Zcon1 GCR Presentation Key Takeaways Part I: Quick Guide to Asia Go-to-Market and Blockchain Community Formation

I attended Zcon1 in Split, Croatia this past weekend, and for the first time, I met many of the folks from the Zcash foundation and the Electric Coin Team. it was honestly one of the best conferences I’ve been to this year and meeting an inclusive and high-quality group of scientists and technologists in the space. It’s really great to see folks from the Zcash community, but also other supportive layer-1 projects from Cosmos, Ethereum, Facebook Libra, who all showed care for privacy.

Ian Miers gave a great presentation on the State of Privacy in Cryptocurrencies and highlighted vulnerabilities in payments with decoy transaction-based systems. Zooko openly shared the financials of the company and its runway time period in the state of Electric Coin company. The company has limited funding left but decided to go “all in on ZEC” anyway. I highly encourage the community to learn more about the team and its mission. Be sure to check all the videos.

I also gave a talk about the Asia cryptocurrency and blockchain go to market, and shared some insight and resources to help folks see the opportunities and happenings in Asia. In this first post, I’ll touch on some of the main points of the talk, which you can also find the entirety here.

So where are we in terms of adoption?

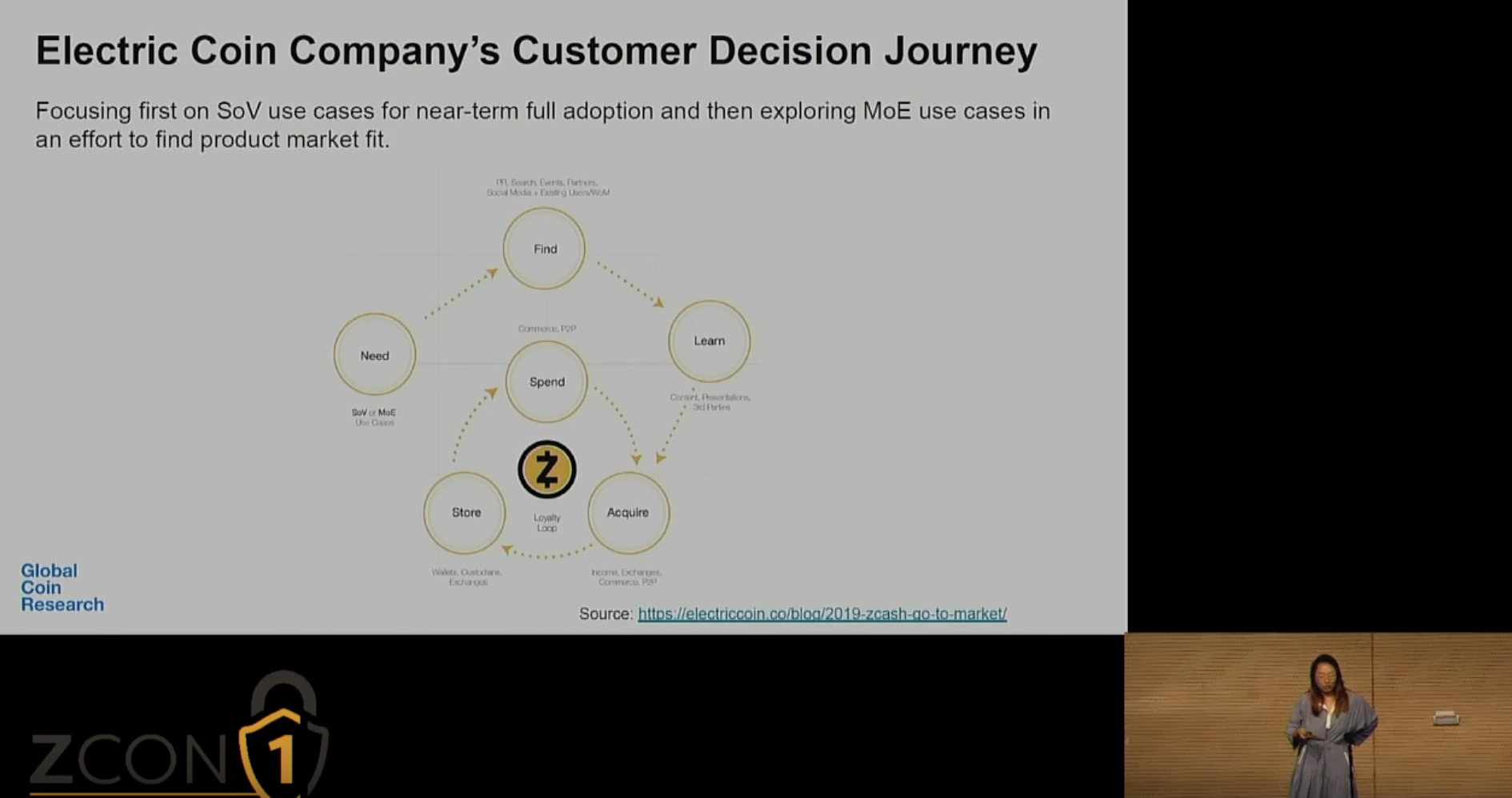

As this recent Electric Coin chart highlights, Electric Coin, along with the rest of the projects in the ecosystem, are in the early innovators and adopters phase.

And after spending some time in the industry, you may feel like we are making so much progress, and things are moving along fine when we talk to our industry peers. The actuality is that we are far from mass adoption. I think Facebook can potentially help us cross that Chasm in the bell curve, or fail to deliver completely and just fall through it.

