Is RMB trading making a comeback in Crypto?

Chainalysis has recently released its October 2019 Asia-Pacific Cryptocurrency Report, and here we dive into some of the recent exchange and trading trends around USDT and the RMB.

Most recently, CZ from Binance confirmed a tweet that claims Binance has created fiat gateway with Alipay and Wechat. Alipay responded to his tweet and immediately refuted that fact.

CZ’s original tweet has since been deleted. He clarified later in a separate tweet that “there are some confusion by some news outlets. @Binance is not working directly with WeChat or Alipay. However, users are able to use them in P2P transactions for payment.”

Currently, 100% of bitcoin transactions are USDT

“In China, almost 100% of bitcoin transactions use USDT. ”

Chainalysis has recently released its October 2019 Asia-Pacific Cryptocurrency Report (if the link doesn’t work for you, we’ve attached the report at the bottom), and here we dive into some of the recent exchange and trading trends around USDT and the RMB.

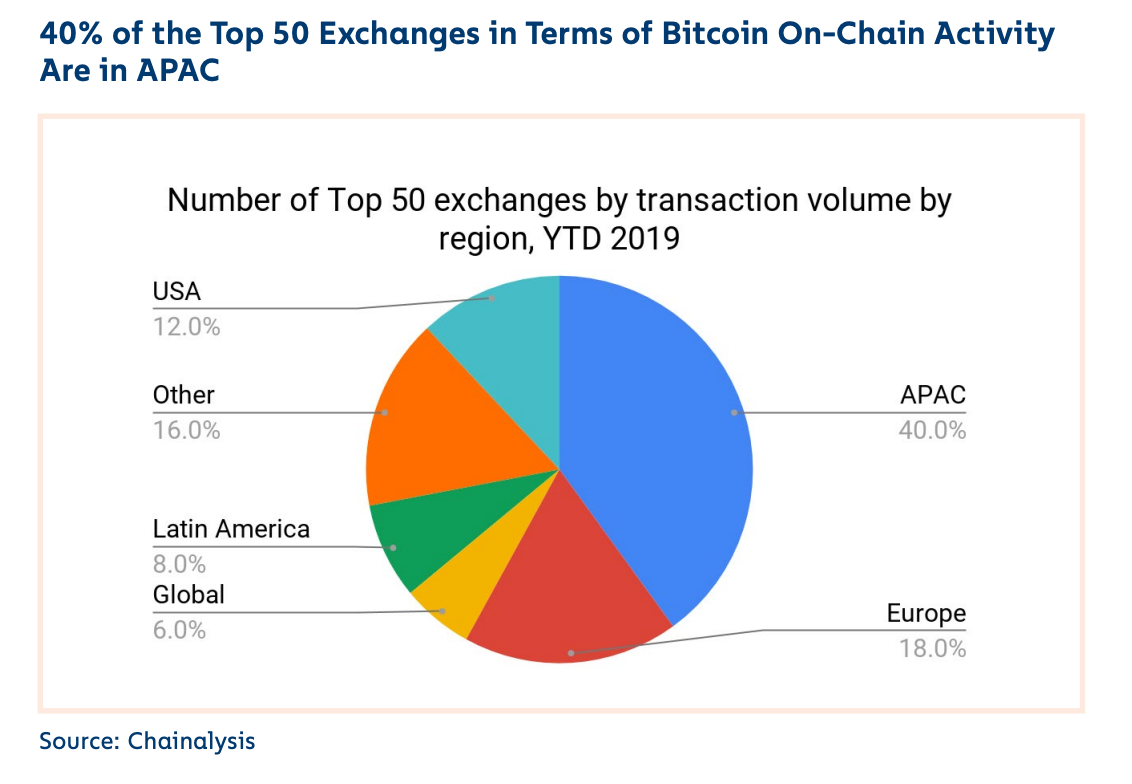

It is no secret that cryptocurrency is popular in China. China has always been ahead of the world in Bitcoin mining (and of course the Asia Pacific region in general). Also, China has a large number of cryptocurrency exchanges. visitlcvalley.com

However, since 2017Chinese government has been cracking down on cryptocurrency activity. This year, the National Development and Reform Commission of China has increased the restrictions on bitcoin mining, which is considered a waste of resources. These all indicate that the government does not like cryptocurrencies. Paradoxically, China still has the world’s most active cryptocurrency trading participants, and the largest use of USDT, that’s linked to the US dollar, rather than the renminbi.

USDT obtains pricing power for Chinese cryptocurrency transactions

An interesting phenomenon was noted when studying the most common currency trading pairs in the Asia Pacific market. The chart below compares the most common exchange user pairs in China, Japan, and Korea.

Source: Chainalysis and Kaiko, Jinse

Almost 100% of the bitcoin transactions in the Japanese and Korean markets use the official currency of the country, the Japanese Yen, and the Korean Won. But when we looked at the China Exchange, almost no one used the yuan when trading Bitcoin. Additionally, these transactions were originated in mainland China and continue to serve Chinese customers today. Almost 100% of transactions involve converting bitcoin to USDT and vice versa. In other words, for crypto users in China, USDT has replaced the RMB as the legal currency for cross-border transactions.

Why is this happening? It is happening because at the end of 2017, China officially forbade citizens from exchange renminbi for cryptocurrency.

The chart below shows how the trading of the Huobi Coin and OKcoin (the exchange that the Chinese usually use) changes over time:

Source: Kaiko, Jinse

The data is almost identical to the government’s decision. Before the introduction of the trading ban, we saw a very high ratio of transactions between the RMB and Bitcoin. Further, all transactions in the RMB and Bitcoin fell sharply. In 2018, when global bitcoin transactions rebounded, the direct transactions between the RMB and Bitcoin did not recover.

For cross-border traders, using the USDT as a substitute for legal tender money makes sense. It is relatively stable because it is linked to the US dollar and can be easily exchanged into different types of cryptocurrencies.

But in fact, OTC transactions still see RMB thriving

It is worth noting that the above statistics are all exchange transactions, and Chinese traders are likely to use RMB to exchange cryptocurrency elsewhere. Although the direct transaction of RMB and Bitcoin has almost fallen to zero since the ban, over-the-counter (OTC) and peer-to-peer (P2p) exchanges provide a channel for Chinese traders. Exchanges such as Firecoin provide over-the-counter trading services, while other P2P networks are managed on WeChat, and are important for continued observation.

Chainalysis has found statistics that show that since the promulgation of the Chinese ban, a large amount of funds have flowed into such OTC services, as shown in the following figure:

Source: Chainalysis

From September 2018 to September 2019, we measured the trading volume of ten OTC brokers and traded $877 million to $577 million in the past 12 months.

The data, as well as all the anecdotal evidence we have, show that in China, RMB and Bitcoin transactions are far from dying. However, for now ordinary exchange users still prefer USDT.

Chainalysis October 2019 Asia-Pacific Cryptocurrency Report