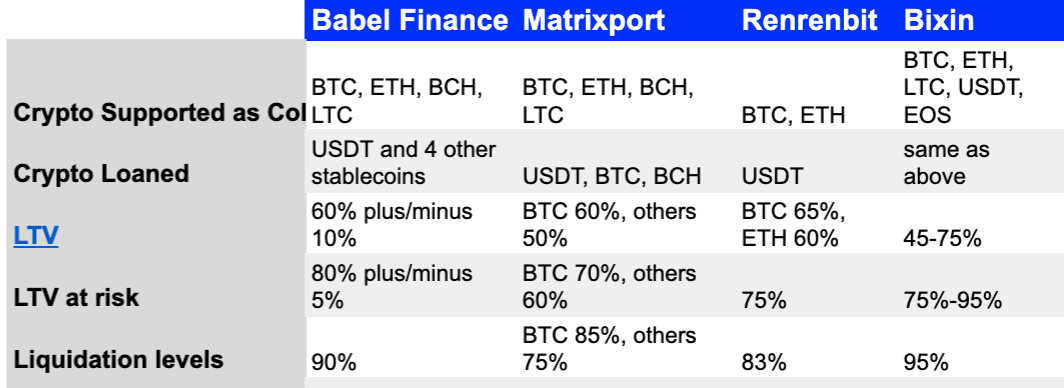

Under similar platform security, the differences in interest rates, lending rates, and safety levels have become the main decision-making points. Below is a detailed layout of the various offerings offered by Babel, Matrixport and other large players.

If the above chart is overwhelming, we’ll explain with examples following. The interest rate determines the cost of capital. In this regard, the interest rate for borrowing stable currencies such as USDC on exchanges such as Binance is the lowest (7.6%), and the lowest interest rate for borrowing non-stable currencies such as BTC (3%) is Bixin.

Due to the small fluctuations in USDT versus that of the excessive fluctuations in assets such as BTC, borrowers in China generally borrow stable currencies such as USDT.

It is worth noting that Bitmain’s Matrixport operates similarly to an exchange. Users get deducted a handling fee when withdrawing their money. Its borrowing handling fee is also denominated in BTC (0.1BTC as referred in the charts).

LTV refers to the pledge rate, which is the ratio of the debt amount to the value of the collateral. It is calculated as below:

(Principle+Total Interest+Total Penalty Interest-Repaid Amount)

LTV= ——————————————————————————————— ×100%

Collateral Value [Cryptoasset price× Cryptoasset Amount]

For example, while not mentioned in the chart above, the collateral rate for borrowing BTC on RenRenbit’s “Lightning Loan” service is 60%. This means that 1 BTC can lend 0.6 BTC worth of USDT.

However, assets such as BTC as collateral often fluctuate too much. For example, when collateral is worth 10,000 US dollars, the lender can lend 6000 USDT. After two weeks, Bitcoin prices hypothetically gets halved, the lender needs to inform the borrower to increase her collateral to return back to the original LTV ratio. As a result, lenders will set up warning and liquidation levels.

Taking Babel as an example, its initial lending rate is 60%. When a currency price drops, the LTV ratio will rise. When it rises to 85%, Babel will remind customers to increase the collateral, or directly repay in advance. If the customer does not act, Babel will sell and liquidate the collateral at the current price when the pledge rate rises to 90%. The final asset that was forcibly liquidated is used to make up for the borrower’s outstanding interest and short-term market turbulence.

Among the above-mentioned lenders, Bixin has the highest pledge rate and liquidation level. A business staff member of Binxin explained this to Odaily, “There are many users who don’t hate risks. We provide such users with high pledge rates and lend more funds. The pledge rate is only 95%. despite the number of major transactions, so far there has not been an extreme market for us to go through. “

Interested in learning more? Leave us your comments below.