So how do we get to the next stage, “early majority”? I think it’s worthwhile to start looking at some jurisdictions that have actually started inching closer to that stage. Specifically, countries in Asia like Korea and Japan.

And this is interesting field research done by Consensys’s SEO team.

Although not entirely rigorous data, but its certainly directional and indicative. When looking at global search interest results from various countries on the terms “blockchain”, “Ethereum, “cryptocurrency” and “Bitcoin”, the search terms for Japan and South Korea (on the right side) are evenly distributed across blockchain, Ethereum, and bitcoin. While in the Americas ( left side) we see primarily a bitcoin dominance, which is likely correlated with the fact that people may still be learning about cryptocurrency and Bitcoin for the first time.

Given all the anecdotes we hear from Asia, we believe folks in Asia have gotten the hang of crypto and are now making the move into blockchain, smart contracts, and Ethereum. This means that they are already in a more advanced adoption stage than what we are seeing in the West.

Japan, with the highest ranking nation among others for ‘Blockchain’ searches with 39%, also exhibits a remarkably even spread of interest, with 30% Ethereum, 29% Bitcoin, and only 3% of searches for ‘Cryptocurrency’ following behind at some distance.

In South Korea, ‘Blockchain’ outranks all other search terms studied here with 40% of interest, with ‘Bitcoin’ at 29%, ‘Ethereum’ at 24%, and ‘Cryptocurrency’ with 7%. It seems the South Koreans have gotten the hang of crypto and are now making the move into blockchain, smart contracts, and Ethereum?—?a progression we expect much of the world to undertake in the coming years.

We encourage you to check out the rest of the findings. Bitcoin has the comparably higher search results in Venezuela and places in Africa.

And while we are still so early in this space and adoption globally, I strongly believe that it’s a good time to go and capture mind and market share in Asia.

More importantly, it is also a learning opportunity for us to see how mass adoption takes place, as they are already underway.

For example, Kakaotalk, the number 1 messaging app of Korea, which is similar to that of Wechat, is launching its own layer 1 blockchain called Klatyn at end of this month (update: it’s already launched! and it has a similar member association model to that of Facebook Libra, with companies like LG, Union Bank of the Phillipines, Wanxiang Blockchain from China, Gumi gaming from Japan, Celltrion, one of the largest biopharma companies, and the largest gaming company in Vietnam as its founding association members.)

It will be fascinating to see how this governance model plays out. While we wait for Facebook to launch in 2020, there will be a lot of learnings we can take from the existing projects and companies.

And other reasons to capture mind share and market share in Asia. Many active ecosystem participants, investors, markets, miners are there and they will continue to thrive.

So how do we actually bring adoption in Asia?

You can do it like what MC Jin says- which is to learn Chinese. And honestly, understanding and speaking multiple languages gives you so much more advantages in this space given the inherent global and borderless nature of this ecosystem.

And I would say learning Chinese is not just good for going to market in China, but the Chinese network is by far the largest by number and the most geographically diverse community in crypto.

Yeah… or you can do an IEO to get your tokens into hands of the retail audience in Asia. But for the majority of the time, it won’t really get you the type of quality, long term investors you’d like.

Speaking of IEOs, I want to clear up some misperceptions about communities and building communities in Asia.

First, for projects going to market in Asia, you can’t just only have a Chinese language Telegram community and expect that will last. You also can’t just translate all your documents and expect it to get accepted and embraced by the locals. Naturally, the lack of general cultural understanding in Asia renders many folks helplessness, and perhaps most straightforward thing to do is to just translate your materials. But that is not going to be effective long term.

Secondly, most of the core crypto community actually speaks English and are very international, with the exception of China. It’s not just that folks in the west want to understand the communities in Asia, but the folks in Asia arguably have even more of a desire to understand the west as well.

Third, I think it’s almost impossible to build a real, self-sustainable community within one year in Asia. Often I see execs going to Asia once a quarter, often to bring awareness, but a self-sustainable community requires long term residence and long term relationships with these communities.

Fourth, for any project, any of your flaws and bad rep will be known from North America and uncovered and spread throughout Asia quickly. This kind of goes back the strong network that folks in asia have, if you go to a conference in Korea, in Japan, or Singapore, many of the folks who go are the same people coming from all over Asia, and they talk to each other

Fifth, some misconceptions about Asia->

1)Not everyone in Asia is about that pump and dump!

2) You think of them as “dumb money”, but the retail investors are REALLY NOT

3) Even the scammers in Asia work harder than those in North America

4) Not everyone is about that Tron-style

To understand the true logic behind the Asian markets, you need to understand how much social immobility and financial insecurity plays in these countries and driving these markets.

Sixth, you can hire quickly, but hiring well will be very difficult. This is partially due to projects in the West having moving targets in terms of hiring criteria given the ever-changing landscape, and also the type of talent that the you are looking for- which is someone who is able to understand the blockchain technology deeply, cryptocurrencies and also speak multiple languages.

Lastly, don’t avoid the regulators, befriend them. Some regulators go to meetups and chat with their community thru Facebook like that in Thailand sec. And some you would never be even able to get a meeting with. Regulators play a more active role in the ecosystems in Asia. This also leads to rise, or encourages a new type of politician and regulators technologically savvy and are essentially forced to engage with outsiders.

My main thinking here is that given historically Asia has followed the footsteps of North America technology companies, coming out of North America with a reputable brand can be extraordinarily helpful.

Part II coming up!